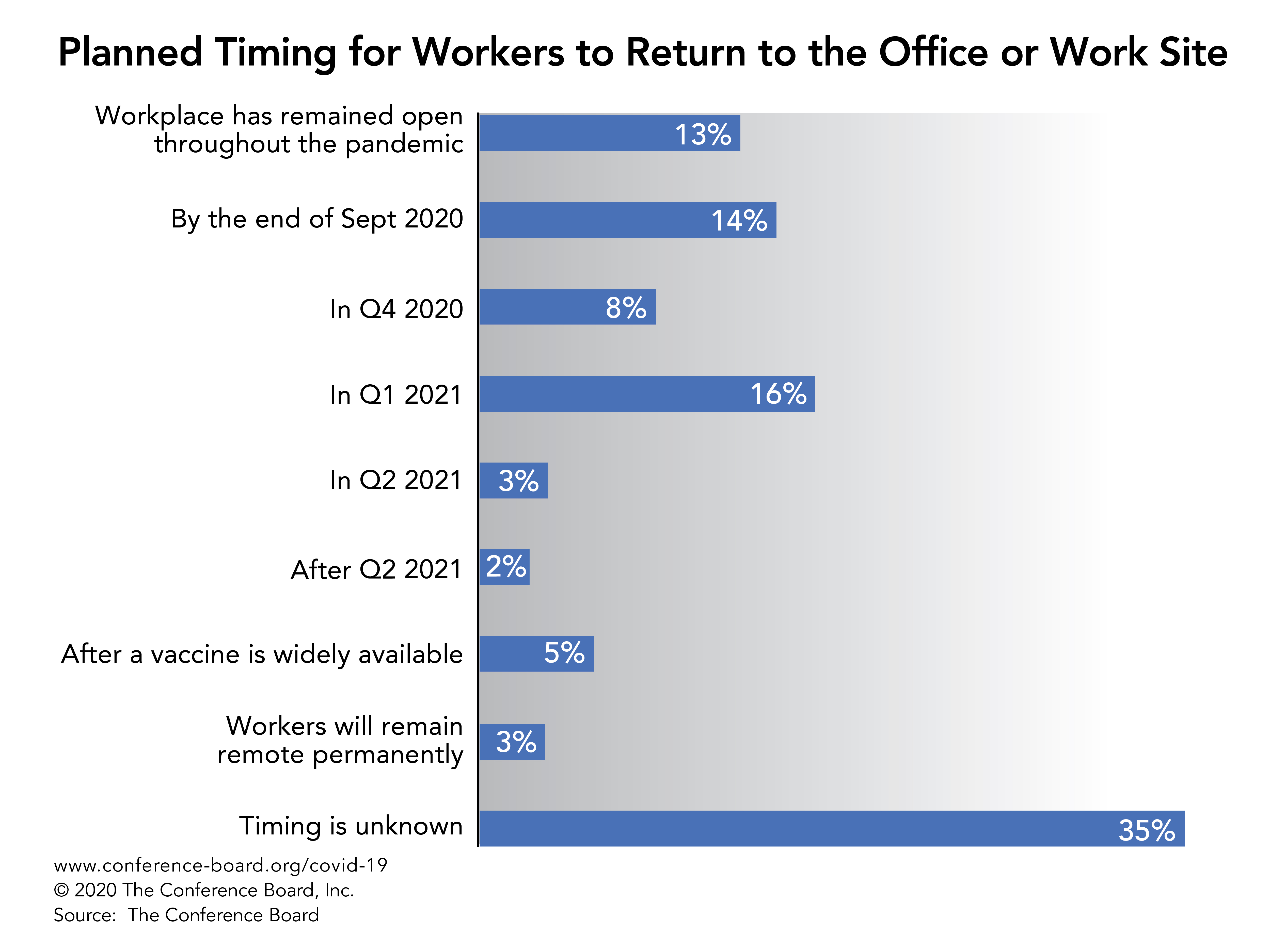

Many businesses hoped to reopen their workplaces after Labor Day, but a new survey of managers and executives suggests a long, uncertain road ahead; 35 percent say the timing of when their companies will reopen the workplace is unknown.

