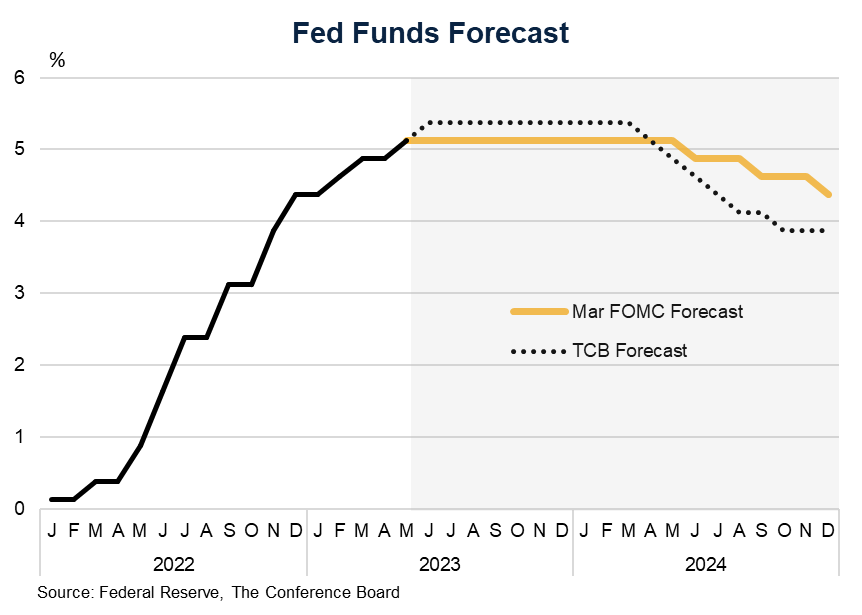

The Fed hiked interest rates by 25 basis points today, as expected. Chair Powell said that the terminal rate may have been reached at this meeting, but that the Fed would continue to closely monitor incoming economic data to determine if additional hikes are needed. Our forecast includes a final 25 basis point hike in June consistent with our inflation forecast, but the evolution of inflation, credit, and labor market data over the coming weeks may result in a pause instead. Chair Powell said that progress continues to be made on inflation, but that it remains far too high. He noted that the FOMC believes that it will take “a while” to bring inflation down to its 2 percent target and that rate cuts would not be appropriate for some time. Powell also said several times that there is mounting evidence that labor markets are softening. However, he also argued that the strength in this corner of the economy could insulate the US against a recession resulting from the Fed’s aggressive monetary policy actions over the last year. Still, the Chairman said that he wasn’t making any promises. On the banking crisis, Powell said that conditions in the banking sector have improved since March. The three large banks at the core of the crisis are no longer a threat to the system and contagion risks are reduced. Indeed, the resulting impact on credit conditions may have done some of the Fed’s work for it. On the emerging risk of the risk of default on US federal debt, the Chairman said that it was essential that the debt limit is raised [or suspended] and that default could result in an unprecedented calamity for the US economy. Finally, he stated that no one should assume that the Fed could step in to protect the economy in such a scenario. The Conference Board posits that businesses should expect interest rates to remain high for the duration of 2023. Furthermore, the Fed’s work to tighten monetary policy coupled with the reverberations from the banking crisis will likely make credit availability scarcer as well. Thus, loans may become more challenging to secure for businesses and consumers moving ahead. As the full impact of these developments continue to weigh on the economy, The Conference Board forecasts that a recession will occur this year. The Fed hiked by another 25 basis points in May and pushed the federal funds rate window to 5.00 – 5.25 percent (the highest since 2007). This was the Fed’s 10th consecutive hike. Rates are now deep in ‘restrictive’ territory (anything above 3 percent). The Fed also said that there will be no change to its ongoing plan to reduce the size of its balance sheet, which was first unveiled in May 2022. Today’s actions were unanimously approved by the members of the Federal Open Market Committee. The Federal Reserve’s actions today were widely anticipated, but its tone about the future shifted. In the policy statement, the FOMC said “In determining the extent to which additional policy firming may be appropriate to return inflation to 2 percent over time, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.” In previous statements it said “In determining the extent of future increases in the target range…” which suggests that the Fed may have reached its terminal rate for this cycle. However, as noted above, the FOMC will be watching economic data closely before implementing a pause in June. Since tightening started in March 2022, the Fed Funds rate has risen by a total of 500 basis points. As a function of this, interest rates throughout the economy have risen rapidly. Tighter monetary policy is cooling the overall economy—though with a variable lags. While the labor market remains exceedingly tight, other parts of the economy are moderating (like nonresidential investment) or contracting (like residential investment). As the full impact of the Fed’s monetary policy tightening continues to weigh on businesses and consumers, economic activity will slow further—tipping the economy into a short, but shallow, recession.What were the Fed’s actions?

What does this mean for the US economy?

Shutdown Aside, Growth Moderates Under Inflationary Pressures

February 20, 2026

January CPI Raises More Questions than Provides Answers

February 13, 2026

Lukewarm Holiday Shopping in 2025 Augurs Slower Spending in Q4

February 10, 2026

FOMC Reaction: US Economy In a Good Place, But Staying Vigilant

January 28, 2026

Fed January Decision: Pause or Full Stop?

January 27, 2026

November PCE: Are Consumers Spending Beyond Their Means?

January 22, 2026