July 21, 2022 | Article

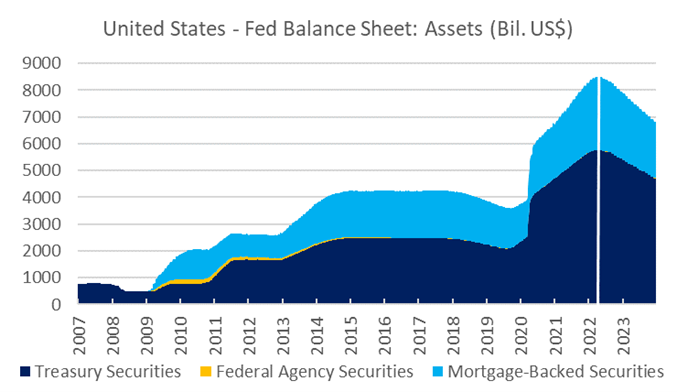

Along with raising interest rates, the US Fed is reducing the size of its balance sheet.

Large-scale asset purchases (LSAPs) that increase the size of the balance sheet are a tool to provide stimulus to the economy and stabilize financial markets when the central bank is forced to cut interest rates to zero during extreme recessions.

The Fed has in the past purchased US Treasuries, agency debt, and mortgage-backed securities to help stabilize investor trading in these markets and provide greater liquidity for the economy. These purchases were made during the 2008-09 Great Financial Crisis and the pandemic (which began in the US in March 2020).

But now that inflation is surging, the Fed no longer needs a giant balance sheet and is shrinking the size of it. Presently, the balance sheet is being cut by US$95 billion a month. The process is estimated to be equivalent to raising rates by 25 basis points.

What are the risks of having an outsized balance sheet, and what are the risks to financial markets and the economy of scaling it back? Explore our guides for more: