US Consumers Expect War Will Cause Prices to Rise Significantly Over Months Ahead

April 05, 2022 | Chart

The Conference Board Consumer Confidence Index® ticked up slightly in March, after back-to-back declines. The Present Situation Index rose substantially, suggesting economic growth continued into late Q1. The Expectations Index, on the other hand, weakened further, with consumers citing rising prices—at the gas pump in particular—and the war in Ukraine as factors. Meanwhile, purchasing intentions for big-ticket items like automobiles have softened over the past few months as expectations for interest rates have risen.

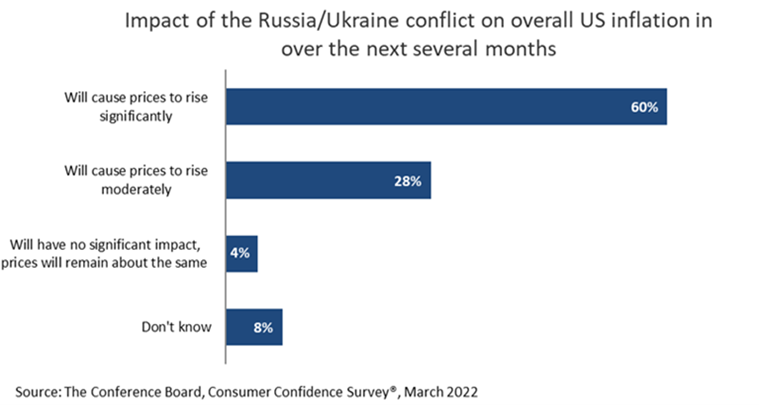

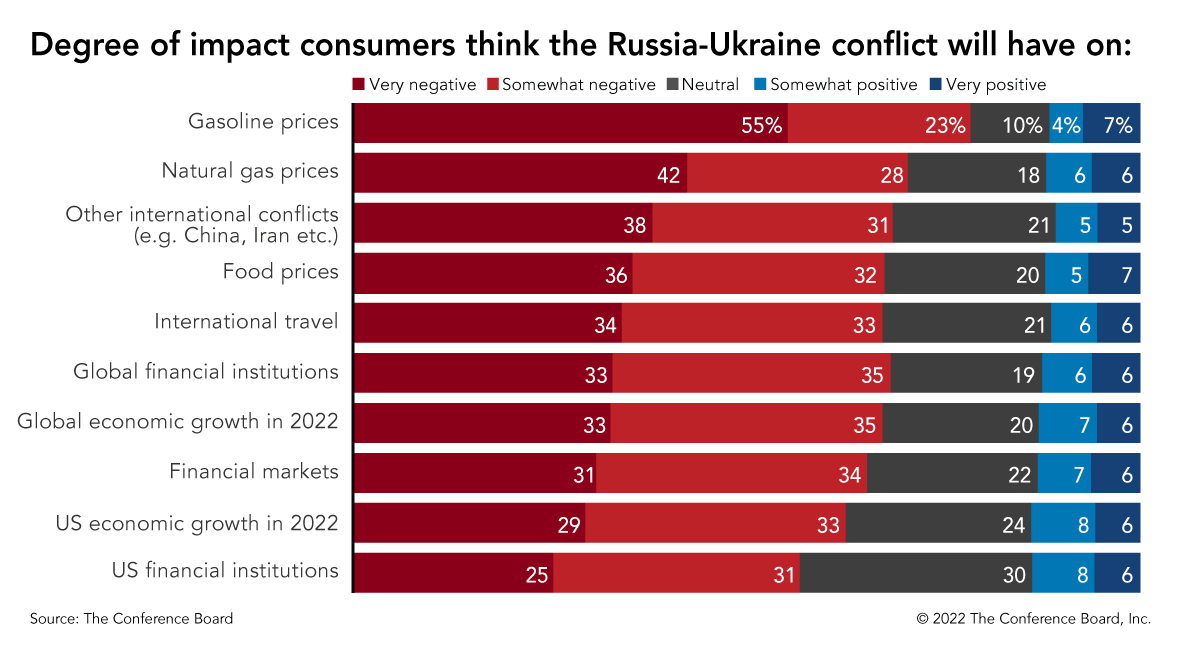

A special poll conducted in the March Consumer Confidence Survey® focused on the perceived impact of the war in Ukraine on overall inflation in the US (see the chart above), as well as its impact on a wide swath of expectations ranging from energy and food prices to economic growth and international travel (see the chart below).

Notably, 6 out of 10 consumers believe the conflict will cause prices to rise significantly over the next several months, while about another 3 out of 10 consumers feel the impact on prices would likely be moderate.

Consumers expect the overall impact of the war in Ukraine to be negative, as well as wide reaching. The most pronounced impacts are expected to be felt in energy prices. In fact, more than half of consumers said that prices at the pump would likely be the hardest hit. With gas prices hovering well above $4 a gallon, energy prices are likely to remain a top concern among consumers.

Meanwhile, consumers expect the impact on food prices to be somewhat more subdued. However, this may be partially due to increases in this sector that will take a bit longer to filter through the supply chain before consumers see visible changes on store shelves.

Less than a quarter expect the US economy to be very negatively impacted, but nonetheless expectations are that growth will slow in the near future.

Overall, consumer confidence continues to be supported by strong employment growth and thus has been holding up remarkably well despite surging geopolitical conflict. However, expectations for inflation over the next 12 months reached 7.9 percent in March—an all-time high—and are likely to rise further in the coming months.

The impact of rising prices, especially for less affluent consumers, is likely to curb spending in 2022. These consumers will have fewer discretionary dollars to spend on dining out, entertainment outside of the home, travel, and vacations. Thus, in-person services industries trying to bounce back from the pandemic may remain challenged, though to a lesser degree than during the worst of the COVID-19 crisis.

We expect headwinds from higher inflation and the war in Ukraine to persist in the short term, and these may well dampen confidence and cool spending and economic growth in the months ahead.