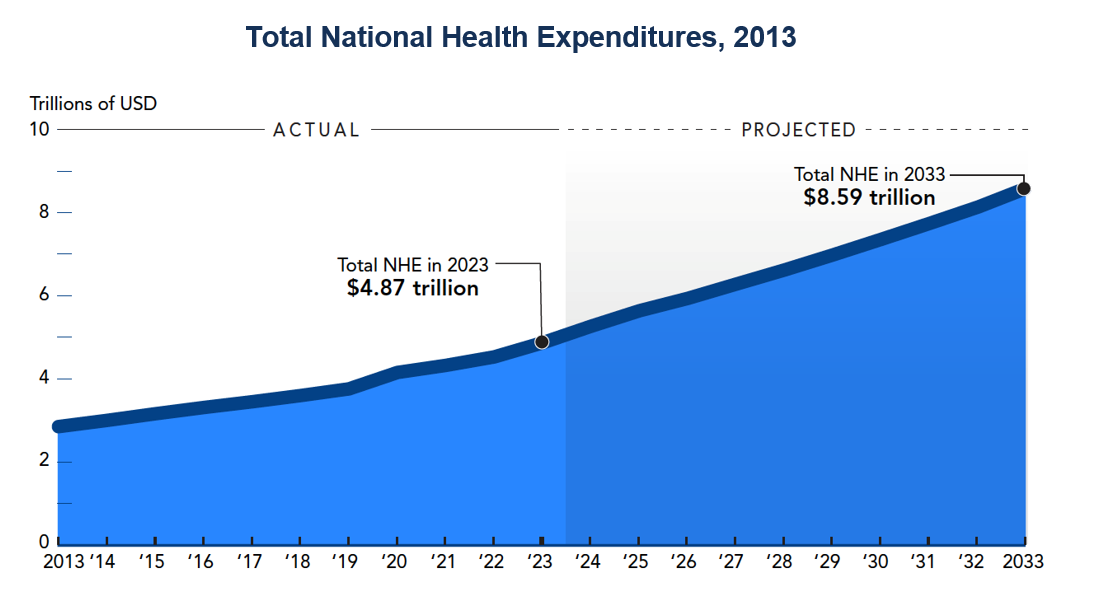

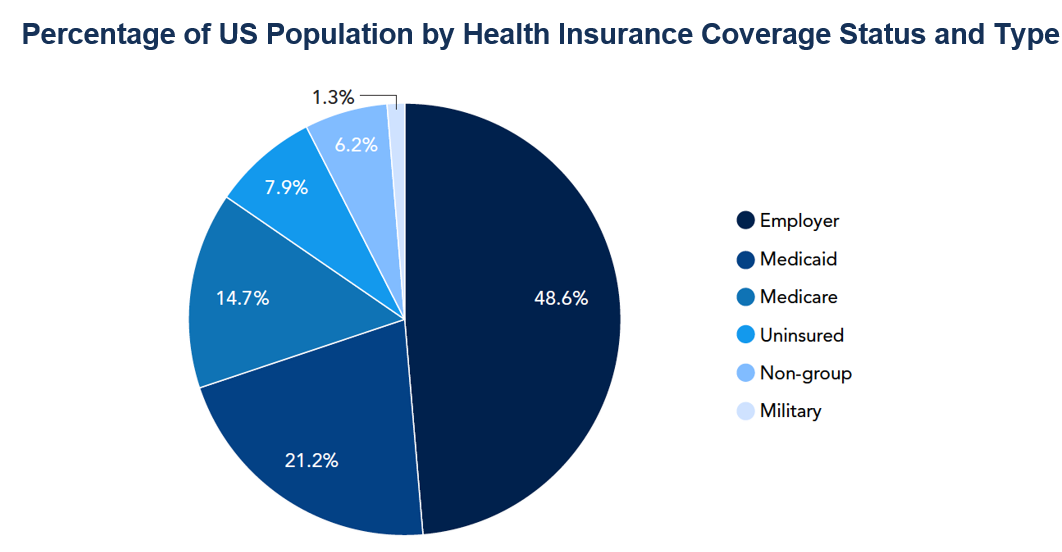

The US health care system stands at a pivotal moment. Demographic pressures are raising demand, costs continue to climb, and some workforce shortages are worsening, heightening concerns about access to and quality of care. Recent reforms have emphasized program integrity and fiscal restraint but have yet to deliver a clear path to lower costs or improve outcomes. CED has long believed that a competitive, cost-responsible, and market-driven system—anchored in value-based, transparent pricing and stronger primary and preventive care—is essential. Well-functioning competition among private health plans and strong, accessible primary care set the conditions for high-quality care in a more connected system that drives patient outcomes holistically. Together, policymakers and business leaders can help build a more efficient, cost-effective system that improves access and quality for all Americans. To ensure quality, access, and cost-effectiveness in the health care system, policymakers and business leaders should recognize that: Health care remains one of the largest components of the US economy, accounting for nearly one-fifth (17.6%) of Gross Domestic Product (GDP). Rising costs strain public budgets and household finances alike. The central challenge is to sustain high-quality, broadly available care while ensuring that health dollars are spent efficiently and responsibly. Health care is the largest sector of employment in the US, supporting more than 22.5 million workers in 2024 and is projected to remain a major growth sector over the next decade. A strong health system underpins national competitiveness by keeping workers healthy, productive, and fully engaged in the labor force. Thus, health care is not only an investment in physical and mental health but also an economic engine that supports productivity, innovation, and workforce participation. As costs rise, the health care system should deliver measurable value, foster competition, and align incentives for efficiency and an increasing role for preventive care. Public programs should operate predictably and transparently, while the private sector—including not only health care organizations, but also employers—plays a leading role in driving modernization and improving quality. According to Census data, more than 91% of Americans have health coverage—about two-thirds (67.2%) through private insurance and over one-third (36.8%) through public programs such as Medicare, Medicaid, Children’s Health Insurance Program (CHIP), TRICARE (the health care program for active-duty service members and certain others), or Department of Veterans Affairs (VA) care. National Health Expenditure data show total spending rising 7.5% in 2023 to $4.9 trillion, or $14,600 per person, and that health spending will continue to grow faster than GDP, expanding its share of the economy from 17.6% in 2023 to more than one-fifth by 2033. With Medicare and Medicaid accounting for nearly 40% of National Health Expenditure (NHE) and private insurance another 30%, health expenditure trends shape Federal and state budgets, employer benefit design, and household finances. Source: Centers for Medicare & Medicaid Services (CMS), National Health Expenditure Accounts: National Health Expenditure Data, last modified September 22, 2025; The Conference Board, December 2025 As the primary purchasers of coverage for most working Americans, employers are central to shaping a health system that improves value, access, and quality. Long term progress will depend on collaboration among business leaders, policymakers, and health systems to advance efficiency, competition, and prevention—modernizing the system to promote better value for the trillions the US spends on health care and improving outcomes while constraining cost growth. At the beginning of 2025, the Congressional Budget Office (CBO) projected Federal spending on health care programs to be at $942 billion for Medicare and $656 billion for Medicaid, collectively accounting for 22.8% of the total estimated $7 trillion outlay for fiscal year 2025. Health care programs, such as Medicare and Medicaid, are the largest drivers of the national debt, which stands at over $38 trillion (a ratio of 100% debt to GDP). Public Law 119-21 (H.R. 1), also referred to as the “One Big Beautiful Bill Act” (OBBBA), marks a major restructuring of Federal health programs. Designed to curb long-term spending growth, the law applies a consistent framework across Medicaid, Medicare, and Affordable Care Act (ACA) marketplaces by tightening eligibility rules, increasing verification and reporting requirements, and