Supply-Demand Imbalances, Uncertainty to Keep Oil Prices in Flux

June 13, 2022 | Article

Three months into the war in Ukraine, the outlook for oil supply and demand remains uncertain. While fear of a chaotic collapse of the global oil market sparked by the war has waned, gross imbalances could still resurface. The timing of resolution of the conflict is unclear, and both consumers and investors are being buffeted by price volatility. Recent events only add to the uncertainty, including the EU’s plan to embargo Russian oil and insurance on tankers carrying the product; reopening and a potential surge in energy demand after COVID-19 lockdowns in Shanghai; and the possibility that Russia may soon be shut out of OPEC+.

We posit that slower global growth and higher inflation may curb demand for oil over the next 18 months. Nonetheless, production caps and disruptions in supply may keep prices well above the $70-$90 per barrel range that prevailed prewar. These elevated prices will reflect the EU’s ban on Russian oil, but likely also capacity constraints for oil production among Gulf states and the US. Still, risks of additional oil price spikes or dives loom as the potential for Russian retaliation or prospects of increased Gulf production may keep investors and consumers of oil guessing.

Insights for What’s Ahead

- The Brent oil price is expected to average US$111/bbl in the second half of 2022, and US$99/bbl in 2023 as demand and supply may fall, but at uneven rates.

- Volatility will continue to characterize the oil market over the medium term. The evolution of the war in Ukraine and global oil demand as growth slows will be key factors in determining the path for prices ahead.

- The EU’s decision to halt Russian oil imports will certainly cause continued disruption to the oil market and boost prices. Still, the desired result—a major decline in Russia’s oil revenues—may not come to fruition given increased Russian sales to China and India.

- Risks of additional spikes in energy prices remain as Russia may choose to retaliate against the EU’s oil ban by shutting off natural gas to EU member states.

- There is scope for increased crude oil production by OPEC members, especially if Russia is sidelined. However, lack of infrastructure may limit the capacity of Gulf states to ramp up production significantly.

- Similarly, lack of investment, labor and equipment shortages, reluctance to rehab aging refineries, and political pressures may continue to limit the degree to which the US can increase oil production.

Slowing Global Growth to Curb Oil Demand

Global oil demand is expected to soften amid higher prices and weaker economic growth. After global real GDP growth expanded by 5.9 percent in 2021, The Conference Board expects it to slow to 2.9 percent this year. This pace includes a full 1 percentage point downgrade in projected output since the start of the war. The deceleration of global growth from last year’s breakneck, pandemic-revival pace, and the strains of the war in Ukraine, are expected to continue to place downward pressure on oil demand ahead.

All three major oil organizations—Energy Information Agency (EIA), International Energy Association (IEA), and OPEC—downgraded their 2022 global oil demand forecasts by 0.3-0.6mb/d, citing drags on global growth from faster inflation and COVID-19-related shutdowns in China. According to the EIA, global oil demand has already declined to 97.37mb/d as of April 2022, the lowest level since June 2021. There may be a surge in Chinese oil demand as the most recent lockdown ends, but if zero-COVID-19 policies persist, then the risk of another drop in global oil demand remains.

