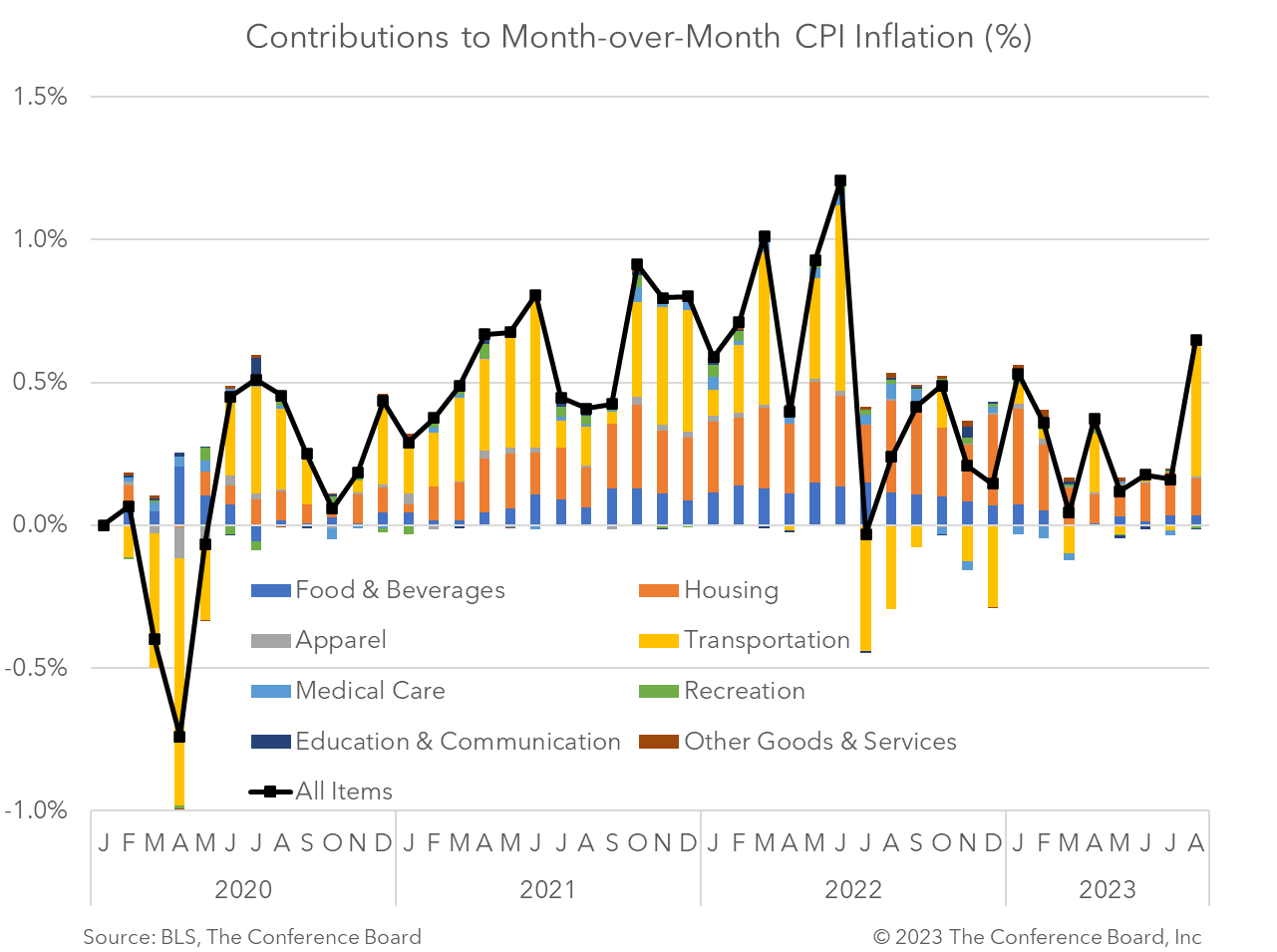

The August Consumer Price Index (CPI) showed that inflation rose 3.7 percent from a year earlier, up from 3.2 percent in July. Still, this print is down from the peak of 9.1 percent in mid-2022. Meanwhile, core CPI, which excludes volatile food and energy prices, rose 4.3 percent in August from a year earlier slowing from 4.7 percent year-over-year in July. The Fed will likely be dissatisfied with these data, but we still expect it to keep interest rates unchanged at the September meeting. Thereafter, we expect one final hike in November and no rate cuts until Q2 2024. However, a more prolonged surge in energy prices could introduce additional inflationary pressures and push the Fed to become even more aggressive. A spike in energy prices was responsible for the higher topline CPI reading. Indeed, gasoline prices alone accounted for more than half the increase this month. Headline CPI rose by 0.6 percent month-on-month and 3.7 percent year-on-year, vs. July’s 0.2 percent m/m and 3.2 percent y/y. The primary drivers of inflation were energy commodities, which rose 10.5 percent m/m. Gasoline rose 10.6 percent m/m and was the largest contributor to the topline index. Meanwhile food prices rose 0.2 percent m/m matching the prior month’s increase. Core CPI rose 0.3% percent month-on-month and 4.3 percent year-on-year, vs. July’s 0.2 percent m/m and 4.7 percent y/y. While there was some progress seen in shelter prices, which are a major driver of inflation, they have not come off as much as expected. There should be more progress here soon according to past declines in home price valuations and smaller new rent increases.

January CPI Raises More Questions than Provides Answers

February 13, 2026

Lukewarm Holiday Shopping in 2025 Augurs Slower Spending in Q4

February 10, 2026

FOMC Reaction: US Economy In a Good Place, But Staying Vigilant

January 28, 2026

Fed January Decision: Pause or Full Stop?

January 27, 2026

November PCE: Are Consumers Spending Beyond Their Means?

January 22, 2026

Retail Sales Highlight Affordability Issues

January 14, 2026