What do online job ads tell us about Amazon’s choice for a second headquarters?

17 Apr. 2018 | Comments (1)

Earlier this year, Amazon revealed the top 20 metropolitan areas for its second headquarters (“HQ2”). The winning city is expected to benefit from $5 billion in capital investments and will grow to be the home of 50,000 new high paying jobs.

Like Amazon’s current headquarters in Seattle, HQ2 will likely be a catalyst for growth in the overall local economy where personal and specialized services develop to support new workers and business operations. Investments in their Seattle campus are estimated to have added $38 billion to the local economy over 6 years and created 53,000 additional jobs.[1]

The expected economic growth and prestige of basing one of the world’s most valuable and innovative companies has cities competing to lure the online retail giant. In anticipation of their choice, speculation has grown and cities are being evaluated on how well they fulfill Amazon’s “decision drivers.” To add to that speculation, Amazon’s need for a large and capable labor force might be a strong indicator of location choice. If we know where Amazon has been hiring in recent years and where it has accelerated hiring, it could provide some hints on where HQ2 might be built.

According to Amazon, jobs for HQ2 will fall under management, engineering (preference for software development), legal, accounting, and administrative type occupations. To help attract this level of talent, Amazon is seeking a city with a “strong university system” and an abundance of recreational opportunities. But filling thousands of these high skilled positions can be challenging in a tight labor market, even in a city with an abundance of college educated residents.

Amazon is expecting their second headquarters to be a “full equal” to their Seattle campus. Therefore, the labor demands are likely to be very similar. Measuring Amazon’s labor demands at their current headquarters can allow us to gauge what demand at HQ2 might look like.

Using The Conference Board Help Wanted OnLine® (HWOL) Data Series, we can measure real-time labor demand through advertised online job vacancies. HWOL, produced by The Conference Board and CEB, Inc., generates detailed timeseries of online job ads for the US, regions, states, MSAs, and counties by occupational level. HWOL’s universe of job ads allows us to measure Amazon’s current and historical demand for virtually all occupations throughout the country.

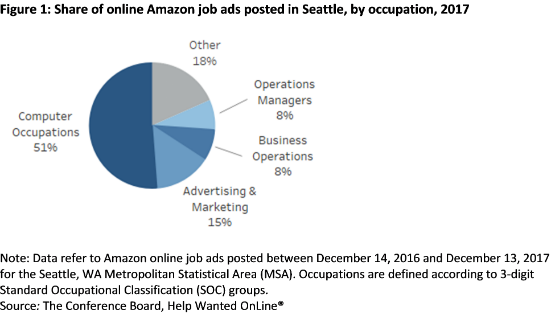

As shown in Figure 1, a more granular breakdown of Amazon job ads reveals the four occupational categories that dominate their Seattle campus. Apart from legal occupations (less than 1 percent of Amazon job ads in Seattle), the jobs Amazon demands at their current headquarters are very similar to what they report will be needed at HQ2. To be a “full equal,” Amazon will likely demand a similar distribution of occupations for HQ2.

Amazon’s demand for these occupations is already present in several cities throughout the United States. Shown in Figure 2 are the locations of all Amazon job ads for the top four occupations from Figure 1. If Amazon chooses to build their second headquarters in a city where they already have a large pool of workers who would fit well into a second headquarters, it can ease the challenge of attracting such talent from elsewhere, especially in a tight labor market.

The cities with a relatively large number of ads that did not make Amazon’s shortlist are San Francisco and San Jose. Over 20 percent of job ads for the top 4 occupations are in these two cities alone. Additionally, both cities possess many of the qualities Amazon looks for in terms of an educated labor pool and a large concentration of high-skilled tech workers. However, competition remains great there. Attracting and retaining workers means competing with other tech giants in the area. Some benefits of agglomeration may diminish when labor demands are high in a tight labor market.

