-

LINKEDIN

-

EMAIL

-

TWITTER

-

FACEBOOK

Charting International Labor Comparisons - Competitiveness in Manufacturing

2014 Edition

21 Mar. 2014

Back to ILC Homepage

Chart 8.

.

Click legend to hide and show years. Hover over data bars to show data for each year.

Chart 8: Hourly compensation costs in manufacturing, selected economies and regions, as a percentage of costs in the United States (2000–2012)

The global marketplace often means that companies, especially in manufacturing, relocate certain operations from one country to another. While there are many criteria for making location decisions, labor cost differences across countries are a critical factor. Hourly compensation costs, or the average hourly cost (including benefits) to employ a worker, vary significantly across countries and regions in manufacturing.

With the exception of a dip in compensation during the global recession, emerging economies in East Asia and Eastern Europe, as well as Brazil, have experienced rapid increases in manufacturing compensation costs relative to costs in the United States since the early-to-mid 2000s.

Although there are several technical limitations with compensation estimates for China and India that diminish the meaningfulness of international comparisons, benchmarking compensation to the US level provides a less sensitive yardstick than costs expressed in US dollar terms. Between 2002 and 2009, manufacturing compensation costs in China grew the fastest of all countries compared in Chart 8 (16.4 percent annually, on average). However, at just 5.1 percent of US compensation costs in 2009, Chinese manufacturing compensation still remains far below labor costs in most other areas compared. By 2009, though, compensation costs in China relative to the US surpassed compensation costs in the Philippines (5.0 percent) and India (3.6 percent).

Chart 9.

.

Click legend to hide and show components. Hover over data bars to show data for each country.

Chart 9: Hourly compensation costs in manufacturing, by component, US dollars (2012)

Hourly compensation costs, which measure the average hourly cost to employ a worker, include the following components: pay for time actually worked, including base wages and overtime; directly paid benefits, including leave pay and seasonal bonuses; and social insurance expenditures incurred by employers, including health and retirement plans. Employers’ social contributions often provide delayed future income and benefits to employees and are therefore an indirect form of worker compensation.

In 2012, among 34 countries compared in Chart 9, total hourly compensation costs in US manufacturing ranked approximately in the middle at $35.67. In addition to Australia and Canada, countries with higher hourly compensation costs were primarily in northern and western Europe. Countries with lower hourly compensation costs were primarily in southern and eastern Europe, Asia, and Latin America.

Chart 10.

.

Click legend to hide and show components. Hover over data bars to show data for each country.

Chart 10. Components of manufacturing hourly compensation costs, as a percentage of total compensation (2012)

Another way to compare manufacturing compensation costs across countries is to view the components of compensation as a percentage of total costs. (See Chart 9 for data in US dollars.)

Pay for time worked, including base wages and overtime, constitute 50 to 75 percent of total compensation in most countries compared. In 2012, the share of pay for time worked was less than 50 percent only in Belgium, where other forms of manufacturing worker compensation carry a larger weight.

Directly paid benefits primarily comprise pay for leave time, irregular bonuses, and pay in kind. The percentage of compensation for directly paid benefits tends to be higher in many European countries (due in large part to leave pay) and Japan (where seasonal bonuses are a large portion of costs). In 2012, for example, direct benefits constituted at least a quarter of total compensation in Poland and Japan. Directly paid benefits are a relatively smaller portion of compensation costs (i.e., less than 10 percent in 2012) in the United States, Australia, and Canada.

In countries with the highest ratio of social insurance costs (e.g., Sweden, Brazil, and Belgium), social insurance makes up approximately one-third of total compensation costs. In the United States, social insurance costs account for about 24 percent of total compensation, while in Asian countries, with the exception of the South Korea, social insurance is less than 20 percent.

The total benefits portion of compensation costs can be seen by combining social insurance with directly paid benefits. Total benefits surpass 40 percent in 14 countries. In contrast, the ratio of benefit costs in the United States is about 33 percent.

Chart 11.

.

Source: The Conference Board, International Labor Comparisons program

Chart 11: Hourly compensation costs in manufacturing industries, US dollars (2012)

Hourly compensation costs, or the hourly cost to the manufacturer of employing labor, are one of the most important indicators of international cost competitiveness in manufacturing. Assessing compensation costs for submanufacturing industries, however, can be more instructive than assessing average compensation for the manufacturing sector as a whole, which often masks important differences in costs and competitiveness at the industry level.