The Conference Board survey also found that only about 60 percent of companies have consulted their workers about their levels of readiness and comfort in returning to the workplace. In addition, despite talk of a looming vaccine and its benefits, just 5 percent say its wide availability would be a significant factor in the timing of a return to the workplace. The findings also reveal that, while most companies have mandated certain protocols for employees arriving at work, only 67 percent are requiring screening, testing, or temperature checks.

The survey polled more than 1,100 businesspersons across 20 US metropolitan statistical areas (MSAs). The respondents—primarily C-suite executives, vice presidents, and senior managers—represent a cross-section of industries. The online survey was fielded August 19–26. Key findings include:

Over a third of companies have not set a date for reopening.

- Over a third of companies surveyed, 35 percent, say their reopening date is still unknown.

- 39 percent of companies plan to reopen by the first quarter of 2021.

- 13 percent of companies have remained open throughout the pandemic.

- The highest levels of uncertainty: Miami (46 percent), Seattle (43 percent), San Diego (42 percent), Washington, DC (41 percent), and San Francisco (41 percent).

For reopening, a vaccine is not top of mind.

- Just 5 percent thought the widespread availability of a vaccine would be a significant factor in the timing of a return to the workplace.

- This low ranking likely reflects concern about the viability of a vaccine with a significantly shorter clinical trial time. It also likely reflects concern about the legal implications for any corporate mandate to get the vaccine as a condition for returning.

