US Consumers Plan to Spend an Average of $73 Less Than Last Year

According to The Conference Board Holiday Spending Survey, the average US consumer intends to spend $990 on holiday-related purchases in 2025. That’s down 6.9% from $1063 in 2024 and close to holiday spending intentions in 2023 ($985), but lower than in 2022 ($1,006) and 2021 ($1,022).

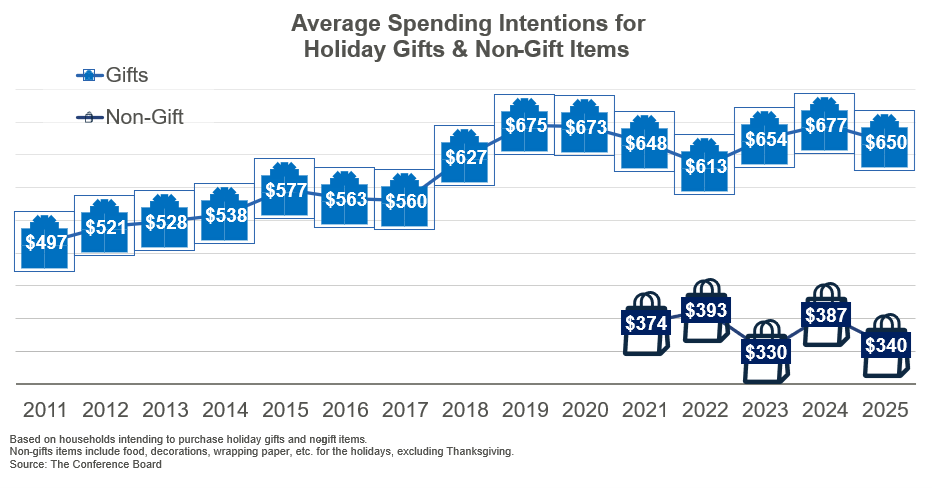

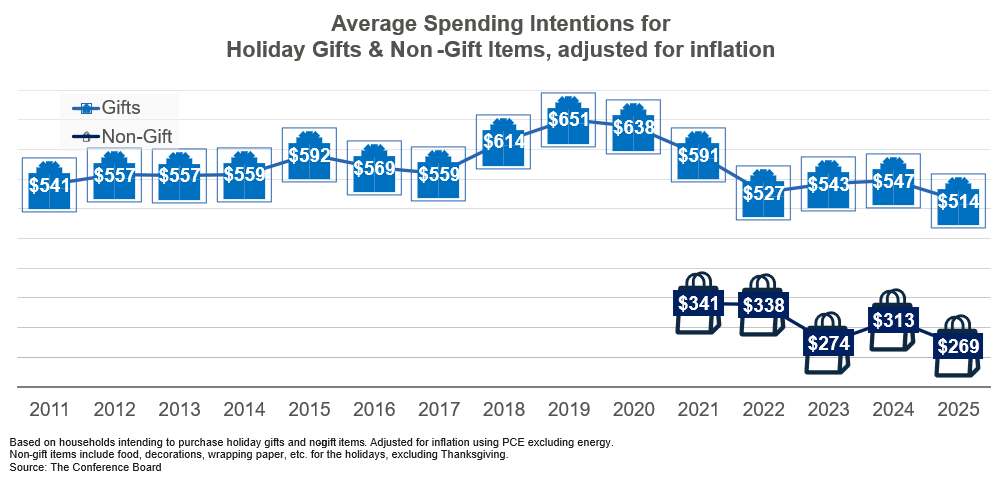

Consumers intend to spend $650 on gifts this year, down 3.9% from $677 last year and the lowest since 2022. Meanwhile, budgets for non-gift items—including food, decorations, and wrapping paper—are down 12% at $340. After adjusting for inflation, these figures are even lower at $513 for gifts and $268 for non-gift items in constant 2017 dollars, both multi-year lows.

