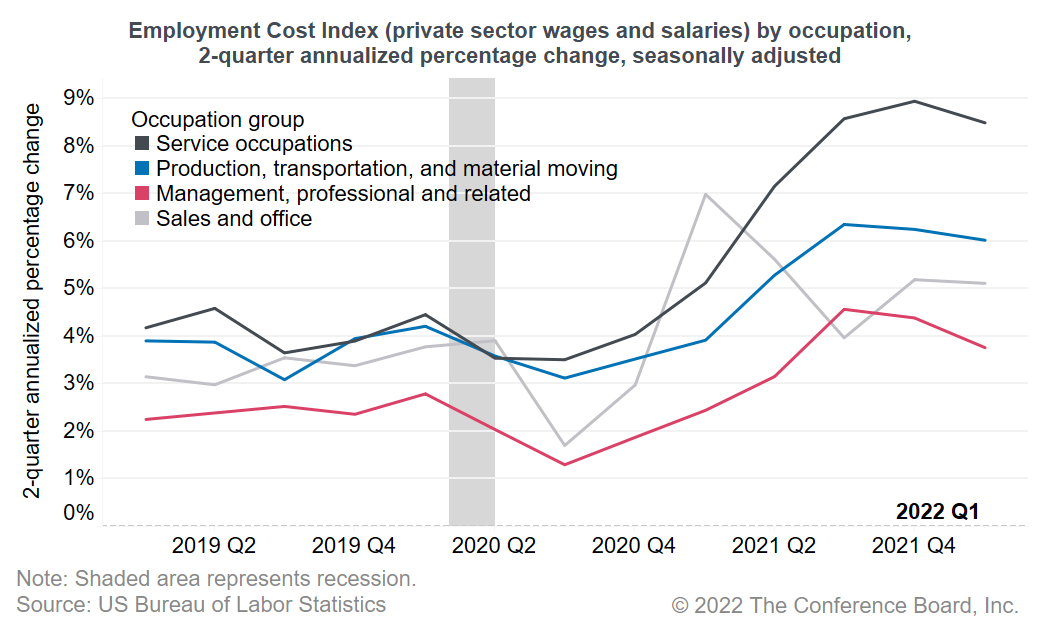

The 2022 Q1 Employment Cost Index data revealed continued pressure on wages amid labor shortages. Wages and salaries for private industry workers increased 4.9 percent at a 2-quarter annualized rate in March 2022, a slowed increase from a high of 5.6 percent in the previous 2-quarters. Wage growth remains high and will continue upward pressures on inflation and consumer prices in the coming months. Tight labor markets in in-person services and transportation continue to contribute to growth in compensation. Wages and salaries for private industry workers in service occupations increased 8.5 percent at a 2-quarter annualized rate, and 6.0 percent for workers in production, transportation, and material moving occupations. Even management and professional related occupations, which have been less impacted by pandemic induced labor shortages, experienced wage growth of 3.8 percent. Consumer demand for in-person services will likely remain high as the summer months approach and COVID-19 related fears dissipate. Continued consumption and constraints on the labor supply will maintain wage pressures in these industries. Overall, wage pressures continue to remain elevated. Labor force participation rates remain low and the labor market will stay tight heading into 2023, contributing to further wage pressures.

Steady as She Goes Labor Market, Risks Remain

February 11, 2026

Vacancies Plunge, But Low Hire-Low Fire Equilibrium Persists

February 05, 2026

Steady Labor Market Allows Fed Pause

January 09, 2026

Rising Unemployment Augurs More Rate Cuts in 2026

December 16, 2025

Rising Unemployment to Dwarf Solid Payrolls in December FOMC Decision

November 20, 2025

BLS Revises 2024 Hiring, But Not the Labor Market Narrative

September 10, 2025