Driving Growth and Mitigating Risk Amid Extreme Volatility

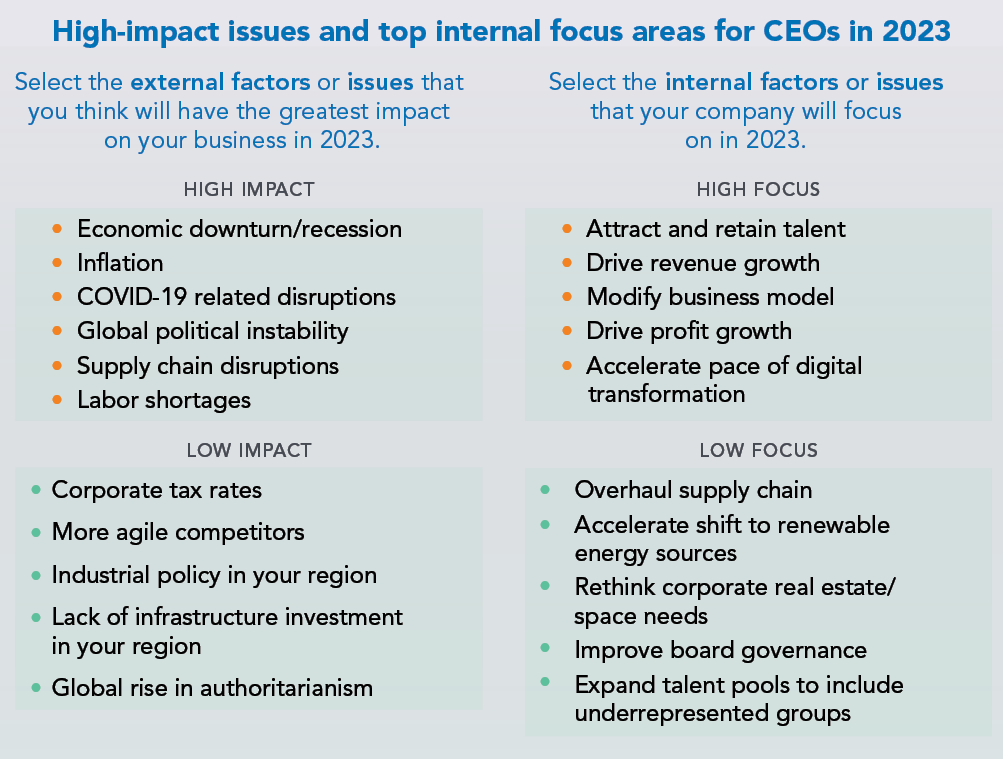

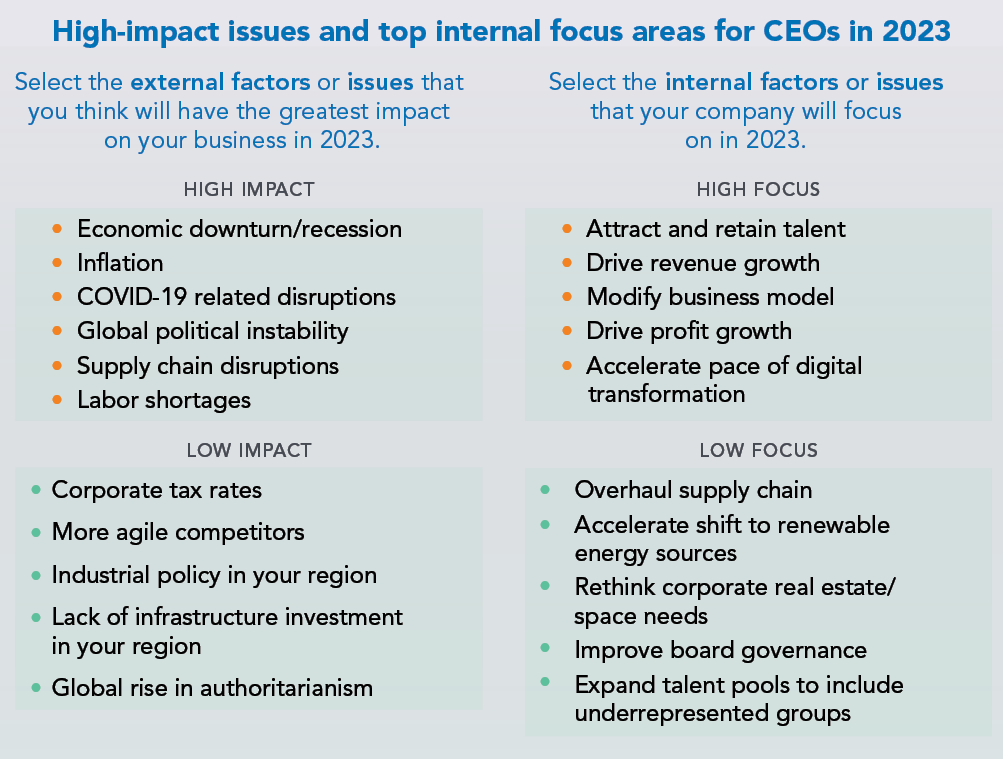

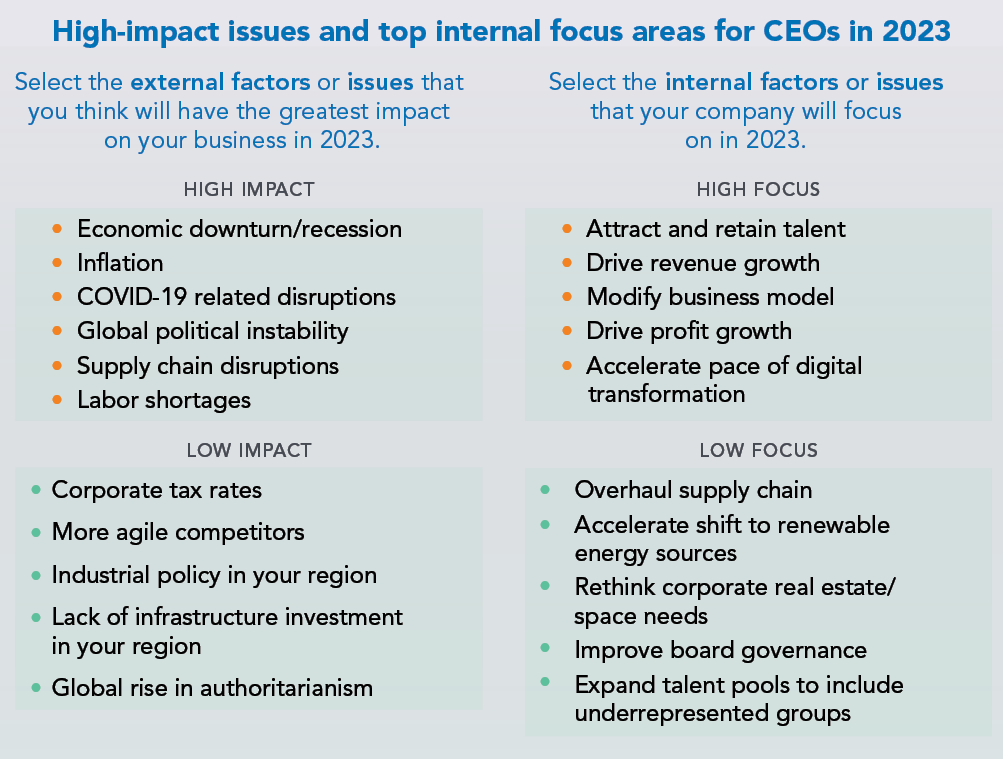

The Conference Board 2023 C-Suite Outlook survey shows that the global economic downturn and regional recessions, inflation, continued disruptions from the pandemic (in Asia), global geopolitical instability, supply chain issues, and labor shortages are the high-impact events that CEOs and C-suite executives see as challenging their organizations this year. In response, they are focusing on driving revenue and profit growth through digital transformations and business model innovations while finding and keeping the talent to make it all happen even as they look to keep costs down. This survey was conducted between mid-November and mid-December 2022, with 1,131 C-suite executives, including 670 CEOs across the globe, responding.

