Recruiting and retention difficulties are more pronounced in blue-collar and manual services jobs. While demand for these workers is rapidly growing, labor supply is low: these workers face high infection risk and elevated unemployment benefits are an attractive option for workers with relatively low wages. Tech occupations are also experiencing a tight labor market as the US economy shifts to more online activity and digital transformation grows.

Wages are accelerating. Companies are reacting to the labor shortages by raising wages, especially in the leisure and hospitality sectors and other blue-collar and manual services occupations.

After a pause in 2022, tight labor markets will remain until the next recession. Some causes of the current labor shortages are temporary; labor shortages may ease by the end of 2021, but not for long: labor shortages may reappear as soon as late 2022. Massive job growth in 2021 will significantly lower the unemployment rate and tighten the labor market. And for the first time in US history, the working-age population is shrinking as many baby boomers are retiring. Though this demographic shift will create increased demand and job opportunities, as younger unemployed job seekers take up these positions, the unemployment rate will lower.

Labor shortages can be somewhat alleviated, though not completely resolved, by using a mix of recruitment strategies. Some of the quickest and most impactful solutions involve making changes to the recruitment process, such as adding or modifying employee referral programs, contracting with staffing firms, implementing new/advanced technologies to streamline recruitment and better target candidates, and shortening the recruitment process with fewer interviews and faster hiring decisions. Another strategy is to expand into new recruitment demographics, populations, and geographies.

Companies should reevaluate and possibly lower credential requirements. To increase the available pool of candidates, organizations could lower requirements for prior experience and for skills/competencies. However, lowering hiring requirements often creates a need for investing more in improving the skills and development of new recruits. Many companies could do this by actively creating talent pipelines by cultivating connections with local high schools, trade schools, and universities to improve technical curricula and develop internships and apprenticeships.

Remote hiring provides an opportunity to recruit candidates who were previously out of reach. The pandemic has posed another potential solution: employers can hire remote workers when they struggle to recruit for office jobs, especially in tech occupations. Inclusion of candidates who can work remotely means employers can cast a wider net. In an April 2021 survey of 231 HR leaders, organizations reported they were more willing to hire remote workers (87 percent of respondents compared to just 48 percent before the pandemic). And some surveyed organizations are willing to hire 100 percent virtual employees anywhere in the United States (25 percent) or globally (7 percent), compared to a combined 5 percent before the pandemic.

Labor shortages are making a comeback

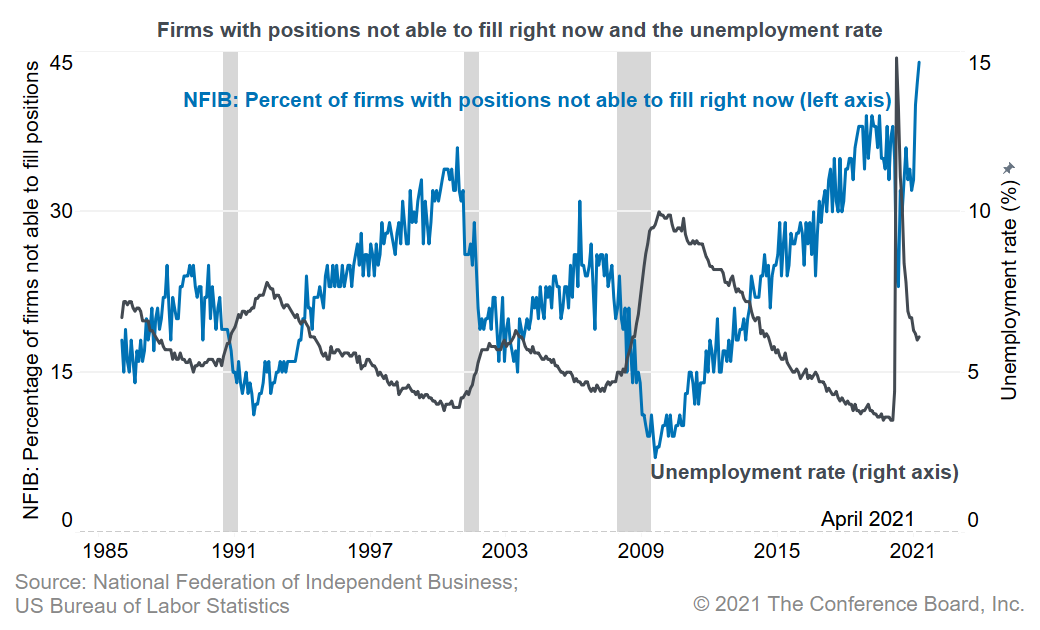

Before the pandemic hit in early 2020, the US was experiencing a labor shortage, especially in blue-collar and manual services jobs. But when the unemployment rate reached 15 percent in April 2020, such scarcity seemed unlikely to return in the foreseeable future. One year later, however, unemployment rates remain elevated, but qualified workers are once again hard to find. According to an April survey by the National Federation of Independent Businesses, 44 percent of firms say that they have job openings they are unable to fill right now, the highest rate in the history of the survey.

