For Release 10:30 AM ET, July 9, 2025

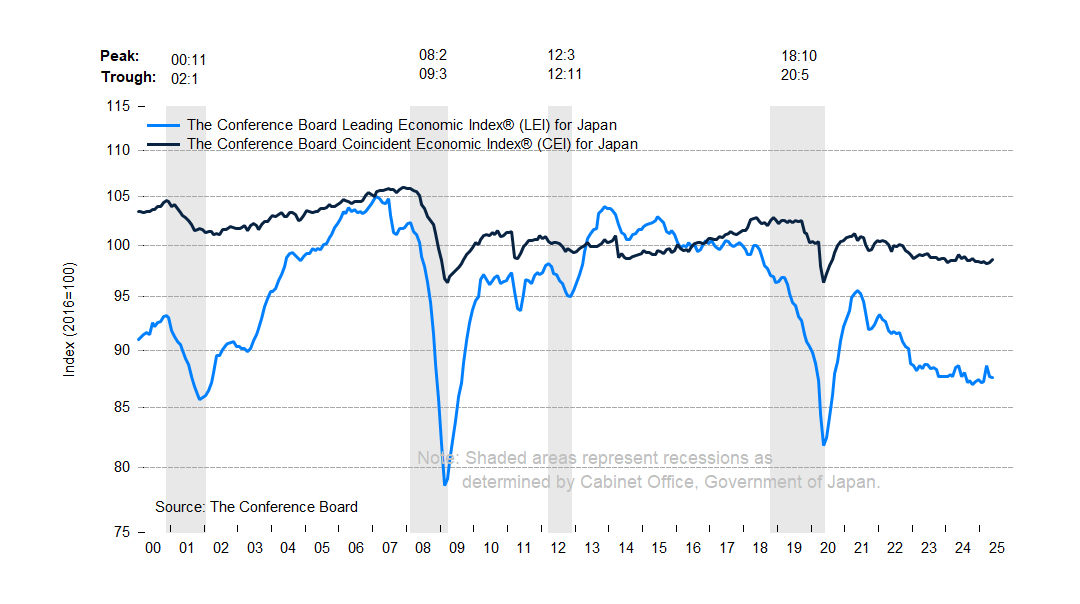

Using the Composite Indexes: The Leading Economic Index (LEI) provides an early indication of significant turning points in the business cycle and where the economy is heading in the near term. The Coincident Economic Index (CEI) provides an indication of the current state of the economy. Additional details are below.

The Conference Board Leading Economic Index®(LEI) for Japan ticked down by 0.1% in May 2025 to 87.6 (2016=100), after falling by 1.0% increase in April. However, over the six months period between November 2024 and May 2025, the LEI for Japan rose by 0.5%, an improvement from a decline of 1.6% over the previous six months between May and November 2024.

The Conference Board Coincident Economic Index® (CEI) for Japan increased by 0.3% in May 2025 to 98.6 (2016=100), after rising by 0.1% in March. As a result, the CEI for Japan improved by 0.2% over the six-month period from November 2024 and May 2025, a reversal from the 0.7% contraction over the previous six-month period (May to November 2024).

“The Japan LEI inched further down in May” said Justyna Zabinska-La Monica, Senior Manager, Business Cycle Indicators, at The Conference Board. “The 8 out of 10 components were either unchanged or improved, but that was not enough to offset the largest negative impact from new construction. Housing starts continued to decline in May, hitting the 40,000-unit range, the lowest monthly level since January 1963. This decline reflects the full enforcement of revised building laws on April 1st, which already led to a surge in March right before the new laws applied, followed by a huge downward correction in April. Also increasing CPI inflation lowered the real money supply, which was the other negative contributor to the LEI. Despite consecutive monthly declines, the LEI growth remained slightly positive on the 6-month basis but was negative on an annual basis. Considering the most recent weaknesses in LEI and persisting trade tensions with US, The Conference Board expects Japan growth at around 1% in 2025 but notes significant downside risks.”

The next release is scheduled for Tuesday, August12, 2025, at 10:30 A.M. ET.

New construction continued to drive the LEI down in May

The annual growth of Japan LEI fell further into negative territory, indicating headwinds to growth ahead

About The Conference Board Leading Economic Index® (LEI) and Coincident Economic Index® (CEI) for Japan. The CEI reflects current economic conditions and is highly correlated with real GDP. The LEI is a predictive tool that anticipates—or “leads”—turning points in the business cycle by around four months. The ten components of the Leading Economic Index® for Japan are:

To access data, please visit: https://data-central.conference-board.org/ About The Conference Board The Conference Board is the member-driven think tank that delivers Trusted Insights for What’s Ahead®. Founded in 1916, we are a non-partisan, not-for-profit entity holding 501 (c) (3) tax-exempt status in the United States. ConferenceBoard.org

|

PRESS RELEASE

LEI for Japan Fell Further in May

July 09, 2025

PRESS RELEASE

LEI for China Decreased Again

June 26, 2025

PRESS RELEASE

LEI for India Increased in May

June 24, 2025

PRESS RELEASE

The LEI for France Improved Again in April

June 18, 2025

PRESS RELEASE

LEI for Australia Increased in April

June 18, 2025

PRESS RELEASE

LEI for the Euro Area Declined Again in May

June 17, 2025

All release times displayed are Eastern Time

Business & Economics Portfolio

July 03, 2025 | Database

The Economy Stabilized in August but Outlook Remains Weak

September 27, 2023 | Report

China's Economic Recovery Continues to Stutter (Economy Watch: China View, June 2023)

June 30, 2023 | Report

Leading Economic Indicators and the Oncoming Recession

December 07, 2022 | Report

The Evolving Economic Outlook for Europe

July 10, 2024

Is a Global Recession on the Horizon?

July 13, 2022