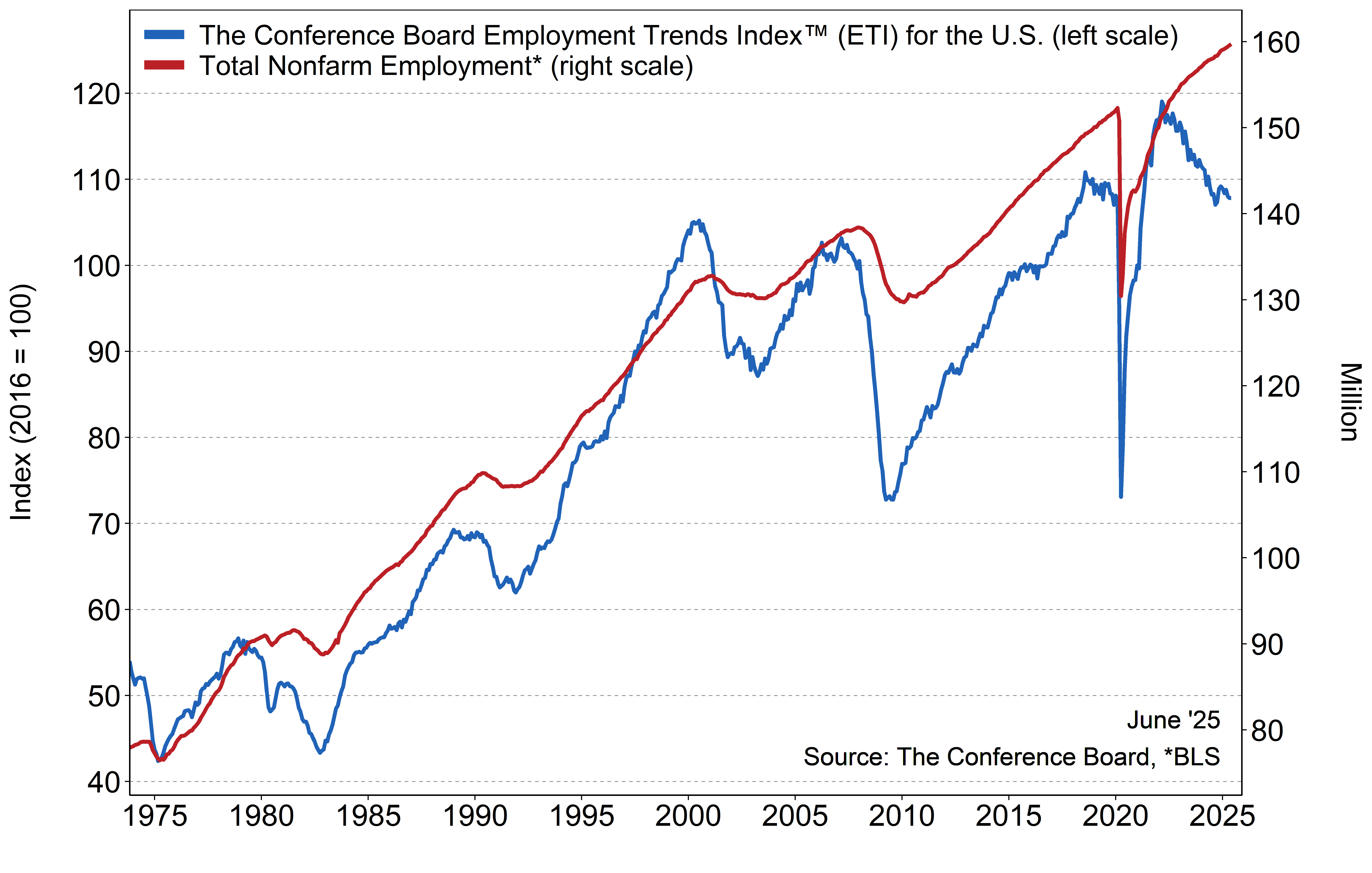

The Conference Board Employment Trends Index™ (ETI) remained level in June at 107.83, from an upwardly revised 107.83 in May. The Employment Trends Index is a leading composite index for payroll employment. When the Index increases, employment is likely to grow as well, and vice versa. Turning points in the Index indicate that a change in the trend of job gains or losses is about to occur in the coming months.

“The June ETI underscored that the US labor market remains stable,” said Mitchell Barnes, Economist at The Conference Board. “Though ongoing uncertainty continues to temper consumer and business confidence.”

The share of consumers who report ‘jobs are hard to get’—an ETI component from the Consumer Confidence Survey®—declined to 18.1% in June, from 18.4% in May, but remains near the highest rate since early 2021. The share of small firms that report jobs are ‘not able to be filled right now’ (an ETI component) rose to 36% in June, from 34% in May; however, it remains below the 2024 average of 37.5%. JOLTS job openings in May also showed an increase, rising to 7.8 million from 7.4 million in April, to reach the highest level since November.

“The ETI is consistent with a solid June Employment Report, which showed payroll gains of 147,000 and a downtick in the unemployment rate to 4.1%,” added Barnes, “We have yet to see layoffs tick up meaningfully despite the pace of hiring slowing.”

