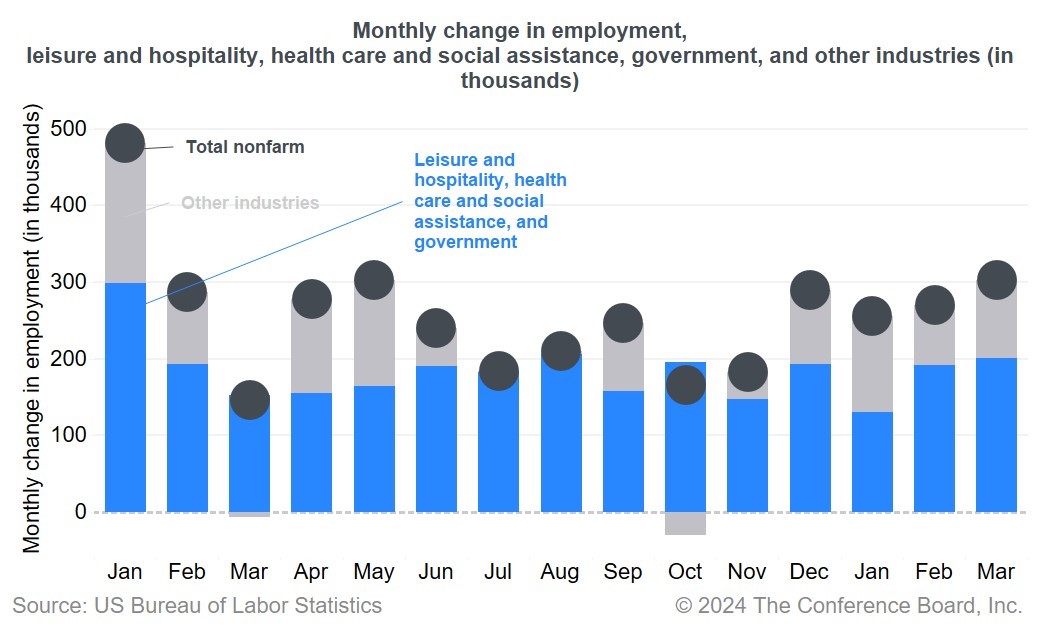

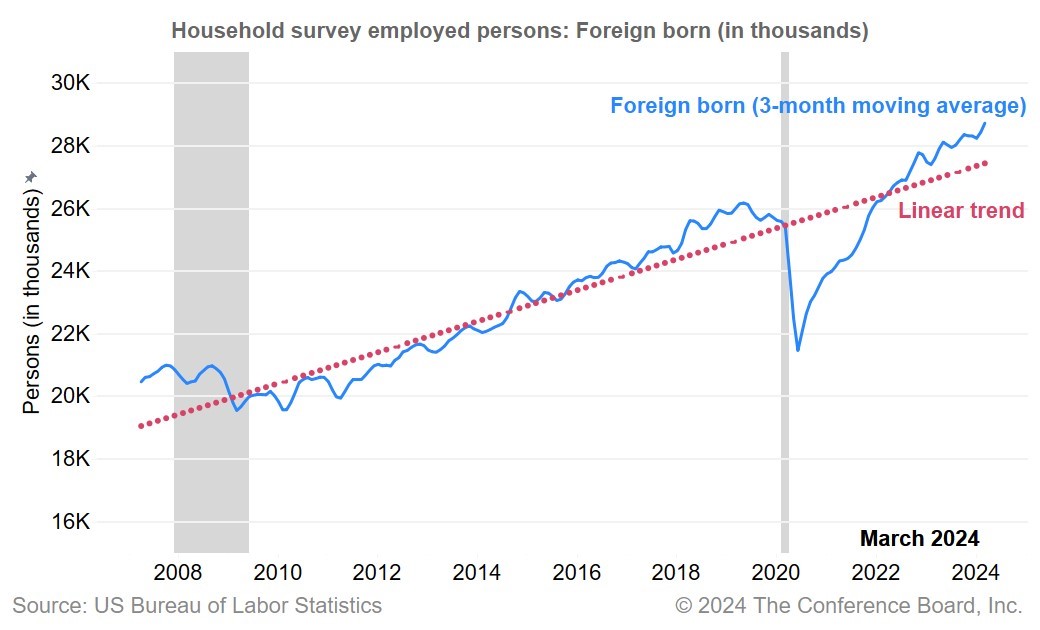

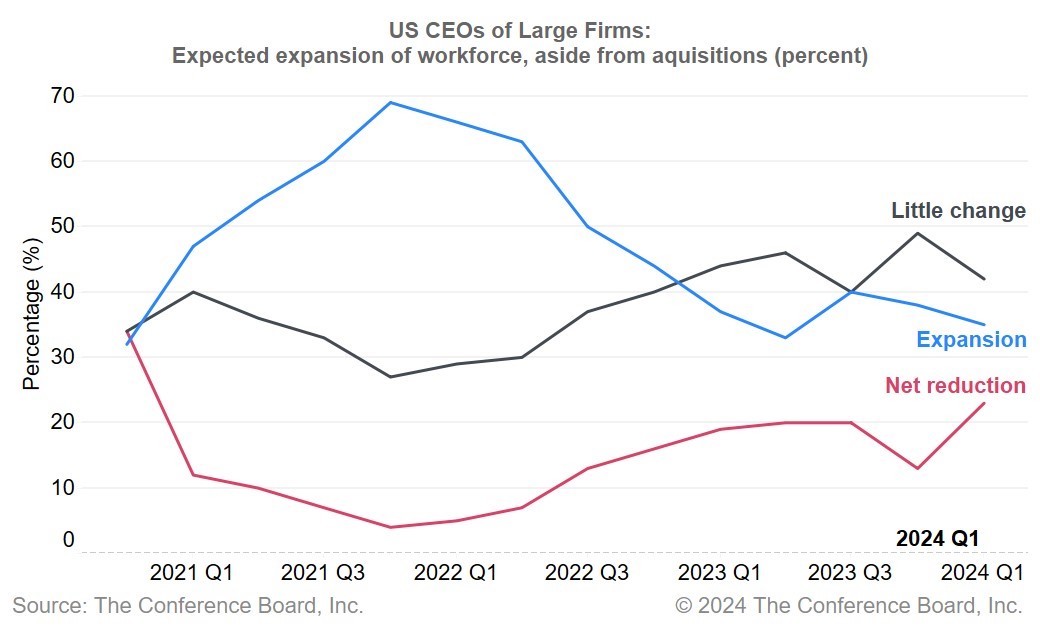

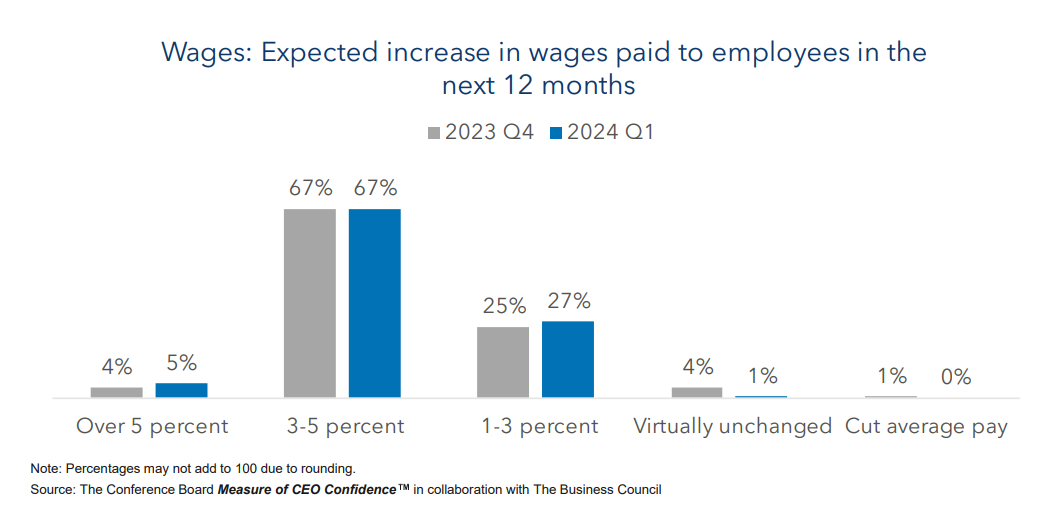

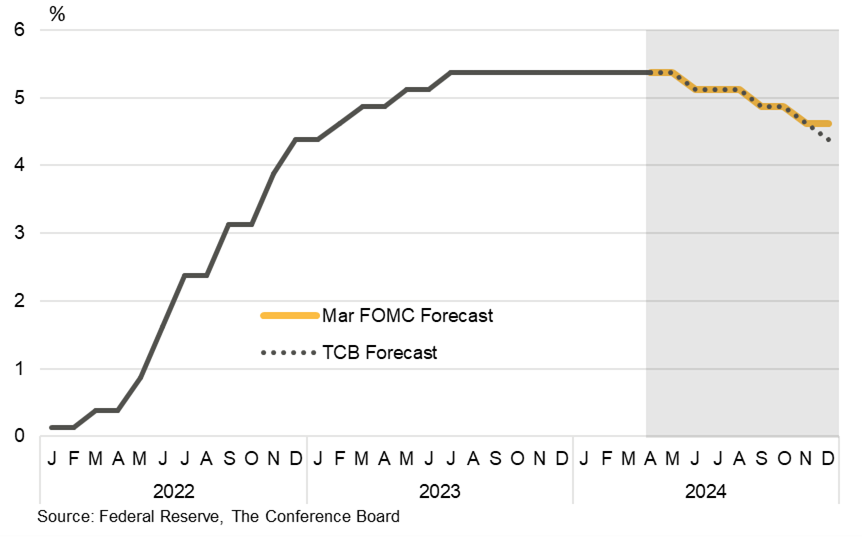

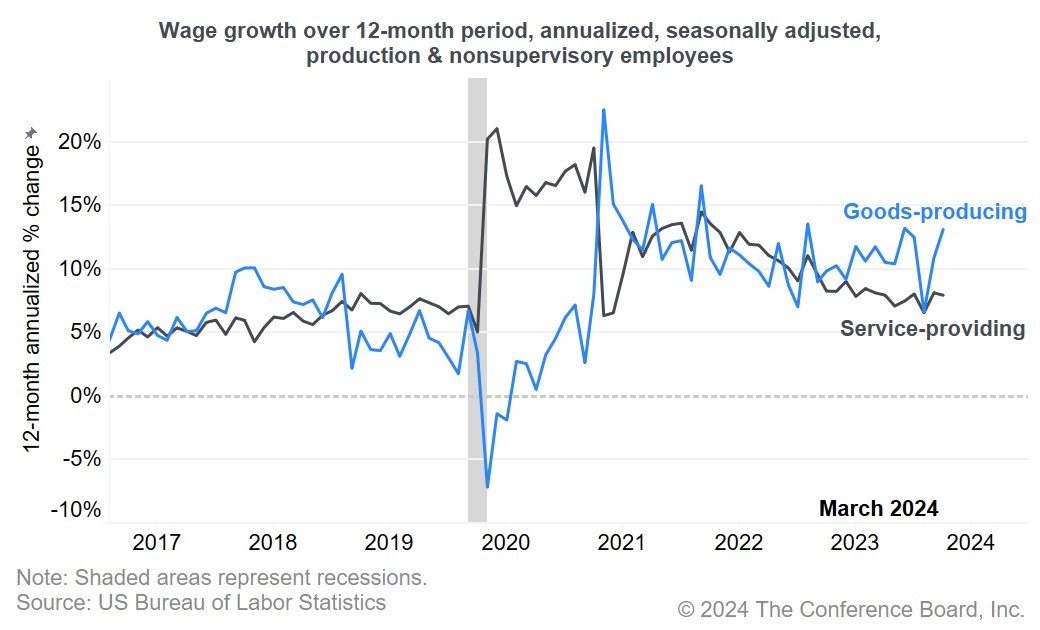

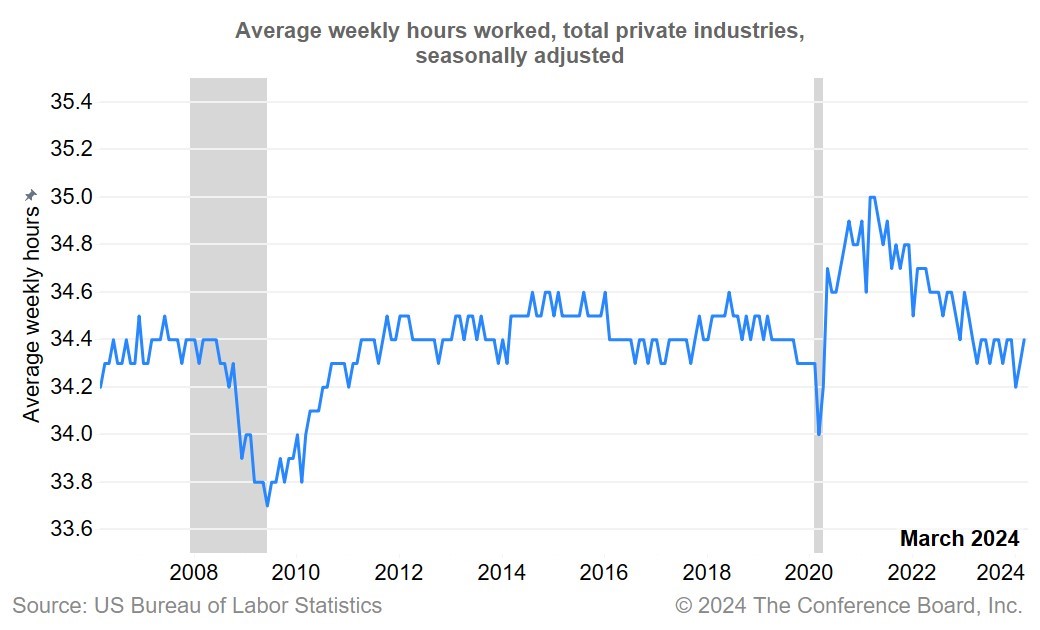

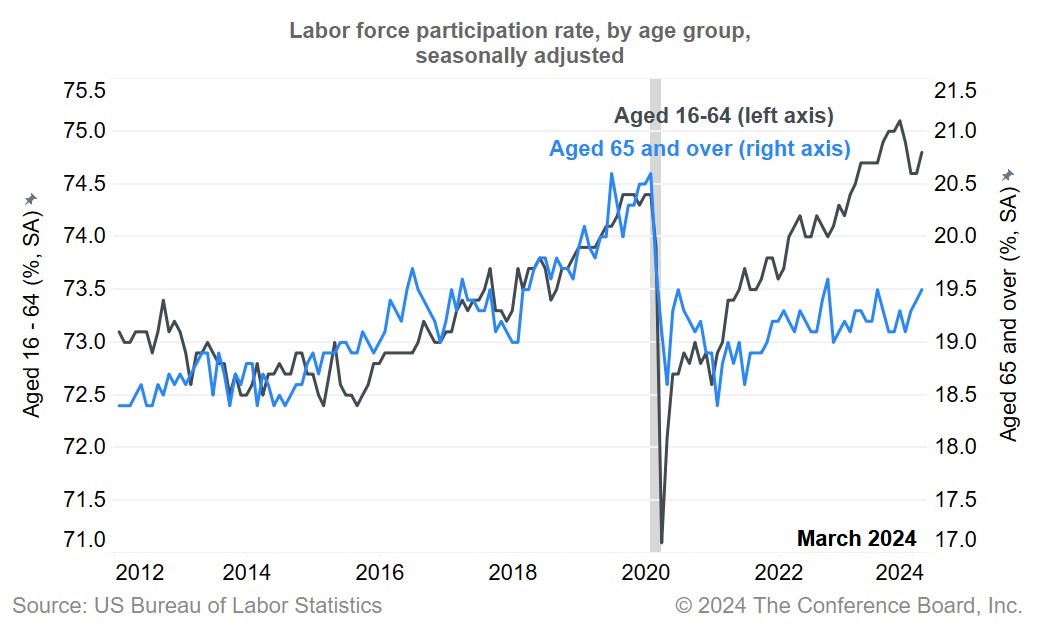

Trusted Insights for What’s Ahead® Figure 1. Nonfarm payrolls logged another solid month of gains led by industries experiencing acute labor shortages Fed officials believe somewhat above-trend immigration is providing a bit more slack in labor supply (Figure 2). In other words, recent outsized payroll prints can persist without signs of an overheating labor market. Still, the concentration of payroll gains, and our own survey of CEOs of large firms, continue to suggest that labor demand remains strong in quarters experiencing labor shortages. Moreover, that firms desiring to stave off shortages will continue to hoard workers (Figure 3). Figure 2. The number of Foreign-Born workers is slightly above the long run trend Figure 3. CEOs of the largest companies plan to still hire and hoard US workers The net effect may be continued upward pressures on wages in hot sectors, and the stickiness of overall wage growth will continue to flow through to consumer inflation. Indeed, our same survey of CEOs and 1-on-1 conversations with CFOs indicate that firms continue to expect to raise wages by more than 3 percent over the course