constraining state and program financing mechanisms. Supporters frame these provisions as essential to restoring fiscal discipline and program integrity, while critics argue they risk widening coverage gaps and shift costs to states, providers, and households. Together, the reforms represent a decisive turn toward cost containment, with far-reaching implications. Medicaid is a vital component of the US system. However, the program faces persistent fiscal pressure; CBO projects Federal Medicaid spending to reach nearly $1 trillion by 2035, even as enrollment declines from 92 million in 2024 to 79 million by 2034, reflecting post-pandemic eligibility redeterminations and stricter state enrollment policies. Rising health care costs, expanded coverage under the ACA, an aging population, and broader service utilization continue to drive spending growth. Provider payments are a major segment of costs, yet public program reimbursements trail medical inflation, straining the delivery system. Even with fewer enrollees, rising costs and more complex needs keep Medicaid spending climbing, and it now makes up about one-third of state budgets. (For more detail, see the Medicaid Explainer.) Structural and Fiscal Reforms to Strengthen Program Integrity OBBBA introduces a national work-reporting requirement for adults ages 19 to 64 in Medicaid expansion and comparable waiver groups. To keep coverage, individuals must complete at least 80 hours per month of work, community service, or job training, with exemptions for parents, medically frail adults, and those in substance use treatment. States must implement the policy by December 31, 2026, and verify compliance every six months. Based upon the bill as it passed the House, CBO projects this provision will save about $326 billion over 10 years, but increase the number of uninsured individuals by roughly 5 million. Some states must also redetermine eligibility for adults every six months. OBBBA also delays the 2024 Medicaid Eligibility and Enrollment rule and the 2023 Medicare Savings Program rule, saving over $120 billion, but increasing administrative complexity and the risk of coverage gaps for low-income and elderly populations. Finally, the law tightens Medicaid financing by limiting states’ use of provider taxes, capping most supplemental payments to hospitals and nursing facilities, and strengthening Federal oversight of waivers and eligibility-error recoveries, all measures intended to control costs and boost accountability. With many states relying upon provider taxes to fund their share of program costs, the changes could significantly constrain state budgets. OBBBA reshapes the Medicaid program more extensively than any legislation since the ACA. Proponents of OBBBA frame these changes as essential to maintaining program sustainability and addressing waste, fraud, and abuse. However, critics point to increasing administrative burdens, shifting financial pressures to states and providers, and reverses in coverage gains achieved over the past decade. Overall, CBO projects that the OBBBA Medicaid provisions will reduce Federal spending by roughly $911 billion over ten years and increase the number of uninsured Americans by 7.8 million by 2034. Medicare covers nearly 69 million Americans, including older adults and people with disabilities. Spending exceeded $1 trillion in 2024 and is projected to reach 5.2% of GDP by 2055. The program faces mounting fiscal pressure from an aging population and rising per-beneficiary costs. The number of workers supporting each beneficiary has fallen from four in 1980 to 2.8 today and is projected to reach 2.4 by 2034, contributing to the Hospital Insurance Trust Fund’s projected insolvency by 2033. CBO projects Medicare spending will rise by 2% of GDP over the next 30 years, reaching 5.2% of GDP by 2055. These trends make Medicare a central driver of long-term Federal spending growth (For more detail, see the Medicare Explainer.) Eligibility and Fiscal Sustainability OBBBA introduces a series of targeted yet consequential reforms to Medicare. Most notably, the law freezes implementation of the September 2023 Centers for Medicare and Medicaid Services (CMS) final rule to streamline enrollment in Medicare Savings Programs (MSPs). The moratorium through 2034 delays Medicaid-Medicare system alignment and automatic enrollment, saving $66 billion over 10 years but increasing financial strain on low-income seniors. To stabilize physician participation, it adds a 2.5% increase in the Medicare Physician Fee Schedule for 2026 at a cost of $1.9 billion. It also revises the Inflation Reduction Act’s (Public Law 117–16) Medicare Part D drug price negotiation program by