The Conference Board publishes leading, coincident, and lagging indexes designed to signal peaks and troughs in the business cycle for major economies around the world.

LEI for the UK Continued to Fall in April

Latest Press Release

Updated: Thursday, June 12, 2025

For Release 9:30 AM ET, June 12, 2025

Using the Composite Indexes: The Leading Economic Index (LEI) provides an early indication of significant turning points in the business cycle and where the economy is heading in the near term. The Coincident Economic Index (CEI) provides an indication of the current state of the economy. Additional details are below.

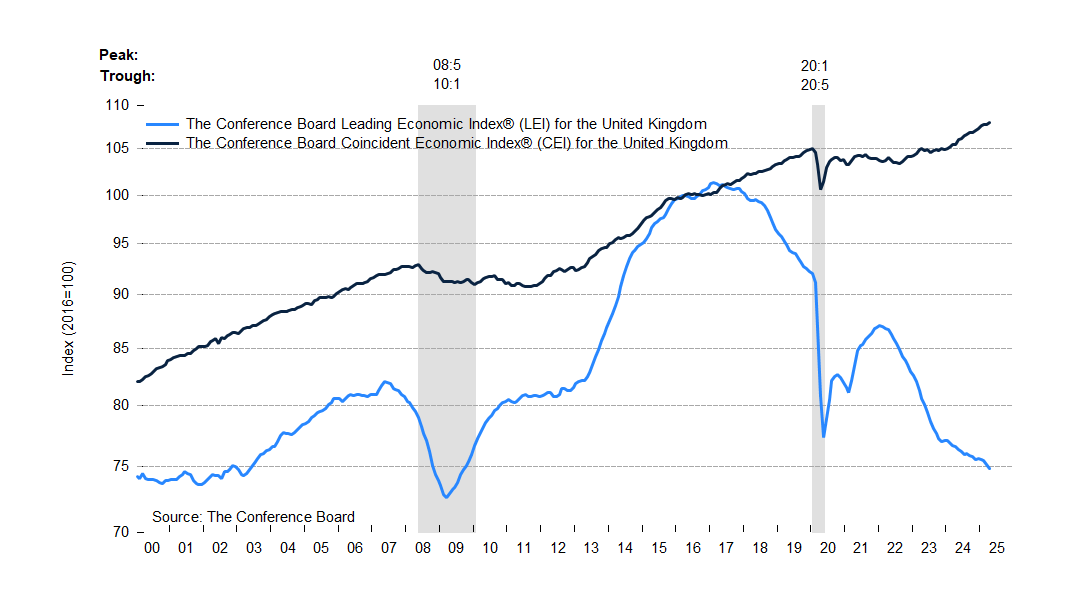

The Conference Board Leading Economic Index® (LEI) for the United Kingdom declined by 0.4% in April 2025 to 74.9 (2016=100), after also declining by 0.4% in March. As a result, the UK LEI contracted by 1.2% over the six-month period between October 2024 and April 2025, a slightly higher rate of decline than the -1.0% over the previous six-month period (April 2024 to October 2024).

The Conference Board Coincident Economic Index® (CEI) for the United Kingdom picked up by 0.2% in April 2025 to 108.0 (2016=100), after being unchanged in March. Overall, the CEI for the UK expanded by 1.1% over the six-month period between October 2024 and April 2025, slightly less than the1.2% growth over the previous six-month period, between April and October 2024.

