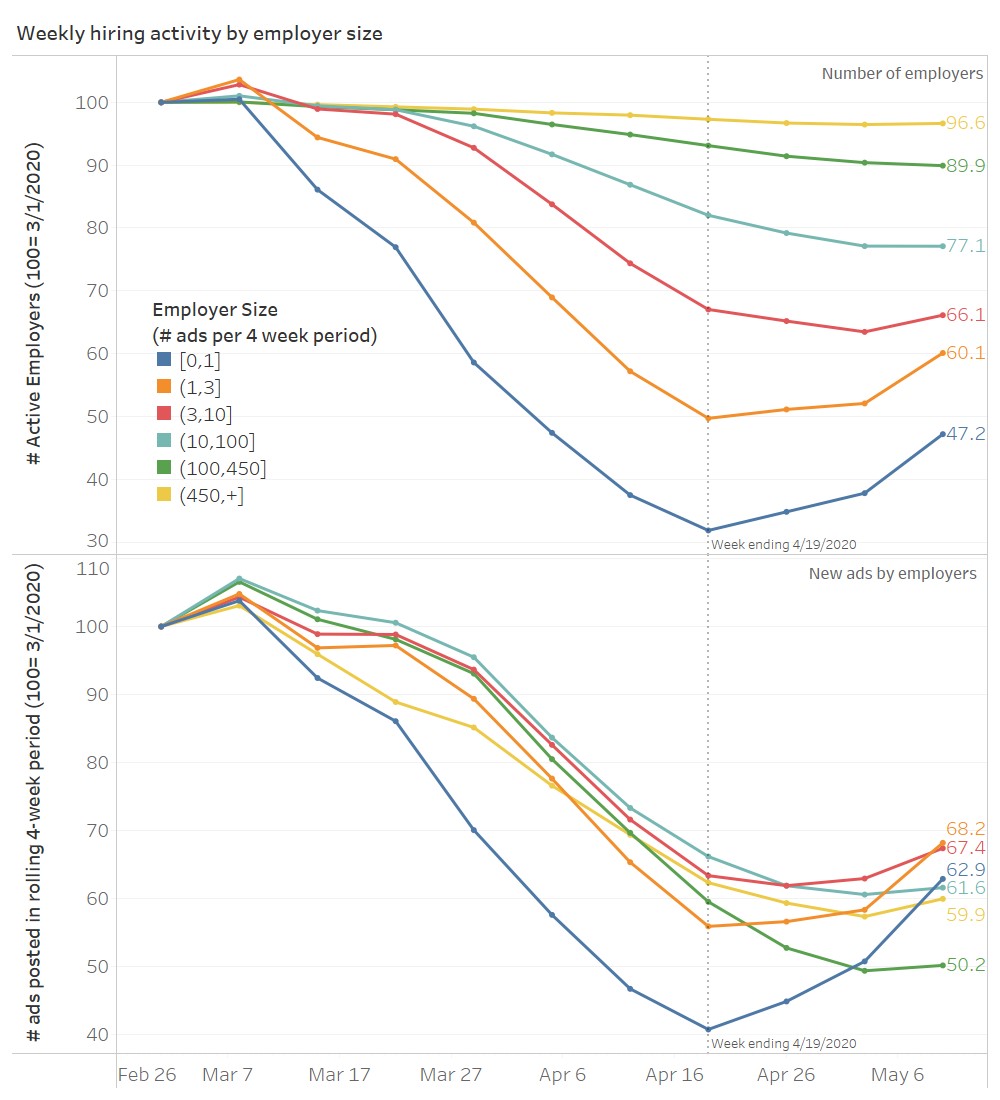

After a major drop in the number of online ads in March and early April, early signs suggest small employers are leading the ramp up in hiring as the economy begins to reopen. The Conference Board®-Burning Glass® Help Wanted OnLine™ (HWOL) data series collects millions of online job ads in real-time and classifies them by occupation, industry, location and essentially any other type of information that can be extracted from the ad description. The real-time nature and deep coverage of the HWOL data series allows us to analyze the labor market in far greater detail and in a much timelier fashion than we could otherwise with traditional government surveys. This is an advantage that is exemplified by COVID-19 and its wide impact on the economy. Using the HWOL data series, we examined the hiring behavior of employers by their size between February and the last 4 weeks ending in May 10. To determine each employer’s size, we calculate the average number of ads each employer posted over 4-week periods in recent years prior to the COVID-19 outbreak. We believe there is strong correlation between the typical number of ads a company posts and the number of workers in that company- larger employers tend to hire in greater volumes, while smaller employers hire more sparingly. In the chart below, the top panel shows the number of active employers (i.e. employers who posted at least one ad in each period) in each week. The bottom panel chart shows the total number of new ads posted by employer size. Each of these measures have been indexed to their initial value as of March 1st so that we can more easily compare changes over time between groups of employers. Source: The Conference