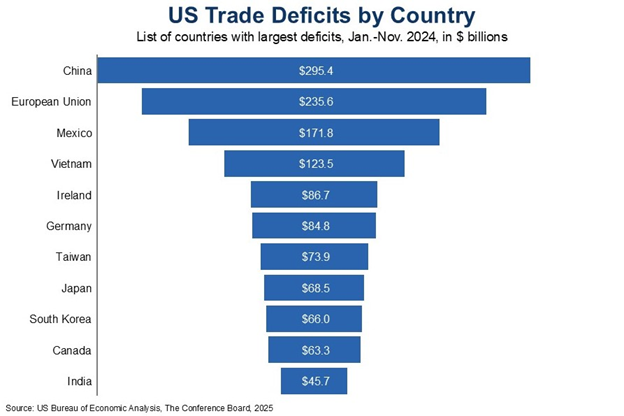

Key goals: The stated objectives of the plan include correcting longstanding trade imbalances, reducing the US trade deficit, and increasing US competitiveness. Key actions: The Administration’s memorandum instructs the Department of Commerce and Office of the US Trade Representative to investigate and propose remedies for imbalances, with reports due in April. Like with other trade activities over the last month, it’s unclear whether tariffs and other actions could be announced before or pending the results of such investigations. This is a large undertaking, as the US is the world’s second largest trading nation, behind only China, with relations with more than 200 trading partners globally. The US also has comprehensive free trade agreements in force with 20 countries. Tariffs are only part of the analysis: The memorandum details that it’s not only tariffs that will be examined when looking at reciprocal US actions. Also considered will be extraterritorial taxes, such as value-added taxes (VAT), subsidies countries provide to their domestic industries, regulatory requirements on US companies operating overseas, limitations to market access for US companies, and other "non-tariff barriers” that would impact US competitiveness. The TCB take: Businesses should consider identifying sources for products and inputs from more than one country and continue evaluating their supply chains for possible diversification and orientation. This might be particularly valuable if supply chains involve countries the US is running large trade deficits with, as listed in the chart below.The White House's Game Plan for Achieving Trade Balance...with 200 Partners

The White House recently announced its “Fair and Reciprocal Plan” regarding trade. The plan details imposing reciprocal trade actions, including tariffs, against US trading partners that the Administration determines to engage in unfair practices.

myTCB® Members get exclusive access to webcasts, publications, data and analysis, plus discounts to events.

Shutdown Aside, Growth Moderates Under Inflationary Pressures

February 20, 2026

January CPI Raises More Questions than Provides Answers

February 13, 2026

Lukewarm Holiday Shopping in 2025 Augurs Slower Spending in Q4

February 10, 2026

FOMC Reaction: US Economy In a Good Place, But Staying Vigilant

January 28, 2026

Fed January Decision: Pause or Full Stop?

January 27, 2026

November PCE: Are Consumers Spending Beyond Their Means?

January 22, 2026

Charts

As a visual explainer of CED's Solutions Brief, this infographic highlights key design elements for a bipartisan fiscal commission.

LEARN MORECharts

As a visual explainer of CED’s Solutions Brief, this infographic outlines CED's policy priorities for 2026.

LEARN MORECharts

The proliferation of easy-to-use generative AI requires that policymakers and business leaders each play an important role.

LEARN MORECharts

A hyperpolarized environment, diminished trust in our nation’s leaders.

LEARN MOREPRESS RELEASE

CED Outlines 2026 Policy Priorities Ahead of Nation’s 250th Anniversary

January 20, 2026

IN THE NEWS

Denise Dahlhoff on How CEOs Are Talking About Tariffs—without Saying “Tarif…

May 21, 2025

IN THE NEWS

Erin McLaughlin on Tariff Policy

April 07, 2025

IN THE NEWS

Erin McLaughlin on Reshoring Factors

April 05, 2025

IN THE NEWS

Erin McLaughlin on US Reshoring

April 02, 2025

IN THE NEWS

Erin McLaughlin: How policy uncertainty may exacerbate infrastructure chall…

March 19, 2025