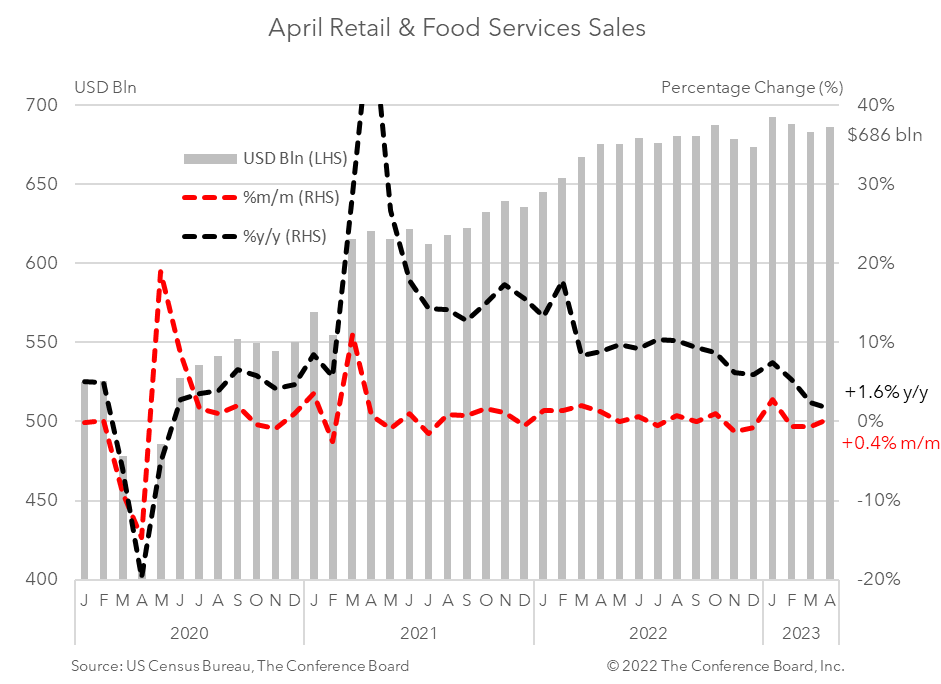

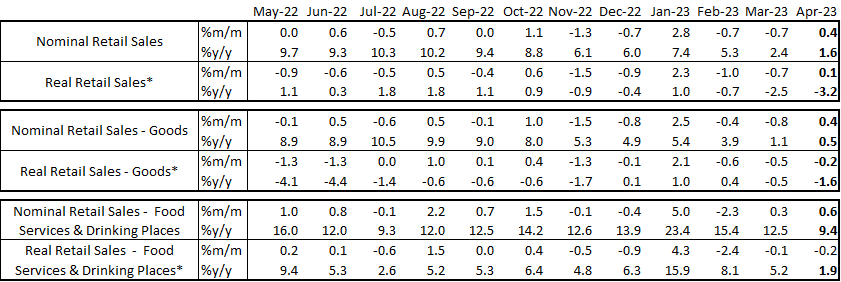

Retail sales rose in April in nominal terms, but were roughly flat in real terms. Total sales rose by 0.4 percent month-over-month, well below the consensus expectation of 0.8 percent. Adjusted for inflation, sales were up just 0.05 percent.* These data are an improvement from the back-to-back negative readings in February and March, but do not portend a reversal in the consumer outlook. When adjusting these data by CPI inflation, the growth rate drops to just over zero percent. Inflationary pressures and high interest rates will remain a burden on consumers in the months ahead and we continue to expect the US economy to slip into a short and mild recession this year. Consumer demand for goods rose 0.4 percent in April from the month prior in nominal terms. Spending on motor vehicles and parts rose by 0.4 percent in April from March, while retail sales excluding motor vehicles also rose by 0.4 percent. Spending at gasoline stations fell 0.8 percent from the month prior. Retail sales less motor vehicles, gasoline, and building supplies (known as “Retail Control”) rose by 0.7 percent from the previous month. However, when adjusting goods spending for CPI inflation, the real growth rate was about -0.2 percent from the previous month.* Meanwhile, spending at food services and drinking places rose by 0.6 percent month-over-month in April. After adjusting for CPI inflation the real growth rate was about -0.2 percent from the previous month.* * Real growth rates are The Conference Board estimates based on Census Retail Sales data and BLS CPI data

Shutdown Aside, Growth Moderates Under Inflationary Pressures

February 20, 2026

January CPI Raises More Questions than Provides Answers

February 13, 2026

Lukewarm Holiday Shopping in 2025 Augurs Slower Spending in Q4

February 10, 2026

FOMC Reaction: US Economy In a Good Place, But Staying Vigilant

January 28, 2026

Fed January Decision: Pause or Full Stop?

January 27, 2026

November PCE: Are Consumers Spending Beyond Their Means?

January 22, 2026