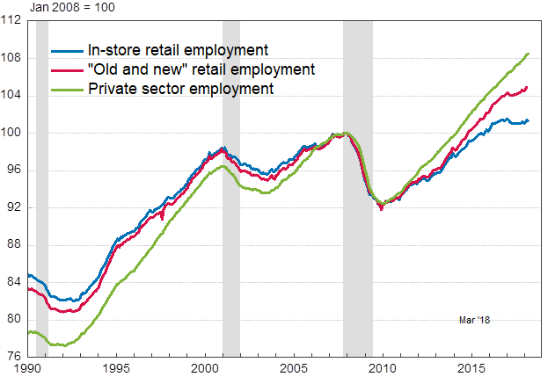

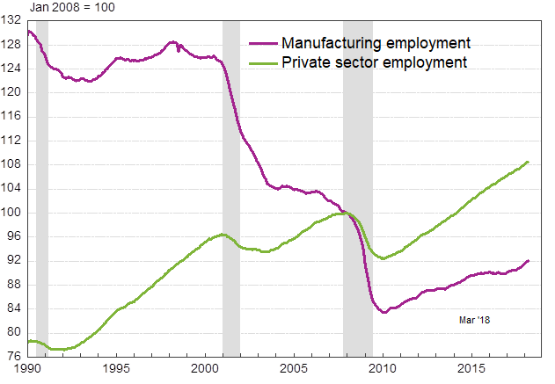

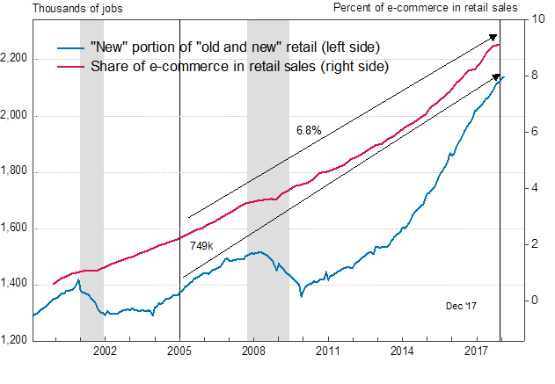

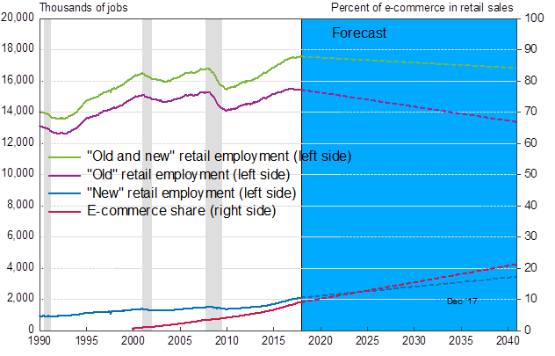

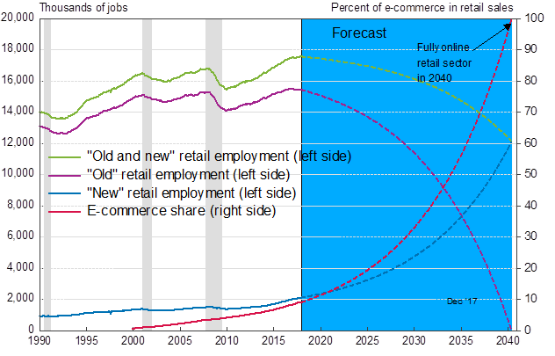

Economist Michael Mandel of the Progressive Policy Institute tells a reassuring story about what will happen to retail employment. Jobs behind retail counters and stocking store aisles will simply be replaced by jobs at warehouses, e-commerce facilities, and as delivery drivers. A wider aperture is necessary to fully understand what is happening to employment that is part of the process of selling goods to consumers. Mandel extends jobs in retail and e-commerce to include both the “warehousing and storage” and the “couriers and messengers” sectors. It is true that these sectors have been booming from an employment perspective since 2015. However, even this more comprehensive definition of retail employment, let’s call it the “old and new” retail sector, reveals a part of the economy that has been producing jobs far more slowly than the rest of the US economy since the Great Recession. Starting in the beginning of 2017, the picture became even more dire. “Old and new” retail has added just 100,000 of the 2,500,000 private sector jobs created during the past 15 months. 14 percent share of total private sector employment. Sadly, the future is likely to be even worse for “old and new” retail workers. The “new” jobs in e-commerce are simply not growing fast enough to make up for the “old” jobs lost at brick and mortar establishments. Under one possible scenario (the “Apocalypse is Ongoing” one described below), retailing moves entirely online, in which case retail sector employment will fall from 17.6 million jobs today to just 12.1 million by 2040. “Old and new” retail consists of five industry groups: 1) Couriers and messengers 2) Warehousing and storage 3) Electronic shopping and mail order houses 4) Other non-store retailing 5) In-store retail – defined as retail trade jobs outside of categories 3 and 4 Employment growth in the “old and new” retail sector has stalled during the past year. Source: BLS For workers, the history of sectors experiencing both massive technological change and slow job growth during a period of fast job growth in the overall economy is not encouraging. Consider the manufacturing sector of the late 1990s. From January 1995 to December 2000 private employment rose by more than 15 percent while manufacturing employment fell by 0.5 percent. Claiming that the manufacturing sector was doing just fine because it was losing few jobs during a robust expansion turned out to sound a bit like claiming that underbrush does just fine before a forest fire. Recessions force businesses to respond to technological and industry changes more rapidly and decisively than during expansions. During the dotcom recession and after, the manufacturing sector was buffeted by the ill winds of expanding global trade and automation. By the end of 2003, manufacturing would employ 16.8 percent fewer workers than it had at the end of 2000. Today, the industry operates with almost 26.8 percent fewer workers than it did at the beginning of 1995. A period of flat manufacturing job growth in the mid-1990s could prove a harbinger of much worse times ahead for “old and new retail” workers. Source: BLS Data on the share of e-commerce in retail sales provide a lens on what will happen to broadly defined retail sector employment as more purchasing moves from in stores to online. From 2005 to today, the share of purchases online has quadrupled from 2.3 to around 9.1 percent[1]. The share of e-commerce in total retail sales has grown from 2.3 percent to 9.1 percent since 2005 during a period where “new” retail sectors have created just 749,000 jobs. Note: New portion of “old and new” retail consists of couriers and messengers, warehousing and storage, and electronic shopping and mail-order houses. Sources: Census Bureau, BLS, calculations by The Conference Board During this same period, 749,000 new jobs were created in the out-of-store portion of “old and new” retail. If one assumes that every 6.8 percent increase in e-commerce yields 749,000 new jobs, a 100 percent online retail sector would employ just 12.1 million workers compared to 17.6 million today. This assumes that productivity in “old and new” retail grows no faster than the growth of consumer demand for goods. How quickly will e-commerce grow as a share of retail sales and how soon will employees in “old and new” retail be displaced? Under an “Apocalypse is an Exaggeration” scenario, e-commerce will grow at a modest pace as a share of total retail sales because many of the lowest hanging e-commerce fruit have already been plucked. Therefore, the transformation from in-store retail to e-commerce would take quite a long time. The logistical challenge of shipping books to individual customers is