Early read on impact of war in Ukraine: Consumer Confidence in Europe plummets, but not uniformly

April 01, 2022 | Chart

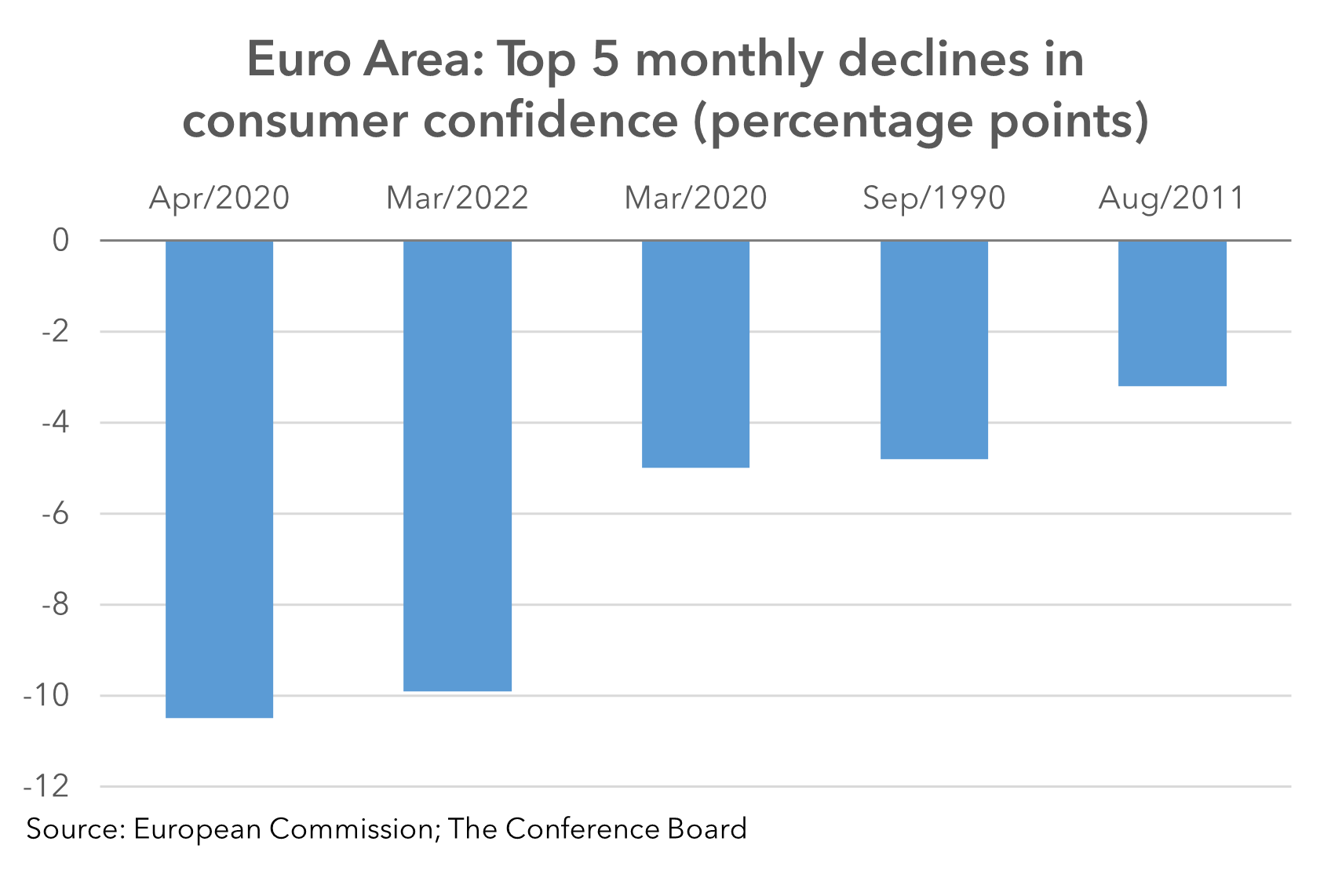

Consumer confidence in the Euro Area in March 2022 plummeted, offering early evidence of the impact of the war in Ukraine on sentiment. The measure is based on consumers’ views on the financial situation (over the last 12 months and over the next 12 months), major purchases and the general economic situation. And it is mostly in the latter category that views turned strongly negative.

The monthly decline in March is similar to the all-time low recorded in April 2020, reflecting the then sharp slowdown in economic activity in response to the pandemic, and where about one in five respondents recorded a negative sentiment versus one in ten for the long-term average (2000-2021).

The drop in confidence in the Euro Area contrasts with the US, where The Conference Board Consumer Confidence Index® increased slightly in March, after a decrease in February. What’s more, 57 percent of consumers said jobs were plentiful, a new high. The Present Situation Index—based on consumers’ assessment of current business and labor market conditions—improved. However, the Expectations Index—based on consumers’ short-term outlook for income, business, and labor market conditions—declined. Taken together, the results reflect the resiliency of the American consumer.