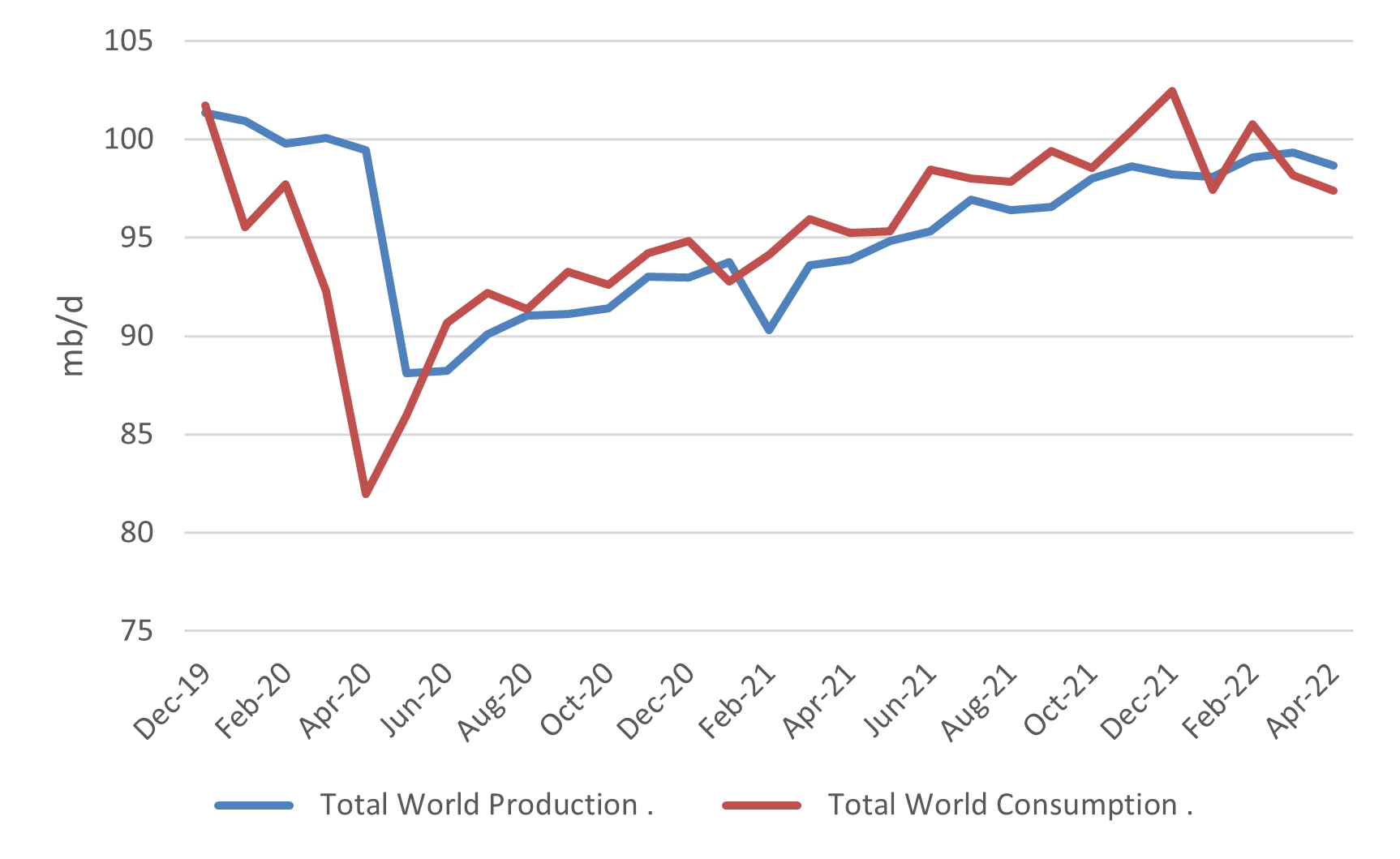

Oil consumption fell behind oil supply for the first time in two years

Source: US Energy Information Administration

Supply May Still Struggle to Keep Up

Even while oil demand may slow over the course of this year and next, supply may continue to struggle to keep pace. Like oil demand, 2022 global oil supply growth has been downgraded by 1.2 thousand barrels per day by major oil organizations since the start of the war. The downshift in expectations reflects the risk of a potential EU ban on Russian oil, limited global production capacity, and the low probability of Iranian oil returning to international markets in 2022. According to the EIA, global oil supply has already fallen by 0.6 mb/d as of April 2022. Since May 2020, when OPEC+ agreed to cut supplies, demand has largely surpassed supply. Only in March and April 2022 did supplies just exceed demand. This is constructive, but there is still the risk that supplies in the future may fall short. Politics and capacity are the reasons.

There is still limited political will among OPEC countries to raise oil output. OPEC countries, predominantly Saudi Arabia and the United Arab Emirates, have repeatedly voiced their commitment to the OPEC+ agreement to limit production. In an unexpected move, OPEC+ agreed on June 2 to raise the incremental monthly increase from 432 to 648 mb/d for July and August 2022, citing increased demand due to the summer travel season. The statement did not mention the Russian oil embargo nor the war in Ukraine. This marginal increase is definitely not enough to compensate for the decline in Russian oil but rather is a political signal on behalf of OPEC to the US and the EU, which have been seeking production increases. The increased production was blessed by Russia, a member of OPEC+.

Politics aside, OPEC has limited spare capacity to increase production to offset the EU’s embargo on Russian oil or help quickly reduce global oil prices. OPEC+ has consistently produced below its monthly targets. According to the IEA, Saudi Arabia and the UAE hold up to 3.3 mb/d of spare capacity that is available to the market within 90 days, while Iraq and Kuwait can only add another 0.8 mb/d.

The US, another major oil exporter, is also experiencing capacity constraints. The US is not ramping up oil production due to shortages of labor, equipment, and funding. While government policy and regulations are blocking increased production, investors are reluctant to finance projects to repair old oil refineries or commit dollars to the energy sector as consumer, business, and government preferences shift toward renewable energy use.

Oil Prices Still Face Risk of Further Spikes

The EU is ratcheting up its economic war on Russia in response to the invasion of Ukraine. In late May, the EU reached a deal to sanction Russian oil by the end of 2022 while temporarily allowing pipeline deliveries to Hungary, Czech Republic, and Slovakia for the next 18 months. This would mark the sixth round of sanctions on Russia to decommission the Russian war machine, which has been largely financed by oil revenues.

The EU’s sanctions have and will continue to prompt Russia to cut production. Since the start of the war in Ukraine, fear of oil sanctions kept investors away from Russian oil, leading to sharp declines in the economy’s production. So far, Russia cut back its oil production in March and April 2022, lowering output to 10.3 mb/d, from 11.3 mb/d in February. This 8.8 percent month-on-month decline is the steepest since May 2020. Estimates from various energy experts suggest that the impending EU oil ban could reduce Russian oil production by another 2-3 mb/d.

