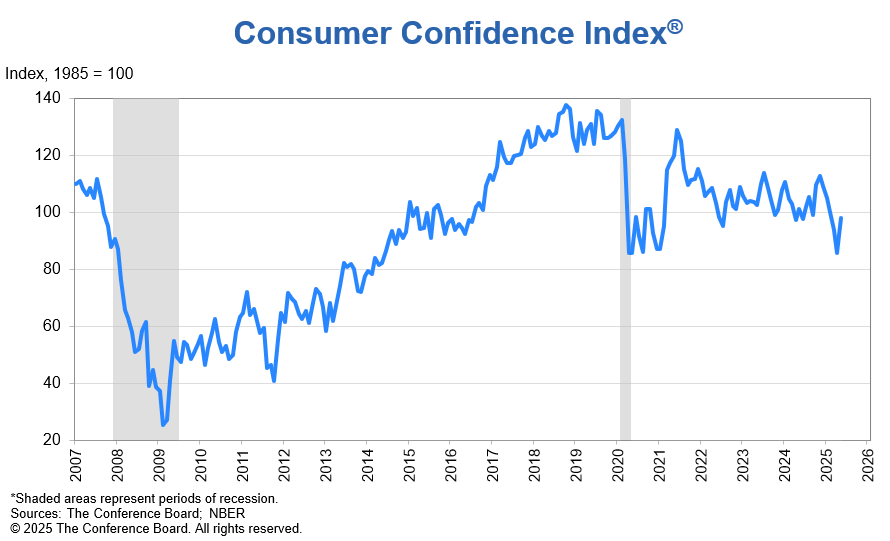

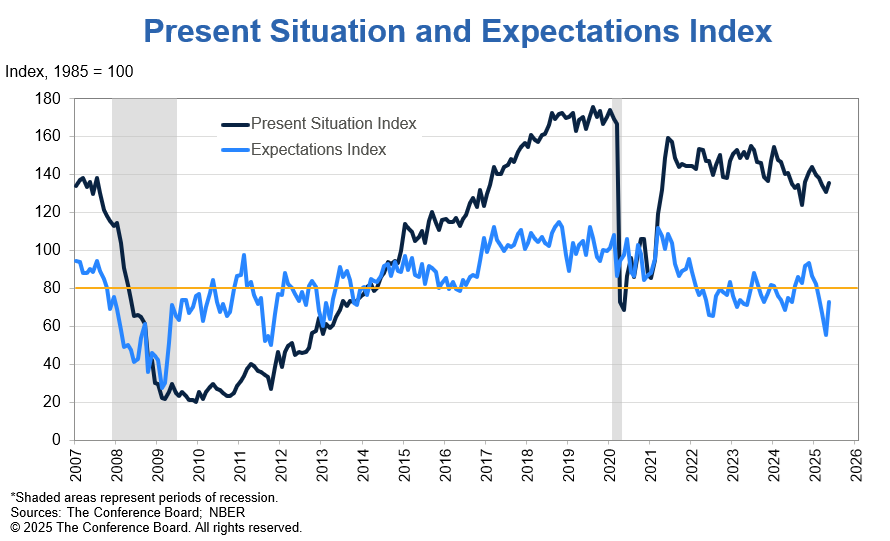

The Conference Board Consumer Confidence Index® increased by 12.3 points in May to 98.0 (1985=100), up from 85.7 in April. The Present Situation Index—based on consumers’ assessment of current business and labor market conditions—rose 4.8 points to 135.9. The Expectations Index—based on consumers’ short-term outlook for income, business, and labor market conditions—surged 17.4 points to 72.8, but remained below the threshold of 80, which typically signals a recession ahead. The cutoff date for preliminary results was May 19, 2025. About half of the responses were collected after the May 12 announcement of a pause on some tariffs on imports from China.