Trusted Insights for What's Ahead™

The global economy is on a downward trend, weakened by high inflation, tighter monetary policy, tight labor markets, mild recessions in several economies, weakness in China’s growth, and pandemic-driven economic scarring. A global recession is not our base forecast, as we anticipate real GDP growth of 2.1 percent in 2023—a pace that does not formally constitute a global recession but, if achieved, would be the weakest growth rate since 2001 (outside of global recession years 2009 and 2020). Nonetheless, regional recessions are highly likely in the US, Europe, and some of the largest Latin American economies. Russia and Ukraine may remain in recession longer.

External impacts

- CEOs see economic downturn/recession, inflation, the effects of COVID-19, geopolitical instability, supply chain disruptions, and labor shortages as the major disruptors to their business operations in 2023. Only CEOs in Europe cite the war in Ukraine, which has disrupted local economies through soaring energy costs, double-digit inflation, plummeting consumer confidence, and reduced business activity, as a top five external impact issue. CEOs in China see US-China tensions as a major disruptor.

- With high expectations for a recession, there is little consensus among CEOs on when their regions are likely to achieve faster GDP growth. Generally, CEOs expect economic weakness to last through the end of 2023 or to mid-2024 in the regions where they operate.

- For CEOs in the US and Europe, COVID-19 disruptions are mostly in the rearview mirror, but concern over the pandemic’s impacts remains strong among CEOs in China, where COVID-19 cases have skyrocketed with the easing of restrictions, and in Japan, where the lockdowns in China disrupted supply chains and a new wave of cases in late summer of 2022 had a negative impact on business activity in the retail and service sectors.

- Concern over the impact of higher borrowing costs, barely on the CEO radar a year earlier, has risen considerably globally, especially among CEOs in the US. It is less of a concern in Europe. Although the European Central Bank has tightened its monetary policy to curb inflation, its monetary policy is less loose than that of the US Fed. This, coupled with positive postpandemic balance sheets for many companies, explains why higher borrowing costs are not seen as a pressing issue in the region.

- Energy price volatility is a rising concern for CEOs, especially in Europe and Japan, where energy and fuel prices catapulted to new highs in 2022. For C-suite executives, dealing with the impact of energy issues on day-to-day operations, it has risen to a top-three impact issue. Soaring energy costs is putting pressure on existing investments, operations, and production lines in Europe, according to the November 2022 edition of The Conference Board Measure of CEO Confidence™ for Europe. In that survey, a third of CEOs and chairs say they plan to temporarily either pause or decrease investments in existing businesses owing to high energy prices. Fifteen percent plan to do this permanently.

Internal focus for 2023 and recession responses

- Even while CEOs globally face slower growth and regional recession risks, concerns about labor shortages and talent retention persist, underscoring how the current global slowdown and expected regional recessions may be different than previous ones. With labor markets in many regions remaining tight, companies should prepare for higher wage and benefit costs in 2023. Lingering pandemic effects are negatively affecting labor force participation around the world, due to ongoing mobility restrictions, fear factor, or people out of work due to having COVID-19 or caring for others with the virus. Skills mismatches are also a challenge along with strict immigration/migration policies.

- When asked specifically about their short-term plans to deal with a recession, CEOs cite four broad strategies: accelerating innovation and digital transformation; pursuing new opportunities (in products/services, regions, and M&A); cutting noncore costs (general & administrative, discretionary); and revising business models (e.g., pricing strategy, risk management).