Board The chart shows that starting in early March, both the number of posting employers and the number of ads started to sharply drop. Unsurprisingly, the drop was far more dramatic for the smallest group—the many employers that used to post at most one ad every four weeks (blue line). These employers typically have smaller financial reserves and were quickly disrupted when the pandemic hit. In the four weeks ending in April 19, the number of ads in this group was almost 60 percent below February levels. But since April 19, the downward trend has begun to reverse. The two smallest groups of employers have begun to rise sharply in terms of number of active employers and number of new ads. Since many of these employers were forced to let go of their workers when their businesses were shut down, new hiring is likely to partly reflect filling of previous positions in addition to hiring for new positions.

Steady as She Goes Labor Market, Risks Remain

February 11, 2026

Vacancies Plunge, But Low Hire-Low Fire Equilibrium Persists

February 05, 2026

Steady Labor Market Allows Fed Pause

January 09, 2026

Rising Unemployment Augurs More Rate Cuts in 2026

December 16, 2025

Rising Unemployment to Dwarf Solid Payrolls in December FOMC Decision

November 20, 2025

BLS Revises 2024 Hiring, But Not the Labor Market Narrative

September 10, 2025

Charts

Measure which job titles in corporate America become more or less popular over time.

LEARN MORECharts

how employers are reacting to shifts in the labor market and the ways in which they are working to combat the labor shortage

LEARN MORECharts

There has been a large increase in the share of office job ads that mention remote work since before the pandemic.