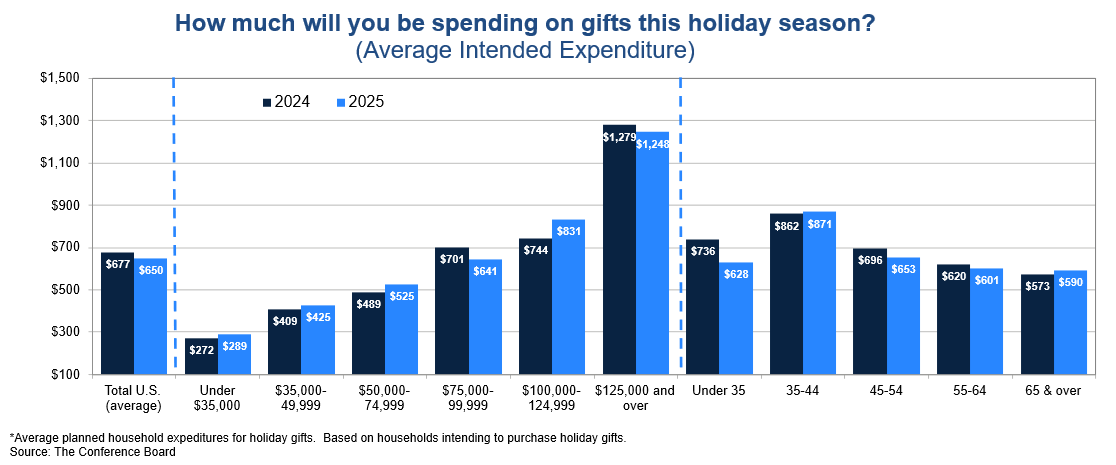

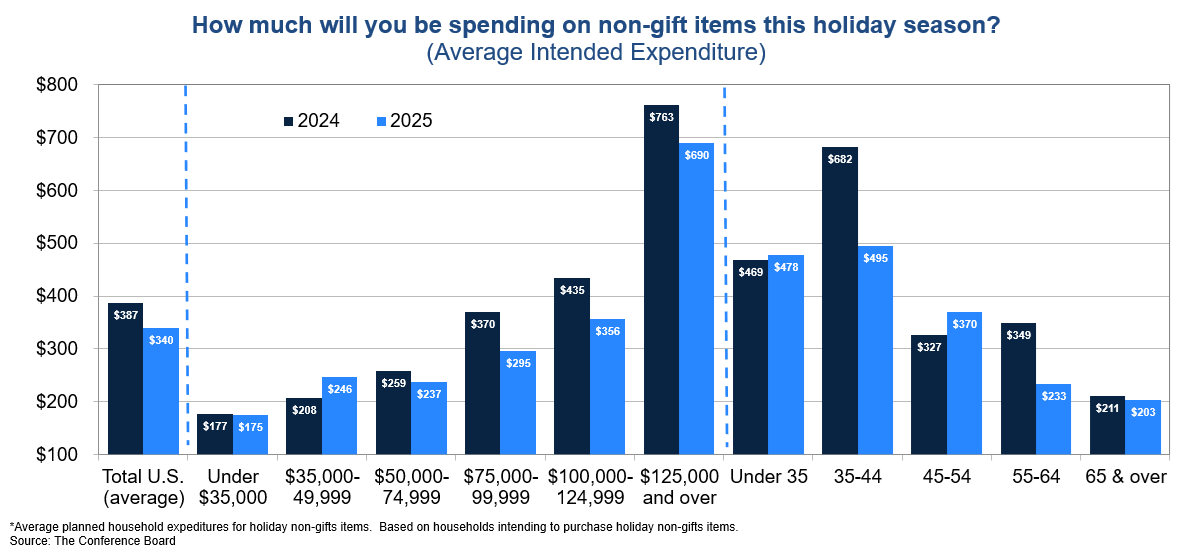

“US consumers remain cautious heading into the holiday season,” said Stephanie Guichard, Senior Economist, Global Indicators at The Conference Board. “The Holiday Spending Survey shows Americans will approach gift-giving and celebrations with restraint this season, as several years of relatively high inflation have raised price levels and squeezed consumers’ wallets. Once accounting for inflation, planned holiday spending is well below pre-pandemic levels, with younger and wealthier consumers cutting back the most. By contrast, consumers over 65 and those earning under $50K expect to spend more overall in 2025 after cutting last year.”