Chart 1

Though unemployment rates remain elevated, qualified workers are once again hard to find

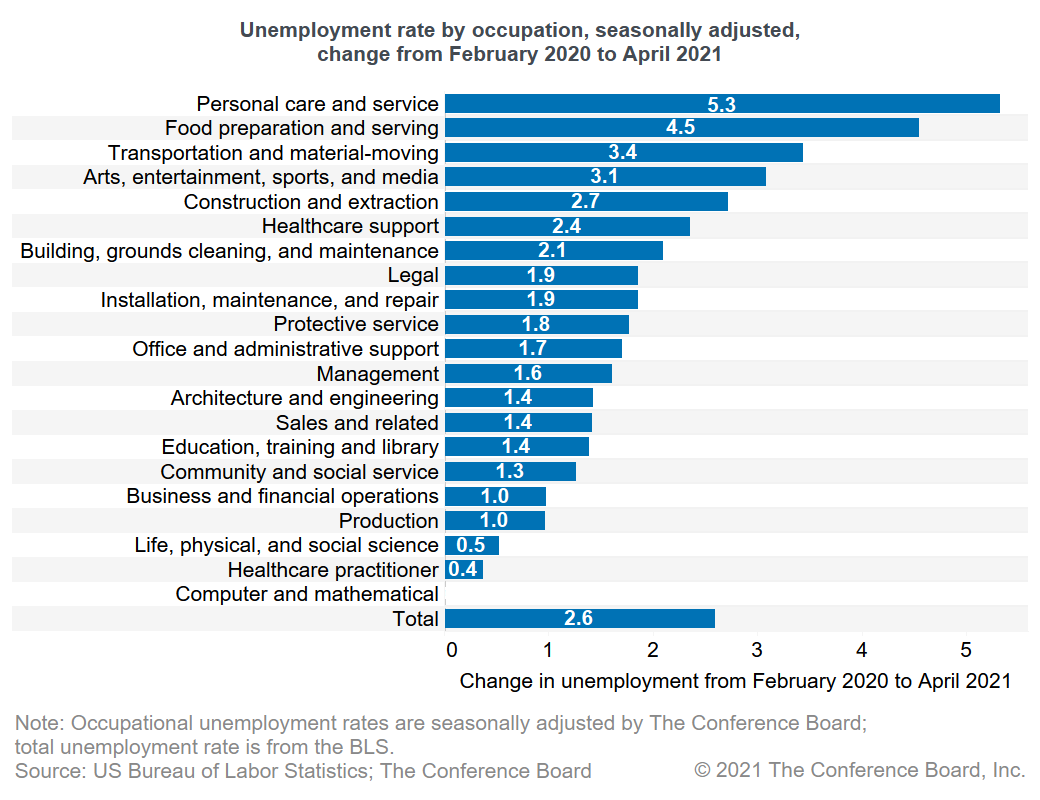

The unemployment rate is still elevated at 6 percent, well above prepandemic rates in most occupations. The unemployment rate for computer and mathematics occupations is one exception; the rate has been historically low and is back to its prepandemic level (Chart 2). The shift to online activity and growing digital transformation limited the negative impact of the pandemic on this occupation.

Chart 2

Overall unemployment rates remain elevated, except for computer occupations

Why is it difficult to find qualified workers when the unemployment rate is still elevated?

