An aggregate of eight labor-market indicators that shows underlying trends in employment conditions. Data series: 1973 – present.

The Conference Board Employment Trends Index™ (ETI) Improved in January

Latest Press Release

Updated: Tuesday, February 17, 2026

NOTE: Note that release of the annual revisions of standardization factors to the Employment Trends Index will be moved from January 2026 to June 2026. This modification ensures that the sample period fully incorporates the most recent completed calendar year of underlying component source data. For the next annual revision in June 2026, the cutoff used for calculating standardization factors and trend adjustment will be December 2025, rather than December 2024. Revisions in subsequent years will also be in June. For more information, please visit our website at http://www.conference-board.org/data/eti.cfm.

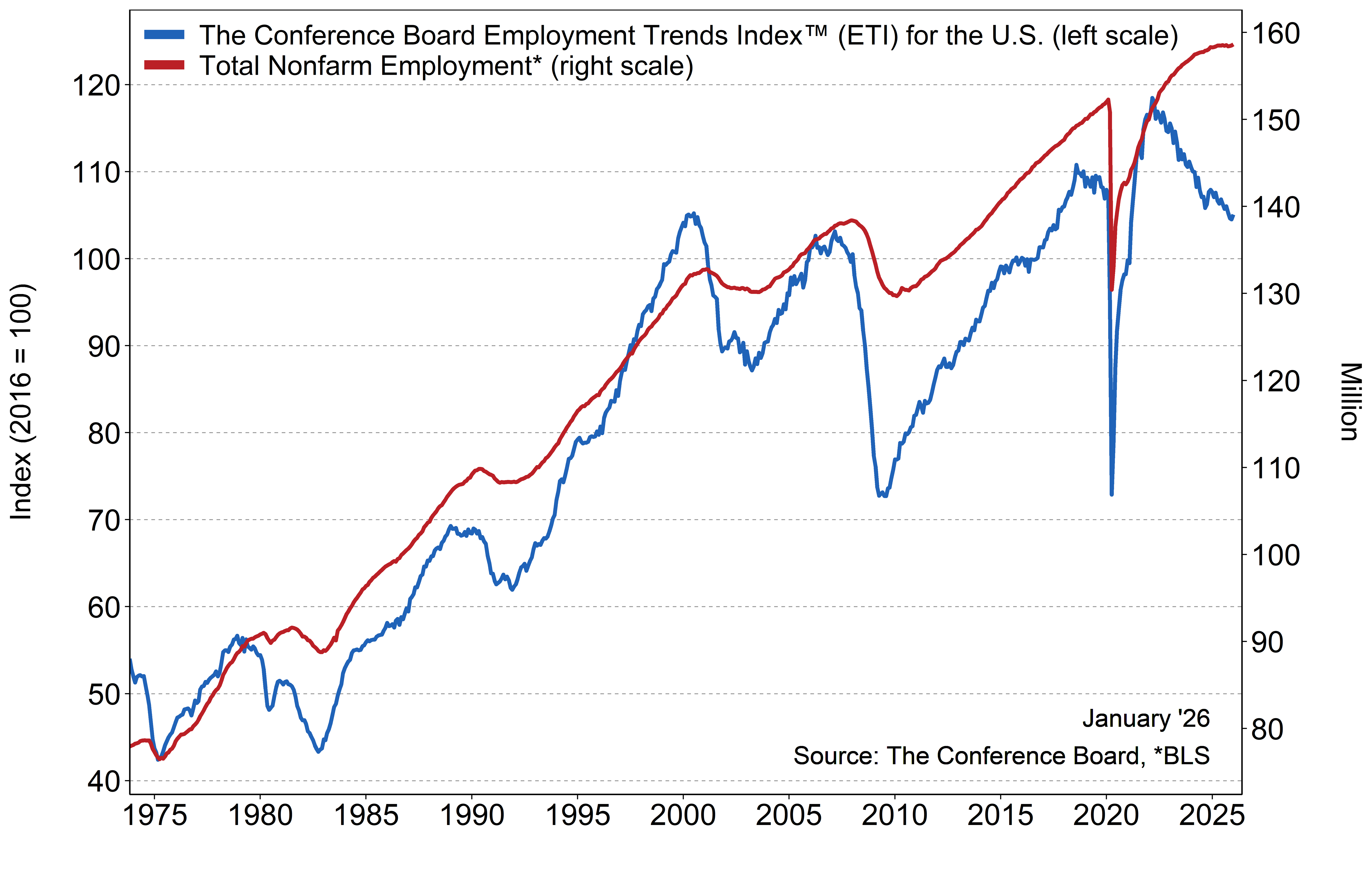

The Conference Board Employment Trends Index™ (ETI) increased in January to 105.06, from an upwardly revised 104.51 in December. The Employment Trends Index is a leading composite index for payroll employment. When the Index increases, employment is likely to grow as well, and vice versa. Turning points in the Index indicate that a change in the trend of job gains or losses is about to occur in the coming months.

