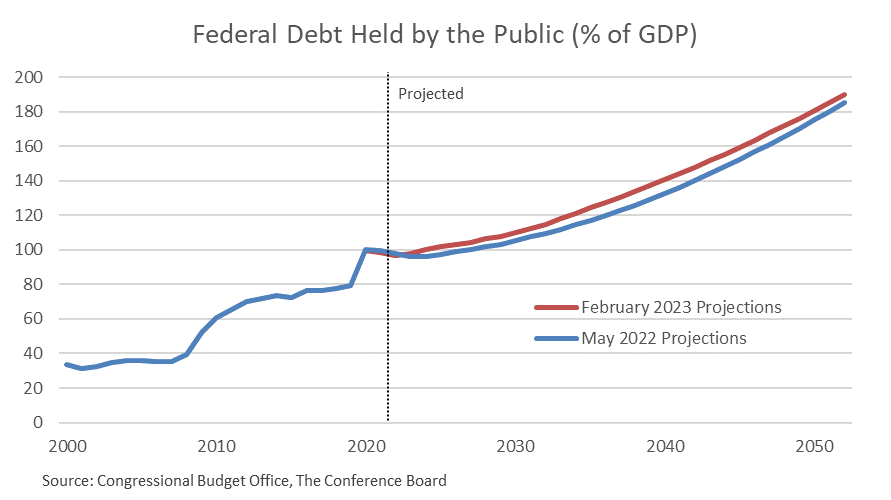

The finances of the US government are materially worsening as is the economic outlook. According to the just-released Congressional Budget Office (CBO) Budget and Economic Outlook, the federal government’s debt burden (the debt owed to the public, expressed as a percentage of the nation’s gross domestic product, or GDP) will rise to its highest level in history within 10 years from its current outsized level of 98 percent to 118 percent, and then continue to rise to almost double the size of the economy by 2053. Perhaps most troubling is how the servicing of the debt will absorb a significant portion of the budget, crowding out the nation’s ability to fund its national priorities. Net outlays for interest nearly double over the period in CBO’s projections, rising from $739 billion in 2024 to $1.4 trillion in 2033. This burden has the potential to severely hinder future economic growth and business activity. According to the CBO's new projections: Overall, these updated projections are more pessimistic than those published last summer and underscore the very dangerous and destabilizing path that US fiscal policy is on. The CBO expects the economy to continue wrestling with high interest rates and inflation for longer than previously anticipated, and for growth to falter in the short-term. On the budget outlook, the CBO’s projections for debt as a percentage of GDP have deteriorated. As noted above, the debt to GDP ratio is now projected to rise to 190% in 2052, as opposed to 185%, and further to 195% in 2053. In summary, the CBO’s already dour expectations about the future have become even worse. As a new CED Solutions Brief clearly details, reining in the ballooning public debt and returning it to a responsible debt-to-GDP level of 70 percent must start now. Driving the urgency is two-fold: rising interest rates are already significantly increasing the cost of servicing the debt and crowding out important national budget priorities, and it will take substantial time to accomplish this task. The analysis by CED forecasts that it will take 20 to 30 years of a sustained effort to draw the debt-to-GDP ratio down from 95% to a responsible 70% with the least draconian fiscal hardship. This analysis is part of CED’s latest Solutions Brief, Debt Matters: A Road Map for Reducing the Outsized US Debt Burden to 70% of GDP. Read the report, which also includes a series of CED recommendations for returning to a path of fiscal health and stability, including a mix of spending cuts, tax reform, saving Social Security and Medicare, and returning to a responsible and enforceable budget process. Join us tomorrow, February 16th @1:00PM ET for a CED Policy Watch Webcast with CBO Director Phill Swagel on Fiscal Health: Road Map For A Responsible Fiscal Budget During Economic Disruption. Register here.

Shutdown Aside, Growth Moderates Under Inflationary Pressures

February 20, 2026

January CPI Raises More Questions than Provides Answers

February 13, 2026

Lukewarm Holiday Shopping in 2025 Augurs Slower Spending in Q4

February 10, 2026

FOMC Reaction: US Economy In a Good Place, But Staying Vigilant

January 28, 2026

Fed January Decision: Pause or Full Stop?

January 27, 2026

November PCE: Are Consumers Spending Beyond Their Means?

January 22, 2026