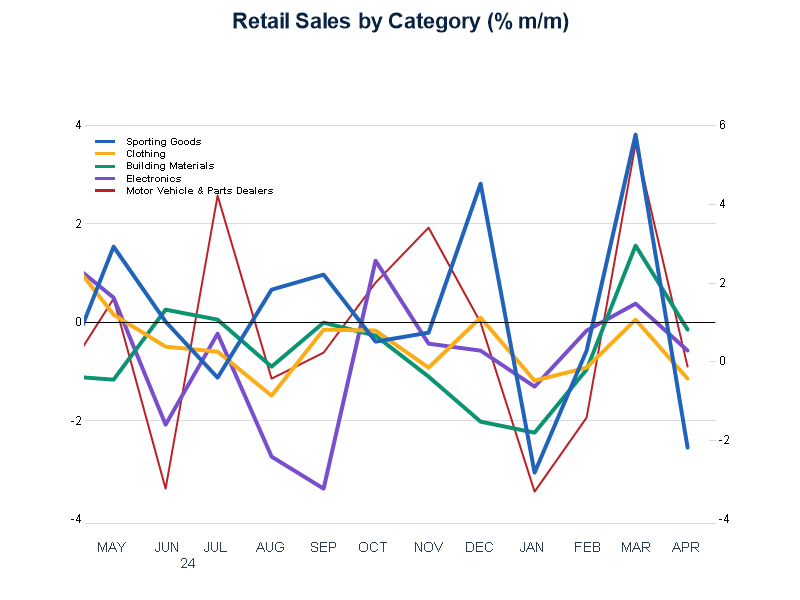

Broad-based weakening in retail sales in April followed an upwardly revised increase to an already solid rise in March, suggesting consumers pulled purchases forward ahead of widely anticipated tariff-driven price increases.

Figure 1. Retail Sales Lull after March Jump

Sources: Census Bureau, Haver Analytics, The Conference Board, 2025

myTCB® Members get exclusive access to webcasts, publications, data and analysis, plus discounts to events.

Shutdown Aside, Growth Moderates Under Inflationary Pressures

February 20, 2026

January CPI Raises More Questions than Provides Answers

February 13, 2026

Lukewarm Holiday Shopping in 2025 Augurs Slower Spending in Q4

February 10, 2026

FOMC Reaction: US Economy In a Good Place, But Staying Vigilant

January 28, 2026

Fed January Decision: Pause or Full Stop?

January 27, 2026

November PCE: Are Consumers Spending Beyond Their Means?

January 22, 2026

Charts

The Gray Swans Tool helps C-suite executives better navigate today’s quickly developing economic, political, and technological environments.

LEARN MORE

Charts

This index identifies the risk of future labor shortages for specific occupations.

LEARN MORE

Charts

Our goal is to help members see beyond the political dynamic to inform a medium-term view that supports your strategic planning at this difficult juncture.

LEARN MOREAll release times displayed are Eastern Time

Note: Due to the US federal government shutdown, all further releases for The Conference Board Employment Trends Index™ (ETI), The Conference Board-Lightcast Help Wanted OnLine® Index (HWOL Index), The Conference Board Leading Economic Index® of the US (US LEI) and The Conference Board Global Leading Economic Index® (Global LEI) data may be delayed.

PRESS RELEASE

LEI for the Global Economy was unchanged in December

February 26, 2026

PRESS RELEASE

CEO Confidence Rose Significantly in Q1 2026

February 26, 2026

PRESS RELEASE

LEI for China Declined in January

February 25, 2026

PRESS RELEASE

US Consumer Confidence Inched Up in February

February 24, 2026

PRESS RELEASE

LEI for India Ticked Up in January

February 23, 2026

PRESS RELEASE

The Conference Board Leading Economic Index® (LEI) for the US Continued to Decli

February 19, 2026

Connect and be informed about this topic through webcasts, virtual events and conferences

Shutdown Aside, Growth Moderates Under Inflationary Pressures

February 20, 2026 | Brief

Economy Watch: US View (February 2026)

February 13, 2026 | Article

January CPI Raises More Questions than Provides Answers

February 13, 2026 | Brief

Priced Out: The State of US Housing Affordability

February 11, 2026

The CEO Outlook for 2026—Uncertainty, Risks, Growth & Strategy

January 15, 2026

The Big Picture: What's Ahead for the Global Economy?

December 10, 2025

AI & Talent Transformation: Hiring, Skills, and Workforce Strategy

November 19, 2025

Economy Watch: Trends in Consumer & CEO Confidence

November 12, 2025

Insurance in Crisis: Surging Prices & Risks

November 05, 2025