LEARN MORECharts

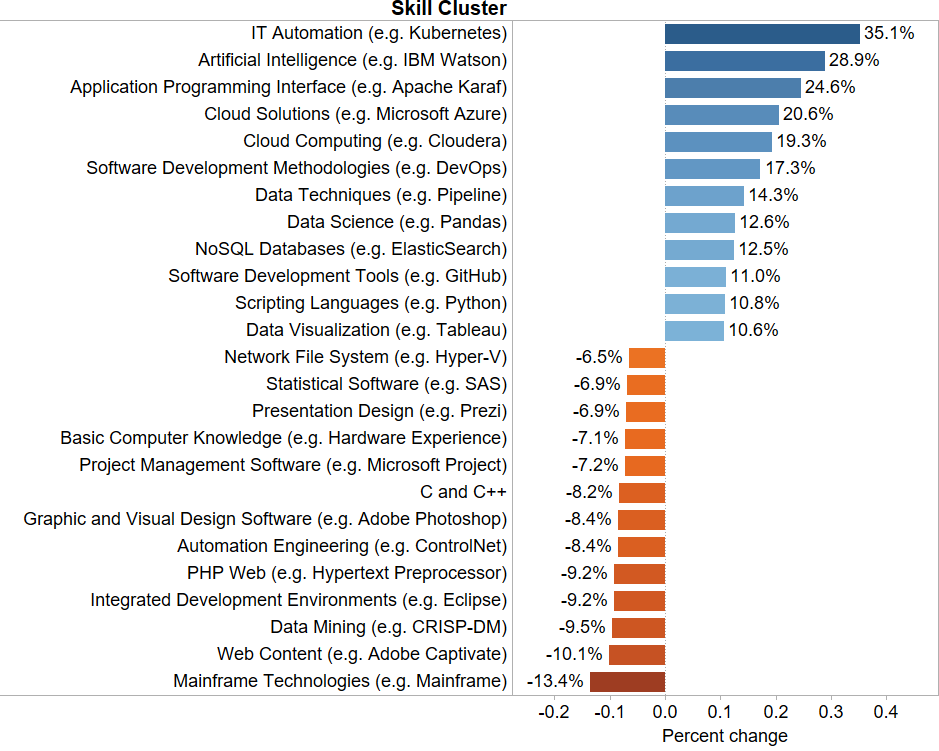

certain skills and groups of skills have grown more rapidly in demand, identifies individual skills mentioned in online job ads and groups them into clusters

LEARN MOREPRESS RELEASE

Online Labor Demand Increased in January

February 17, 2026

PRESS RELEASE

Report: How Employers Combat Labor Shortages

December 08, 2021

All release times displayed are Eastern Time

Note: Due to the US federal government shutdown, all further releases for The Conference Board Employment Trends Index™ (ETI), The Conference Board-Lightcast Help Wanted OnLine® Index (HWOL Index), The Conference Board Leading Economic Index® of the US (US LEI) and The Conference Board Global Leading Economic Index® (Global LEI) data may be delayed.

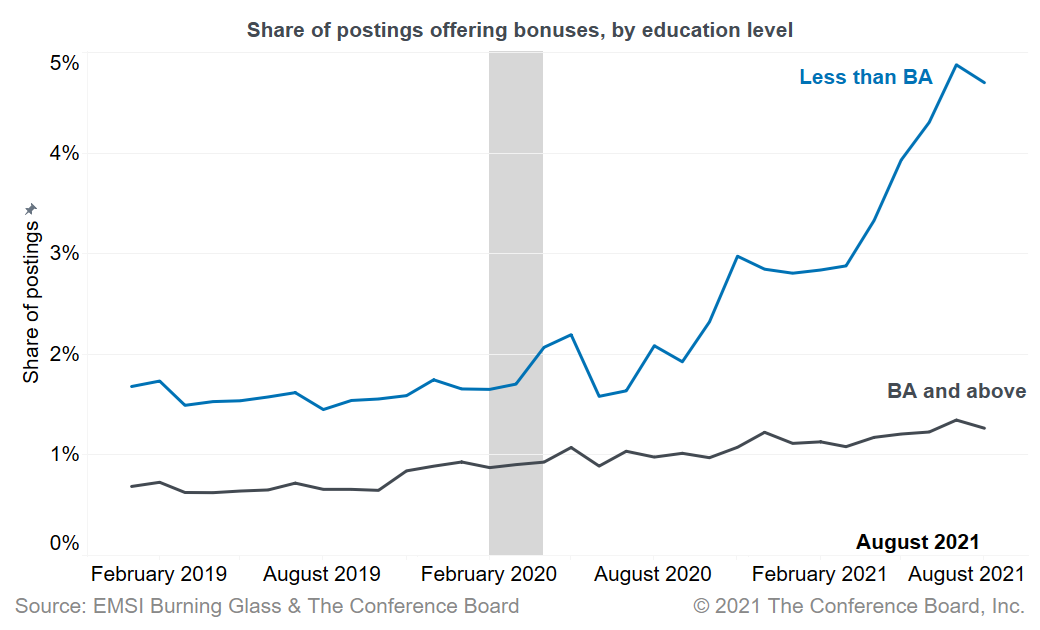

Using Bonuses To Attract New Workers

September 14, 2021 | Chart

Skills Growing in Demand for Tech Jobs

March 11, 2021 | Chart

The economy is struggling to keep up with the rise in coronavirus cases

July 27, 2020 | Brief

What types of jobs will experience a large permanent increase in remote working?

July 13, 2020 | Brief