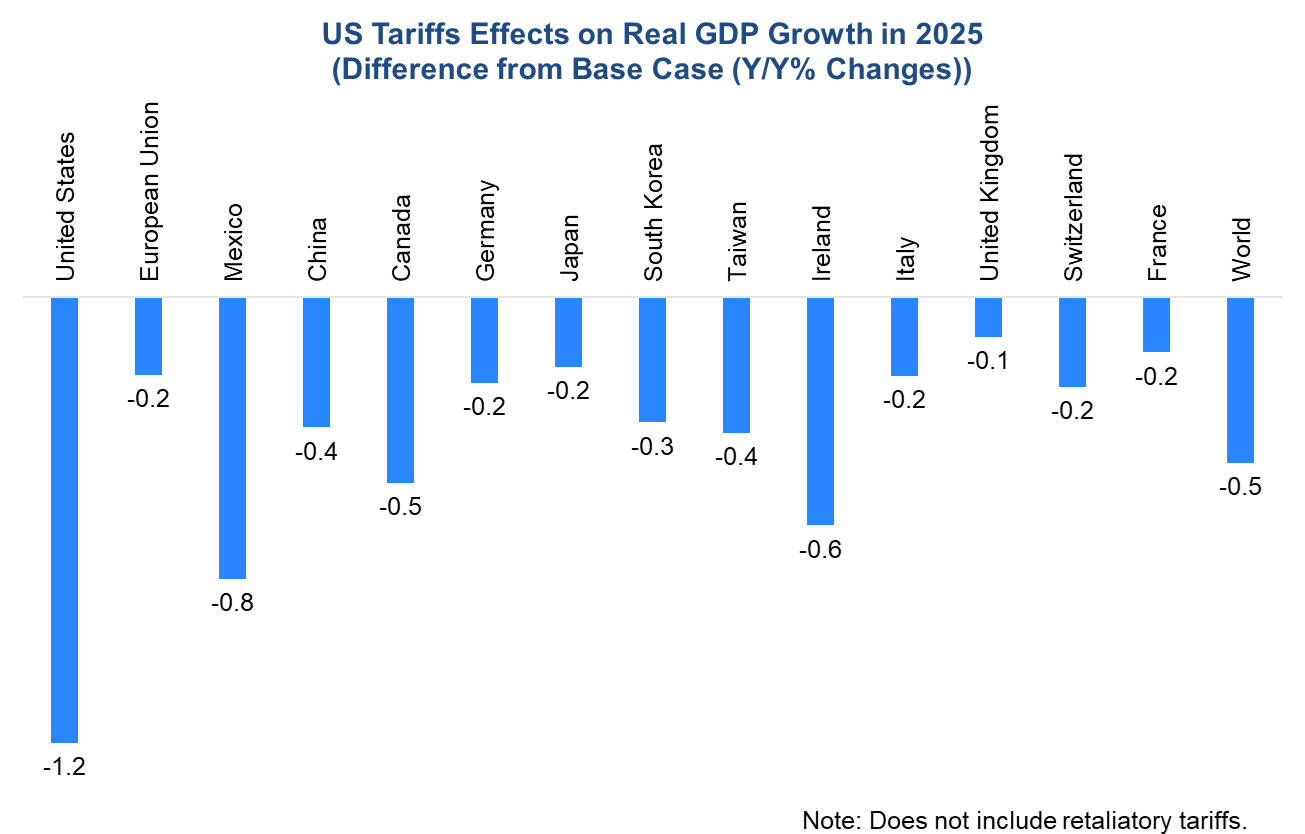

The White House announced reciprocal tariffs on April 2 against most US trading partners, issuing an executive order and invoking the International Emergency Economic Powers Act and other statutes. As a result, base tariff rates will be 20% on goods from the European Union—the largest US trading partner when taken as the full bloc of member countries—and 54% on goods from China. (For details on additional countries, please visit TCB’s Tariff Tracker.) By the numbers: Our analysis assumes these tariffs would be in place for a year and doesn’t include any reciprocal tariffs on US goods. The TCB take: The Administration has cited the great benefit of forthcoming tariff levies to the federal coffers, but our analysis shows this to be about $460 billion in 2025, and potentially not enough to mitigate economic losses. Although not inconsequential, $460 billion is a small fraction of the US’ outstanding public debt of $28.9 trillion (97% of GDP)—or the $2.2 trillion annual spend on Medicare and Medicaid. It also only represents a fraction of the $4 to $5 trillion in expected lost revenue over the next decade if the Tax Cuts and Jobs Act of 2017 (TCJA) is extended past its expiration on December 31, 2025. Implementation of these tariffs will cause weaker growth in both the US and globally, higher inflation, and disruptions to global supply chains. Source: The Conference Board estimates using the Oxford Economics model.US Growth Could be 1.2% Lower in 2025

myTCB® Members get exclusive access to webcasts, publications, data and analysis, plus discounts to events.

Shutdown Aside, Growth Moderates Under Inflationary Pressures

February 20, 2026

January CPI Raises More Questions than Provides Answers

February 13, 2026

Lukewarm Holiday Shopping in 2025 Augurs Slower Spending in Q4

February 10, 2026

FOMC Reaction: US Economy In a Good Place, But Staying Vigilant

January 28, 2026

Fed January Decision: Pause or Full Stop?

January 27, 2026

November PCE: Are Consumers Spending Beyond Their Means?

January 22, 2026

Charts

As a visual explainer of CED's Solutions Brief, this infographic highlights key design elements for a bipartisan fiscal commission.

LEARN MORECharts

As a visual explainer of CED’s Solutions Brief, this infographic outlines CED's policy priorities for 2026.

LEARN MORECharts

The proliferation of easy-to-use generative AI requires that policymakers and business leaders each play an important role.

LEARN MORECharts

A hyperpolarized environment, diminished trust in our nation’s leaders.

LEARN MOREPRESS RELEASE

CED Outlines 2026 Policy Priorities Ahead of Nation’s 250th Anniversary

January 20, 2026

IN THE NEWS

Denise Dahlhoff on How CEOs Are Talking About Tariffs—without Saying “Tarif…

May 21, 2025

IN THE NEWS

Erin McLaughlin on Tariff Policy

April 07, 2025

IN THE NEWS

Erin McLaughlin on Reshoring Factors

April 05, 2025

IN THE NEWS

Erin McLaughlin on US Reshoring

April 02, 2025

IN THE NEWS

Erin McLaughlin: How policy uncertainty may exacerbate infrastructure chall…

March 19, 2025