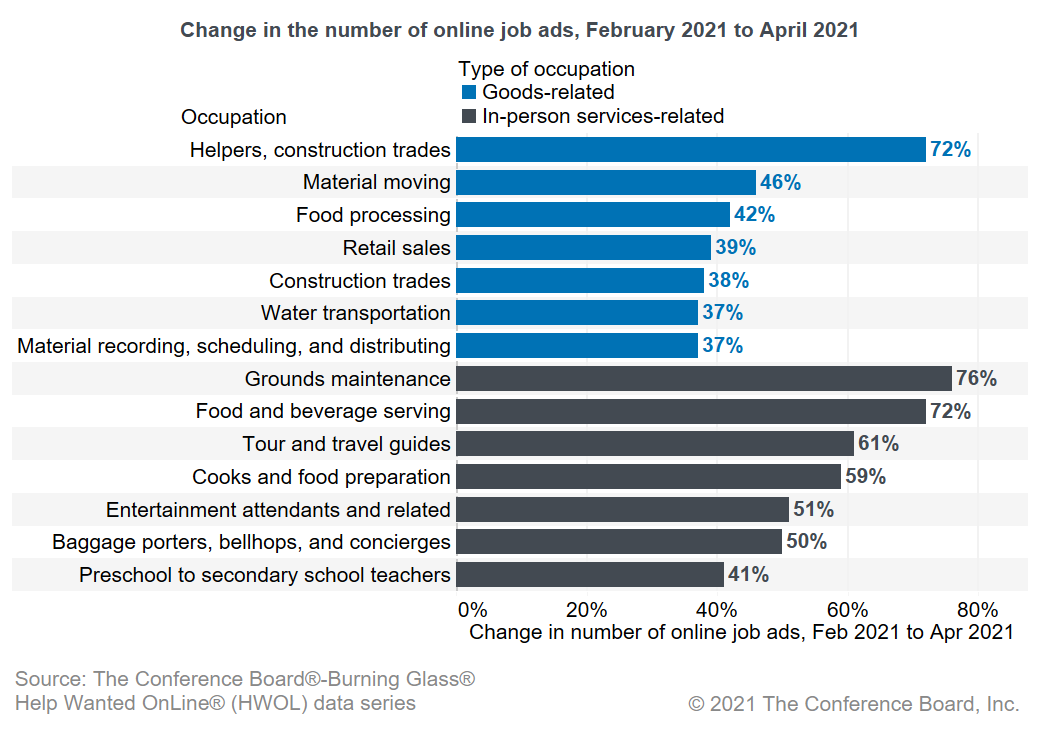

The combination of a surge in demand with stagnant labor supply created historic recruiting difficulties in April and May of 2021. Usually, businesses form and expand gradually during periods of economic growth, creating a steady demand for workers. Now, however, as the economy re-opens all at once, the demand for workers is surging. Recent data from The Conference Board®-The Burning Glass® Help Wanted OnLine® (HWOL) program shows that the number of online job ads has been rapidly growing in recent months. When in-person services reopened in early 2021, demand for occupations in food services, tour and travel guides, entertainment attendants, and hotel occupations grew rapidly (Chart 3). Strong activity in construction and freight transportation led to strong hiring effects in those occupations as well.

Chart 3

Rapid increase in hiring as the economy opens up

On the supply side, many working-age adults may be slow to re-enter the workforce because of lingering factors driven by the pandemic (fear of getting infected, the need to take care of young children during school closures/remote learning, elder care, or high federal unemployment benefits) that may have reduced the incentive to rejoin the labor force.

The US Census’ Household Pulse Survey from March shows that 6.3 million were not working because they were caring for children not in school or daycare, and 4.2 million were afraid of catching or spreading the virus.

