A robust increase in retail sales for March was expected and likely highlighted consumers pulling purchases forward ahead of widely anticipated tariff-driven price increases. The latest data suggest GDP growth will likely remain positive in Q1 2025, consistent with our latest projections, however growth is likely set to moderate significantly later this year as higher tariffs actually take place.

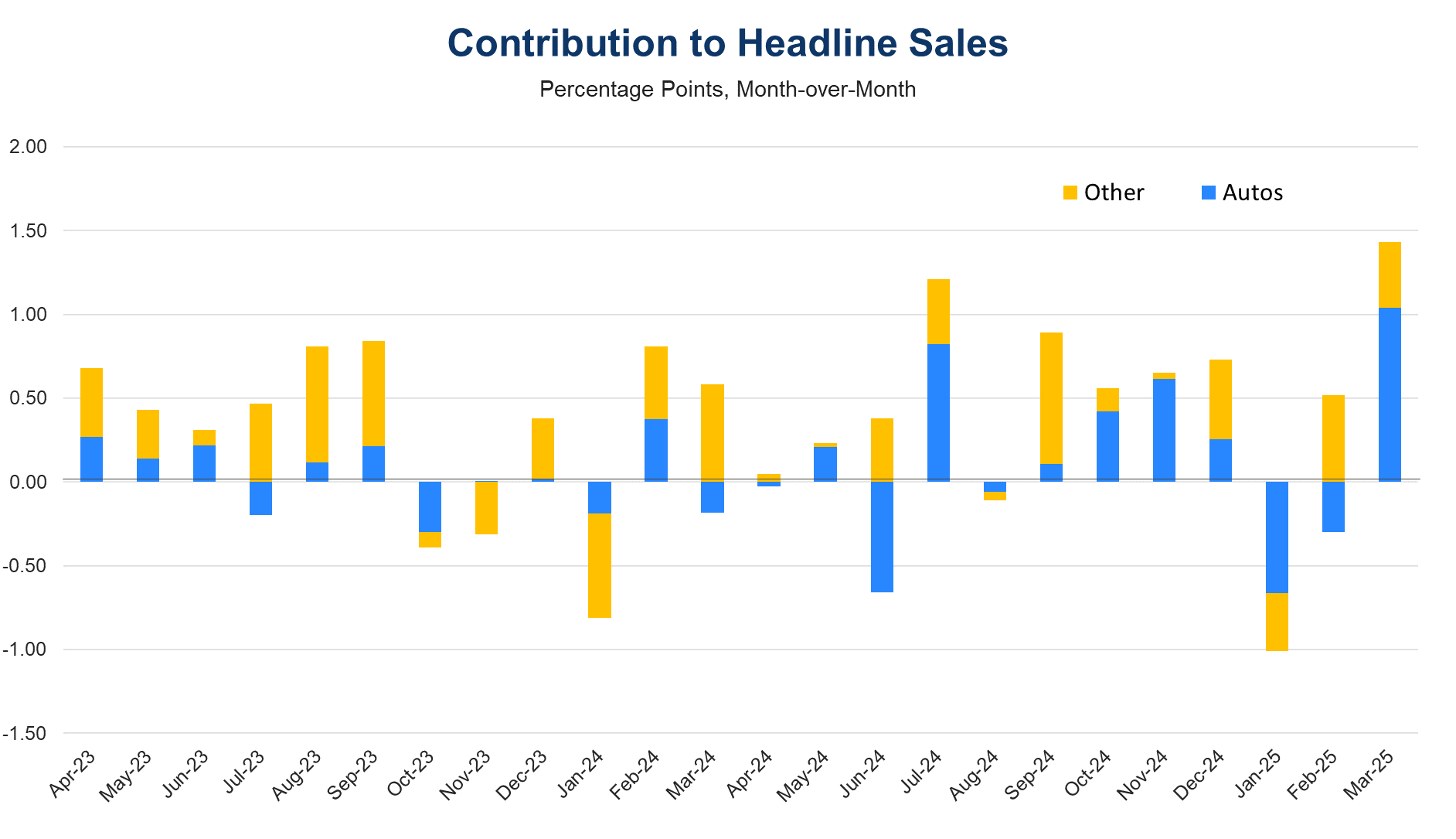

Figure 1. Car Purchases Fuel Headline Sales

Sources: Census Bureau, Haver Analytics, The Conference Board.

A strong increase in retail sales in March was mainly driven by an outsized rise in motor vehicles and parts purchases, which was already captured by the unit auto sales data released earlier this month. The spike likely resulted from consumers stockpiling ahead of steep tariff increases which took effect in the beginning of April.

The latest data will likely push tracking GDP estimates, such as Atlanta Fed GDPNow into positive territory for Q1 from the previously estimated contraction and closer to our own projection for a 1% q/q saar pace. We estimate real consumer spending will rise by about 0.5% q/q saar in Q1.

Despite a solid rise in Mar

myTCB® Members get exclusive access to webcasts, publications, data and analysis, plus discounts to events.

Shutdown Aside, Growth Moderates Under Inflationary Pressures

February 20, 2026

January CPI Raises More Questions than Provides Answers

February 13, 2026

Lukewarm Holiday Shopping in 2025 Augurs Slower Spending in Q4

February 10, 2026

FOMC Reaction: US Economy In a Good Place, But Staying Vigilant

January 28, 2026

Fed January Decision: Pause or Full Stop?

January 27, 2026

November PCE: Are Consumers Spending Beyond Their Means?

January 22, 2026