In Chart 11, a country flag represents the average compensation cost in manufacturing for that country, and each notch along a country line represents average costs in a particular submanufacturing industry. Within each country, industry compensation costs can vary greatly from average manufacturing compensation.

The overall spread of compensation costs across industries can be compared across countries by looking at the relative — and not the absolute — distance of costs between the highest and the lowest compensated industries. In 2012, for example, the highest paid industry was more than double the lowest paid industry in 13 of the 23 countries compared in Chart 11. The greatest variation in compensation across industries occurred in Brazil and Mexico, as well as in countries in eastern Europe and Asia. In Brazil, for instance, compensation in coke and petroleum products manufacturing was more than eight times the labor costs in the apparel industry. In contrast, industry compensation costs were relatively more compressed in Australia, New Zealand, and countries in northern and western Europe.

Historically, the highest and lowest compensated industries have tended to be similar across countries. In 2012, coke and petroleum products and pharmaceuticals were among the highly paid industries, while the lower paid industries included apparel and wood products manufacturing.

Chart 12.

.

Click legend to hide and show countries. Hover over data series to show data for each year.

Chart 12: Productivity (output per hour worked) in manufacturing (1995–2012)

Manufacturing productivity, defined as output per hour worked, measures how effectively labor hours are converted into output. Increases in labor productivity indicate that a country’s workforce is becoming more efficient.

Historically, while manufacturing productivity has increased in all countries over the long run, the rate of productivity growth has varied across countries. Among advanced European economies in Chart 12, Finland and Sweden exhibited the fastest average annual productivity growth (6 percent or higher) during the 1990s and 2000s (i.e., prior to the global recession). Manufacturing productivity growth in emerging economies in Asia has also been historically robust. In South Korea, for example, productivity increased at 10.5 percent per year between 1990 and 2000, on average. In eastern Europe, another emerging bloc, productivity in the Czech Republic grew at an average annual rate of 9.7 percent from 2000 to 2007. On the other hand, Australia and Norway have had the slowest long-run productivity growth (on average under 2 percent per year between 1979 and 2012) of the countries compared.

Manufacturing productivity weakened due to the 2008–2009 global recession in all economies shown in Chart 12. However, the extent of the impact differed among countries. Following the crisis, manufacturing productivity declines were largest in Finland, Germany, and Sweden, while productivity growth merely slowed in South Korea, Taiwan, and Norway. During the period from 2007 to 2012, manufacturing productivity was weakest among the Euro Area economies.

Chart 13.

.

Note: For Belgium and Taiwan, data relate to manufacturing employees (wage and salary earners). For all other countries, data relate to all employed persons (employees and self-employed workers) in manufacturing.

Source: The Conference Board, International Labor Comparisons program

Chart 13: Average annual percent change in manufacturing productivity, output, and hours worked (2000–2012)

Increases in labor productivity, or output per hour worked, are approximately equal to the difference between the growth of output and the growth of hours worked; the larger the gap between output and hours, the greater the productivity growth.

Despite the 2008–2009 global recession, productivity increased between 2000 and 2012 in all countries compared. The largest productivity gains were in the Czech Republic, Taiwan, and South Korea, and these gains were primarily the result of strong output growth (while hours stayed the same or dipped slightly). Productivity growth in Japan resulted from approximately equal portions of output growth and hours decline. Productivity also increased in Spain, Denmark, and the United Kingdom despite falling output because the number of hours worked fell even more. Moreover, productivity gains were driven by a reduction in hours worked in 12 of the 19 countries compared.

Chart 14.

.

Note: For Belgium and Taiwan, data relate to manufacturing employees (wage and salary earners). For all other countries, data relate to all employed persons (employees and self-employed workers) in manufacturing.

Source: The Conference Board, International Labor Comparisons program

Chart 14: Annual percent change in manufacturing productivity, output, and hours worked (2012)

In 2012, manufacturing productivity (output per hour worked) declined in 12 of the 19 countries compared in Chart 14. For a majority of countries that saw a decrease in productivity, such as Finland and France, the trend was driven by falling output despite a modest decline in hours worked. For Japan and the United Kingdom, however, the decline in output was exacerbated by an increase in hours worked, which led to even larger productivity losses.