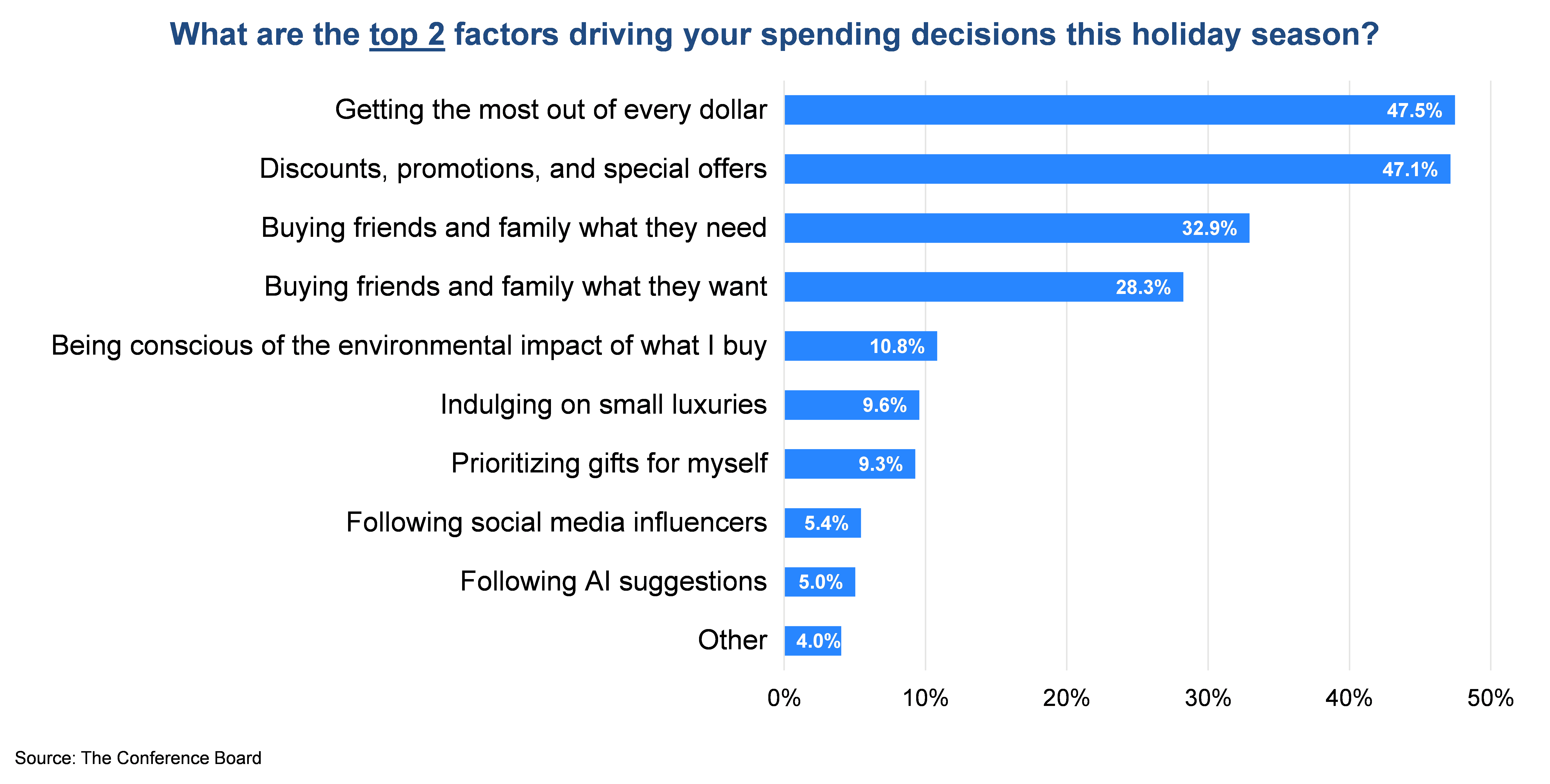

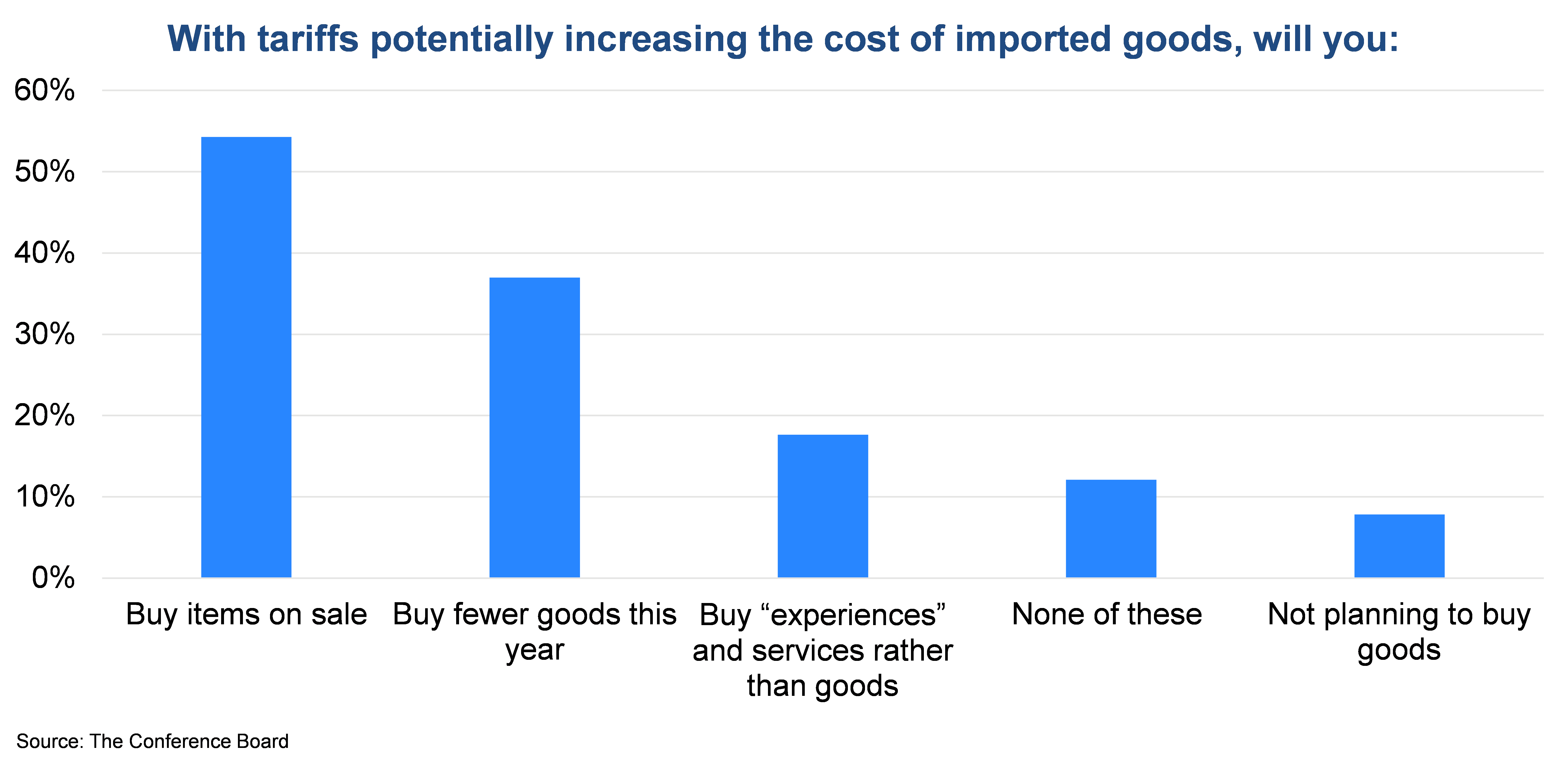

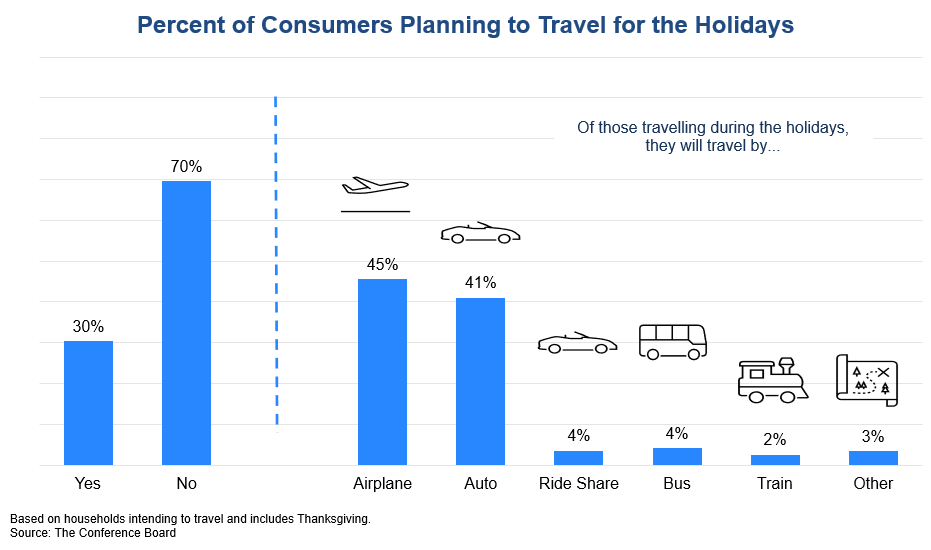

Guichard added: “In order to fit purchases into tighter budgets, consumers’ spending decisions will be driven by promotions and getting the most out of every dollar. Overall, suggestions from AI and influencers will play only a marginal role in spending decisions, though younger age groups are more receptive. Consumers also said they are focused on giving their family and friends items they need this year rather than items they want. In addition to seeking promotions, consumers say they are likely to buy fewer goods if the price of imported items is inflated by tariffs. Lastly, just 30% of consumers plan to travel this holiday season, down slightly from 2024.”

Among the other key findings in the survey:

