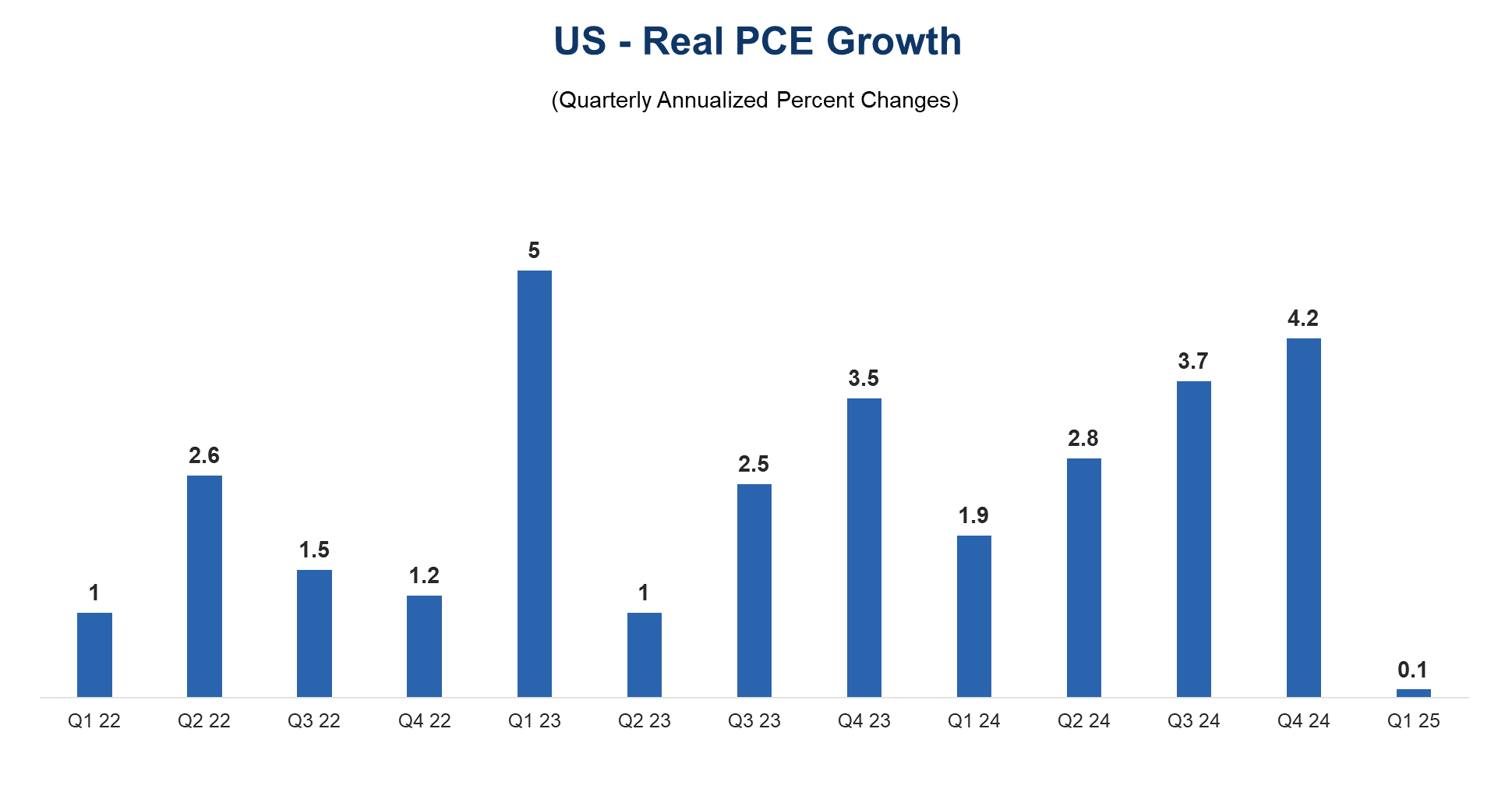

A sharp pullback in consumer spending in the beginning of the year, despite rising income, corroborates declining consumer confidence and supports our projections for economic growth to slow this year and for the next Fed move to be a rate cut.

Trusted Insights for What’s Ahead®™

Figure 1. Spending Growth Sharply Slows in Q1

Sources: Bureau of

myTCB® Members get exclusive access to webcasts, publications, data and analysis, plus discounts to events.

Shutdown Aside, Growth Moderates Under Inflationary Pressures

February 20, 2026

January CPI Raises More Questions than Provides Answers

February 13, 2026

Lukewarm Holiday Shopping in 2025 Augurs Slower Spending in Q4

February 10, 2026

FOMC Reaction: US Economy In a Good Place, But Staying Vigilant

January 28, 2026

Fed January Decision: Pause or Full Stop?

January 27, 2026

November PCE: Are Consumers Spending Beyond Their Means?

January 22, 2026

Charts

The Gray Swans Tool helps C-suite executives better navigate today’s quickly developing economic, political, and technological environments.

LEARN MORECharts

Preliminary PMI indices show no change in weak DM growth momentum in November

LEARN MORE

Charts

How Might the World Fall Back into Recession?

LEARN MORECharts

Passing increases downstream, cutting costs, and absorbing price increases into profit margins are the chief ways to manage rising input costs. Few see changing

LEARN MORECharts

US continues to lead global productivity race

LEARN MORECharts

The Global Economic Fallout of the Ukraine Invasion

LEARN MORECharts

The global supply chain disruption associated with the COVID-19 pandemic has resulted in production delays, shortages, and a spike in inflation in world.

LEARN MORECharts

The Conference Board recently released its updated 2022 Global Economic Outlook.

LEARN MORE

PRESS RELEASE

LEI for the Global Economy was unchanged in December

February 26, 2026

PRESS RELEASE

CEO Confidence Rose Significantly in Q1 2026

February 26, 2026

PRESS RELEASE

LEI for China Declined in January

February 25, 2026

PRESS RELEASE

US Consumer Confidence Inched Up in February

February 24, 2026

PRESS RELEASE

LEI for India Ticked Up in January

February 23, 2026

PRESS RELEASE

LEI for Mexico Increased in January

February 18, 2026

All release times displayed are Eastern Time

Note: Due to the US federal government shutdown, all further releases for The Conference Board Employment Trends Index™ (ETI), The Conference Board-Lightcast Help Wanted OnLine® Index (HWOL Index), The Conference Board Leading Economic Index® of the US (US LEI) and The Conference Board Global Leading Economic Index® (Global LEI) data may be delayed.

This report identifies trends to help businesses prepare for an environment with more challenges for labor and capital but improvements in productivity growth.

LEARN MOREConnect and be informed about this topic through webcasts, virtual events and conferences

Shutdown Aside, Growth Moderates Under Inflationary Pressures

February 20, 2026 | Brief

Economy Watch: US View (February 2026)

February 13, 2026 | Article

January CPI Raises More Questions than Provides Answers

February 13, 2026 | Brief

The Conference Board Economic Forecast for the US Economy

February 12, 2026 | Article

Steady as She Goes Labor Market, Risks Remain

February 11, 2026 | Brief

Priced Out: The State of US Housing Affordability

February 11, 2026

The CEO Outlook for 2026—Uncertainty, Risks, Growth & Strategy

January 15, 2026

The Big Picture: What's Ahead for the Global Economy?

December 10, 2025

Economy Watch: Trends in Consumer & CEO Confidence

November 12, 2025

US Tariffs: What’s Changed, What’s Next

October 15, 2025

The Economic Outlook—Storms or Sunshine Ahead?

September 10, 2025