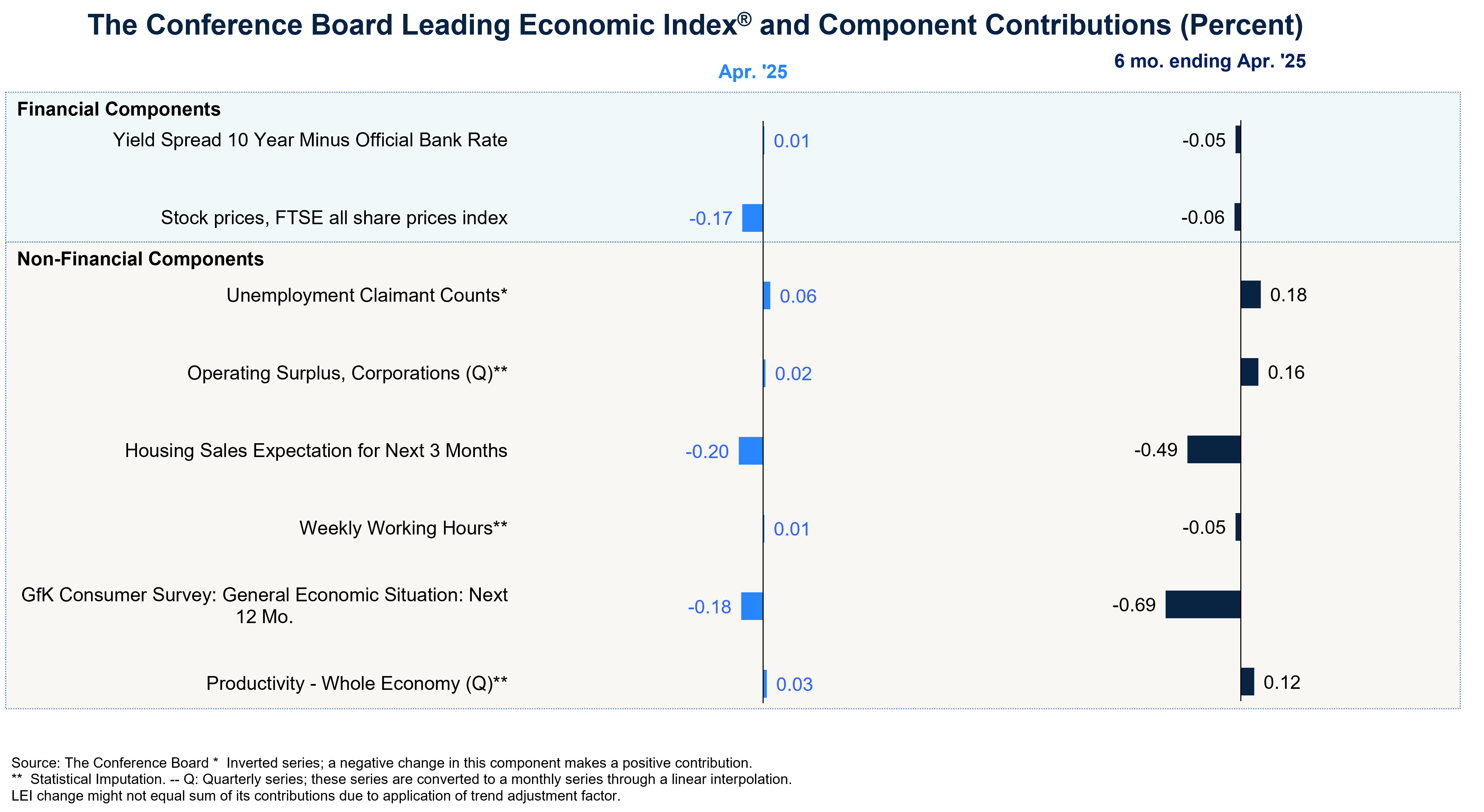

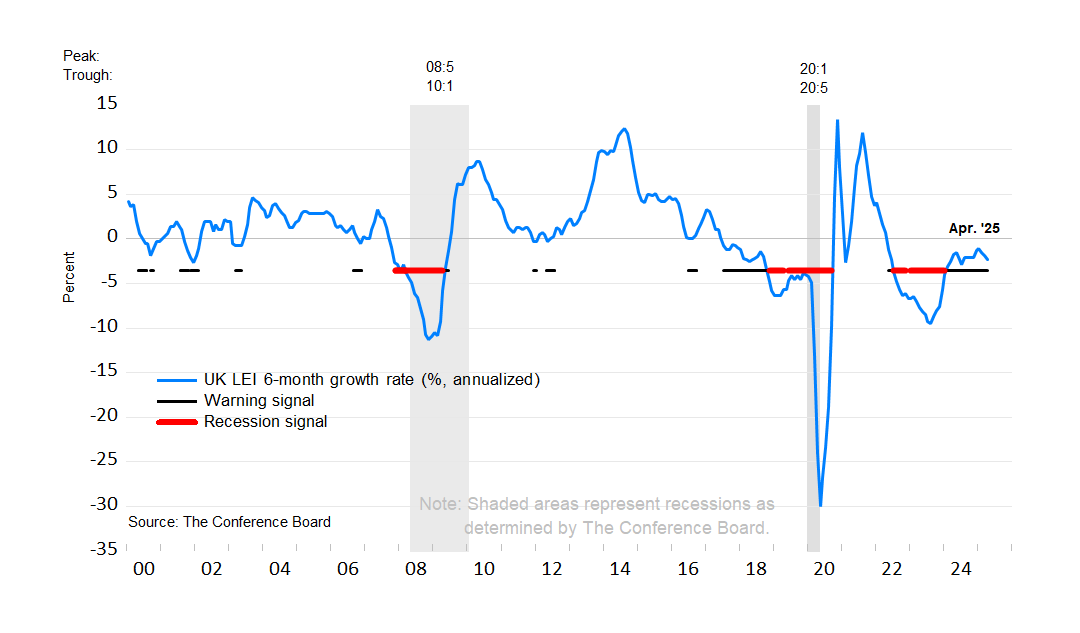

“The UK LEI continued to slide in April, remaining on a downward trend that started in 2022” said Allen Li, Associate Economist at The Conference Board. “UK LEI’s monthly decline was driven primarily by weakness in housing sales expectations, consumer expectations, and lower stock prices, while the rest of the components held relatively steady. This reflected the economic uncertainty in the month, as well as higher inflation and energy costs, and worries regarding escalating trade tensions. The 6-month growth rate of the UK LEI has cooled but remained above the recession threshold. Overall, the LEI reading suggests that, after a stronger than expected first quarter, economic growth in the United Kingdom will likely moderate in the remainder of 2025. The Conference Board expects UK GDP to grow by 1.4% in 2025 after 1.1% in 2024.”

The next release is scheduled for Wednesday, July 16, 2025, at 9:30 A.M. ET.

The UK LEI continued its downward trend in April

April’s decline in the UK LEI was driven primarily by weak housing sales expectations, consumer expectations, and lower stock prices

The 6-month growth rate of the UK LEI has cooled but remained above the recession threshold

NOTE: The chart illustrates the so-called 3Ds—duration, depth, and diffusion—for interpreting a downward movement in the LEI. Duration refers to how long the decline has lasted. Depth denotes the size of decline. Duration and depth are measured by the rate of change of the index over the most recent six months at an annualized rate. Diffusion is a measure of how widespread the decline is among the LEI’s component indicators—on a scale of 0 to 100, a diffusion index reading below 50 indicates most components are weakening.

