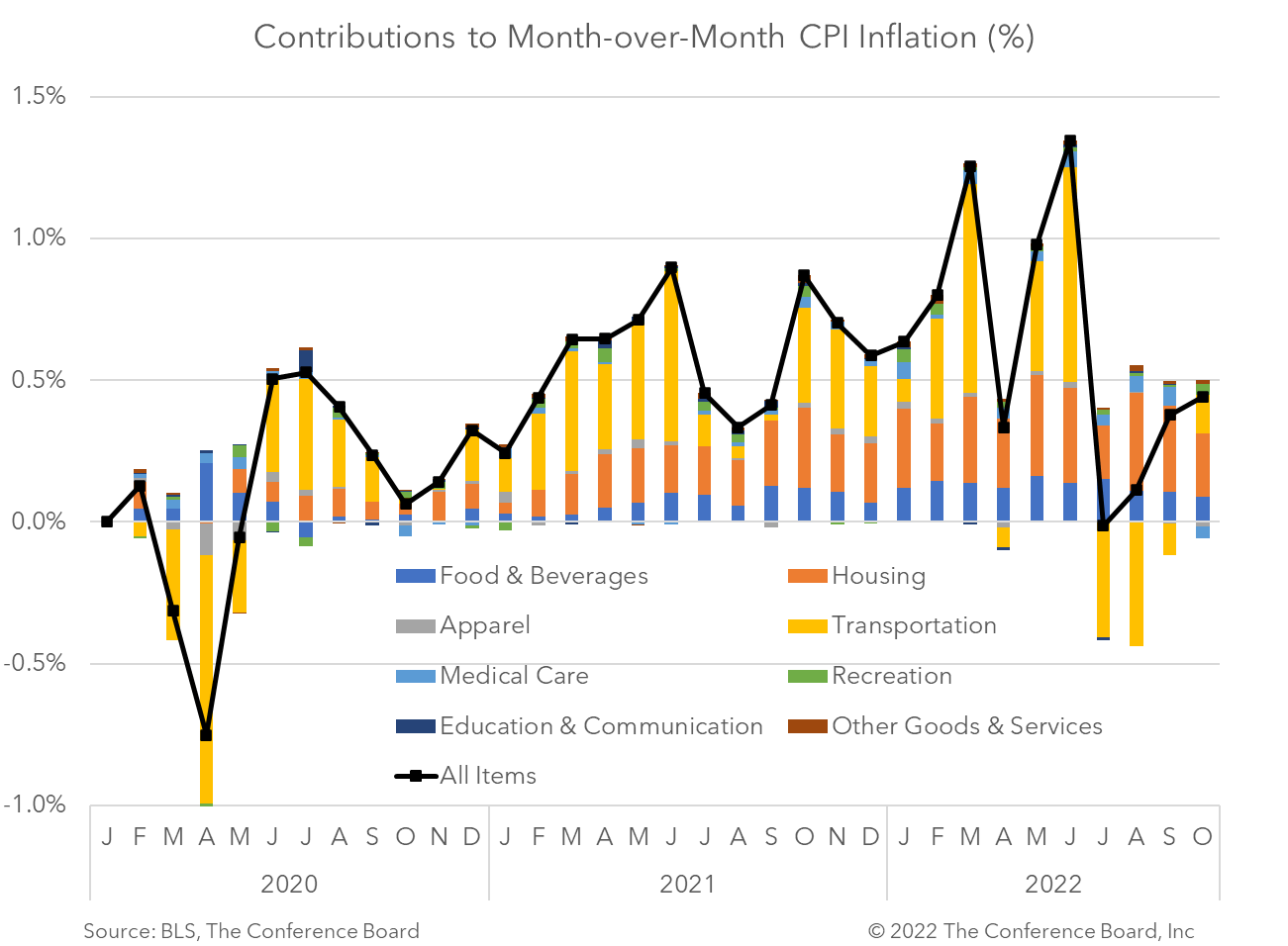

The headline Consumer Price Index (CPI) eased somewhat in October along with Core CPI, which excludes food and energy. While these data show some progress in the Fed’s fight against inflation, we continue to expect additional interest rate hikes over the coming months and a recession to begin around the end of the year. Headline CPI slowed to 7.7 percent year-over-year in October, vs. 8.2 percent in September. In month-over-month terms, however, this topline inflation metric was 0.4 percent—flat from the month prior. Many index components saw price gains moderate for the month, and some (including used vehicles and apparel) saw prices decline. However, shelter prices remained high and energy price gains accelerated. Core CPI also moderated in October. The core index, which is total CPI less volatile food and energy prices, rose by 0.3 percent month-over-month in October, vs. 0.6 percent in September, and 0.6 percent in August. In year-over-year terms core CPI was rose to 6.3 percent from 6.6 percent in September.Insights for What’s Ahead

October Inflation Highlights

January CPI Raises More Questions than Provides Answers

February 13, 2026

Lukewarm Holiday Shopping in 2025 Augurs Slower Spending in Q4

February 10, 2026

FOMC Reaction: US Economy In a Good Place, But Staying Vigilant

January 28, 2026

Fed January Decision: Pause or Full Stop?

January 27, 2026

November PCE: Are Consumers Spending Beyond Their Means?

January 22, 2026

Retail Sales Highlight Affordability Issues

January 14, 2026