broadening the orphan drug exemption to cover treatments for rare diseases. CBO projects these actions, along with other reforms, will reduce Federal spending by roughly $87 billion over the next decade, driven mainly by eligibility restrictions, the MSP enrollment moratorium, and the delayed nursing home staffing rule. While the temporary physician payment update and orphan drug exemption modestly offset those savings, the overall package reinforces fiscal restraint and limits new Federal obligations. Still, the reforms do not address the structural cost drivers—including demographics, utilization, and system inefficiencies—that continue to define Medicare’s long-term fiscal challenge. Fiscal restraint is necessary, but not sufficient on its own. Sustainable Medicare reform depends on aligning incentives through competition and value-based payment to tackle the structural drivers of cost and inefficiency. The ACA remains a central component of the US health care framework, extending coverage through both Medicaid expansion and state and Federal marketplaces for private insurance. In 2023, marketplace subsidies totaled about $91 billion, or roughly 6% of Federal Health Expenditure; CBO projects that share will decline to 5% by 2034. Marketplace subsidies, delivered through premium tax credits and cost-sharing reductions, supported coverage for over 21 million Americans. Under the enhanced premium tax credits extended through 2025, subsidy eligibility extends beyond 400% of the Federal Poverty Level (FPL) when premiums exceed 8.5% of household income. Source: US Census Bureau, Health Insurance in the United States: 2023, Appendix A, Table A-1: Percentage of People Tightening Marketplace Oversight and Fiscal Controls OBBBA imposes tighter eligibility and verification standards across the ACA marketplaces to strengthen oversight. Beginning in 2028, applicants must fully verify income, household size, and immigration status before receiving subsidies, ending conditional eligibility and automatic renewals—a change projected to save $37 billion, but increase the number of uninsured by about 700,000. The law also removes repayment caps for excess premium tax credits, requiring all enrollees to repay any overpayment, saving $17 billion, but increasing financial risk for lower-income households. Starting in 2026, eligibility for subsidized coverage narrows. Combined with new restrictions on tax credits for low-income immigrants below the poverty line, these provisions are expected to reduce spending by more than $120 billion and raise the number of uninsured by roughly 1.2 million. OBBBA further limits Special Enrollment Periods by barring individuals below 150% of the FPL from receiving subsidies outside qualifying life events, saving $39 billion. Together, these changes emphasize fiscal discipline and program integrity, but risk eroding coverage gains. In total, CBO estimates the provisions will reduce Federal spending by nearly $215 billion through 2034 while leaving more than 2 million additional Americans uninsured. OBBBA represents the most significant Federal health program restructuring in more than a decade. Its focus on tighter eligibility verification, standardized budget neutrality, and limits on supplemental payments strengthens fiscal discipline, accountability, and transparency in Federal-state financing. By codifying stronger oversight across Medicaid and Medicare, the law seeks to slow cost growth. However, the legislation achieves savings primarily through eligibility and administrative restrictions rather than outcome-based performance or delivery-system modernization. It does not directly connect fiscal restraint to measurable gains in efficiency, quality, or competition—key elements of a sustainable, value-driven system. Long-term success will depend on whether these fiscal guardrails can become a platform for modernization. Promoting a value-based system will require innovation, data-driven performance, and linking cost control with improved access and quality. In short, these changes rebalance responsibility across the health system. As some spending falls, states, employers, and households will assume a larger role in financing and managing care. State and local governments may face tighter budgets to sustain public health systems, while providers and insurers adapt to leaner payment structures. In this environment, private sector partnership and innovation will be critical to advancing efficiency, maintaining access, and supporting a stable, competitive health care market. The best way to fix health care is to make it function more fully as a market again, which means giving those who actually pay for it—including