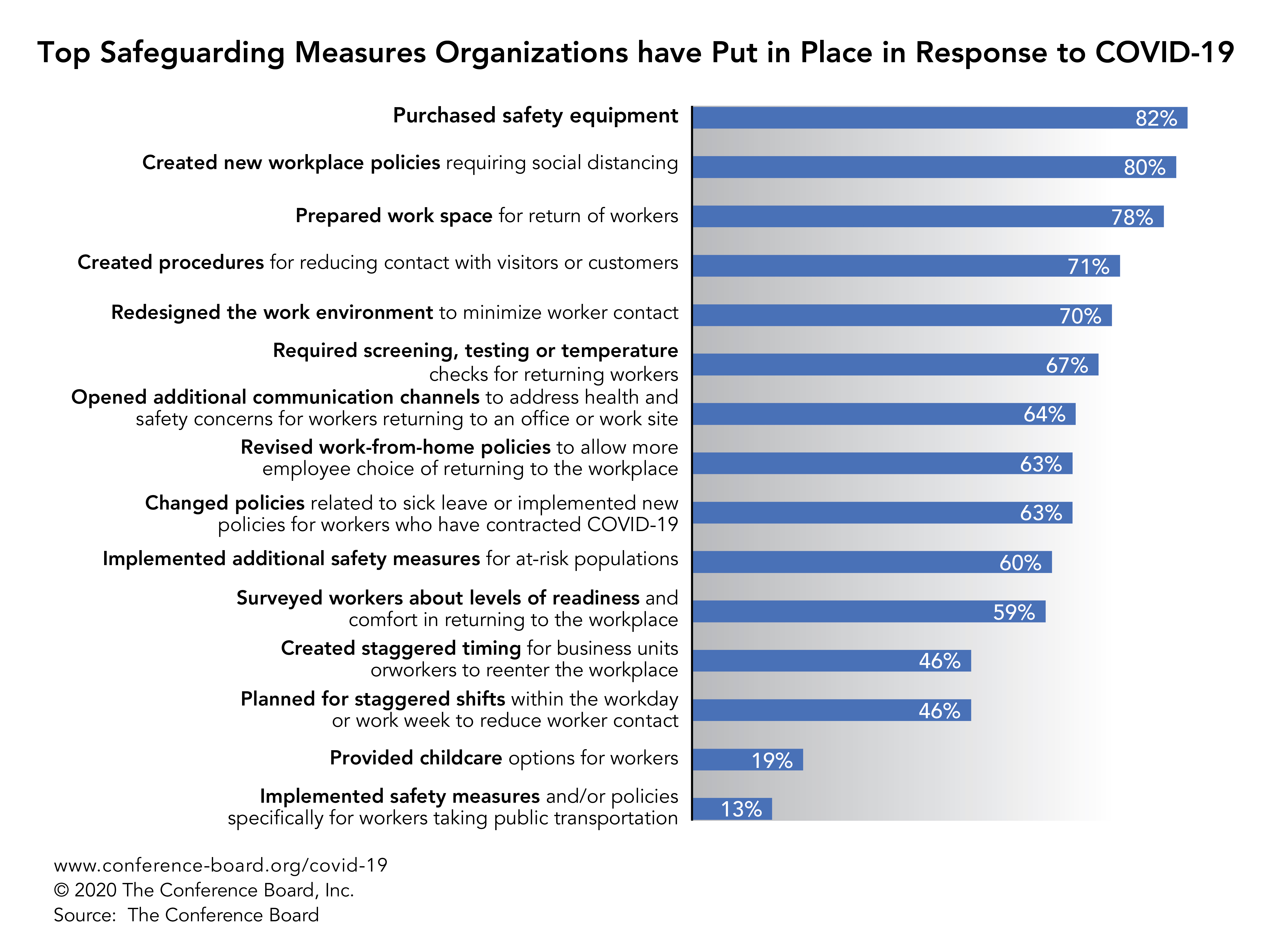

The most and least frequent actions businesses are taking to safeguard their workers:

The most frequent:

- Purchasing safety equipment (e.g., masks, thermometers, contactless entry devices, sanitization devices) (82 percent).

- Creating new workplace policies requiring social distancing (e.g., limiting size of in-person meetings or usage of common areas) (80 percent).

- Preparing workspace for return of workers (e.g., deep cleaning or disinfecting) (78 percent).

The least frequent:

- Providing childcare options for workers (e.g., on-site childcare, flexible scheduling to meet childcare needs) (19 percent).

- Implementing safety measures and/or policies specifically for workers taking public transportation (e.g., requiring more frequent screening or providing extra safety supplies for workers who use public transportation or shared shuttles) (13 percent).