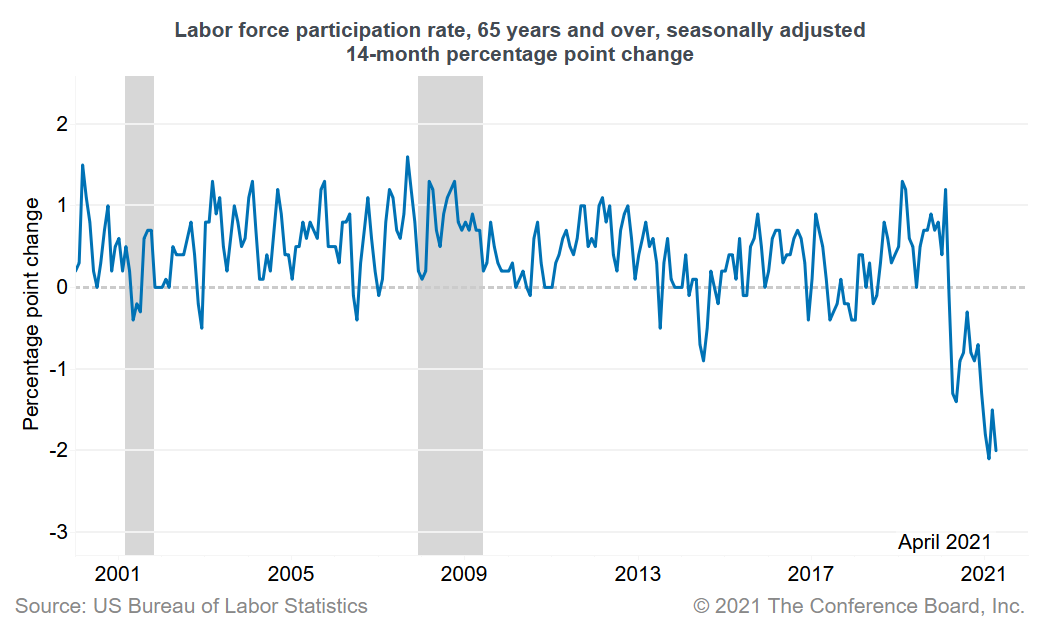

Massive retirement of baby boomers further reduces labor supply

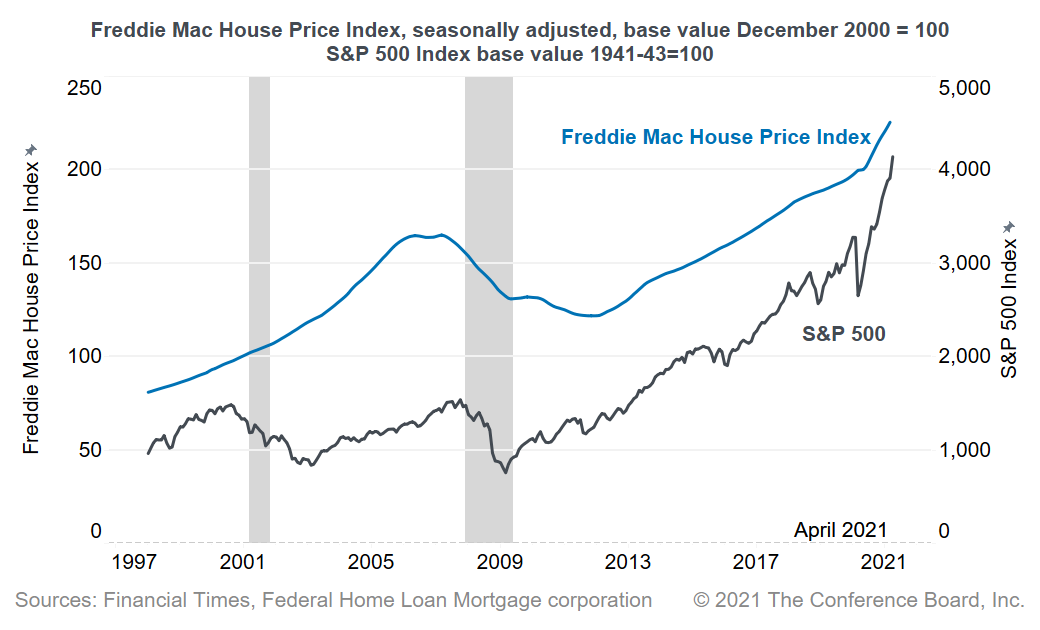

In addition, the pandemic and other factors drove many baby-boomers from the labor force, reversing a 25-year trend of rising participation among mature workers and further reducing labor supply. Because the pandemic was riskier for older workers, some may have had more incentive to leave the labor force. In addition, during the pandemic, in contrast to the 2008–2009 financial crisis, stock and home prices rose sharply, making older workers more financially prepared for retirement.