The 3Ds rule signals an impending recession when: 1) the six-month diffusion index lies at or below 50, shown by the black warning signal lines in the chart; and 2) the LEI’s six-month growth rate (annualized) falls below the threshold of −3.6%. The red recession signal lines indicate months when both criteria are met simultaneously—and thus that a recession is likely imminent or underway.

About The Conference Board Leading Economic Index® (LEI) and Coincident Economic Index® (CEI) for the U.K.

The composite economic indexes are key elements in an analytic system designed to signal peaks and troughs in the business cycle. Comprised of multiple independent indicators, the indexes are constructed to summarize and reveal common turning points in the economy in a clearer and more convincing manner than any individual component.

The CEI reflects current economic conditions and is highly correlated with real GDP. The LEI is a predictive tool that anticipates—or “leads”—turning points in the business cycle by around seven months.

The eight components of Leading Economic Index® for the U.K. are:

- Unemployment Claimant Counts

- Weekly Working Hours

- GfK Consumer Survey: General Economic Situation: Next 12 months

- Stock prices, FTSE all share prices index

- Yield Spread

- Productivity, Whole Economy

- Total Gross Operating Surplus of Corporations

- Housing Sales Expectation for next 3 months©

The four components of the Coincident Economic Index® for the U.K. are:

- Industrial Production

- Retail Sales

- Employment

- Real Household Disposable Income

To access data, please visit: https://data-central.conference-board.org

About The Conference Board

The Conference Board is the member-driven think tank that delivers Trusted Insights for What’s Ahead®. Founded in 1916, we are a non-partisan, not-for-profit entity holding 501 (c) (3) tax-exempt status in the United States. ConferenceBoard.org