Members of The Conference Board get exclusive access to the full range of products and services that deliver Trusted Insights for What's Ahead ® including webcasts, publications, data and analysis, plus discounts to conferences and events.

15 October 2025 | Press Release

For Release 10:00 AM ET, October 15, 2025

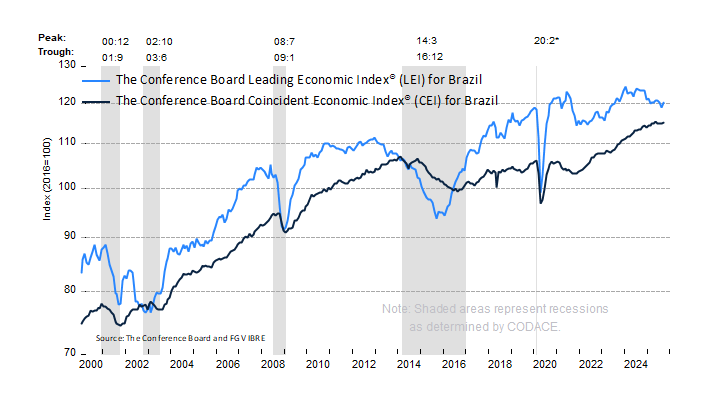

Using the Composite Indexes: The Leading Economic Index (LEI) provides an early indication of significant turning points in the business cycle and where the economy is heading in the near term. The Coincident Economic Index (CEI) provides an indication of the current state of the economy. Additional details are below.

