|

Shareholders have been a major force in driving attention to ESG issues at public companies. But private companies also have good reasons to focus on ESG, including expectations of employees, customers, business partners, and creditors. Moreover, freed from many of the short-term pressures and regulatory disclosure obligations of public companies, private companies can lead in this area to their competitive advantage. |

To date, much of the discourse on ESG has focused on public companies. But CEOs of private companies are also paying close attention to—and demonstrating strong leadership on—ESG. And for good reason: while most ESG regulations and reporting requirements are aimed at public companies, ESG is far more than a compliance issue. Companies—both public and private—are vulnerable to pressure from outside groups, and ensuring ESG issues are integrated into business strategy can create significant competitive advantages. Recent conversations with senior executives at a $6 billion private chemical company and a $3 billion+ family-owned business shed light on some of these advantages.

Below are five reasons private firms are taking ESG seriously—or should:

1) To strengthen and secure relationships with business partners ESG is an increasingly important factor in business partnerships and procurement decisions. Organizations are looking to do business with partners and suppliers who can demonstrate strong ESG credentials. In the words of one senior executive from a private chemical company:

Many companies are beginning to assess their partners’ sustainability programs and are developing long-term goals for steering their supply chains to companies that meet ESG criteria, such as specific ESG scores.

Indeed, in the most recent poll of CDP Supply Chain program members, almost 3 out of 4 companies said they expect to deselect suppliers based on inadequate environmental performance. Companies—public or private—that want to secure access to top business partners will need to take ESG issues seriously. As the same chemical company senior executive added:

Some of the biggest customers of private companies are public companies and/or companies that sell to consumers, and those companies are looking for their suppliers and business partners to behave in a manner consistent with the expectations of their stakeholders.

This sentiment is supported by a comment from a senior executive of one of the largest US family-owned businesses, who notes:

We benchmark our annual reports against public companies; we impose on ourselves certain reporting requirements that would normally be imposed on a public company.

At the same time, executives from both companies acknowledge that to date most of their customers are simply looking for evidence of an ESG program and are unlikely to deselect suppliers for not providing data, at least not yet. A chemical company executive noted:

While the availability of a supplier’s ESG performance data and a supplier’s ability to demonstrate improvement in ESG metrics may not be a driving force now for supplier selection, there is a pretty good chance that it will be in the future. And ESG programs are not something you turn on overnight, so private companies should be ready for that eventual pressure. This is clearly where the world is headed.

An executive from the family-owned business suggests that, while purchasing departments still focus mostly on pricing, the company has had success when engaging with multifunctional teams rather than purely buyers and sellers:

If we can get the innovation and sustainability teams in the room, it helps to make it a stickier relationship.

And companies supplying the US government should take note: an executive order introduced on May 20, 2021, called on the Federal Acquisition Regulatory Council to consider requiring that climate-related information (e.g., social cost of greenhouse gas emissions) be considered in federal procurement decisions, and that preference be given to bids and proposals from suppliers based on this information.

2) To capture new business opportunities and spur innovation Integrating ESG into the business can help with more than meeting supplier selection criteria—it can strengthen partnerships with customers by spurring sustainability-led innovation. As a chemical company executive notes:

We contribute to sustainability by reducing our own footprint, but it’s not that large; the biggest impact comes from our products and helping our customers reduce their footprints during the use phase.

Designing solutions to help customers meet their sustainability goals is a smart move since virtually every large company is pursuing its own sustainability story and looking to its suppliers and partners for help.

|

Explore more from The Conference Board on how companies are organizing around and communicating sustainability: |

Awareness of a customer’s ESG goals, and a commitment to develop products that help customers achieve those goals, can go a long way to strengthening business relationships. An executive from the family-owned business stresses that:

An important differentiator is being able to help customers with products and solutions that help them meet upcoming ESG expectations. It makes us a strong partner in innovation.

Companies that integrate ESG into business strategy and planning gain visibility into the risks—and opportunities—associated with emerging societal issues. By doing so, companies are not only better able to anticipate ESG risks to their business, but also better positioned to pivot their business models to capture new business opportunities. Indeed, while stronger risk management is a benefit of ESG integration, for some companies an important upside of ESG is the reframing of challenges such as climate change from purely risks to innovation opportunities. This chance to explore novel solutions is a key reason companies should consider strengthening the ties between their sustainability teams and the strategy and finance functions: not just because those areas often own core planning and budgeting processes, but also because they are key to identifying and pursuing future business opportunities.