Young and wealthy consumers plan to spend less this year

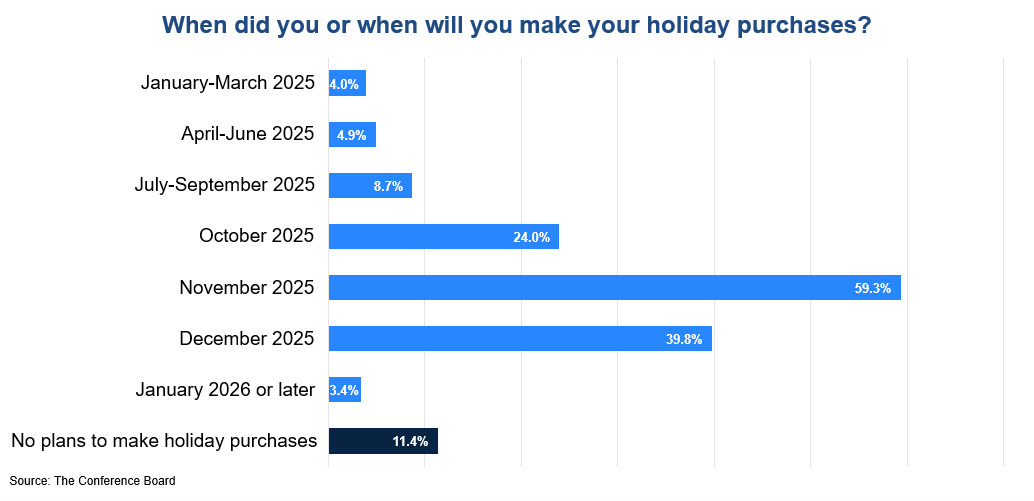

Despite tariffs, most holiday shopping will be done in Q4 2025

Consumers are budget-conscious and looking for bargains

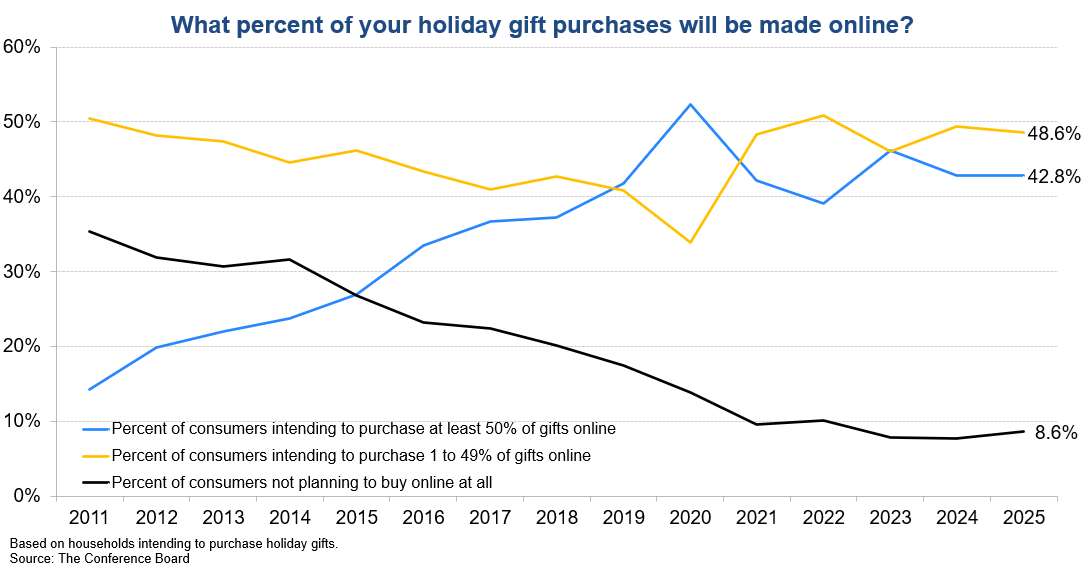

Buying gifts online remains widely popular

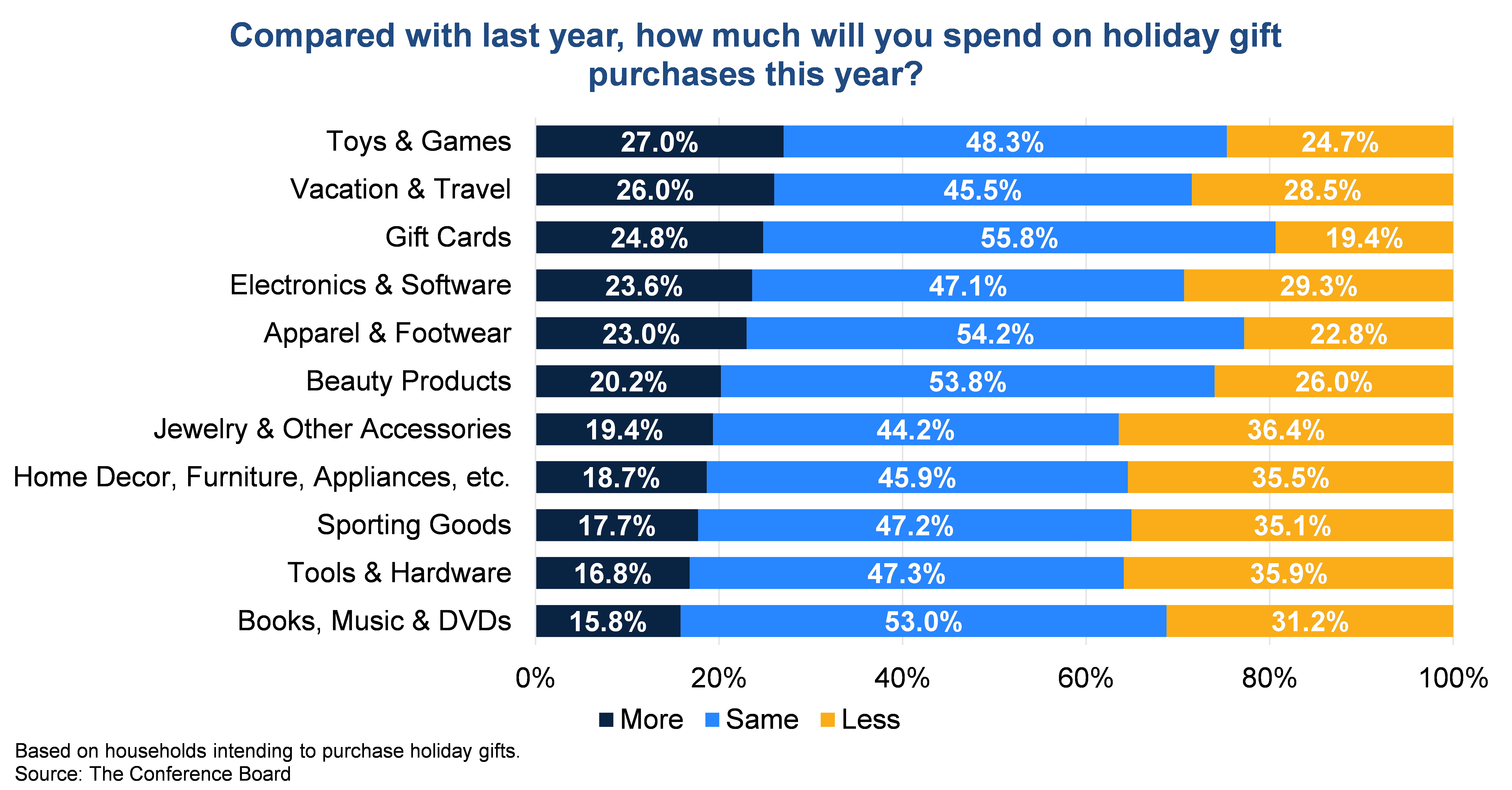

Purchasing plans reveal a preference for toys, travel, and gift cards

Most consumers plan to stay home or near home for the holidays

About The Conference Board

The Conference Board is the member-driven think tank that delivers Trusted Insights for What's Ahead®®. Founded in 1916, we are a non-partisan, not-for-profit entity holding 501(c)(3) tax-exempt status in the United States. TCB.org

For further information contact:

Jonathan Liu

jliu@tcb.org

Joseph DiBlasi

781.308.7935

jdiblasi@tcb.org

All release times displayed are Eastern Time