While the shock will most certainly keep global oil prices elevated, the desired outcome of zero-out Russia’s oil revenues may not be achieved. This is due to two factors. First, Russia has alternative buyers for its oil: China and India—the world’s first and third largest oil importers. Since the onset of the war, China and India have increased their Urals (Russian oil) purchases at a US$30-40/bbl discount. Second, the oil sanctions will reduce supplies to Europe, raising oil prices and inflation in future quarters. For Russia, higher revenues from elevated global oil prices will help offset losses in production, partially defeating the EU’s goal.

The risk of additional shocks to energy prices linked to the war still looms. In response to the impending EU embargo on roughly 90 percent of Russia’s oil, Russia may shut off natural gas supplies to the rest of the EU.[1] Russia cut gas exports to Bulgaria and Poland several months ago due to their support of the Ukraine government and the nation’s millions of refugees. More recently, Russia halted gas supplies to Finland over its request to join NATO, and the Netherlands and some companies in Denmark and Germany for refusing to pay for gas in rubles. The extension of gas cuts to such large swaths of Europe would undoubtedly prompt higher energy costs for businesses and consumers in the region and possibly around the world.

Oil Price Bands to Remain Wide

The pace of slowing in global demand and OPEC supply decisions will continue to foment volatility in oil markets ahead and keep pricing bands wide. OPEC claims not to intervene in the oil market to control or influence price. However, the group’s decision to accelerate or limit oil production in the upcoming quarters amid an expected shortage in Russian oil will significantly affect the trajectory of oil prices going forward.

Gulf countries are losing dollars and market share due to existing production agreements, prompting aims to shun Russia. The July 2021 OPEC+ agreement that kept monthly production increments very limited has cost the Gulf countries. Although oil revenues have increased amid the high-price environment, Gulf countries, which are the major oil producers within OPEC+, are missing out on an opportunity to further improve their financial positions due to the production caps. Moreover, Gulf countries are losing market share to Russia as India and China increase their Urals imports—thanks to the US$30-40/bbl discount price. While OPEC countries are not looking to make up market share lost to discounted Russian oil, plans are in the works to potentially shut the country out of OPEC+ Bloc decisions. Indeed, a new production deal beyond September 2022 is being drafted that might exclude Russia from its production targets given oil sanctions and the ban on insuring ships carrying Russian oil.

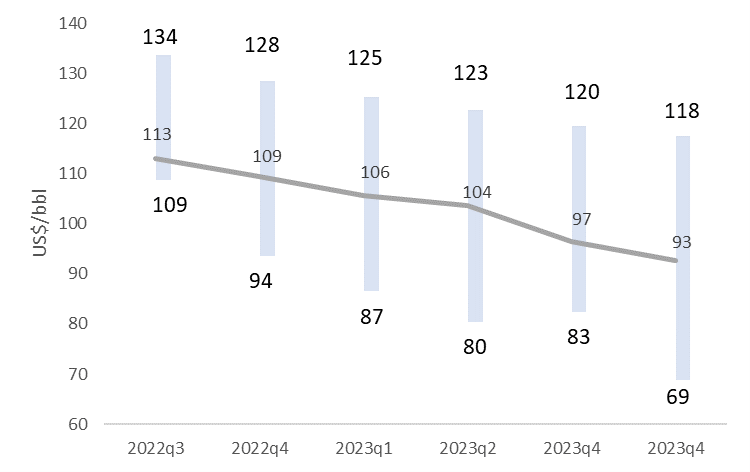

Given downgrades to our global growth forecasts, but the potential for continued oil supply variability, we have updated our oil price projections.

- In a base case scenario, The Conference Board forecasts Brent oil prices to average US$113 in Q3 2022 and gradually decline to an average of US$93/bbl by the end of 2023. This is a slightly lower profile than our previous path, but nonetheless still higher than what was expected before the war in Ukraine began.

- Low oil price scenario: If OPEC increases its production to compensate for the loss of Russian oil, Brent is forecast to hover between $110-115/bbl in the third quarter of this year before trending downward toward US$70-80/bbl next year.

- High oil price scenario: If OPEC, citing production spare capacity limitations and/or weaker global oil demand, decides to maintain its production levels at current levels or increase them slowly and steadily beyond September 2022, then Brent oil prices are forecast to exceed US$120/bbl on average over the next 18 months.

The range between the high and low oil prices scenarios is expected to widen through 2024 as uncertainties on the geopolitical front and the probability of global economic recession rise.

Possible oil price trajectories based on OPEC production decisions

Source: Supply-Demand Imbalances, Uncertainty to Keep Oil Prices in Flux, The Conference Board, June 2022

[1] To read more about the impact of a gas embargo on the EU’s economy, go to: Marina Feliciano et al., Effects of an Embargo on Russian Gas, Vox EU, May 24, 2022.

To get complimentary access to this publication click "Read more" to sign in or create an account.