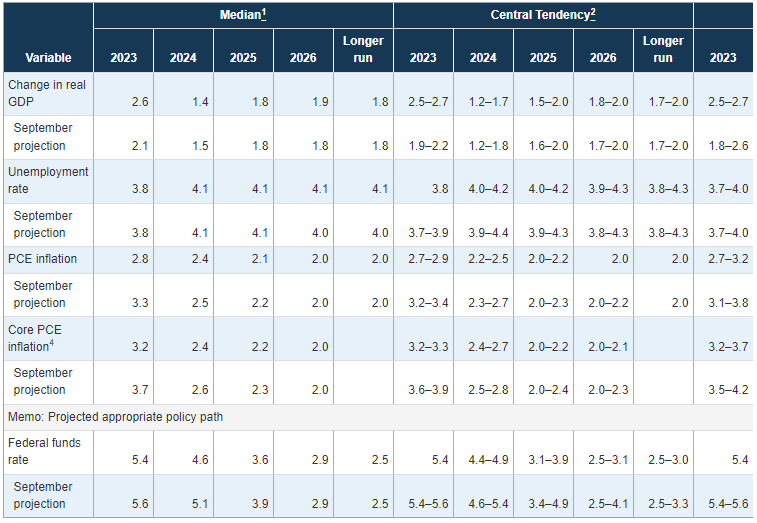

In terms of the outlook, the December Summary of Economic Projections painted a slightly more optimistic picture of the future than the September SEP. GDP growth expectations were generally the same looking ahead, but inflation expectations were tempered, and more rate cuts were expected sooner. The Conference Board’s expectations for the US economic outlook differs from the December SEP. We continue to believe a recession is probable in 2024 and that inflation will fall to 2% by yearend. We also expect 100 basis points of interest rate cuts next year, vs. the Dec SEP’s 75 basis points. During the press conference, Chair Powell declined to provide detailed guidance on when rate cuts would commence and at what pace. However, he did provide some guidelines. He noted that the Fed would need to cut rates well before annual inflation rates hit their 2% target. Waiting to cut until that target is reached could hurt the economy due the lagged impact of monetary policy. He also said that the Fed is concerned about holding rates too high for too long and dampening the economy too much. Thus, the Fed will have to walk a tightrope—maintaining restrictive policy for just the right amount of time. Importantly, the SEP projects that the Federal Funds rate will fall to 4.6% in 2024, 3.6% in 2025, and 2.9% in 2026. This implies three 25 basis point rate cuts in 2024, vs. our projection of four cuts. Thereafter, the Fed sees additional cuts with the Fed Funds rate gradually converging to 2.5%. Insights for What’s Ahead

Highlights

On the economy, Chair Powell said that economic activity has slowed substantially since Q3. While inflation remains too high, he said that much progress was seen in 2023. He noted that higher rates are weighing on fixed investments and that nominal wage growth is moderating. Chair Powell also welcomed easing in the labor market and noted that “the era of frantic labor shortages is behind us.”What were the Fed’s actions?

After implementing 525 basis points of interest rate hikes since March 2022, the FOMC elected to hold the federal funds rate window at 5.25 – 5.50% again in December. Doing so, they argue, will allow the monetary tightening that has already been implemented more time to work through the economy. Rates remain deep in ‘restrictive’ territory (anything above 3 percent). The Fed also said that there will be no change to its ongoing plan to reduce the size of its balance sheet, which was first unveiled in May 2022. Today’s actions were unanimously approved by the members of the Federal Open Market Committee.What are the Fed’s expectations for the future?

The Federal Reserve’s December Summary of Economic Projections (see figure) generally anticipates a better economic environment than the September SEP. The FOMC projects 4q/4q 2023 GDP growth of 2.6% (vs. September SEP of 2.1%), 4q/4q 2024 GDP growth of 1.4% (vs. September SEP of 1.5%), and 4q/4q 2025 and 2026 GDP growth of 1.8% (vs. September SEP of 1.8%). We agree with the Fed’s 4q/4q 2023 forecast, but expect just 0.4% for 4q/4q 2024 due to our projected recession early next year. The FOMC forecast for inflation was reduced, with 4q/4q 2023 PCE inflation of 2.8%, 4q/4q 2024 of 2.4%, 4q/4q 2025 of 2.1%, and 4q/4q 2026 of 2.0%. We forecast PCE inflation to slow to 2.0% y/y by Q4 2024—much earlier than the Fed’s estimate.

myTCB® Members get exclusive access to webcasts, publications, data and analysis, plus discounts to events.

Shutdown Aside, Growth Moderates Under Inflationary Pressures

February 20, 2026

January CPI Raises More Questions than Provides Answers

February 13, 2026

Lukewarm Holiday Shopping in 2025 Augurs Slower Spending in Q4

February 10, 2026

FOMC Reaction: US Economy In a Good Place, But Staying Vigilant

January 28, 2026

Fed January Decision: Pause or Full Stop?

January 27, 2026

November PCE: Are Consumers Spending Beyond Their Means?

January 22, 2026