Members of The Conference Board get exclusive access to the full range of products and services that deliver Trusted Insights for What's Ahead ® including webcasts, publications, data and analysis, plus discounts to conferences and events.

19 November 2025 | Press Release

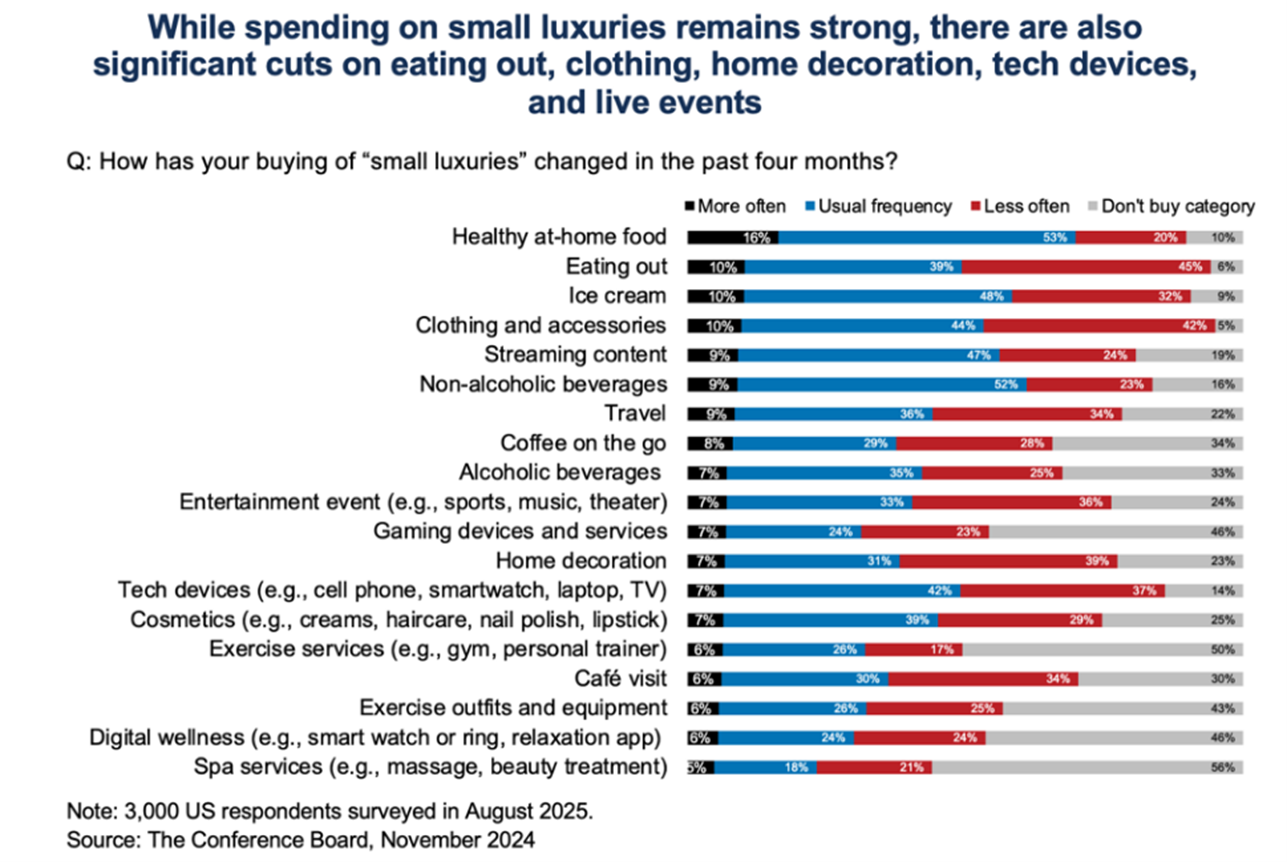

Consumers Turn to Healthy Eating at Home and Cut Back on Tech, Eating Out, and Travel

Against a backdrop of continued economic uncertainty, Americans are maintaining—or even increasing—their spending on “little luxuries” more than they are cutting back. That’s according to a survey of 3,000 US consumers from The Conference Board, based on their self-reported spending behaviors (which may or may not align with actual spending).

The report reveals that affordable indulgences like healthy at-home foods, ice cream, non-alcoholic beverages, and streaming content are proving resilient, even as consumers cut back overall on certain discretionary purchases—including dining out, apparel, travel, and live entertainment. Yet, for a portion of US consumers, some of these same areas have become more popular. One person's treat is another's cost-saving opportunity.

The findings highlight a divergent economy: higher-income households are fueling the growth in little luxuries disproportionately relative to their segment size, especially in more costly categories such as travel and live entertainment. And perhaps surprisingly, men—not women—are driving growth in most small luxury categories.

“Today’s most popular small luxuries reflect a mix of mindful indulgence and broader consumer trends—healthier eating, shared experiences, and affordable entertainment,” said Denise Dahlhoff, PhD, Director of Marketing & Communications Research at The Conference Board and author of the report. “Consumers value affordable, feel-good everyday pleasures even more during uncertain times, especially those that support healthy living. Likewise, streaming services both reflect our digital lifestyles and offer a lower-cost alternative to live events.”

Key findings from the report include:

Consumers continue to indulge—especially in food and experiential services.

Men are leading the growth in little luxuries.

Higher-income households are driving disproportionate growth.

Younger consumers remain the “treat generation.”

About The Conference Board

The Conference Board is the member-driven think tank that delivers Trusted Insights for What's Ahead®®. Founded in 1916, we are a non-partisan, not-for-profit entity holding 501(c)(3) tax-exempt status in the United States. TCB.org

Media Contact:

Jonathan Liu

jliu@tcb.org