“Consumer confidence improved in May after five consecutive months of decline,” said Stephanie Guichard, Senior Economist, Global Indicators at The Conference Board. “The rebound was already visible before the May 12 US-China trade deal but gained momentum afterwards. The monthly improvement was largely driven by consumer expectations as all three components of the Expectations Index—business conditions, employment prospects, and future income—rose from their April lows. Consumers were less pessimistic about business conditions and job availability over the next six months and regained optimism about future income prospects. Consumers’ assessments of the present situation also improved. However, while consumers were more positive about current business conditions than last month, their appraisal of current job availability weakened for the fifth consecutive month.”

May’s rebound in confidence was broad-based across all age groups and all income groups. It was also shared across all political affiliations, with the strongest improvements among Republicans. However, on a six-month moving average basis, confidence in all age and income groups was still down due to previous monthly declines.

Guichard added: “With the stock market continuing to recover in May, consumers’ outlook on stock prices improved, with 44% expecting stock prices to increase over the next 12 months (up from 37.6% in April) and 37.7% expecting stock prices to decline (down from 47.2% in April). This was one of the survey questions with the strongest improvement after the May 12 trade deal.”

Write-in responses on what topics are affecting views of the economy revealed that tariffs are still on top of consumers’ minds. Notably, consumers continued to express concerns about tariffs increasing prices and having negative impacts on the economy, but some also expressed hopes that the announced and future trade deals could support economic activity. While inflation and high prices remained an important concern for consumers in May, there were also some mentions of easing inflation and lower gas prices.