orders of magnitude less complicated than delivering groceries. The “in-store” experience also provides special value to some consumers, especially when the ability to touch and feel merchandise and consult with experts is part of the value proposition stores and their workers provide. Firms will learn how to adapt to the challenge of e-commerce in less easily adapted industries, but because of these challenges, growth in the e-commerce share may increase by only 6.8 percent every 13 years, as happened between 2005 and 2017. Under this scenario, the share of e-commerce in retail sales would be 21 percent by the end of 2040, and the “old and new” retail sector will employ 16.8 million workers, compared to 17.6 million today. A disappointing job trajectory to be sure, but hardly apocalyptic. Apocalypse is an Exaggeration: If e-commerce grows slowly as a share of total retail sales, the number of jobs in “old and new” retail will decline modestly over the long-term. Sources: BLS, Census Bureau The 2005 to 2017 period though lights the way to a bolder, yet in my view more likely “Apocalypse is Ongoing” scenario. This scenario assumes that exponential growth of the e-commerce share will continue as it did from 2005 to 2017 meaning that the e-commerce share of retail will double every 6.5 years. Incentives for firms to adapt new sectors to e-commerce will be tremendous due to the convenience and efficiency commerce without stores can provide. Companies can apply the lessons from developing one form of e-commerce to new product areas with knowledge of the pitfalls they are likely to encounter. Under this scenario, e-commerce would represent 18 percent of retail sales by the middle of 2024, 36 percent by the end of 2030, and 100 percent by the middle of 2040. Initially, job losses resulting from the shift to e-commerce would be small in “old and new” retail with 738,000 jobs disappearing between now and the end of 2025. By 2040, however, only 12.1 million workers, all employed by “new” retail sectors, would be able to manage all retail sales activities, a loss of 5.5 million jobs. “Apocalypse is Ongoing”: As the share of e-commerce expands more quickly, the number of jobs in the “old and new” retail sector will decline rapidly. Note: “Old” retail employment includes both in-store retail and other non-store retail Sources: BLS, Census Bureau An even more dramatic change is quite possible where even fewer jobs will be created in “old and new” retail as e-commerce expands its reach. Under an “Apocalypse has Arrived” scenario, the potential for autonomous vehicles to streamline deliveries, and additional advancements in robotics to help ultra-modern warehouses move goods in and out even more efficiently, would drive further productivity improvements. The next recession would likely catalyze shifts already ongoing in both in-store retailing and e-commerce, driving employment in “old and new” retail down rapidly. The “new” retail sector includes many of the economy’s most innovative firms who are likely to develop and deploy technology that could result generate these rapid productivity gains. If the experience of late 1990s manufacturing sector is any guide, expect “old and new” retail job losses to exceed those projected in the above “Apocalypse is Ongoing” scenario. Finally, network effects may provide a further source of acceleration for e-commerce growth. As e-commerce in a given sector increases as a share of total sales, surviving in-store retail branches could become progressively harder to maintain. Downstream supplier networks could wither and may also become increasingly well adapted to e-commerce. Synergies between e-commerce activities in different industries could also encourage faster growth of the e-commerce share generally. The quicker e-commerce grows, the more rapidly the number of jobs in “old and new” retail would dwindle. This post remains agnostic as to questions around total future employment and what exactly workers across the labor market will be doing. Labor market data though very clearly suggest that jobs in warehousing, delivery, and e-commerce, are unlikely to fully replace those lost in brick and mortar retail. [1] The share of e-commerce represents according to the Census Bureau “sales of goods and services where the buyer places an order, or the price and terms of the sale are negotiated, over an Internet, mobile device (M-commerce)” divided by total retail sales excluding food services.

Steady as She Goes Labor Market, Risks Remain

February 11, 2026

Vacancies Plunge, But Low Hire-Low Fire Equilibrium Persists

February 05, 2026

Steady Labor Market Allows Fed Pause

January 09, 2026

Rising Unemployment Augurs More Rate Cuts in 2026

December 16, 2025

Rising Unemployment to Dwarf Solid Payrolls in December FOMC Decision

November 20, 2025

BLS Revises 2024 Hiring, But Not the Labor Market Narrative

September 10, 2025