of this year (Figure 4). Figure 4. Most CEOs of large firms plan to raise wages for US workers by more than 3 percent Against this backdrop, markets may fear that the Fed will keep interest rates higher for longer this year and reduce the number of basis points of cuts relative to the 75 basis points suggested in the Fed’s March Summary of Economic Projections. Still, it is yet early in the year, and there will be several more important data reports ahead of the June monetary policy meeting, when we think the Fed may consider its first interest rate cut. Likely the Fed will desire to see more data before determining if interest rate cuts must wait until later this year and/or be smaller than what the central bank signaled at the March meeting. We too think it is appropriate to see whether real GDP slowed in Q1 (we estimate to around 2.3 percent), and whether there is continued progress in the cooling of wages and consumer prices before making additional changes to our rate trajectory. We forecast continued slowing in total and core (less food and energy) inflation, with the headline settling on 2 percent in Q4 2024 and the core in Q1 2025. This timing is faster than the Fed’s, as we also expect real GDP growth to be softer than the Fed’s SEP suggests. Currently, we anticipate 100 basis points of cuts this year (Figure 5), likely starting around mid-year, but will continue to monitor the data closely. Figure 5. The Fed still has room to cut this year if the data cooperate Nonfarm payrolls rose by an outsized 303,000 additions in March, following a slightly downwardly revised, but still robust, 270,000 gain in February. Unsurprisingly, the bulk of payroll additions were among the sectors experiencing the most labor shortages. Combined, leisure and hospitality, healthcare and social assistance, and government added 201,300 jobs in March, or 66.4 percent of total gains. Indeed, the Bureau of Labor Statistics’ JOLTs data continue to show acute labor shortages in these sectors, and, hence, continued hiring. Away from the usual suspects, 101,700 payrolls were added, marking a fourth month of sizable gains after few additions over much of the last half of 2024. Gains were outsized in specialty trade contractors within construction (25,200) and retail (17,600), and there were modest gains among a few other sectors. Meanwhile, there continued to be tepid or negative payroll readings for the many of the former “pandemic darlings.” Information, finance and insurance, and transportation and warehousing were roughly flat in the month. Utilities payrolls were also about unchanged. Additionally, temporary help services, which usually signal recession, were slightly negative another month. However, rather than signaling recession, the continued weakness in this industry likely reflects hoarding by firms who do not need to add temporary workers. Wages Remain Sticky Average hourly earnings slowed a tad to 