For Release 10:30 AM ET, February 11, 2026

Using the Composite Indexes: The Leading Economic Index (LEI) provides an early indication of significant turning points in the business cycle and where the economy is heading in the near term. The Coincident Economic Index (CEI) provides an indication of the current state of the economy. Additional details are below.

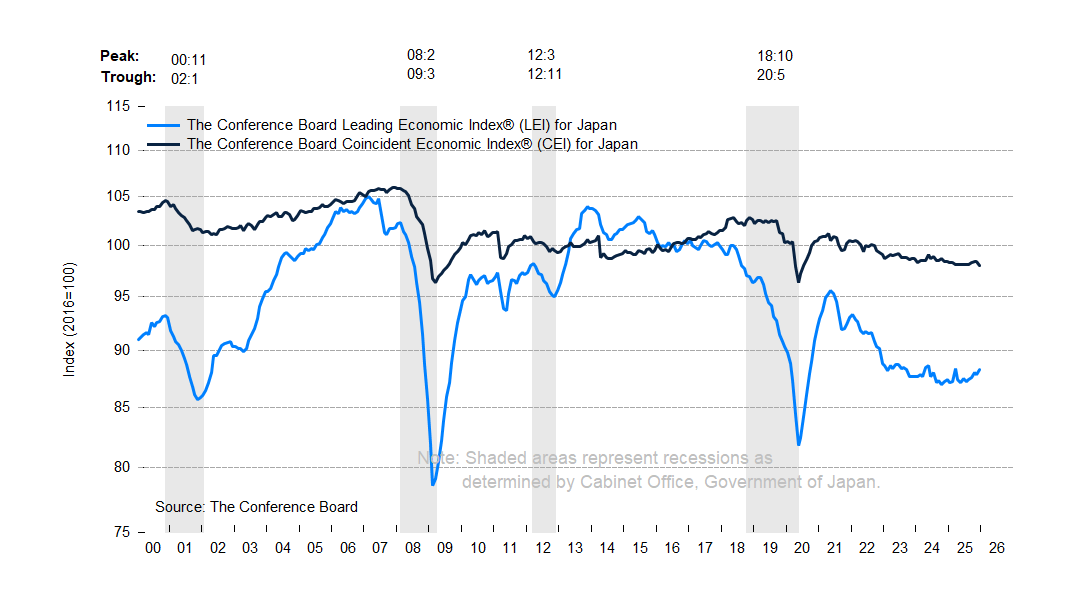

The Conference Board Leading Economic Index®(LEI) for Japan rose by 0.6% in December 2025 to 88.3 (2016=100), more than reversing a decrease of 0.2% in November. Over the second half of 2025, the LEI for Japan also increased by 0.9%, a significant improvement compared to the slight growth of 0.1% recorded in H1 2025.

The Conference Board Coincident Economic Index® (CEI) for Japan declined by 0.4% in December 2025 to 98.0 (2016=100), after being unchanged in November. Over the most recent six month period ending in December 2025, the CEI ticked down by 0.1%, continuing the 0.3% decline observed over the first half of 2025.

The next release is scheduled for Tuesday, March10, 2026, at 10:30 A.M. ET.

The positive financial components along with suspension of transactions and new construction drove LEI higher in the last month of 2025

The annual growth rate of the Japan LEI remained positive in December

About The Conference Board Leading Economic Index® (LEI) and Coincident Economic Index® (CEI) for Japan.

The CEI reflects current economic conditions and is highly correlated with real GDP. The LEI is a predictive tool that anticipates—or “leads”—turning points in the business cycle by around four months.

The ten components of the Leading Economic Index® for Japan are:

To access data, please visit: https://data-central.conference-board.org/

|

PRESS RELEASE

LEI for Mexico Increased in January

February 18, 2026

PRESS RELEASE

LEI for the Euro Area Remained Unchanged in January

February 18, 2026

PRESS RELEASE

The LEI for Germany Increased in December

February 16, 2026

PRESS RELEASE

LEI for Brazil Continued to Rise in January

February 13, 2026

PRESS RELEASE

The LEI for France Increased in December

February 13, 2026

PRESS RELEASE

The LEI for the UK remained unchanged in December

February 12, 2026

All release times displayed are Eastern Time

Note: Due to the US federal government shutdown, all further releases for The Conference Board Employment Trends Index™ (ETI), The Conference Board-Lightcast Help Wanted OnLine® Index (HWOL Index), The Conference Board Leading Economic Index® of the US (US LEI) and The Conference Board Global Leading Economic Index® (Global LEI) data may be delayed.

Business & Economics Portfolio

December 23, 2025 | Database

The Economy Stabilized in August but Outlook Remains Weak

September 27, 2023 | Report

China's Economic Recovery Continues to Stutter (Economy Watch: China View, June 2023)

June 30, 2023 | Report

Leading Economic Indicators and the Oncoming Recession

December 07, 2022 | Article

The Evolving Economic Outlook for Europe

July 10, 2024

Is a Global Recession on the Horizon?

July 13, 2022