Growth in the medium term

- CEOs are looking to innovation, technology, and talent to ensure growth for their business over the next two to three years. CEOs in the US and Europe, eyeing healthy returns as valuations come down, see M&A as a key growth strategy. US CEOs also see expanding their workforces as a growth contributor for the medium term.

Geopolitical risk and the war in Ukraine

- More CEOs expect geopolitical instability to have an impact on their businesses in 2023, compared to the previous year. CEOs in China are significantly more concerned about US-China tensions, compared to their counterparts in the US. Depending on enforcement stringency, and the extent of allied support, new US export controls on semiconductors could be debilitating to China’s electronics, auto, and capital goods sectors.

- CEOs in the US and other parts of the world (except for Europe) do not list the war in Ukraine among the top five events likely to have a significant impact on their operations in 2023. Considering its disruptive impact on the global economy, are businesses underestimating the impact on global growth, trade, energy, and supply chains of the war intensifying?

- When it comes to the impacts of the war in Ukraine, more than 80 percent of CEOs globally expect cyberattacks outside the war theater to intensify, while more than 65 percent believe economic sanctions will increase and global food and energy crises will worsen. The ranking of the top three impacts is consistent across all countries and regions in our survey.

- While concern about rising authoritarianism has receded globally, declining trust in government is rising as a concern for CEOs globally and especially in Latin America and China, where protests over COVID lockdowns and property market scandals have been cause for concern.

Human capital management

- Many companies continue to deal with the pandemic effects and erosion of the employee experience, manifesting in greater employee burnout, declining self-reported levels of mental health, lower engagement, and a rise in sick days and workplace safety incidents. To combat this, CEOs are focused on building stronger cultures of resilience, innovation, employee centricity, and inclusiveness to meet their objectives to attract and retain talent.

- There appears to be an emerging equilibrium around remote work in economies that more rapidly moved to hybrid models during the pandemic, with just 5 percent of CEOs in the US and Europe looking to expand it and about 4 percent looking to reduce it. Despite evidence showing many CEOs in the US and Europe desire a return to the office mandate, just 5 percent of CEOs in the US and 2 percent in Europe cite returning workers to the physical workplace as an HCM priority in 2023. For many, the challenge now is how to optimize a hybrid work model.

- While CEOs are focused on enterprise-wide digital transformation and face increasing demand for data-backed human capital disclosures from investors and regulators, they do not see improving skills in HR data analytics or investing in artificial intelligence (AI) for HR as high human capital management priorities—two issues that the HR community itself is highly focused on.

ESG priorities, climate change, and renewable energy

- Stakeholder capitalism—the idea that businesses serve the long-term welfare of all their constituents, not just shareholders—appears to be on a firm footing in many companies, with customers and employees ranking ahead of investors in stakeholder prioritization for CEOs in most countries and regions in our survey.

- Almost half of CEOs globally say climate change is already having a significant impact on their businesses now or will in the next one to five years. This underscores the urgency to formulate a firm-level strategy to mitigate the risk now and in the future. However, despite China’s need to urgently attend to environmental protection and decarbonization to achieve its climate commitments, more than a quarter of CEOs in China see the impact of climate change affecting their businesses six to 10 years down the road.

- Despite their concerns about high transition costs, almost half of CEOs globally (49 percent) and 59 percent of C-suite executives say the transition to renewable energy will be significantly positive for their organizations.

- Neither an economic slowdown, nor an environmental, social & governance (ESG) backlash will affect ESG spending this year.

- Even as dependence on fossil fuels, including persistent use of coal, is increasing in many countries, energy (from usage to sourcing to security) is the top environmentally related ESG priority for CEOs globally. China, where air pollution ranks as the top priority for CEOs, is the lone exception.

- Most CEOs cite economic opportunity, equality, and security as their organization’s number one social priority. It is ranked second by CEOs in Japan after a similarly themed but broader priority, sustainable capitalism. Gender equality is the top ESG-social priority for CEOs in the financial services industry, a sector where women remain underrepresented in the workforce, especially at the senior management level.

