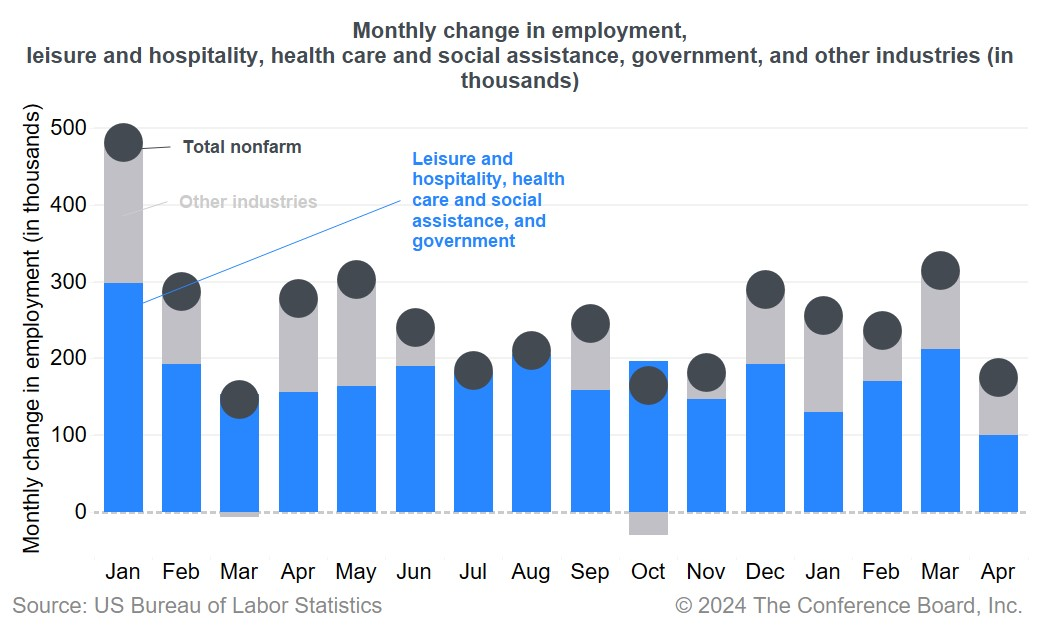

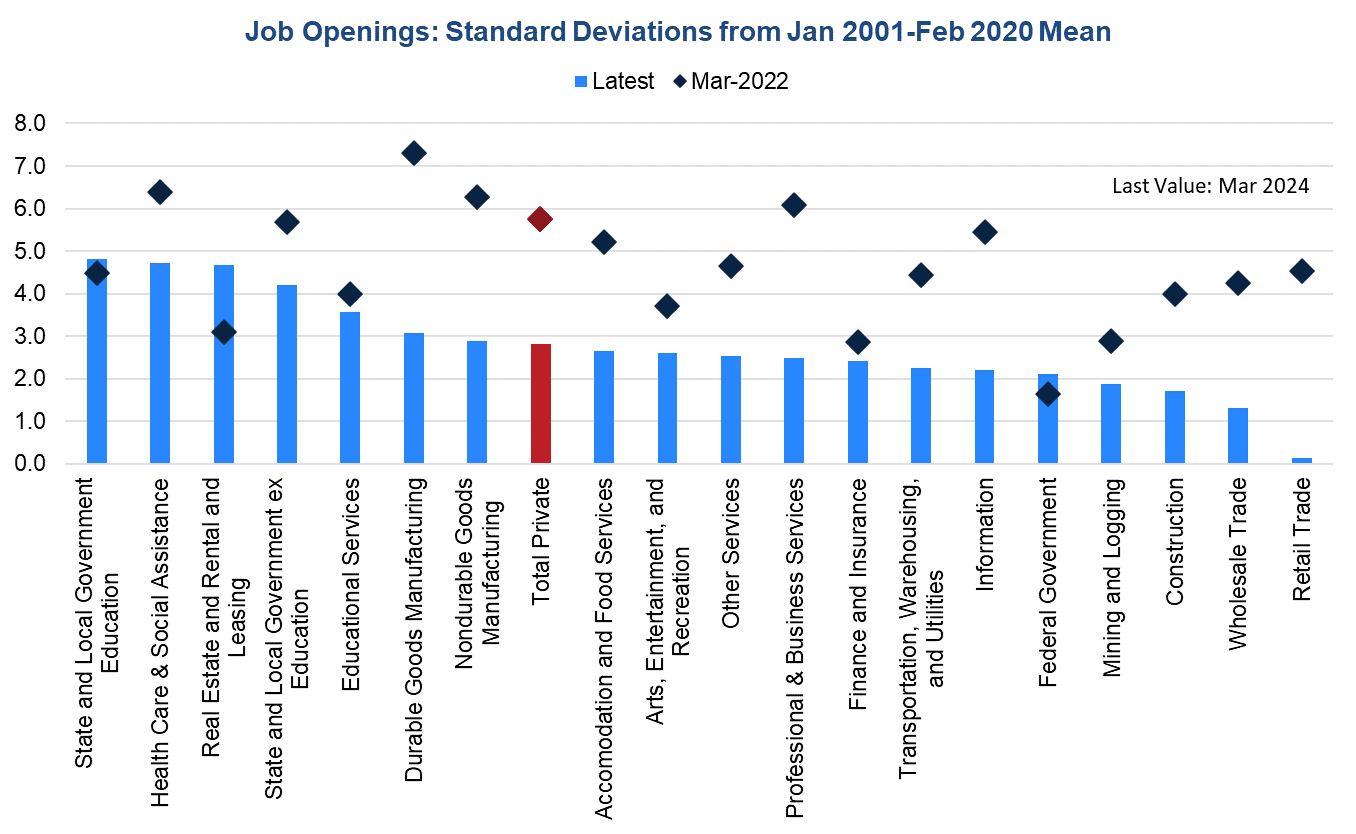

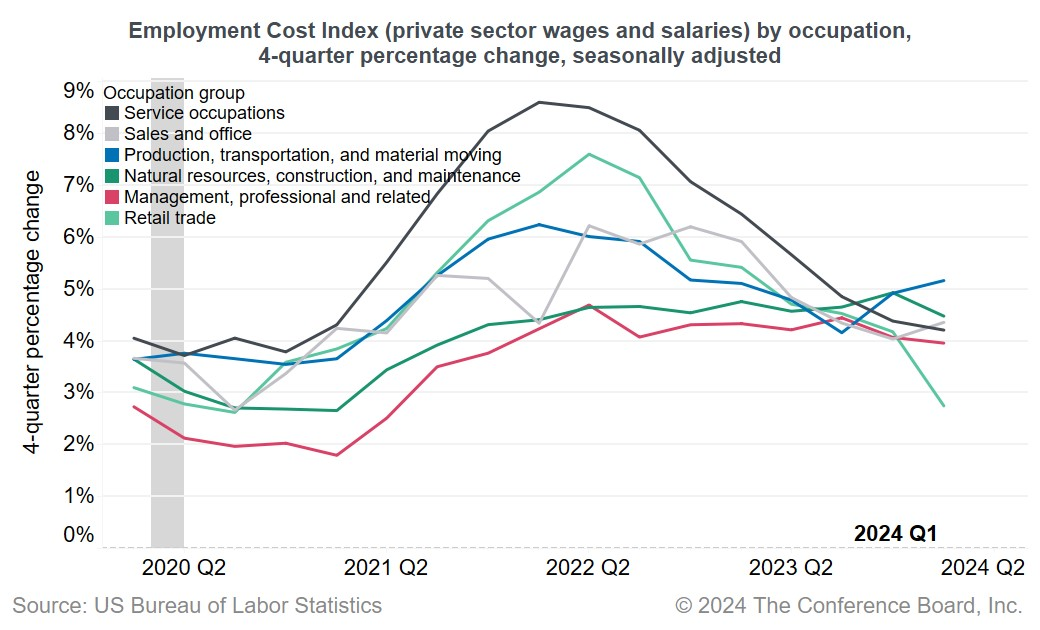

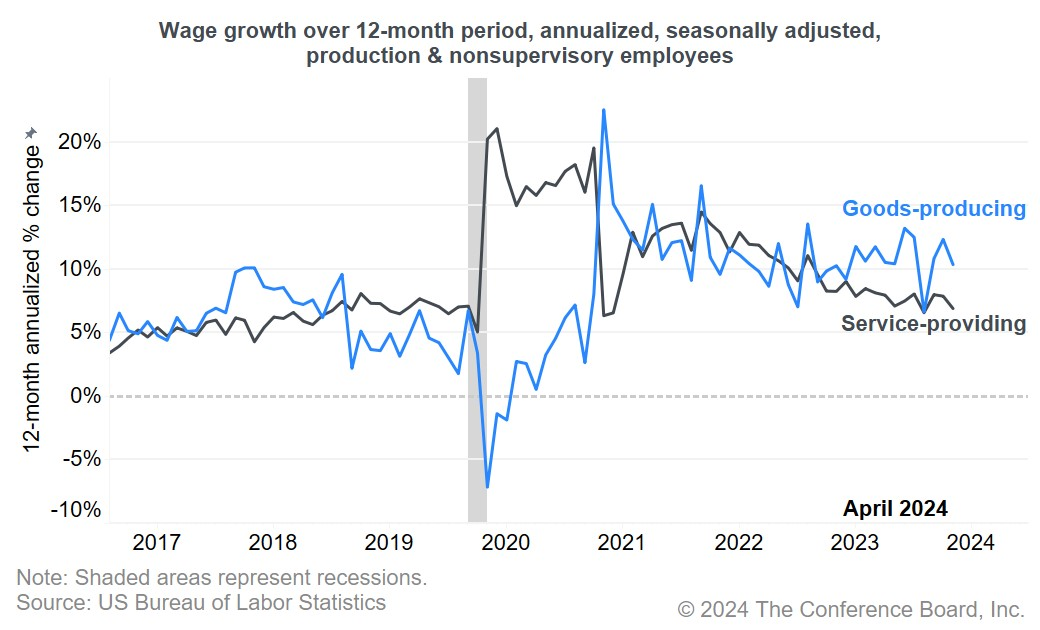

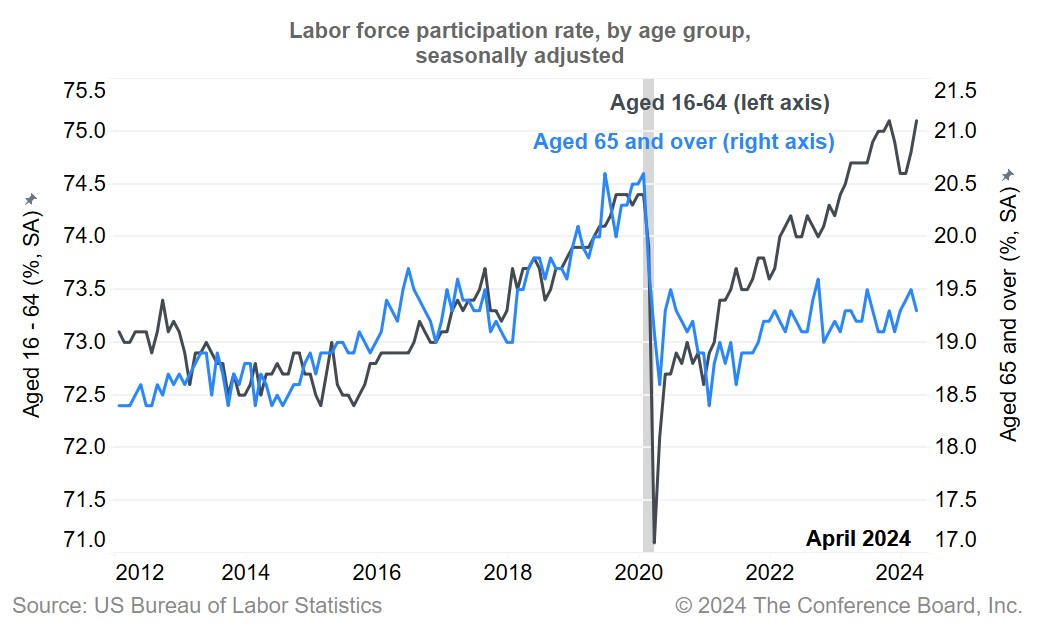

Nonfarm payrolls cooled in April 2024 as several industries that drove job gains over the past year pulled back on hiring. The unemployment rate ticked up but remained range-bound and well below a level that might signal a troubled labor market. Average hourly earnings cooled from a year ago but remained notably above the pre-pandemic range amid persistent labor shortages. The labor force participation rate held below the 2019 level due to mounting Baby Boomer retirements. Figure 1. Payroll gains slow as some sectors pull back on hiring Some of the “usual suspect” sectors pull back. The leisure and hospitality, and government sectors, which have been significant drivers of monthly payroll gains, only added a few workers in April. Arts entertainment and recreation jobs fell slightly in the month, but this sector has recovered all jobs lost during the pandemic. Accommodation and food services added about 8,000 jobs, mostly from food services and drinking places, which are still struggling to replace workers lost during the pandemic. Restaurant and bar jobs are in-person jobs that are more difficult to fill. All hotel sector jobs have been fully recovered as consumers continue to spend on vacations and travel. The government sector, especially local government, which has been a persistent driver of monthly payroll gains only added a few workers. This could be because the state and local government sector has just recently fully recovered from pandemic-era job losses. “Pandemic darling” industries remain weak. The information sector shed about 8,000 workers as the tech industry continues to right size labor forces, and temporary help services logged another month