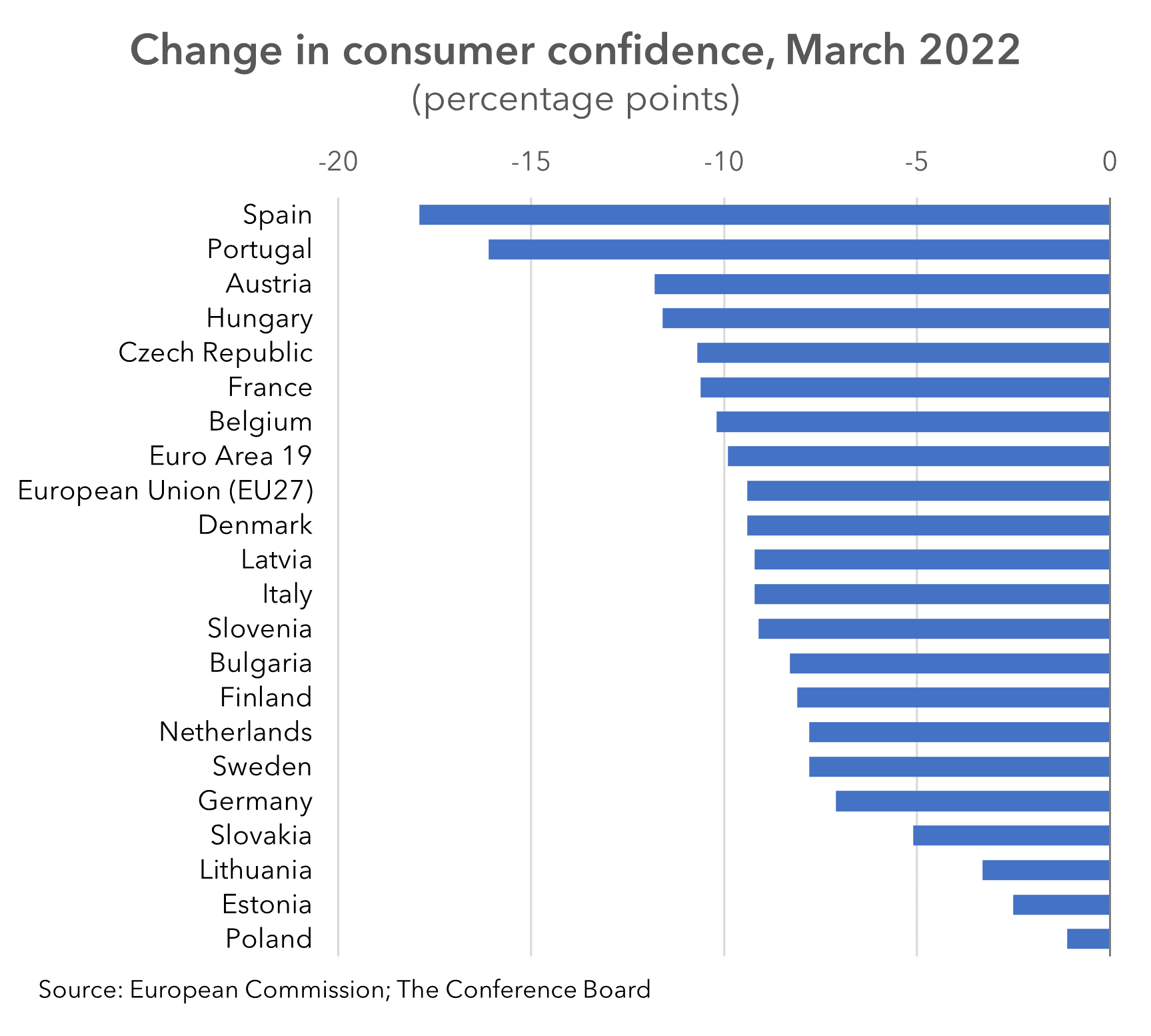

A deeper dive into European consumer confidence trends

Figures reveal a stark contrast between Eastern and Western Europe. In Scandinavian economies, as well as in France and Belgium, the current drop in confidence exceeds the drop recorded in April 2020. However, in predominantly Eastern European economies, the decline in confidence was much less pronounced than the decline recorded in April 2020. In fact, in Poland, which has taken in millions of refugees from Ukraine, consumer confidence did not change much compared to February. The same holds for other countries closer to the conflict, including Estonia and Lithuania. It is unclear why consumers closest to the conflict report little change in overall confidence. The decline in March 2022 confidence in large economies, including Italy [1], Spain and Germany, was similar to the decline in April 2020, in line with the European average.

Does the drop confidence portend a drop in economic growth? It’s too early to tell. While weakening consumer confidence is certainly not a positive signal, it should be assessed in conjunction with other indicators which point to some strength for consumer spending. These include a tight labor market and healthy household balance sheets. Still with prices rising faster than wages, purchasing power is diminishing, and this is likely one of the reasons why consumers are becoming less optimistic, as highlighted by the decline in sentiment in regard to the “financial situation over the next 12 months”.

Understanding what lies ahead for consumer spending is vital for all businesses

Marketers will have to closely monitor the playoff between supply—compromised by the conflict in Ukraine and the impact on commodities like fuel and grain—and the demand of consumers with the will to spend or save depending on how they see events evolving.

For many consumers, essentials like food, energy, and transport are already taking a larger slice of disposable income. Opportunities to market new, higher priced, experience-led discretionary products and services are narrowing.

Marketers should build brand preference now with communications and actions that reflect the sentiments of consumers in particular countries, and manage the expected returns on brand and promotional investment in the context of decreased spending.

[1] For Italy, we compare it to the March 2020 data due to unavailability of the April 2020 figures.