Note: Due to the US federal government shutdown, all further releases for The Conference Board Employment Trends Index™ (ETI), The Conference Board-Lightcast Help Wanted OnLine® Index (HWOL Index), The Conference Board Leading Economic Index® of the US (US LEI) and The Conference Board Global Leading Economic Index® (Global LEI) data may be delayed.

PRESS RELEASE

The Conference Board Leading Economic Index® (LEI) for the US Continued to Decli

February 19, 2026

PRESS RELEASE

LEI for Mexico Increased in January

February 18, 2026

PRESS RELEASE

LEI for the Euro Area Remained Unchanged in January

February 18, 2026

PRESS RELEASE

The Conference Board Employment Trends Index™ (ETI) Improved in January

February 17, 2026

PRESS RELEASE

Online Labor Demand Increased in January

February 17, 2026

PRESS RELEASE

The LEI for Germany Increased in December

February 16, 2026

Charts

The Gray Swans Tool helps C-suite executives better navigate today’s quickly developing economic, political, and technological environments.

LEARN MOREConnect and be informed about this topic through webcasts, virtual events and conferences

Economy Watch: US View (February 2026)

February 13, 2026 | Article

January CPI Raises More Questions than Provides Answers

February 13, 2026 | Brief

The Conference Board Economic Forecast for the US Economy

February 12, 2026 | Article

Steady as She Goes Labor Market, Risks Remain

February 11, 2026 | Brief

Lukewarm Holiday Shopping in 2025 Augurs Slower Spending in Q4

February 10, 2026 | Brief

Priced Out: The State of US Housing Affordability

February 11, 2026

The CEO Outlook for 2026—Uncertainty, Risks, Growth & Strategy

January 15, 2026

The Big Picture: What's Ahead for the Global Economy?

December 10, 2025

AI & Talent Transformation: Hiring, Skills, and Workforce Strategy

November 19, 2025

Economy Watch: Trends in Consumer & CEO Confidence

November 12, 2025

Insurance in Crisis: Surging Prices & Risks

November 05, 2025