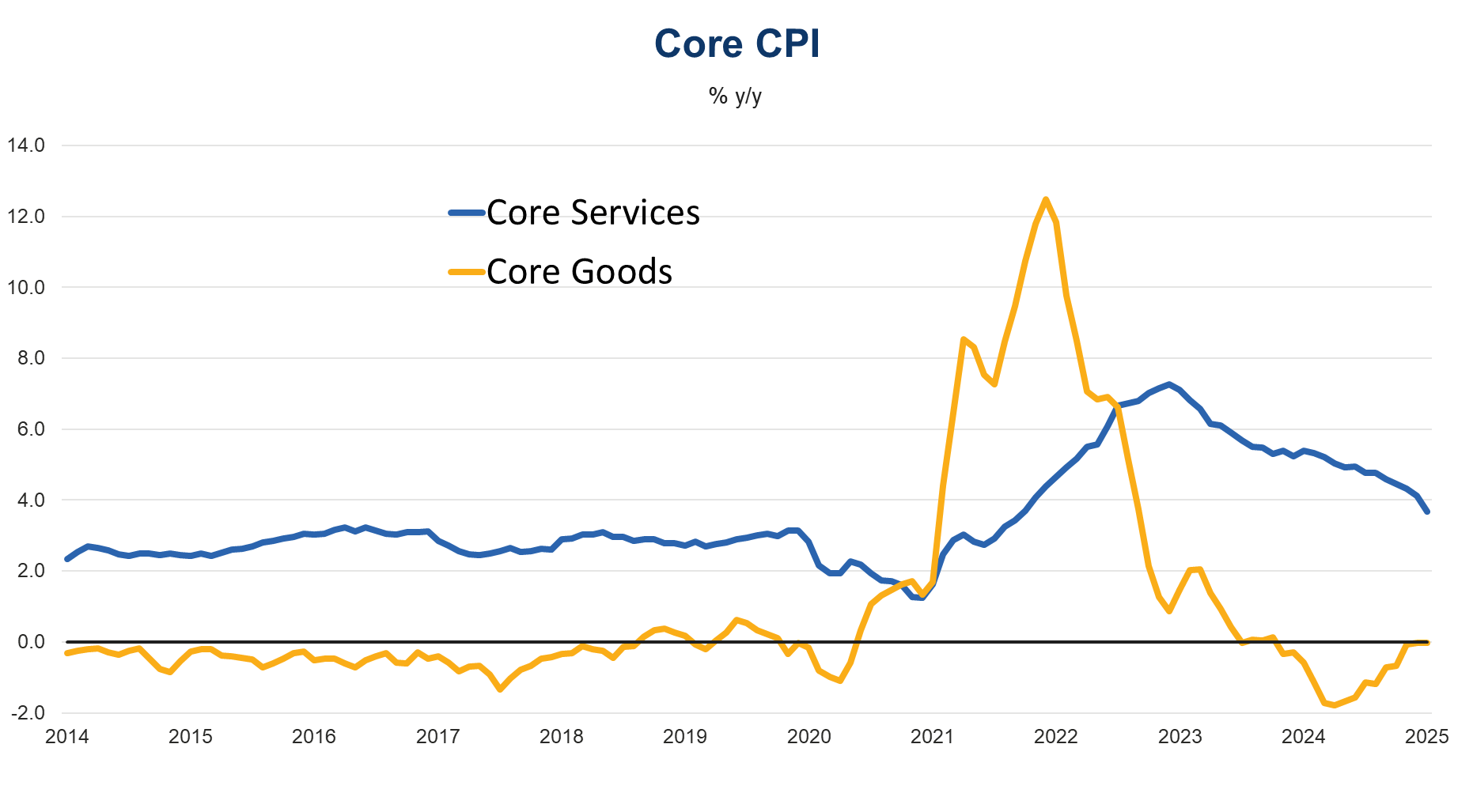

March CPI might have provided a hint of what to expect in the coming months as a broader set of tariffs impact the economy. Rising goods prices may limit discretionary spending. In March, potentially some initial pass-through of tariffs on imports from China into apparel and furniture prices were offset by sharp declines in discretionary travel-related services prices.

Figure 1. Service Price Growth Slows

Sources: Bureau of Labor Statistics, Haver Analytics, The Conference Board.

Uncertainty with respect to what extent tariffs will impact inflation suggests the Fed will likely remain on hold in the coming months, but may cut interest rate later this year as demand slows and the labor market deteriorates.

Rising prices in Q2 and Q3 will likely weigh on demand. Reduced spending will likely lead companies to cut prices, which will limit the rise in inflation later this year.

We project both Headline and Core PCE inflation, which CPI feeds into, to stabilize at around 3% y/y going into 2026. The Conference Board estimates tariffs may substantially lower GDP growth and raise inflation.

Figure 2. Goods Prices Dec

myTCB® Members get exclusive access to webcasts, publications, data and analysis, plus discounts to events.

Shutdown Aside, Growth Moderates Under Inflationary Pressures

February 20, 2026

January CPI Raises More Questions than Provides Answers

February 13, 2026

Lukewarm Holiday Shopping in 2025 Augurs Slower Spending in Q4

February 10, 2026

FOMC Reaction: US Economy In a Good Place, But Staying Vigilant

January 28, 2026

Fed January Decision: Pause or Full Stop?

January 27, 2026

November PCE: Are Consumers Spending Beyond Their Means?

January 22, 2026