Supply chain

- CEOs globally cite supply chain disruptions as a top five high-impact issue for 2023, but it has fallen in intensity for CEOs in both the US and Europe since our January 2022 report, dropping from 3rd in 2022 to 5th in the US and 7th in Europe in 2023 amid signs of some easing as inventories return to prepandemic levels, according to the November 2022 Logistics Managers’ Index, which is a sign that supply chains are returning to normal.

- Many CEOs (34 percent globally, 44 percent in the US) have no plans to alter supply chains over the next three to five years. It appears that the multiple challenges caused by the pandemic and the immediate impact of the war in Ukraine have already forced some changes.

- Those taking actions plan to further localize supply sourcing; increase the use of technologies such as AI and blockchain to improve performance; and become more transparent with vendors while applying lessons learned from recent disruptions. Global supply chains will become shorter over the coming decade. COVID-19-related disruptions to supply chains and geopolitical considerations will result in a return to the diversification of global production networks in a way that may be less economically efficient. Trends such as “nearshoring” and “friend-shoring,” favored by 30 percent of CEOs in Europe, will increase costs but also make supply chains more resilient to shocks, especially in mature economies.

Marketing & communications

- Globally, CEOs place marketing and promotions in their top three investment areas to ensure medium-term growth for their organizations. About two-thirds of CEOs (65 percent) say they are planning to increase budgets for customer service and experience, and new customer acquisition over the next 24 months, with 58 percent increasing budget for new product/service development.

Crisis preparedness

- CEOs are generally more pessimistic than the rest of the C-suite team about organizations’ level of preparedness to handle a major crisis, such as a pandemic, recession, financial instability, or a surge in energy prices. Generally, business leaders are more prepared for events that they have experienced recently (e.g., recession, pandemic, financial crisis) compared to events they likely have not had to lead through (e.g., extreme violence, nuclear war, major food or water shortages).

Driving Growth and Mitigating Risk Amid Extreme Volatility

The Conference Board 2023 C-Suite Outlook survey shows that the global economic downturn and regional recessions, inflation, continued disruptions from the pandemic (in Asia), global geopolitical instability, supply chain issues, and labor shortages are the high-impact events that CEOs and C-suite executives see as challenging their organizations this year. In response, they are focusing on driving revenue and profit growth through digital transformations and business model innovations while finding and keeping the talent to make it all happen even as they look to keep costs down. This survey was conducted between mid-November and mid-December 2022, with 1,131 C-suite executives, including 670 CEOs across the globe, responding.

Trusted Insights for What's Ahead™

The global economy is on a downward trend, weakened by high inflation, tighter monetary policy, tight labor markets, mild recessions in several economies, weakness in China’s growth, and pandemic-driven economic scarring. A global recession is not our base forecast, as we anticipate real GDP growth of 2.1 percent in 2023—a pace that does not formally constitute a global recession but, if achieved, would be the weakest growth rate since 2001 (outside of global recession years 2009 and 2020). Nonetheless, regional recessions are highly likely in the US, Europe, and some of the largest Latin American economies. Russia and Ukraine may remain in recession longer.

External impacts

- CEOs see economic downturn/recession, inflation, the effects of COVID-19, geopolitical instability, supply chain disruptions, and labor shortages as the major disruptors to their business operations in 2023. Only CEOs in Europe cite the war in Ukraine, which has disrupted local economies through soaring energy costs, double-digit inflation, plummeting consumer confidence, and reduced business activity, as a top five external impact issue. CEOs in China see US-China tensions as a major disruptor.

- With high expectations for a recession, there is little consensus among CEOs on when their regions are likely to achieve faster GDP growth. Generally, CEOs expect economic weakness to last through the end of 2023 or to mid-2024 in the regions where they operate.

- For CEOs in the US and Europe, COVID-19 disruptions are mostly in the rearview mirror, but concern over the pandemic’s impacts remains strong among CEOs in China, where COVID-19 cases have skyrocketed with the easing of restrictions, and in Japan, where the lockdowns in China disrupted supply chains and a new wave of cases in late summer of 2022 had a negative impact on business activity in the retail and service sectors.

