What if Oil Hits US$200 per Barrel?

March 28, 2022 | Chart

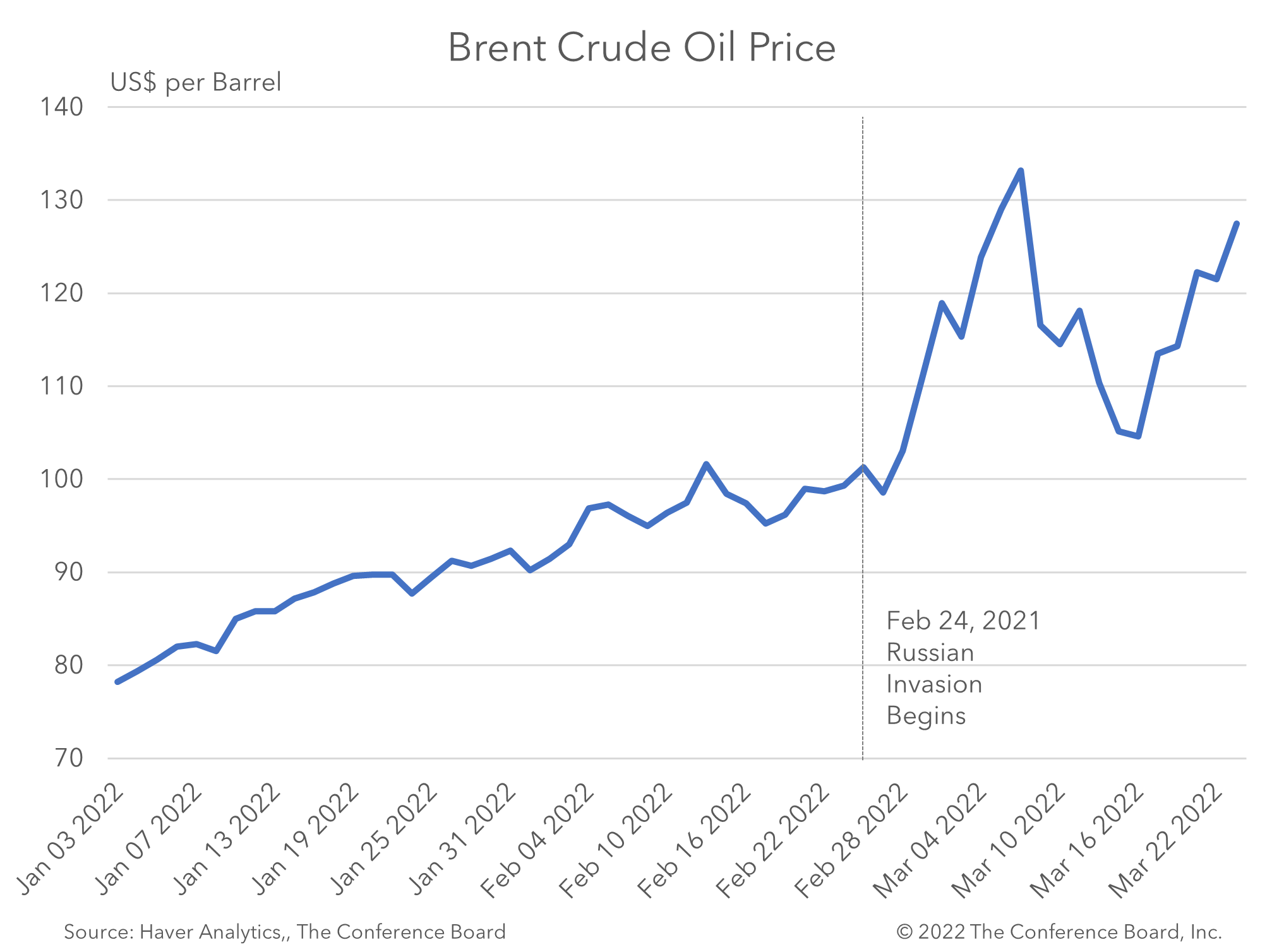

The prospect of Brent Crude Oil prices rising to US$200 per barrel may not be as remote as it sounds. Major disruptions to Russia’s crude oil production and exports could result in prices this high – even if other countries try to step in to offset the shortage.

According to a scenario developed and modeled by The Conference Board, the economic implications of US$200 oil are acute. Inflation would spike around the world and economic growth would slow. Already high inflation rates in places like the United States and the Eurozone would rise even higher. While no global recession would likely result, economic downturns would be more severe in some economies than others.

For more information about potential causes and implications of a large spike in oil prices, please see our new report What if Oil Hits US$200 per Barrel?