Chart 4

Large drop in labor force participation for workers over 65

Chart 5

Inflation of asset prices makes older workers better prepared for retirement

Employers are deeply impacted

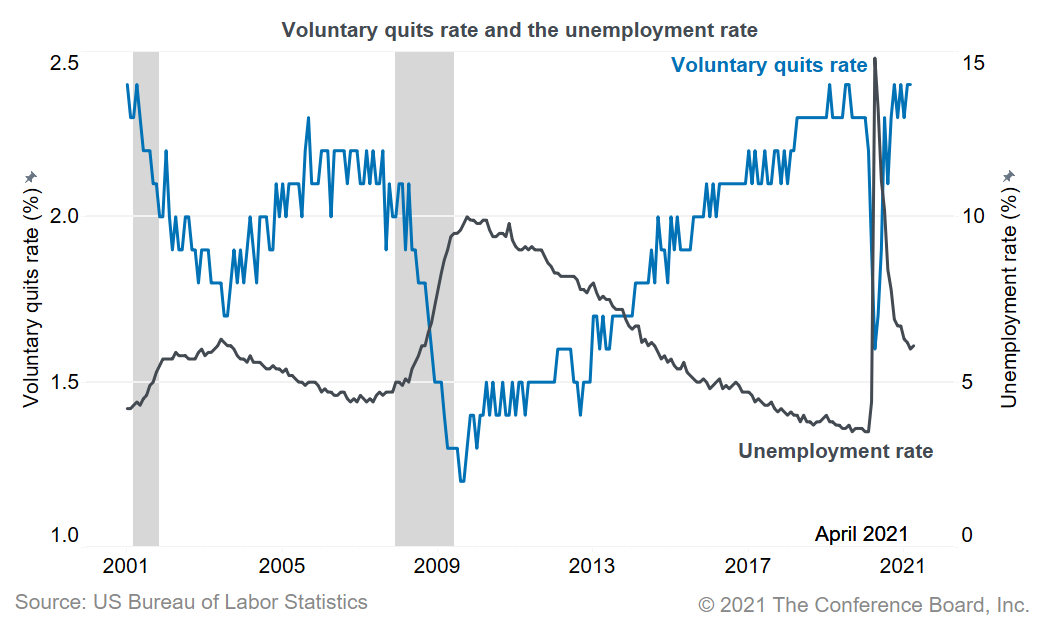

In addition to recruiting new workers, employers may also be having trouble keeping workers. The voluntary quits rate is at a historic high. As the war for talent intensifies, workers have a wider array of options, and more confidence in their ability to advance their career by finding a new job.

