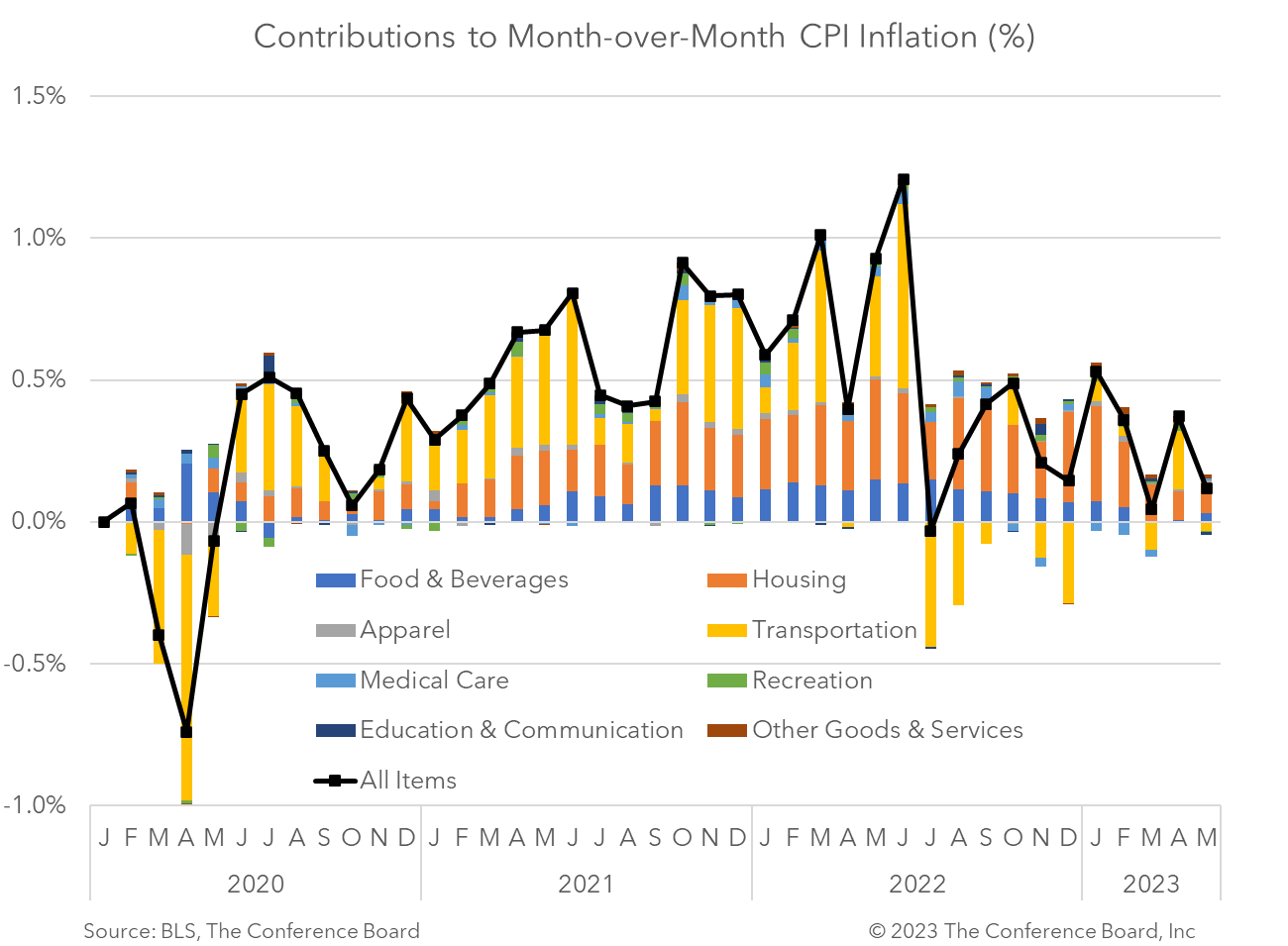

The May Consumer Price Index (CPI) showed that inflation rose 0.1 percent month-over-month (vs. 0.4% in April) and core inflation, which excludes food and energy, rose 0.4 percent month-over-month (vs. 0.4% in April). Year-over-year CPI dropped 0.9 percentage points to 4.0 percent largely due to base effects while year-over-year Core CPI dropped 0.2 percentage points to 5.3 percent. The CPI’s components were mixed in month-over-month terms, with some increasing and some decreasing. At the conclusion of June’s FOMC meeting tomorrow we expect the Fed to pause tightening to allow already high interest rates to continue to weigh on the economy. May CPI data showed mixed progress across a variety of goods and services. Energy prices dropped sharply from the previous month while food rose 0.2 percent. Thus, much of the difference between topline and core inflation was due to energy. Shelter prices, which rose 0.6 percent and are heavily weighted in CPI, remained the largest contributor to both overall and core inflation. However, further relief in this key component of inflation is on the way as housing and rental markets continue to cool. These inflation data, while unacceptably high, are unlikely to spur another rate hike at the conclusion of the June Federal Reserve meeting tomorrow. While some progress in topline inflation was seen in today’s report, the core reading increased by 0.4 percent for the third consecutive month. This persistence in core inflation is troubling, but we expect the FOMC to pause tightening to allow the high interest rates that have already been implemented to work through the economy. If inflation continues to cool, as we forecast, we may not see another rate hike this cycle, but we do not expect any rate cuts from the Fed until 2024. Headline CPI slowed to 4.0 percent year-over-year in May, vs. 4.9 percent in April, partially due to large base effects. In month-over-month terms this topline inflation metric slowed to 0.1 percent, vs. 0.4 percent the month prior. According to the BLS, the index for shelter was the largest contributor to the monthly all items increase, followed by increases in the index for used cars and trucks. The energy index declined for the month and the food index rose slightly. Large base effects will also impact the June CPI and likely drive the headline year-over-year reading even lower. Core CPI, which is total CPI less volatile food and energy prices, slipped to 5.3 percent year-over-year in May, vs. 5.5 percent in April. The core index rose 0.4 percent month-over-month in May, as it did in April. As was the case with topline CPI, the increases in the core CPI was driven by shelter prices.Insights for What’s Ahead

May Inflation Highlights

January CPI Raises More Questions than Provides Answers

February 13, 2026

Lukewarm Holiday Shopping in 2025 Augurs Slower Spending in Q4

February 10, 2026

FOMC Reaction: US Economy In a Good Place, But Staying Vigilant

January 28, 2026

Fed January Decision: Pause or Full Stop?

January 27, 2026

November PCE: Are Consumers Spending Beyond Their Means?

January 22, 2026

Retail Sales Highlight Affordability Issues

January 14, 2026