employers and taxpayers—the necessary information and leverage to drive meaningful results. Technology could enforce transparency, as would a rule reset that links cost control and modernization. Competition and consumer choice are essential to building a more efficient, innovative, and sustainable health system. Yet health care markets remain largely state-based, as state regulation of health insurance determines which plans, benefits, and pricing structures are available to residents. While this regulatory arrangement reflects local market conditions, it also fragments the national market, constrains consumer choice, reduces competitive pressure, and contributes to uneven access and pricing, all of which produces significant variation across states. While opening state markets must be approached with caution, it could reduce the barriers successful health plans face in moving to other areas (such as neighboring states) and drive competition, further expanding consumer choice. As OBBBA increases the role of states, employers, and insurers in shaping health outcomes, aligning regulatory practices becomes central to translating fiscal restraint into modernization. Variation in oversight raises administrative and compliance costs and limits the spread of value-based care models. A more consistent regulatory environment could strengthen competition, enhance consumer choice, and support innovation while preserving state flexibility and consumer protections. It would also expand the reach of telehealth, an increasingly popular choice for delivery of many health care services. The 2023 unwinding of pandemic-era coverage expansion strained state Medicaid systems, exposing persistent administrative challenges. No one should get Medicaid who is not entitled to it, but reducing enrollment among eligible individuals reduces overall coverage and causes financial strain, with additional impacts upon the health care system. Looking ahead, a major test will be how effectively states modernize data matching and automation systems to verify work hours and exemptions. Leveraging data from programs such as SNAP and TANF can automate verification, but this will require targeted investment in interoperability and flexible technology capable of capturing caregiving, self-employment, and other nontraditional work arrangements. Addressing these challenges will require stronger state capacity and collaboration with private partners to modernize verification and communication systems. Medicaid managed care organizations can help states integrate data, automate verification, and strengthen outreach based on their experience with eligibility, coordination, and reporting. By sharing best practices in automation and analytics—and working with employers and community groups via digital tools and targeted social-media campaigns—insurers can reach eligible but at-risk populations with clear information on work-reporting requirements, exemptions, and deadlines. Collectively, these efforts can help maintain coverage while advancing fiscal discipline and efficiency. Learning from past state experience, Federal and state agencies should make technology modernization and collaboration central to implementation efforts, ensuring that new requirements strengthen workforce participation without unintended coverage loss. Automated verification, streamlined data-sharing, and coordinated outreach can also improve efficiency. Moving forward, implementation should balance fiscal accountability with safeguards that prevent eligible individuals from losing coverage, ensuring that Medicaid remains a stabilizing force for families, communities, and the broader economy. The Administration’s Health Tech Ecosystem initiative, launched by CMS in July 2025, aims to develop a voluntary national interoperability framework based on shared standards including Fast Healthcare Interoperability Resources Application Programming Interfaces (FHIR APIs), digital identity credentials, and standardized clinical terminology. This initiative seeks to lower administrative waste and enhance the transparency needed for market discipline to work. This broader effort to build a modern, interoperable digital health ecosystem focused on reducing administrative burdens and improving program integrity could also support the implementation of new Federal Medicaid requirements related to work reporting and eligibility verification. A seamless, privacy-protected information exchange can reduce administrative waste, improve coverage continuity, and promote transparency so insurers and providers can compete more fully on quality and cost. Automating eligibility verification, aligning preventive care measures, and