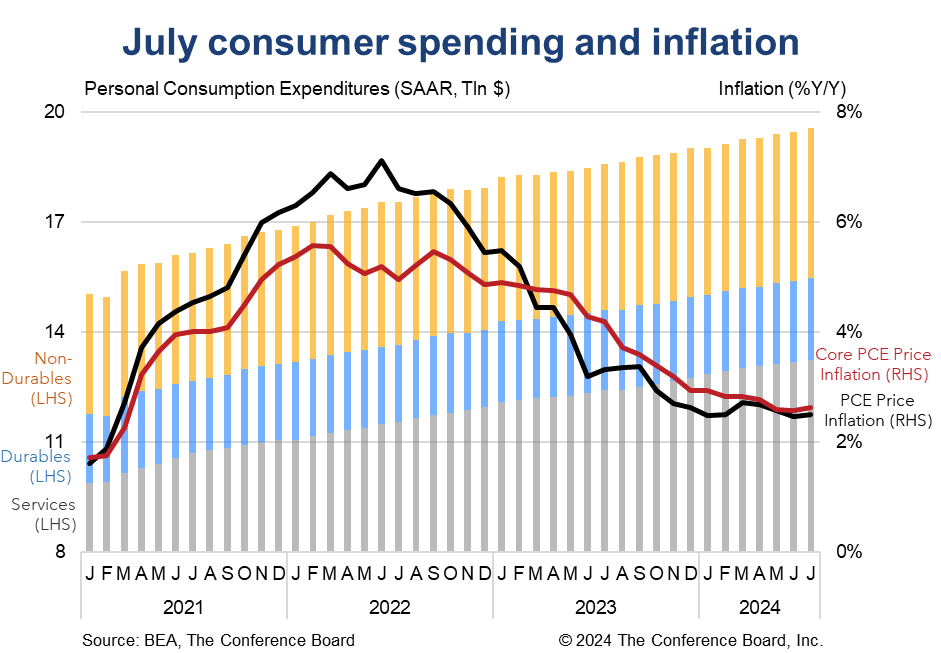

Real consumer spending rose in July and inflation readings pointed to a gradual convergence to the Fed’s 2% target. Real disposable personal income growth grew modestly in the month, but savings rates remained very low, and interest payments on debt as a share of income remained elevated. Spending data at the onset of Q3 have been strong, but we remain concerned about the sustainability of this trend. Inflation data for July were consistent with the gradual deflationary narrative that has held over the course of the summer. We continue to expect the Fed to start cutting interest rates in September.

myTCB® Members get exclusive access to webcasts, publications, data and analysis, plus discounts to events.

Exiting International Climate Pacts Will Leave The US Isolated

January 08, 2026

Robust Q3 GDP: Finding a Signal in the Noise

December 23, 2025

Fed Doves Get Nice Holiday Gift as CPI Inflation Drops

December 18, 2025

FOMC Decision: Do Three Dissents Mean a January Pause?

December 10, 2025

Fed December Decision: Not So Clear Cut

December 09, 2025

September Inflation Pause Bodes Well for Fed Cut

December 05, 2025

Charts

The Gray Swans Tool helps C-suite executives better navigate today’s quickly developing economic, political, and technological environments.

LEARN MORECharts

Preliminary PMI indices show no change in weak DM growth momentum in November

LEARN MORE

Charts

How Might the World Fall Back into Recession?

LEARN MORECharts

Passing increases downstream, cutting costs, and absorbing price increases into profit margins are the chief ways to manage rising input costs. Few see changing

LEARN MORECharts

US continues to lead global productivity race

LEARN MORECharts

The Global Economic Fallout of the Ukraine Invasion

LEARN MORECharts

The global supply chain disruption associated with the COVID-19 pandemic has resulted in production delays, shortages, and a spike in inflation in world.

LEARN MORECharts

The Conference Board recently released its updated 2022 Global Economic Outlook.

LEARN MORE

PRESS RELEASE

LEI for South Korea Inched Up in November

January 08, 2026

PRESS RELEASE

US Consumer Confidence Fell Again in December

December 23, 2025

PRESS RELEASE

LEI for China Declined in November

December 22, 2025

PRESS RELEASE

LEI for India Increased in November

December 19, 2025

PRESS RELEASE

LEI for Mexico Ticked Down in November

December 17, 2025

PRESS RELEASE

LEI for the Global Economy Decreased in September

December 16, 2025

All release times displayed are Eastern Time

Note: Due to the US federal government shutdown, all further releases for The Conference Board Employment Trends Index™ (ETI), The Conference Board-Lightcast Help Wanted OnLine® Index (HWOL Index), The Conference Board Leading Economic Index® of the US (US LEI) and The Conference Board Global Leading Economic Index® (Global LEI) data may be delayed.

This report identifies trends to help businesses prepare for an environment with more challenges for labor and capital but improvements in productivity growth.

LEARN MOREConnect and be informed about this topic through webcasts, virtual events and conferences

The Conference Board Economic Forecast for the Euro Area Economy

January 09, 2026 | Article

Robust Q3 GDP: Finding a Signal in the Noise

December 23, 2025 | Brief

The Conference Board Economic Forecast for the US Economy

December 12, 2025 | Article

Economy Watch: US View (December 2025)

December 12, 2025 | Article

Global Economic Outlook 2026: Euro Area Edition

December 12, 2025 | Report

The Big Picture: What's Ahead for the Global Economy?

December 10, 2025

Economy Watch: Trends in Consumer & CEO Confidence

November 12, 2025

US Tariffs: What’s Changed, What’s Next

October 15, 2025

The Economic Outlook—Storms or Sunshine Ahead?

September 10, 2025

Economy Watch: US Public Policy and the Economy

April 09, 2025

US Economic Volatility in 2025

February 12, 2025