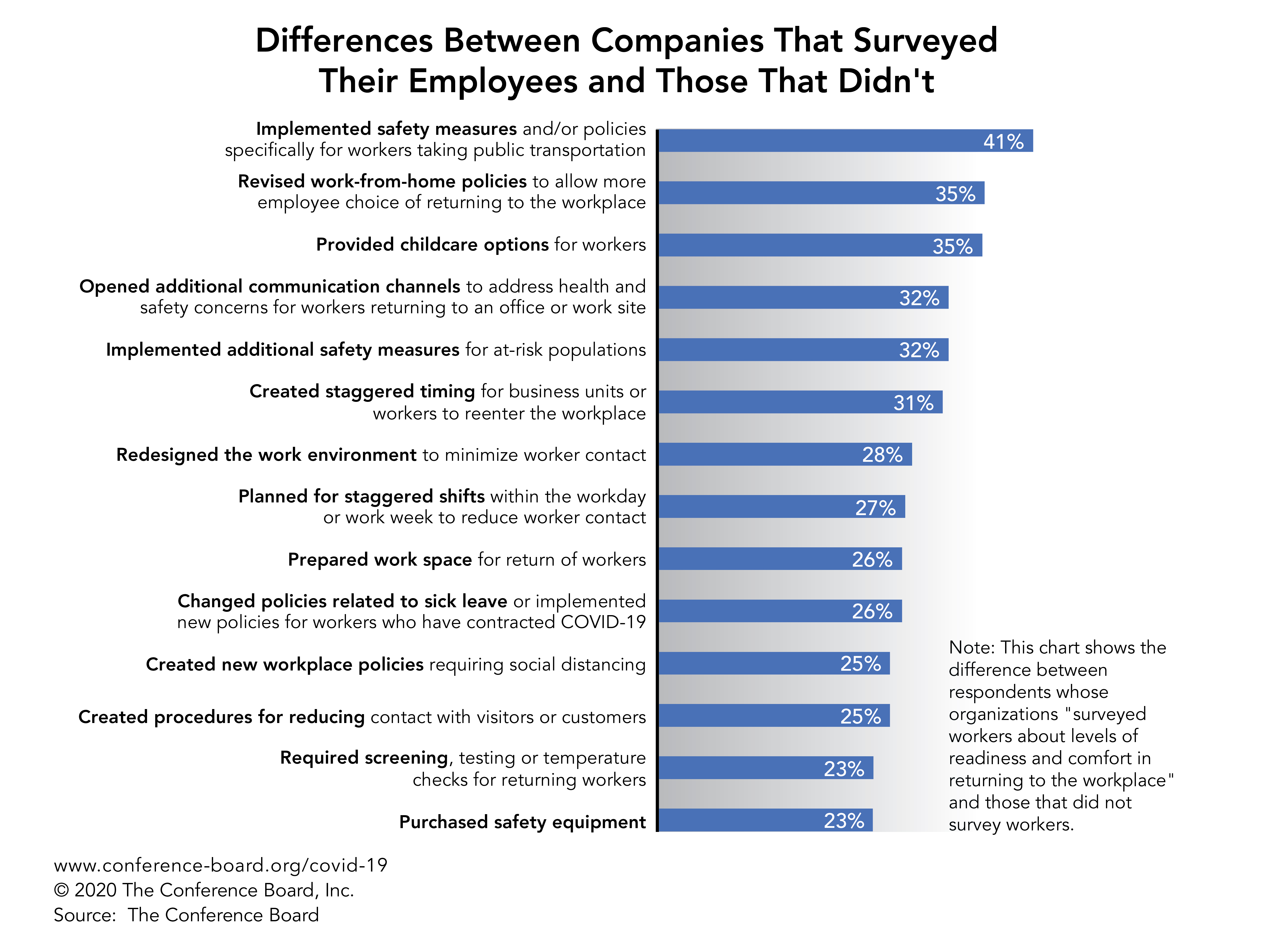

Do employees feel comfortable returning? Only about 60 percent of companies have even checked.

- About 60 percent of businesses chose to survey workers about their levels of readiness and comfort in returning.

On the upside, those businesses that did survey workers were more likely to put all safeguard measures in place, including top employee concerns.

- “Companies that sought worker sentiment about their comfort levels were more likely to implement safety measures specifically for workers taking public transportation, revise work-from-home policies, and provide childcare options,” said Rebecca Ray, Executive Vice President of Human Capital at The Conference Board. “Notably, these top worker concerns were low on the overall list of safeguards that organizations are implementing, indicating that they are more important to employees than employers may realize. This disconnect reinforces the need for companies to receive buy-in from their most precious resource – their people – especially about matters as consequential as this one.”

Less than half of companies have enacted or plan to enact staggered shifts or staggered timing.

- Despite fairly consistent health organization guidance regarding social distancing, only 46 percent planned for staggered shifts within the workday or work week to reduce worker contact.

- Moreover, only 46 percent plan to create staggered timing for business units or workers to reenter the workplace.

Two-thirds of companies are requiring screening, testing, or temperature checks.

- 67 percent of companies are requiring screening, testing, or temperature checks for returning workers.

- Such actions may not have universal backing due to the fear of litigation – specifically relating to who is asked to come back into the workplace – along with the efficacy of these protocols.

This analysis is a continuation of previous work by The Conference Board. In April 2020, researchers gauged how organizations were reacting to the changing business environment in the context of their workforces. For additional research on this pandemic as well as specific content for human capital professionals, visit our COVID-19 Hub or contact The Conference Board’s press office.