tracking outcomes in real time will be key to the success of OBBBA reforms. Employers and insurers, who finance much of national health spending, rely upon accurate and timely data to manage premiums and sustain investments. Where appropriate, Federal modernization efforts should promote collaboration among agencies, states, and private partners on shared standards for claims, outcomes, and cost reporting. Policymakers can build on this effort by linking state and Federal data systems and aligning them with participating private payers to improve real-time verification, reduce duplication, and enhance program oversight. States, too, will play an essential role in making this theoretical framework succeed in practice. Expanding state level interoperability would reduce administrative burden, improve data accuracy, and promote transparency for both fiscal accountability and operational efficiency. However, voluntary frameworks require safeguards. Data shared through health applications may fall only under general consumer protection laws. Without clear, consistent rules for how data are stored, used, and shared, privacy breaches or secondary uses could erode trust and offset efficiency gains. Working with industry partners, Federal and state agencies can help ensure that interoperability advances alongside strong privacy and governance standards. Insurers, hospitals, employers, and technology vendors also play an important role by adopting secure, standardized tools and communicating clearly with consumers about how their information is protected. Rural health care is both a social and economic asset: hospitals and clinics often anchor local economies and sustain workforce participation. Section 71401 of OBBBA established the Rural Health Transformation (RHT) Program—a five-year, $50 billion initiative (FY 2026-2030) the Centers for Medicare and Medicaid Services (CMS) administers through cooperative agreements with states. The program is designed to strengthen the rural health ecosystem by modernizing care delivery, stabilizing access, and promoting long-term financial sustainability. Under OBBBA and CMS guidance, states may apply for RHT funding by December 31, 2025. Of the $10 billion available annually, half will be distributed evenly among states, and the remainder allocated based on rural population, facility numbers, and local hospital finances. Funds will remain available through the next fiscal year to support multi-year projects focused on prevention, behavioral health, workforce recruitment, telehealth, and data interoperability. CMS emphasizes technology-enabled care as central to rural health care. RHT funds may be used for remote monitoring, interoperable data systems, telehealth expansion, and advanced technologies—including AI, robotics, and cybersecurity tools—to help providers manage costs and capacity. Effective use of these resources means pairing investments in technology, telehealth, and workforce development with outcome-based goals that expand access, strengthen provider solvency, and generate long-term productivity gains in rural communities. To maximize impact, states should design projects with measurable outcomes—such as improved care coordination, provider stability, and expanded essential services access—within the program’s timeframe. Similarly, CMS can build on outcome-based models from past initiatives, such as the State Innovation Models Initiative in states including Vermont and Minnesota, to ensure reporting encourages accountability, transparency, and learning, as well as compliance. RHT’s cooperative agreement structure offers flexibility for states to tailor solutions to local needs. Governors and health leaders can use this framework to convene hospitals, insurers, employers, and community organizations around shared transformation plans. Pairing RHT funding with existing state and private initiatives—such as workforce development, broadband expansion, or health innovation grants—can further extend program benefits. OBBBA takes an initial meaningful step toward addressing instability in Medicare’s physician payment system by providing a one-time 2.5% increase to the Physician Fee Schedule conversion factor for 2026. This temporary adjustment replaces what would have been another minimal update under current law and reflects the broader need for a more predictable, outcomes-oriented payment framework that rewards quality, efficiency, and patient outcomes rather than service volume alone. Sustained physician payment policy reform is essential to maintain access, support independent practices, and ensure that cost containment translates into efficiency and innovation. Physician payment stability affects