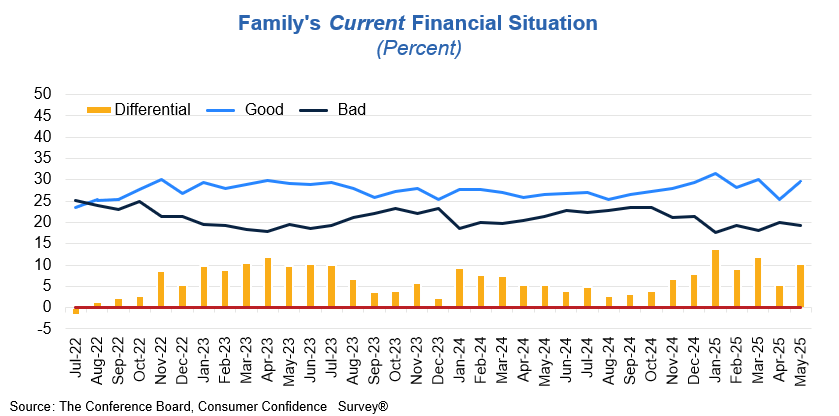

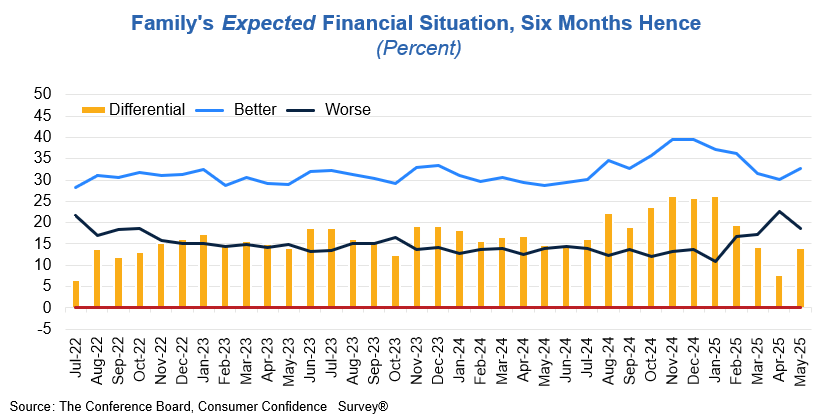

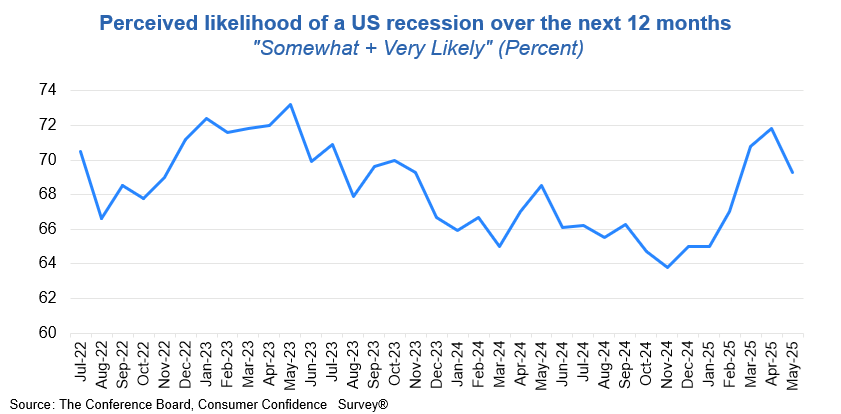

Consumers’ views of their Family’s Current and Future Financial Situations improved. The share of consumers expecting a recession over the next 12 months declined. (These measures are not included in calculating the Consumer Confidence Index®). Consumers’ expectations for interest rates ahead were little changed, while average 12-month inflation expectations eased to 6.5% after spiking at 7% in April.

Compared to April, purchasing plans for homes and cars and vacation intentions increased notably, with some significant gains after May 12. Plans to buy big-ticket items—including appliances and electronics—were also up. Likewise, consumers’ intentions to purchase more services in the months ahead, with almost all services categories rising. Dining out remained number one among spending intentions, followed by streaming services, while plans to spend on movies, theater, live entertainment, and sporting events increased the most over last month.