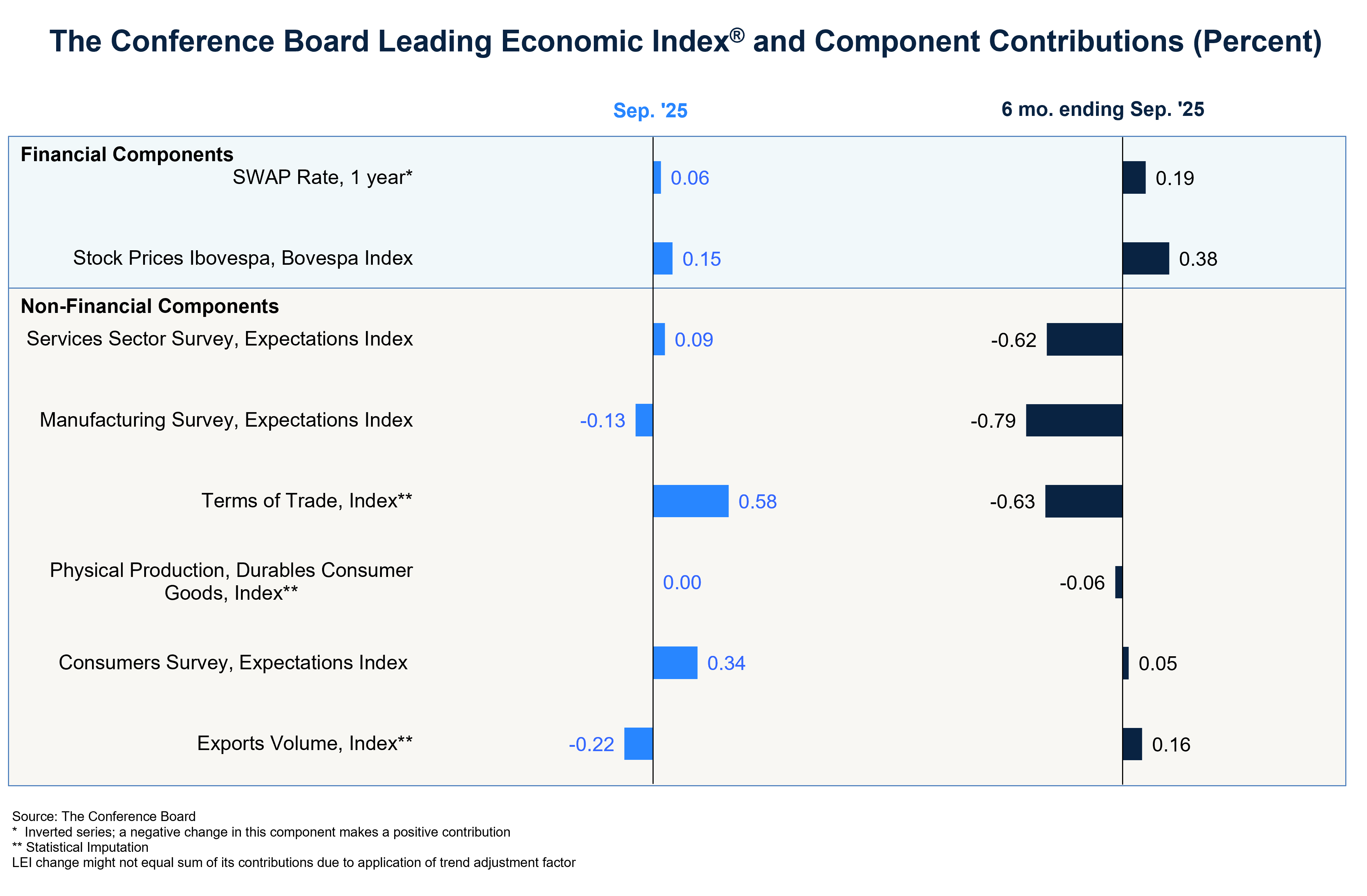

The Conference Board Leading Economic Index® (LEI) for Brazil, together with Fundação Getulio Vargas, increased by 0.9% in September 2025 to 120.1 (2016=100), reversing a 0.9% decline in August. The LEI slightly contracted by 0.1% over the six-month period between March and September 2025, after contracting by 2.6% over the previous six-month period between September 2024 and March 2025.

The Conference Board Coincident Economic Index® (CEI) for Brazil, together with Fundação Getulio Vargas, increased by 0.2% in September 2025 to 115.2 (2016=100), following an increase of 0.1% in August. Overall, the CEI expanded by 0.2% over the six-month period between March and September 2025, after increasing by 1.3% over the previous six-month period.

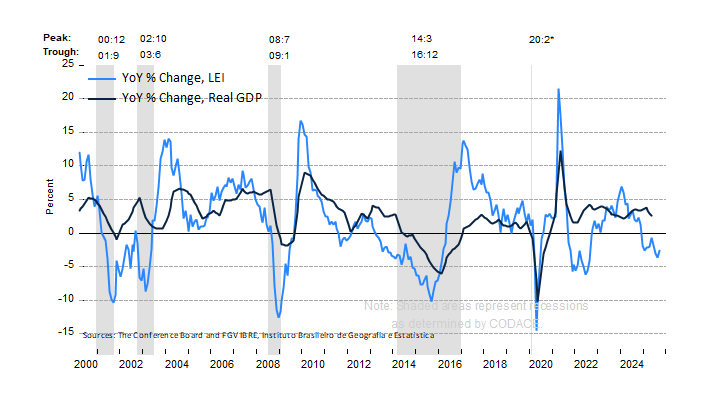

“The Brazil LEI increased in September after three consecutive months of declines” said Malala Lin, Economic Research Associate at The Conference Board. “Positive contributions from 6 of the 8 components supported the LEI. The Terms of Trade Index made an especially large contribution while the other trade component of the LEI, the Exports Volume Index, contributed negatively to the composite Index. This dichotomy captures current complexities in the trade environment faced by Brazil with export volumes to US impacted by the US tariff hikes and the terms of trade supported by increases in prices for top commodities like coffee and beef. As a result of the September gain in the LEI, the annual growth for the Index improved, but remained negative, pointing to persistent headwinds and potentially slower growth going forward. Overall, The Conference Board forecasts real GPD to continue to slow in the second half of 2025 and reach only about 2.5% for the year and under 2% in 2026.”

The next release is scheduled for Thursday, November 13, 2025 at 10 A.M. ET.

*CODACE has determined that the recession beginning in September 2020 ended in the second quarter of 2020. We will update our business cycle chronology when the monthly trough date is available.

*CODACE has determined that the recession beginning in September 2020 ended in the second quarter of 2020. We will update our business cycle chronology when the monthly trough date is available.

About The Conference Board Leading Economic Index® (LEI) and Coincident Economic Index® (CEI) for Brazil

The composite economic indexes are key elements in an analytic system designed to signal peaks and troughs in the business cycle. Comprised of multiple independent indicators, the indexes are constructed to summarize and reveal common turning points in the economy in a clearer and more convincing manner than any individual component.

The CEI reflects current economic conditions and is highly correlated with real GDP. The LEI is a predictive tool that anticipates—or “leads”—turning points in the business cycle by around six months.

The eight components of the Leading Economic Index® for Brazil are:

The six components of the Coincident Economic Index® for Brazil are:

To access data, please visit: https://data-central.conference-board.org/

About The Conference Board

The Conference Board is the member-driven think tank that delivers Trusted Insights for What's Ahead®. Founded in 1916, we are a non-partisan, not-for-profit entity holding 501(c)(3) tax-exempt status in the United States. TCB.org

ABOUT FGV IBRE

Created in 1944, FGV is a Brazilian private higher education institution, think tank and producer of statistics, with a mission "to foster Brazil’s socioeconomic development." The Brazilian Institute of Economics (IBRE) is FGV´s arm with the mission to produce and disseminate high-quality economic statistics and studies that are relevant to improve policies and private action in Brazil. www.fgv.br/ibre

Property Insurance in Turmoil: The New Reality of Rising Costs and Risk

November 05, 2025

Plugged In or Power Outage? Corporate Risk in US Grid Capacity

September 24, 2025

Property Insurance in Turmoil: The New Reality of Rising Costs and Risk

November 05, 2025