Chart 6

Quits rates are also historically high, despite high unemployment rates

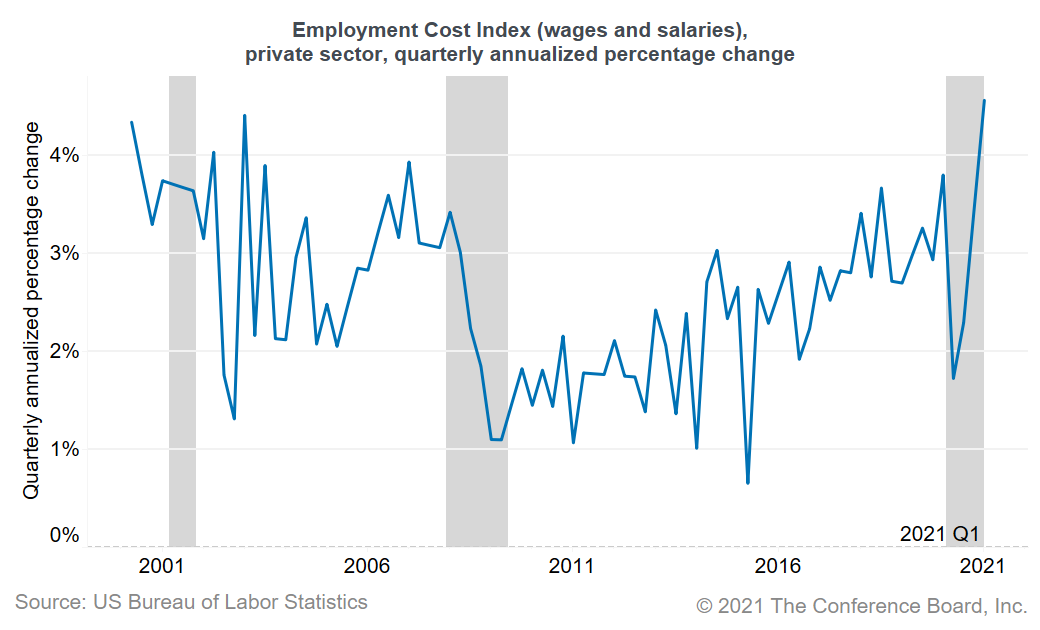

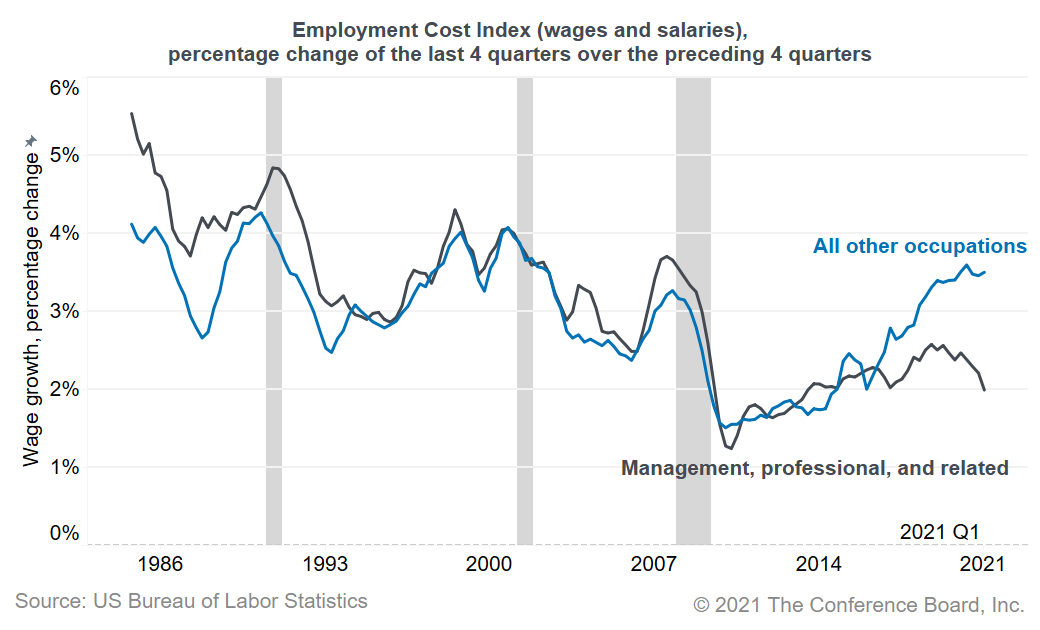

The most basic and intuitive way to solve labor shortages is to raise wages. And indeed, according to the Employment Cost Index, the best measure of changes in wages over time, wages experienced the fastest quarterly growth rate in 20 years in the first quarter of 2021.

Chart 7

In the first quarter of 2021, wages had the fastest growth rate in 20 years

Not all industries are equally impacted

In a survey by The Conference Board conducted in April 2021, 80 percent of employers with a majority of non-desk workers said they find it “very” or “somewhat difficult” to find qualified workers, versus 60 percent of employers with a majority of professional and office workers who said the same.

The same is true for retention. Among employers in industrial and manual services, 49 percent of respondents said they find it “very” or “somewhat difficult” to retain workers versus 28 percent of employers of professional and office workers.

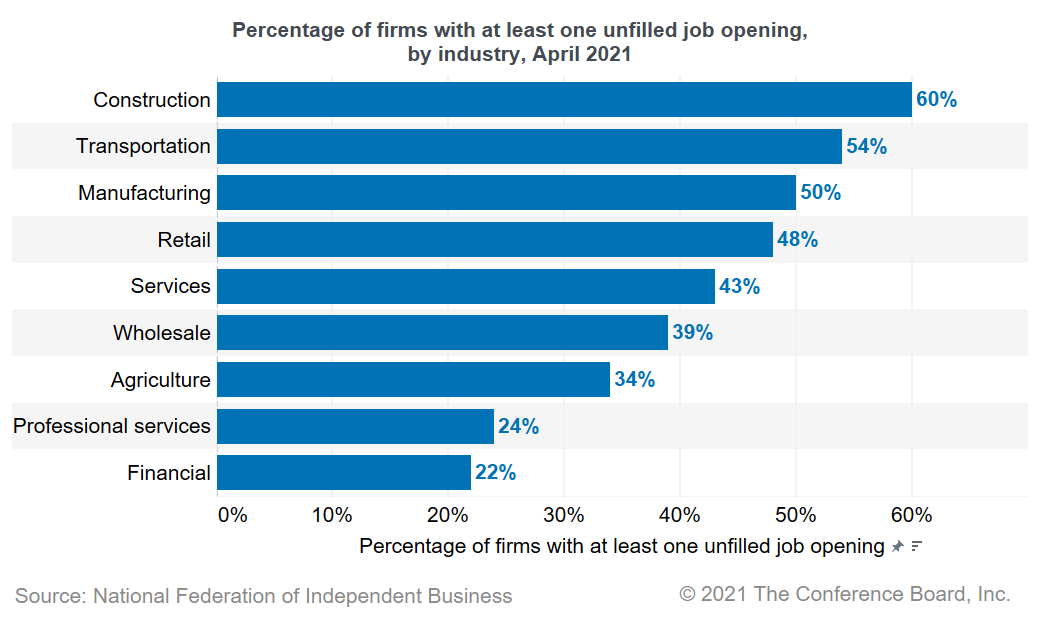

As discussed above, according to an April survey by the National Federation of Independent Businesses, 44 percent of firms say that they have job openings they are unable to fill right now, the highest rate in the history of the survey. The chart below shows that in blue-collar and manual services industries, such as construction, transportation, manufacturing, retail, and services, the share is in the 40–60 percent range; for professional services and financial businesses it is in the 25 percent range.

Chart 8

Recruiting difficulties are more pronounced in blue-collar and manual services jobs

Many of the reports of labor shortages are coming from food services employers who are especially struggling to hire workers because of the high risk of infection and the relatively low pay which may make unemployment benefits an attractive option.

It is not surprising then that most of the wage acceleration is occurring in blue-collar and manual services jobs, where wage growth is already above prerecession rates. Wage growth for management and professional workers, which includes close to 40 percent of the workforce and most of total compensation, is growing more moderately. Wage growth for management and professional workers had already begun to slow before the pandemic.

Chart 9

Most of the wage acceleration is occurring in blue-collar and manual services jobs

In recent months, the leisure and hospitality sector has opened up, and now accounts for most of the job growth. Most of the jobs in this sector involve relative high risk of infection and wages are especially low—but are now growing. But Average hourly earnings of nonsupervisory employees in the leisure and hospitality increased by 26 percent (annual rate) in the past three months, dwarfing any other three-month growth rate in recent decades.