of decline as businesses continue to hold only existing workers and are not demanding temps. Financial activity payrolls added only a few workers led by insurance carriers, but other sectors like finance, and real estate, which thrived during the pandemic and amid low interest rates—added few people or even shed workers as the Fed keeps interest rates at multi-decade highs. Will payroll gains continue to cool? We posit that as many industries have recovered from pandemic losses and the economy continue to slow over the course of the second and third quarters amid elevated interest rates, monthly payroll readings probably will continue to moderate ahead. Additional payroll gains going forward probably will continue to be driven by the health care sector, which is still missing thousands of workers, and sectors still suffering from acute labor shortages (i.e., many sectors requiring in-person work). Where are labor shortages most acute? Look to JOLTs. Total job openings at 7.5 million, as of March, are still about 2.8 standard deviations above the pre-pandemic average (Jan 2001 to Feb 2020) but are materially lower than the peak of 11.2 million reached in March 2022. This level was an outsized 5.7 standard deviations above the pre-pandemic average. Still as job openings have yet to fully normalize, there are still some sectors experiencing labor shortages as suggested by still sizable numbers of job openings. These openings are still considerable for the health care and social assistance sector because many of these jobs require in-person work, as well as the government sector, which is challenged by the inability to raise wages much. Figure 2. JOLTs data suggest that labor shortages are still a problem for some industries Sources: Bureau of Labor Statistics and The Conference Board. Also look to wages for labor shortages. Wage growth can also signal where labor