Companies that view ESG through the lens of value creation can spur innovation by redesigning products and services or delivering new solutions that address environmental and social challenges (for more on this topic, see Unlocking Growth through Sustainable Innovation, The Conference Board).

3) To connect with consumers For B2C companies, being able to authentically demonstrate ESG credentials is an important way to engage with consumers. But companies appear to be struggling with this: in a 2020 survey of 30 sustainability executives, The Conference Board finds that almost half of respondents are dissatisfied with how they engage with consumers on sustainability. This may be a significant missed opportunity: Deloitte’s Global 2021 Millennial and Gen Z Survey finds that ESG issues (such as climate change) are among the top concerns for Gen Z and millennials, and more than 3 out of 4 consumers are changing their purchase preferences based on these issues, a 2020 Capgemini Research Study indicates.

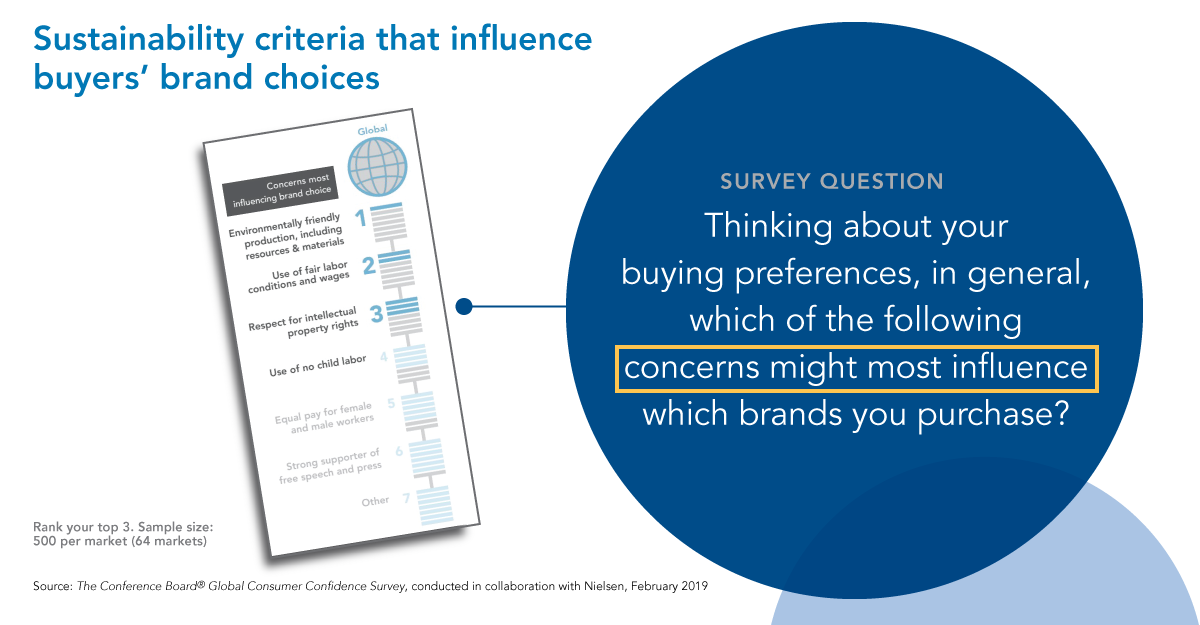

Indeed, protecting the environment seems to resonate broadly with consumers: research from The Conference Board finds that environmentally friendly production is the sustainability feature with the biggest impact on consumers’ brand choices. Brands should pay attention, as ESG concerns are influencing consumer purchasing decisions. But authenticity is crucial: companies need to ensure their ESG efforts are viewed not as ancillary but as fundamental to furthering the company’s mission. To ensure authenticity, ESG efforts should be anchored in the company’s business strategy, ambition, and culture.

The rise in consumer preferences for more sustainable products is also relevant for B2B companies. An executive from the family-owned business notes that, despite the company being a B2B, consumer preferences play a strong role in product development:

Many of our products are sold to consumer-facing companies, so we are looking through our direct customer to understand what the consumer expectations are. When we develop new products, we ask ourselves: What can we bring to market that will meet the needs of our B2B customers and make a societal difference?