Initial claims for unemployment insurance increased modestly in June. Meanwhile, continuing unemployment claims have risen steadily but the pace has not accelerated. The share of involuntary part-time workers also declined in June to 16.5%, from 17% in May. Employment in the temporary-help industry fell by 2,600 in June, and have now declined five out of six months in 2025. Industrial production and real manufacturing and trade sales each moderated slightly in recent data, likely impacted by ongoing tariff and trade volatility.

“New data ultimately still show a continuation of the recent low-hiring, low-firing environment,” Barnes commented, “But the question is to what extent the build-up of uncertainty will translate into a broader softening in activity and labor demand.”

June’s flat reading in the Employment Trends Index was a result of slight negative contributions from 5 of its eight components: Job Openings, Real Manufacturing and Trade Sales, Industrial Production, Initial Claims for Unemployment Insurance, and Number of Employees Hired by the Temporary-Help Industry. Whereas the following 3 components contributed positively: Percentage of Firms with Positions Not Able to Fill Right Now, Ratio of Involuntarily Part-time to All Part-time Workers, Percentage of Respondents Who Say They Find ‘Jobs Hard to Get.

The Employment Trends Index aggregates eight leading indicators of employment, each of which has proven accurate in its own area. Aggregating individual indicators into a composite index filters out “noise” to show underlying trends more clearly.

The Conference Board Employment Trends Index ™, November 1973 to Present

The eight leading indicators of employment aggregated into the Employment Trends Index include:

*Statistical imputation for the recent month

**Statistical imputation for two most recent months

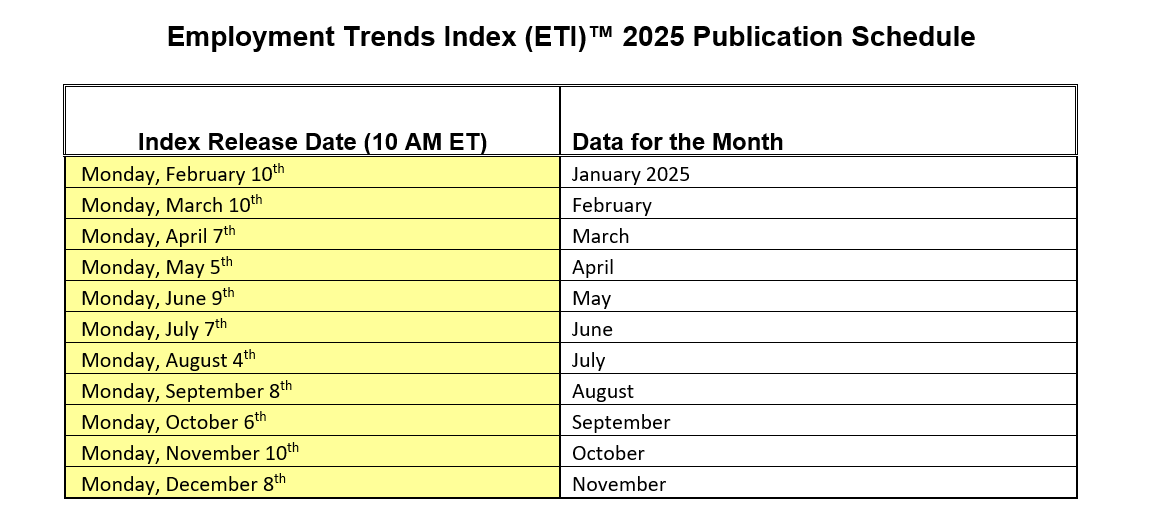

The Conference Board publishes the Employment Trends Index monthly, at 10 a.m. ET, on the Monday that follows each Friday release of the Bureau of Labor Statistics Employment Situation report. The technical notes to this series are available on The Conference Board website: http://www.conference-board.org/data/eti.cfm.

About The Conference Board

The Conference Board is the member-driven think tank that delivers Trusted Insights for What’s Ahead®. Founded in 1916, we are a non-partisan, not-for-profit entity holding 501 (c) (3) tax-exempt status in the United States. www.conference-board.org.

For further information contact:

Joseph DiBlasi

781.308.7935

jdiblasi@tcb.org

Jonathan Liu

jliu@tcb.org

Methodology

July 07, 2025

PRESS RELEASE

Employment Trends Index™ (ETI) Held Steady in May

July 07, 2025

PRESS RELEASE

Employment Trends Index™ (ETI) Fell in May

June 09, 2025

All release times displayed are Eastern Time

June’s Goldilocks Payrolls May Allow Fed to Cut Rates in H2

July 03, 2025 | Brief

Jobs Report: April Showers, Tariff Storm Looms

May 02, 2025 | Brief

March Payrolls: The Calm Before the Tariff Storm

April 04, 2025 | Brief

February Jobs Report Hints at Growing Uncertainty

March 07, 2025 | Brief

Q4 ECI Wage Deceleration Slows

February 07, 2025 | Brief

Stability Underneath January’s Noisy Jobs Report

February 07, 2025 | Brief

Labor Markets Watch: Trade Wars, Industrial Agendas, and Workforce Readiness

May 21, 2025 01:00 PM ET (New York)