How long will the labor shortages last?

Some of the factors discussed above are temporary. If the pandemic is largely over for the US by September–October, schools will likely reopen, easing the childcare crisis, and life may return to normal. (The end of the childcare crisis may be especially beneficial for the labor force participation of mothers of young children.) In addition, Federal unemployment benefits are set to expire in September. That will bring many people back to the labor force and temporarily ease the labor shortage toward the end of 2021.

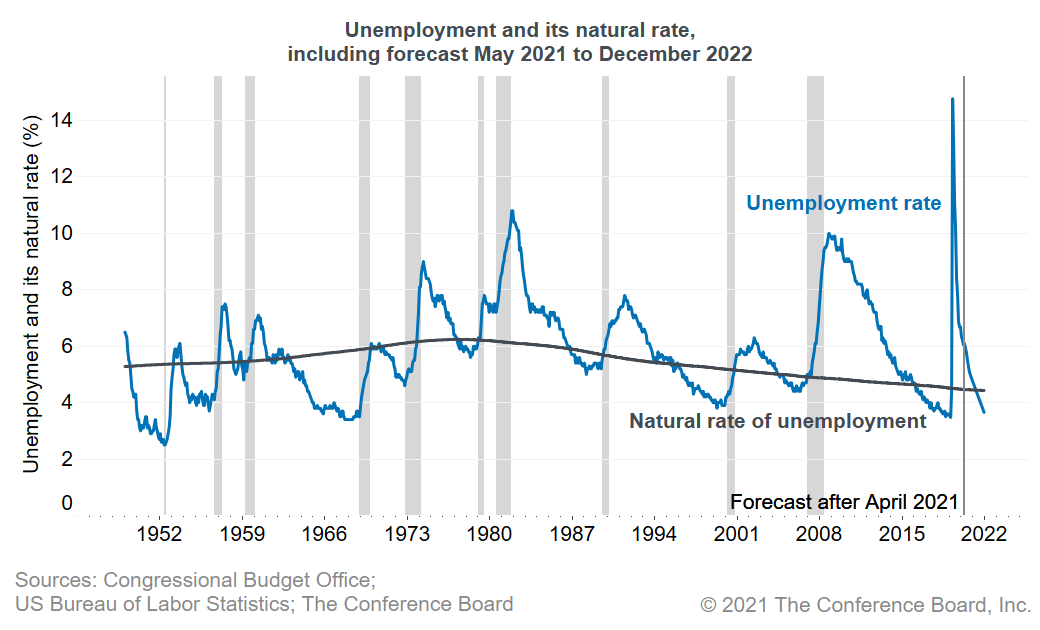

But by the end of 2022, however, labor markets could become tight again simply because a strong economic recovery and job growth will lower the unemployment rate significantly.

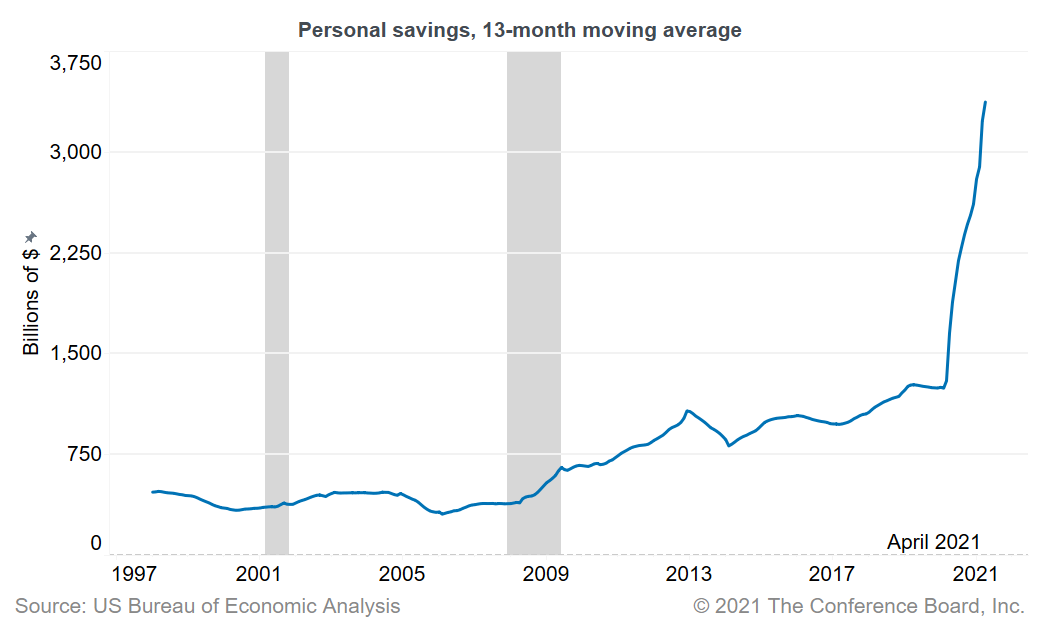

If the number of new infections continues to rapidly decline, and state and local governments continue to loosen restrictions, people will feel more comfortable engaging in in-person services. And many US households are flush with cash after accumulating more than $3.5 trillion worth of savings in the past year, both because they were not able to spend on services they typically used to and because of historically large fiscal support packages.