4) To retain and attract employees CEOs across the globe cite talent attraction and retention as their number-one internal focus for 2022, the annual C-suite survey from The Conference Board finds. Companies perceived as sustainability and ESG leaders had a leg up in employee recruitment and retention even before the current labor conditions, and a tight labor market amplifies this trend. This rings true for a senior executive from the family-owned business:

We see our ESG commitment as a competitive differentiator for our labor pool. We have been very purposeful in communicating our strong commitment to sustainability to prospective and current employees, and we are finding that prospective employees want to come to a company with a purpose. They are interviewing us as much as we are interviewing them. Our recent strategic hires have been very much driven by our environmental commitments.

By making ESG a priority, CEOs can send a strong signal to their employees and prospective employees that the company is committed to a purpose beyond profits. There is good news for private companies: because of fewer public reporting and compliance pressures, private companies may have an advantage in building a sustainability culture among employees. Indeed, heads of sustainability at private companies seem to spend more time on employee engagement and training than their peers at public companies.

5) To ensure access to markets and capital on favorable terms ESG-related regulations are not just aimed at public companies, or equity investors, but at financial institutions and other providers of capital to private companies as well. In Europe, for example, all large companies (whether listed or not) will be required to disclose ESG data under the Corporate Sustainability Reporting Directive. The disclosure requirements will apply to reports published in 2024 covering FY 2023 data and will also apply to non-EU companies with EU subsidiaries. Further, public and private financial institutions fall under the scope of the EU Taxonomy Regulation, which requires these institutions to disclose how their sustainable funds align to the taxonomy.

In the US, the SEC is also considering introducing rules that will place more scrutiny on “sustainable” or “green” funds, as SEC Chair Gary Gensler noted in his July 7, 2021, remarks before the asset management advisory committee. If these rules are introduced, fund managers will be expected to disclose the criteria that go into classifying these funds as such. ESG regulation is increasingly relevant for private companies; companies that are proactive and prepare for these regulations will be at an advantage.

Companies are also finding that ESG plays an important role in attracting capital on preferential terms. Lenders, including to private companies, are increasingly adopting ESG screening policies, and ESG is being integrated into bond analysis, as discussed in a March 2021 Sustainability Watch webcast from The Conference Board. In light of climate risks, the Federal Reserve is conducting stress tests, and the European Central Bank is requiring banks to do the same. The fact that regulators are focusing on financial institutions’ exposure to climate puts pressure on those banks and other financial institutions to include climate in their credit policies, which in turn affects borrowers, such as private companies. Further, shareholder interest in ESG issues is at historically high levels, even among private companies. As noted by an executive from the family-owned business:

ESG issues are very important to our shareholders. Environmental and social stewardship—not just compliance—is important to them, and they want us to be leaders in DE&I. Our shareholders don’t just want us to embody these things, they want us to be standard-bearers for other companies. As a family-owned company, the way we engage and retain our shareholders is by giving them something to be proud of in the future, and this is a key reason why we invest in sustainability.

Beyond complying with regulations, integrating ESG into the business can also help garner the support of communities and local stakeholders. As noted by an executive from the chemical company:

For larger manufacturing companies, a lot of the activities for those companies depend on the goodwill of the local community, such as support in obtaining required permits and authorizations. As local communities increasingly view sustainability as a desired, and even expected, aspect of businesses, it behooves any company to maintain good relationships with its community by demonstrating its commitment to sustainability.

As outlined above, it makes sense for private companies to integrate ESG issues into their business strategy and operations. Customers, shareholders, regulators, and other stakeholders increasingly expect private companies to address these issues. But perhaps more importantly, integrating ESG into the business can yield significant competitive advantages such as stronger business partnerships, new opportunities for innovation, greater engagement with consumers, an edge with talent attraction and retention, and preferential access to markets and capital.

Indeed, many private companies are well positioned to be leaders in integrating ESG into their business strategy and operations. Without the need to devote as many resources to address insatiable demands for information from investors, regulators, and ESG rating agencies, they can focus on the areas where they can have the greatest impact. Without the threat of short-term shareholder activism, they often have greater ability to focus on the long term and to make pioneering investments in sustainability-based products and services. And with typically greater continuity in leadership—particularly at family-controlled companies—they can grow a culture where ESG is in the firm’s DNA.

May 29, 2025 | Report

January 21, 2025 | Quick Take