shortages are acute. The latest Employment Cost Index reveals that wages and salaries in Q1 2024 remained elevated for many occupations, and especially for natural resources, construction, and maintenance jobs; management, professional and related occupations; and production, transportation, and material moving jobs. Some of these jobs do require in person work, and/or are benefiting from strong employer demand as public policies support infrastructure repair and factory-building for supply chain reshoring. Figure 3. Wages still elevated or rising for many occupations Industry average hourly earnings remain elevated. Total average hourly earnings growth decelerated to 3.9 percent year-over-year in April, which was a materially slower pace than the post-pandemic peak of 5.9 percent reached in March 2022. Nonetheless, wages are still growing at a pace that exceeds the pre-pandemic range. Wages in the goods producing sectors, especially for mining, nonresidential construction, and durable goods manufacturing sectors remain elevated, with some continuing to rise. Wage growth among services generally have cooled, and the pace of growth is nearing the pre-pandemic range. Nonetheless, there are still pockets of sticky wages especially among sectors that have benefited from union negotiated wage increases (e.g., warehousing and storage). Upward wage pressures are bad news for Fed interest rate cut prospects. The Conference Board surveys of CEOs of large corporations continue to signal wage increases exceeding 3 percent over the next 12 months. Upward wage pressures are contributing to the stall in consumer inflation gauge slowing. Until the Fed feels confident that consumer inflation will slow to the 2-percent target, interest rate cuts remain off the table. Figure 4. Sticky wages are bad news for Fed interest rate cut prospects Retirements continue to stoke labor shortages. The