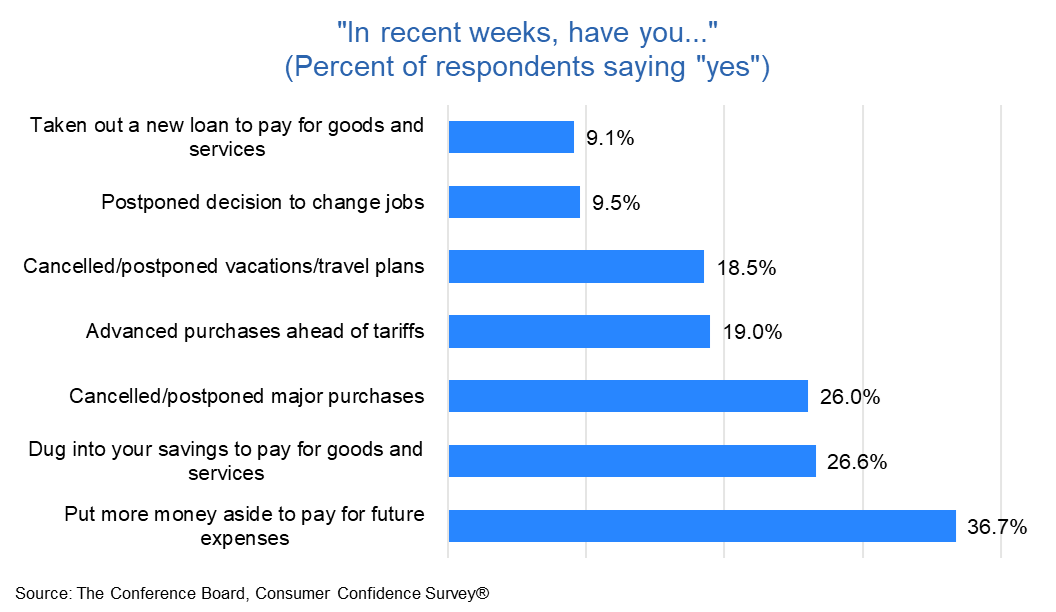

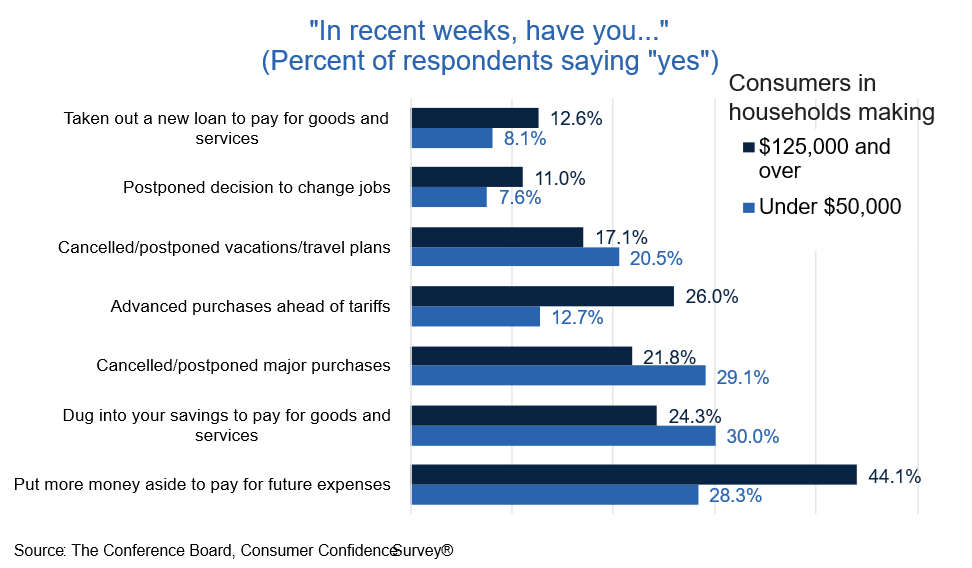

In a special question, consumers were asked if they changed their spending and financial behavior recently. More than a third (36.7%) said they put money aside for future spending. Around a quarter of consumers dug into their savings to pay for goods and services (26.6%) and postponed major purchases (26%). However, there were notable differences between income groups: Consumers in households making over $125K were more likely to say that they saved money while less wealthy households were more likely to have dug into their savings or postponed purchases. In addition, only 19% indicated having advanced purchases ahead of tariffs, but that share was higher for consumers in wealthier households (26%).