- Concern over the impact of higher borrowing costs, barely on the CEO radar a year earlier, has risen considerably globally, especially among CEOs in the US. It is less of a concern in Europe. Although the European Central Bank has tightened its monetary policy to curb inflation, its monetary policy is less loose than that of the US Fed. This, coupled with positive postpandemic balance sheets for many companies, explains why higher borrowing costs are not seen as a pressing issue in the region.

- Energy price volatility is a rising concern for CEOs, especially in Europe and Japan, where energy and fuel prices catapulted to new highs in 2022. For C-suite executives, dealing with the impact of energy issues on day-to-day operations, it has risen to a top-three impact issue. Soaring energy costs is putting pressure on existing investments, operations, and production lines in Europe, according to the November 2022 edition of The Conference Board Measure of CEO Confidence™ for Europe. In that survey, a third of CEOs and chairs say they plan to temporarily either pause or decrease investments in existing businesses owing to high energy prices. Fifteen percent plan to do this permanently.

Internal focus for 2023 and recession responses

- Even while CEOs globally face slower growth and regional recession risks, concerns about labor shortages and talent retention persist, underscoring how the current global slowdown and expected regional recessions may be different than previous ones. With labor markets in many regions remaining tight, companies should prepare for higher wage and benefit costs in 2023. Lingering pandemic effects are negatively affecting labor force participation around the world, due to ongoing mobility restrictions, fear factor, or people out of work due to having COVID-19 or caring for others with the virus. Skills mismatches are also a challenge along with strict immigration/migration policies.

- When asked specifically about their short-term plans to deal with a recession, CEOs cite four broad strategies: accelerating innovation and digital transformation; pursuing new opportunities (in products/services, regions, and M&A); cutting noncore costs (general & administrative, discretionary); and revising business models (e.g., pricing strategy, risk management).

Growth in the medium term

- CEOs are looking to innovation, technology, and talent to ensure growth for their business over the next two to three years. CEOs in the US and Europe, eyeing healthy returns as valuations come down, see M&A as a key growth strategy. US CEOs also see expanding their workforces as a growth contributor for the medium term.

Geopolitical risk and the war in Ukraine

- More CEOs expect geopolitical instability to have an impact on their businesses in 2023, compared to the previous year. CEOs in China are significantly more concerned about US-China tensions, compared to their counterparts in the US. Depending on enforcement stringency, and the extent of allied support, new US export controls on semiconductors could be debilitating to China’s electronics, auto, and capital goods sectors.

- CEOs in the US and other parts of the world (except for Europe) do not list the war in Ukraine among the top five events likely to have a significant impact on their operations in 2023. Considering its disruptive impact on the global economy, are businesses underestimating the impact on global growth, trade, energy, and supply chains of the war intensifying?

- When it comes to the impacts of the war in Ukraine, more than 80 percent of CEOs globally expect cyberattacks outside the war theater to intensify, while more than 65 percent believe economic sanctions will increase and global food and energy crises will worsen. The ranking of the top three impacts is consistent across all countries and regions in our survey.

- While concern about rising authoritarianism has receded globally, declining trust in government is rising as a concern for CEOs globally and especially in Latin America and China, where protests over COVID lockdowns and property market scandals have been cause for concern.

Human capital management

- Many companies continue to deal with the pandemic effects and erosion of the employee experience, manifesting in greater employee burnout, declining self-reported levels of mental health, lower engagement, and a rise in sick days and workplace safety incidents. To combat this, CEOs are focused on building stronger cultures of resilience, innovation, employee centricity, and inclusiveness to meet their objectives to attract and retain talent.