unemployment rate ticked up to 3.9 percent in April but remains in a very low range. The increase in the number of unemployed people in the month edged higher, and as the labor force increased. The increase in the labor force was mainly among prime age workers (ages 16-64), with the labor force participation rate among this cohort rebounding to 75.1 percent. This kept the overall labor force participation rate steady at 62.7 percent in April, but the rate remained below the 2019 level as Baby Boomer retirements continue to depress labor force participation among workers aged 65+. Labor shortages are likely to persist going forward without initiatives to draw workers back to the labor market and keep them there. Figure 5. Baby Boomer retirements continue to dampen labor force participationTrusted Insights for What’s Ahead®

Jobs Report Highlights

Healthcare and social assistance lead payroll gains. Nonfarm payrolls rose by a healthy 175,000 in April, but at the slowest pace since October 2023. Job additions were driven by health care and social assistance (87,000), per usual, but also by several other sectors that have mostly only added a few workers per month over the last year. Notably, the wholesale and retail trade industries added a combined 32,200 workers, and transportation and warehousing hired 20,100 employees.

myTCB® Members get exclusive access to webcasts, publications, data and analysis, plus discounts to events.

Steady as She Goes Labor Market, Risks Remain

February 11, 2026

Vacancies Plunge, But Low Hire-Low Fire Equilibrium Persists

February 05, 2026

Steady Labor Market Allows Fed Pause

January 09, 2026

Rising Unemployment Augurs More Rate Cuts in 2026

December 16, 2025

Rising Unemployment to Dwarf Solid Payrolls in December FOMC Decision

November 20, 2025

BLS Revises 2024 Hiring, But Not the Labor Market Narrative

September 10, 2025