In contrast, productivity increases, such as those in the United States and Norway, were primarily the result of gains in output. The main exception was Spain, where the fall in hours far outpaced the decline in output, resulting in the largest productivity increase in 2012 of the countries compared.

Chart 15.

.

Note: Charted values are natural logarithms of productivity and compensation indexes. For Belgium and Taiwan, data relate to manufacturing employees (wage and salary earners). For all other countries, data relate to all employed persons (employees and self-employed workers) in manufacturing.

Source: The Conference Board, International Labor Comparisons program

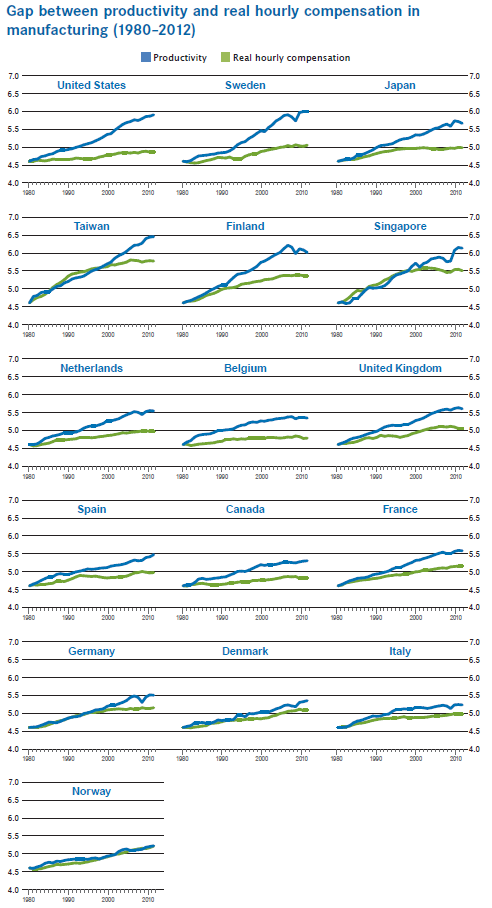

Chart 15: Gap between productivity and real hourly compensation in manufacturing (1980–2012)

Since 1980, labor productivity has outpaced real hourly compensation in nearly all of the economies compared in Chart 15, creating a productivity compensation gap. Increases in productivity signal potential for increases in labor income and, by extension, increases in the standard of living of workers. To the extent that compensation growth does not track productivity growth, the fruits of productivity gains are not equally distributed among the factors of production.

The size of the productivity-compensation gap varies by country, ranging from the largest in the United States to the smallest (nearly nonexistent) in Norway. The gap has also emerged at different times across the countries compared, starting in the 1970s in the United States and in the late 1990s in Singapore.

Chart 16.

.

Click legend to hide and show series. Hover over data series to show data for each country.

Previous Section: Labor Force

Next Section: Consumer Prices

Chart 16: Manufacturing unit labor costs, annual percent change (2012)

Unit labor costs (ULCs), or total compensation divided by real output, are the direct link between productivity and the cost of labor required in generating output. In 2012, manufacturing ULCs in national currency terms increased in all countries compared in Chart 16, with the exceptions of Spain, Denmark, and the United States.

When converted to a common currency, ULCs are used to compare cost competitiveness across countries. In US dollar terms, when ULCs in other countries rise faster (or decline slower) than ULCs in the United States, US cost competitiveness improves. As such, ULCs are a widely used measure in assessing firms’ location decisions.

Despite almost across-the-board increases in ULCs in national currency units, when the same data are expressed in US dollars, the results are mixed. In 2012, due to the appreciation of the US dollar, ULCs in US dollar terms increased in nine of the 19 countries. Therefore, US manufacturing increased competitiveness against all countries where ULCs in US dollars rose, as well as in Norway. Notably, US competitiveness increased against all Asian countries (Taiwan, South Korea, Singapore, and Japan) and had the largest improvement against the United Kingdom. On the other hand, the US competitive position deteriorated against eight of the 19 countries. This decline was most notable in Spain and other Euro Area economies that saw greater declines in US dollar-based ULCs than the United States.

The use of all TCB data and materials is subject to the Terms of Use. Reprint requests are reviewed individually and may be subject to additional fees. TCB reserves the right to deny any request.