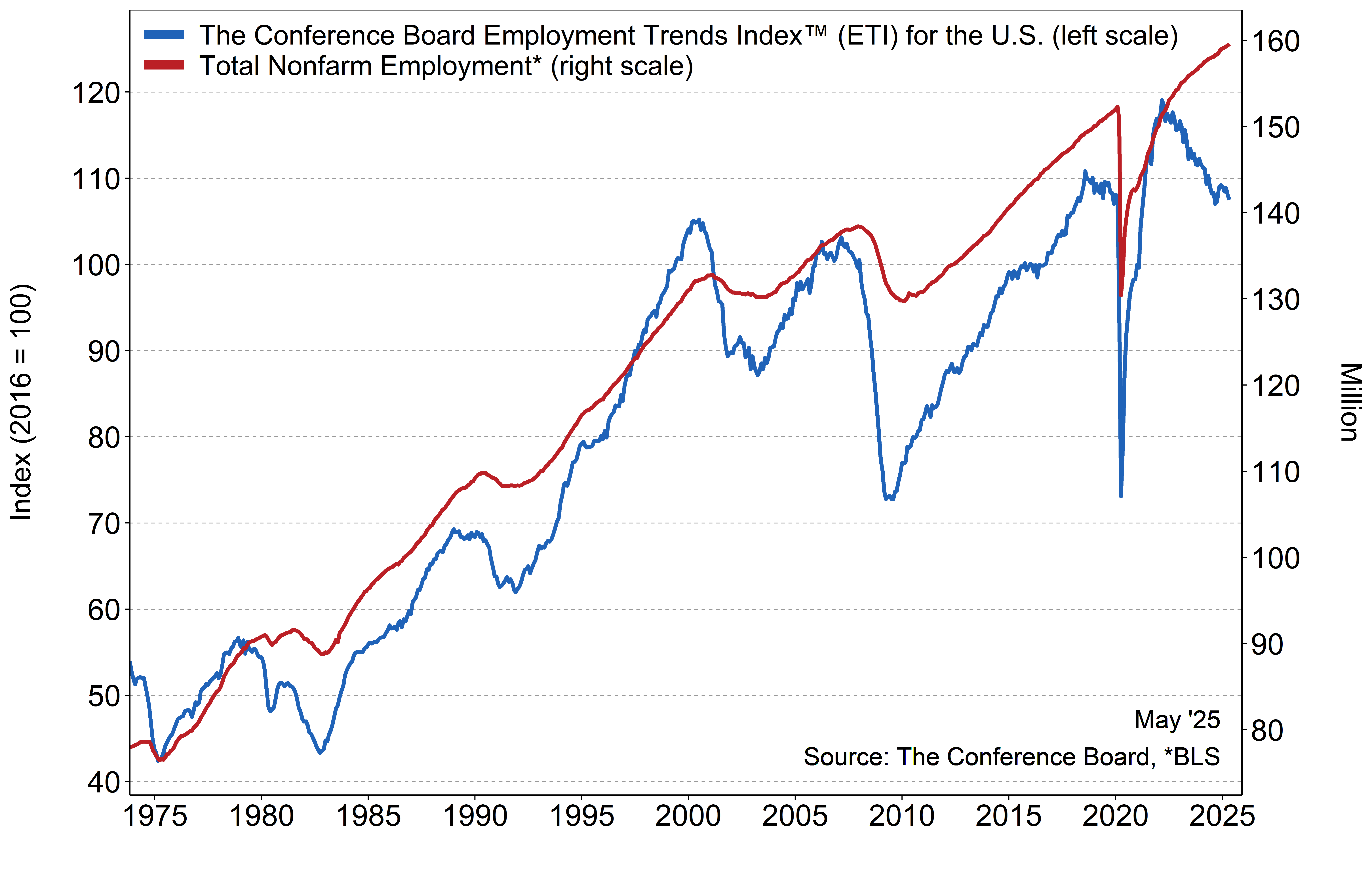

The Conference Board Employment Trends Index™ (ETI) decreased in May to 107.49, from an upwardly revised 108.00 in April. The Employment Trends Index is a leading composite index for payroll employment. When the Index increases, employment is likely to grow as well, and vice versa. Turning points in the Index indicate that a change in the trend of job gains or losses is about to occur in the coming months.