- There appears to be an emerging equilibrium around remote work in economies that more rapidly moved to hybrid models during the pandemic, with just 5 percent of CEOs in the US and Europe looking to expand it and about 4 percent looking to reduce it. Despite evidence showing many CEOs in the US and Europe desire a return to the office mandate, just 5 percent of CEOs in the US and 2 percent in Europe cite returning workers to the physical workplace as an HCM priority in 2023. For many, the challenge now is how to optimize a hybrid work model.

- While CEOs are focused on enterprise-wide digital transformation and face increasing demand for data-backed human capital disclosures from investors and regulators, they do not see improving skills in HR data analytics or investing in artificial intelligence (AI) for HR as high human capital management priorities—two issues that the HR community itself is highly focused on.

ESG priorities, climate change, and renewable energy

- Stakeholder capitalism—the idea that businesses serve the long-term welfare of all their constituents, not just shareholders—appears to be on a firm footing in many companies, with customers and employees ranking ahead of investors in stakeholder prioritization for CEOs in most countries and regions in our survey.

- Almost half of CEOs globally say climate change is already having a significant impact on their businesses now or will in the next one to five years. This underscores the urgency to formulate a firm-level strategy to mitigate the risk now and in the future. However, despite China’s need to urgently attend to environmental protection and decarbonization to achieve its climate commitments, more than a quarter of CEOs in China see the impact of climate change affecting their businesses six to 10 years down the road.

- Despite their concerns about high transition costs, almost half of CEOs globally (49 percent) and 59 percent of C-suite executives say the transition to renewable energy will be significantly positive for their organizations.

- Neither an economic slowdown, nor an environmental, social & governance (ESG) backlash will affect ESG spending this year.

- Even as dependence on fossil fuels, including persistent use of coal, is increasing in many countries, energy (from usage to sourcing to security) is the top environmentally related ESG priority for CEOs globally. China, where air pollution ranks as the top priority for CEOs, is the lone exception.

- Most CEOs cite economic opportunity, equality, and security as their organization’s number one social priority. It is ranked second by CEOs in Japan after a similarly themed but broader priority, sustainable capitalism. Gender equality is the top ESG-social priority for CEOs in the financial services industry, a sector where women remain underrepresented in the workforce, especially at the senior management level.

Supply chain

- CEOs globally cite supply chain disruptions as a top five high-impact issue for 2023, but it has fallen in intensity for CEOs in both the US and Europe since our January 2022 report, dropping from 3rd in 2022 to 5th in the US and 7th in Europe in 2023 amid signs of some easing as inventories return to prepandemic levels, according to the November 2022 Logistics Managers’ Index, which is a sign that supply chains are returning to normal.

- Many CEOs (34 percent globally, 44 percent in the US) have no plans to alter supply chains over the next three to five years. It appears that the multiple challenges caused by the pandemic and the immediate impact of the war in Ukraine have already forced some changes.

- Those taking actions plan to further localize supply sourcing; increase the use of technologies such as AI and blockchain to improve performance; and become more transparent with vendors while applying lessons learned from recent disruptions. Global supply chains will become shorter over the coming decade. COVID-19-related disruptions to supply chains and geopolitical considerations will result in a return to the diversification of global production networks in a way that may be less economically efficient. Trends such as “nearshoring” and “friend-shoring,” favored by 30 percent of CEOs in Europe, will increase costs but also make supply chains more resilient to shocks, especially in mature economies.

Marketing & communications

- Globally, CEOs place marketing and promotions in their top three investment areas to ensure medium-term growth for their organizations. About two-thirds of CEOs (65 percent) say they are planning to increase budgets for customer service and experience, and new customer acquisition over the next 24 months, with 58 percent increasing budget for new product/service development.

Crisis preparedness

- CEOs are generally more pessimistic than the rest of the C-suite team about organizations’ level of preparedness to handle a major crisis, such as a pandemic, recession, financial instability, or a surge in energy prices. Generally, business leaders are more prepared for events that they have experienced recently (e.g., recession, pandemic, financial crisis) compared to events they likely have not had to lead through (e.g., extreme violence, nuclear war, major food or water shortages).