Chart 10

Record accumulation of savings could boost consumer spending in the coming year

As a result, economic activity and employment are likely to grow fast in the coming year, which will significantly lower the unemployment rate and tighten the labor market. When the unemployment rate drops below the natural rate of unemployment, currently estimated to be about 4.5 percent, labor shortages and wage pressures start developing.

Chart 11

Unemployment will drop below its natural rate in record time and is likely to stay low until the next recession

By the end of 2021, the unemployment rate is expected to reach its natural rate. And then what?

Typically, after the start of a recession, it takes about four to seven years for unemployment to return to its natural rate. This time this process is likely to be much shorter: it will probably happen during 2022, about two years after the beginning of the recession. And then what?

Once the unemployment rate starts declining, it usually keeps doing so until several months before the next recession. The drop in the unemployment rate is likely to continue to decline for the next five to ten years.

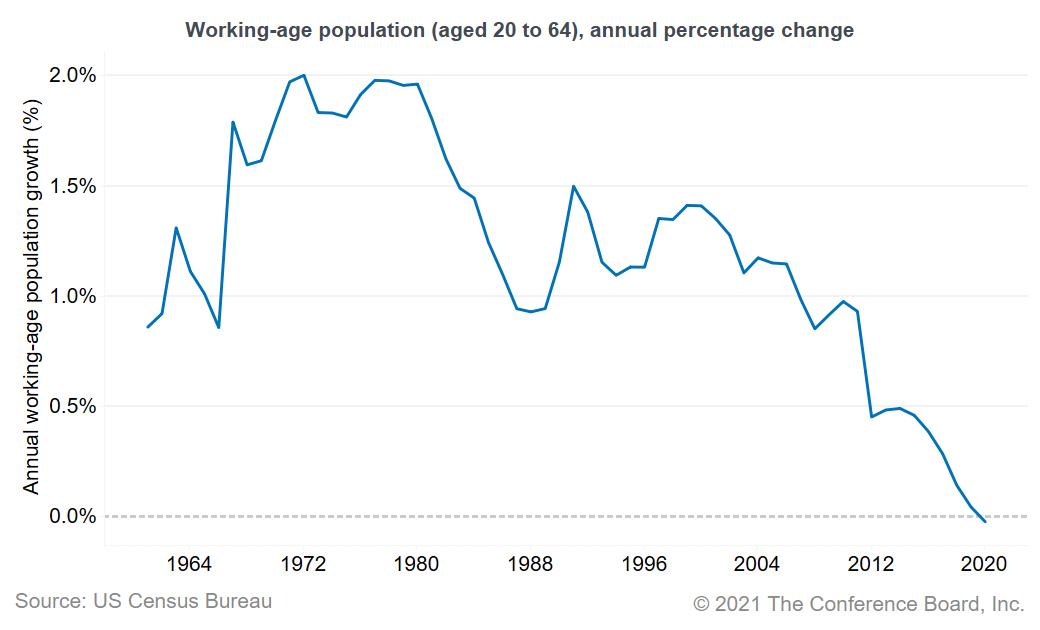

If anything, the downward pressure on the unemployment rate is likely to be stronger than usual because for the first time in US history, the working-age population is shrinking as the large baby-boom generation continues to reach retirement age. Retirees leaving the labor market open up more jobs for unemployed workers.

Chart 12

For the first time in US history, the working-age population is shrinking

The worker’s perspective

While employers may struggle, the tight labor market is great news for workers.

Usually there is a strong connection between job satisfaction and labor market conditions. Respondents to The Conference Board’s job satisfaction survey who say that openings are plentiful in their area are much more likely to be satisfied with their jobs than respondents who say that jobs are hard to get. This is presumably because people can and do leave jobs they don’t like when there is a war for talent. When labor market conditions are strong, and the risk of job loss is lower, people are more likely to find a job they like, and wages, benefits, and related spending on employees are likely to improve.

Americans should look forward to a prolonged period of very low unemployment, shortages of qualified workers, and high job satisfaction.