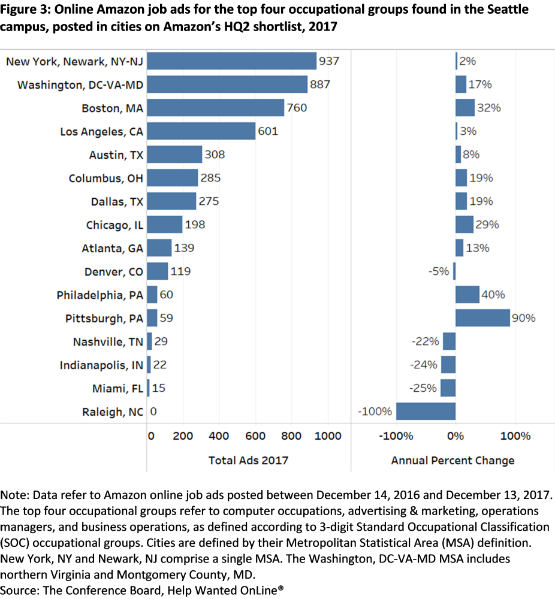

Not all cities from Amazon’s top 20 shortlist have a large concentration of these online job ads. As shown in Figure 3, Nashville, Indianapolis, and Miami each had less than 50 ads for the top occupations in 2017, with all three cities experiencing a decline from last year. At the lowest level, Raleigh had zero ads for the top occupations in 2017, down from 2 in 2016. Comparative labor conditions surely played a role for Amazon to include these cities on their shortlist. Relatively low unemployment, decent shares of workers with BAs and MAs and strong labor force growth in the last decade perhaps added to their appeal. However, Amazon’s small and declining demand for headquarter caliber occupations in these cities indicates a minimal presence, potentially complicating their talent search in today’s tight labor market.

Nearly all other cities experienced growth in the number of ads from 2016, indicating an increased presence from Amazon. Pittsburgh and Chicago experienced some of the strongest growth, but the overall number of ads remains low compared to the New York and Washington DC metro areas. Amazon’s footprint in Chicago for these headquarter caliber jobs seems unusually low considering the city’s large population and world class universities.

Given the relatively large number of ads for headquarter caliber occupations and the growth rate in those ads, the Washington, DC metro area and Boston seem the most likely candidates for a second headquarters. Amazon’s current footprint in these cities could ease the hiring of 50,000 new employees and growing demand signals their desire to increase their presence. This is potentially indicative of a labor market suitable for a second Amazon headquarters.

While DC and Boston seem most likely to win, Amazon’s decision to open the bidding process widely has provided cities that may ultimately fall short the chance to position themselves as having a tech friendly environment. All cities on the shortlist likely possess many of the key attributes Amazon seeks. Win or lose, they are able to promote and advertise themselves as a good location for start-ups and technology companies looking to expand or relocate.

Observing labor demand using online job ad postings for a specific company like Amazon is possible with Help Wanted OnLine® data. Most importantly, HWOL allows us to analyze monthly trends in labor demand both in real-time and historically down to the most granular occupational level for areas throughout the United States. Analyzing trends in online job ads with the granularity of Help Wanted OnLine® broadens our understanding of the overall U.S. labor market.

-

About the Author:Agron Nicaj

Agron Nicaj is a former Associate Economist with The Conference Board’s Help Wanted OnLine (HWOL)© and Labor Markets programs. He was responsible for the production and analysis of the HWOL…

-

About the Author:Jeanne Shu

Jeanne Shu is the Associate Director of The Conference Board Help Wanted OnLine (HWOL)® Data Series program. In this role, she oversees all the activities of the program and its publication series…

-

About the Author:Gad Levanon, PhD

The following is a biography of former employee/consultant Gad Levanon is the former Vice President, Labor Markets, and founder of the Labor Market Institute. He led the Help Wanted OnLine©…

1 Comment Comment Policy

The number of job ads strikes me as a perverse indicator. All it shows is the measure of unfilled vacancies. The better indicator is the ratio of job ads to actual hires. It's also striking that you omit Toronto and not even bother to mention it, if only in a footnote. Why is this omission galling? Because in recent years, Toronto has filled more IT jobs than any US city outside of Silicon Valley.