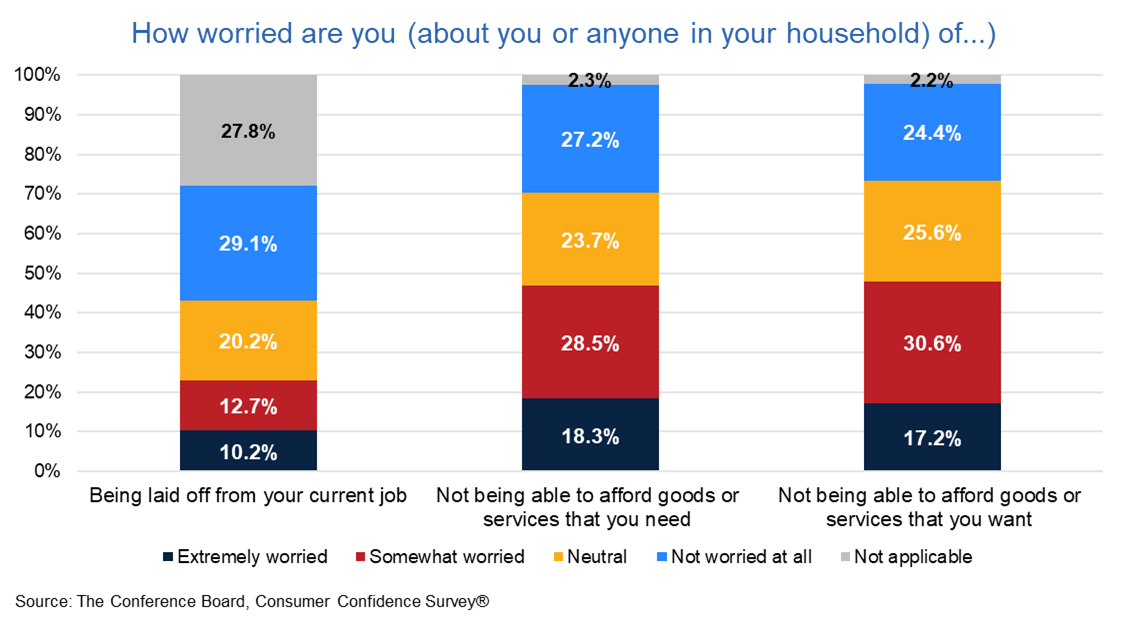

This month’s survey also asked consumers how worried they were about being laid off, not being able to afford necessities, and not being able to afford desired goods and services. Overall, they were more anxious about affordability than job security: Nearly half of consumers said they were concerned about not being able to buy the things they need or want, compared to less than a quarter worried about losing their jobs.

Present Situation

Consumers’ assessments of current business conditions improved in May.

Consumers’ views of the labor market weakened in May.

Expectations Six Months Hence

Consumers were less pessimistic about future business conditions in May.

Consumers’ outlook for the labor market outlook was also less negative in May.

Consumers’ outlook for their income prospects turned positive in May.

Assessment of Family Finances and Recession Risk

Many consumers indicated saving for future expenses, digging into their savings, and postponing major purchases…

…but there are substantial differences in behavior based on household income

Consumers are more worried about the affordability of goods and services than losing their jobs

The monthly Consumer Confidence Survey®, based on an online sample, is conducted for The Conference Board by Toluna, a technology company that delivers real-time consumer insights and market research through its innovative technology, expertise, and panel of over 36 million consumers. The cutoff date for the preliminary results was May 19.

Source: May 2025 Consumer Confidence Survey®

The Conference Board

The Conference Board publishes the Consumer Confidence Index® at 10 a.m. ET on the last Tuesday of every month. Subscription information and the technical notes to this series are available on The Conference Board website: https://www.conference-board.org/data/consumerdata.cfm.

About The Conference Board

The Conference Board is the member-driven think tank that delivers Trusted Insights for What’s Ahead®. Founded in 1916, we are a non-partisan, not-for-profit entity holding 501 (c) (3) tax-exempt status in the United States. ConferenceBoard.org.

The next release is Tuesday, June 24th at 10 AM ET.

For further information contact:

Joseph DiBlasi

781.308.7935

jdiBlasi@tcb.org

Jonathan Liu

jliu@tcb.org

PRESS RELEASE

US Consumer Confidence Partially Rebounds in May

May 27, 2025

PRESS RELEASE

US Consumer Confidence Plunged Again in April

April 29, 2025

IN THE NEWS

Steve Odland on Consumer Confidence

April 29, 2025

IN THE NEWS

Stephanie Guichard on Consumer Confidence

March 25, 2025

IN THE NEWS

Yelena Shulyatyeva: What February consumer confidence says about the labor marke

February 25, 2025

IN THE NEWS

Stephanie Guichard: Consumers are less optimistic about the future in February

January 29, 2025

All release times displayed are Eastern Time

Connect and be informed about this topic through webcasts, virtual events and conferences

How Businesses Can Succeed as US Consumers Guard Wealth, Health Amid Uncertainty

May 12, 2025 | Article

Social Standing: Current Attitudes About Social Media

April 02, 2025 | Article

Politics Shapes US Consumer Views About 2025

February 10, 2025 | Report

US Consumers Hope for Lower Prices and Taxes in 2025

December 17, 2024 | Article

June CPI data support Fed rate cuts later this year

July 11, 2024 | Brief

What’s Behind Conflicting US CEO & Consumer Confidence Readings?

March 12, 2025 11:00 AM ET (New York)

C-Suite Perspectives

The State of the Economy for August 2024

August 27, 2024

C-Suite Perspectives

The State of the Economy for July 2024

July 30, 2024

C-Suite Perspectives

The State of the Economy for June 2024

June 25, 2024