4.1 percent year-over-year in March but remained well above the average between the Great Recession and the 2020 pandemic of just below 3 percent. Wages for many goods sectors jobs are still rising (Figure 6), especially in manufacturing and construction. Indeed, infrastructure spending by the government and industrial policies encouraging factory building in the US are driving wages higher in these sectors. Even among services, wage growth is above the prepandemic average, with continued increases in wholesale, air transportation, financial services, leisure and hospitality, and an assortment of other personal services. While wages are remaining elevated, hours worked have generally stabilized after spiking and then falling dramatically during the pandemic (Figure 7). We will continue to watch this figure as further decline may mean companies are trading higher wages for fewer hours. Figure 6. Wages growth remains sicky for goods and some services Figure 7. Hours worked have fallen back to the 2019 level Unemployment Rate Falls, Helping Participation The unemployment rate fell back to 3.8 percent in March from 3.9 percent. The jobless rate remains close to pandemic-era lows, and notably below what is likely the natural rate of around 4.5. The Fed’s SEP anticipate a 4.0 unemployment rate by yearend, so this figure will need to be watched closely. A decline in the number of unemployed people and a rebound in the number of employed persons in the Household Survey helped revive labor force participation after it foundered in recent months. Nonetheless, the gauge is notably below the 2019 level, and is being weighed down by exits among workers 65 and over. The labor force participation rate among workers 65 and older collapsed during the pandemic and has yet to recover (Figure 8). Indeed, Baby Boomer retirements continue to dampen overall labor force participation and are contributing to chronic labor shortages in several sectors. Figure 8. Labor force participation remains low for workers 65 and older as retirements intensify

Highlights

The March employment report revealed continued strength in the labor market. While the usual suspects continued to drive most nonfarm payroll employment additions, there continued to be a slight broadening in gains elsewhere (Figure 1).

Employment Report Details

Nonfarm Payrolls Log Another Month of Outsized Gains

myTCB® Members get exclusive access to webcasts, publications, data and analysis, plus discounts to events.

Steady as She Goes Labor Market, Risks Remain

February 11, 2026

Vacancies Plunge, But Low Hire-Low Fire Equilibrium Persists

February 05, 2026

Steady Labor Market Allows Fed Pause

January 09, 2026

Rising Unemployment Augurs More Rate Cuts in 2026

December 16, 2025

Rising Unemployment to Dwarf Solid Payrolls in December FOMC Decision

November 20, 2025

BLS Revises 2024 Hiring, But Not the Labor Market Narrative

September 10, 2025