“The ETI in May continued to slow relative to the start of 2025,” said Mitchell Barnes, Economist at The Conference Board. “But despite general tariff wariness, the ETI is currently above the 2017-19 average, suggesting that the labor market broadly remains on solid footing.”

Initial claims for unemployment insurance (an ETI component) climbed in May to 235,000—the highest level since July 2024. The share of consumers who report ‘jobs are hard to get’—an ETI component from the Consumer Confidence Survey®—increased in May to 18.6%, rising for the fourth consecutive month and matching its 2024 high. The share of small firms that report jobs are ‘not able to be filled right now’ remained at 34% in May, which marks the lowest share since September.

“While uncertainty may be weighing on business and consumer confidence, May employment data indicated that hiring continued to keep the labor market roughly in balance,” Barnes said. “However, we are beginning to see some sector erosion that could suggest emerging pressures from tariff shifts.”

Employment in the temporary-help industry fell by 20,200 in May’s Employment Report, which otherwise showed the labor market holding steady. Temporary help payrolls in 2025 have declined four out of five months, losing a total of 41,600 workers. The share of involuntary part-time workers declinedmodestly in May to 17%, down from a recent high of 18% in February but remained above the 2024 average. Job openings rose in April data, but job openings are likely to decline in May’s report, consistent with Help-Wanted-OnLine job posting data.

Barnes added, “Pessimism about the labor market among firms and consumers did not translate to widespread weakening through May. Even as trade-exposed sectors and the broader economy brace for anticipated tariff impacts, the high rate of employment and elevated wage growth provide a buffer.”

May’s decrease in the Employment Trends Index was driven by negative contributions from 4 of its eight components: Percentage of Respondents Who Say They Find ‘Jobs Hard to Get,’ Number of Employees Hired by the Temporary-Help Industry, Initial Claims for Unemployment Insurance and Job Openings.

The Employment Trends Index aggregates eight leading indicators of employment, each of which has proven accurate in its own area. Aggregating individual indicators into a composite index filters out “noise” to show underlying trends more clearly.

The eight leading indicators of employment aggregated into the Employment Trends Index include:

*Statistical imputation for the recent month

**Statistical imputation for two most recent months

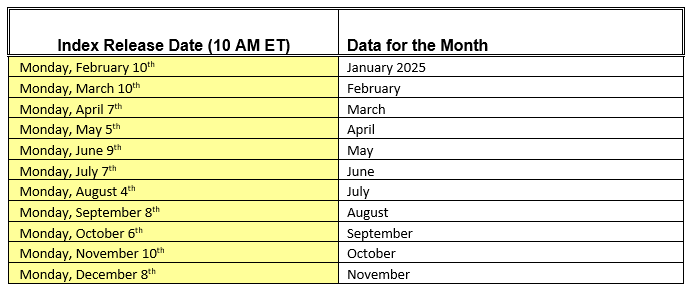

The Conference Board publishes the Employment Trends Index monthly, at 10 a.m. ET, on the Monday that follows each Friday release of the Bureau of Labor Statistics Employment Situation report. The technical notes to this series are available on The Conference Board website: http://www.conference-board.org/data/eti.cfm.

About The Conference Board

The Conference Board is the member-driven think tank that delivers Trusted Insights for What’s Ahead®. Founded in 1916, we are a non-partisan, not-for-profit entity holding 501 (c) (3) tax-exempt status in the United States. www.conference-board.org.

|

Employment Trends Index (ETI)™ 2025 Publication Schedule |

For further information contact:

Jonathan Liu

jliu@tcb.org

Joseph DiBlasi

781.308.7935

jdiblasi@tcb.org

All release times displayed are Eastern Time

June’s Goldilocks Payrolls May Allow Fed to Cut Rates in H2

July 03, 2025 | Brief

Jobs Report: April Showers, Tariff Storm Looms

May 02, 2025 | Brief

March Payrolls: The Calm Before the Tariff Storm

April 04, 2025 | Brief

February Jobs Report Hints at Growing Uncertainty

March 07, 2025 | Brief

Q4 ECI Wage Deceleration Slows

February 07, 2025 | Brief

Stability Underneath January’s Noisy Jobs Report

February 07, 2025 | Brief