“The ETI’s rise in January reflected a stronger-than-expected Employment Report with healthy payroll growth,” commented Mitchell Barnes, Economist at The Conference Board. “Unemployment and layoffs continue to remain mild, suggesting that the labor market is in balance despite a low 2025 hiring rate.”

Initial claims for unemployment insurance declined in January, continuing to fall from mid-2025 highs. The share of involuntary part-time workers also declined in January, to 17.6%, its lowest percentage since September. Real manufacturing and trade sales and industrial production continued to show steadiness despite other measures of manufacturing activity and employment indicating contraction.

“While most labor market indicators suggest relative stability, the confidence of consumers and businesses point in a negative direction,” added Barnes. “It remains to be seen whether 2026 will continue the theme of a low-hire, low-fire environment.”

The share of consumers who report “jobs are hard to get”—an ETI component from the Consumer Confidence Survey®—rose to 20.8% in January to reach the highest point since early 2021. The share of small firms reporting that jobs are ‘not able to be filled right now’ fell to a post-pandemic low of 31% in January, while the net share of small firm’s that plan to increase employment fell to a three-month low.

January’s increase in the Employment Trends Index was a result of positive contributions from six of its eight components: Initial Claims for Unemployment Insurance, the Number of Employees Hired by the Temporary-Help Industry, the Ratio of Involuntarily Part-time to All Part-time Workers, Real Manufacturing and Trade Sales, Industrial Production, and Job Openings. Two components contributed negatively: the Percentage of Respondents Who Say They Find ‘Jobs Hard to Get and the Percentage of Firms with Positions Not Able to Fill Right Now was unchanged.

The Conference Board Employment Trends Index ™, November 1973 to Present

The eight leading indicators of employment aggregated into the Employment Trends Index include:

- Percentage of Respondents Who Say They Find “Jobs Hard to Get” (The Conference Board Consumer Confidence Survey®)

- Initial Claims for Unemployment Insurance (U.S. Department of Labor)

- Percentage of Firms with Positions Not Able to Fill Right Now (© National Federation of Independent Business Research Foundation)

- Number of Employees Hired by the Temporary-Help Industry (U.S. Bureau of Labor Statistics)

- Ratio of Involuntarily Part-time to All Part-time Workers (BLS) ?

- Job Openings (BLS)*

- Industrial Production (Federal Reserve Board)*

- Real Manufacturing and Trade Sales (U.S. Bureau of Economic Analysis)***

*Statistical imputation for the recent month

***Statistical imputation for three most recent months (due to data release delays)

? Note missing October 2025 value for Ratio of Involuntarily Part-time Workers estimated using linear interpolation

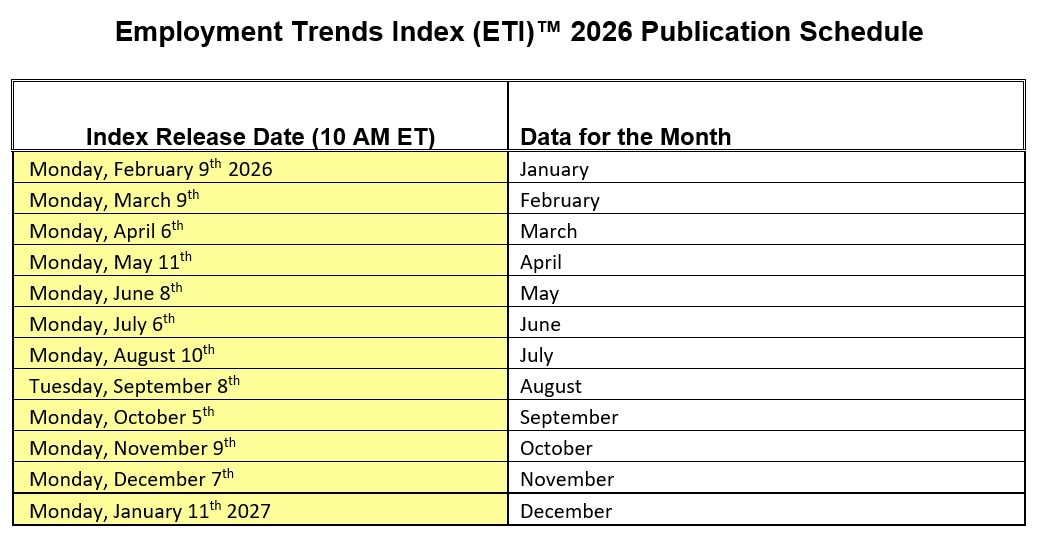

The Conference Board publishes the Employment Trends Index monthly, at 10 a.m. ET, on the Monday that follows each Friday release of the Bureau of Labor Statistics Employment Situation report. The technical notes to this series are available on The Conference Board website: http://www.conference-board.org/data/eti.cfm.

About The Conference Board

The Conference Board is the member-driven think tank that delivers Trusted Insights for What’s Ahead®. Founded in 1916, we are a non-partisan, not-for-profit entity holding 501 (c) (3) tax-exempt status in the United States. www.conference-board.org.