the entire health care system. A predictable, inflation-adjusted payment structure—tied to measurable improvements in care quality and health outcomes—would stabilize participation, encourage investment, and promote long-term program sustainability. Policymakers should expand incentives for alternative payment models that align reimbursement with performance and results. When Medicare payments are unpredictable, providers face the challenge of managing a practice while not knowing what payments will be, reflecting the need for a consistent payment framework. Congressional efforts further underscore the urgency for stability. Bipartisan proposals include the Strengthening Medicare for Patients and Providers Act (H.R. 2474) and the Senate Finance Committee’s 2024 white paper, Bolstering Chronic Care through Physician Payment. They would permanently link payment updates to the Medicare Economic Index, which measures practice cost inflation, and sustains incentives for participation in Advanced Alternative Payment Models. Both proposals reflect growing recognition that physician payment stability and value-based incentives are essential to maintaining access and fostering practice models that strengthen coordination and market efficiency. OBBBA has tightened Federal health spending, shifting greater responsibility to states, employers, and insurers. In this environment, prevention is the most practical way to control long-term costs, strengthen the workforce, and improve health outcomes. Regular screenings, early detection, and chronic disease management offer high returns by promoting early interventions and reducing avoidable hospitalizations. Strengthening and modernizing primary care is essential to a prevention-oriented system that delivers value for patients and payers. In the context of OBBBA reforms, states can use existing administrative resources and data-sharing tools to maintain contact with eligible individuals as they transition between Medicaid, Marketplace, and employer plans, while insurers can integrate outreach into current care management programs. Federal agencies can support these efforts by offering technical assistance and performance-based grants tied to improved continuity of preventive services. Employers and insurers share an interest in sustaining preventive care, which supports a healthier workforce, stabilizes coverage, and helps contain long-term costs across public and private systems. Models such as Accountable Care Organizations (ACOs) demonstrate how shared-savings arrangements can align incentives for prevention, quality, and efficiency. This advances fiscal reform goals by improving efficiency and preserving access to essential care without imposing new costs on states or businesses. Private sector innovation offers insights into how preventive care can be strengthened within fiscal limits. Medicare Advantage (MA), now covering nearly half of all Medicare beneficiaries, provides one example of how payment structures tied to quality and care coordination can influence performance. However, as recent analyses highlight, the program’s fiscal impact remains mixed, underscoring the need for further evaluation to ensure better outcomes and value. More broadly, MA’s experience affirms that aligning financial incentives with prevention advances economic efficiency and can serve to inform broader efforts to embed prevention throughout the US health system. Embedding prevention more deeply into the US health system aligns directly with the idea that effective and efficient health care is an investment in human capital. Screening and early intervention are not only essential to maintaining a healthy labor force; they are also important levers to constraining costs. As fiscal pressures mount and system incentives shift, prevention must move to the center of US health strategy. The Make America Healthy Again (MAHA) initiative provides a complementary Federal framework to OBBBA’s structural reforms by emphasizing prevention, nutrition, and chronic disease. As MAHA initiatives develop, collaboration with private sector partners can help build a focus on prevention into a national effort supported by measurable goals. Employers remain the foundation of US health coverage, financing care for over half of the nonelderly population. While important, the private sector’s diverse arrangements in how they provide benefits to employees can effectively limit the sector’s collective influence when it comes to national health policy discussions. Employers continue to absorb rising premiums and broader workforce health costs, particularly as changes in Federal health programs, changes in market structure of providers and hospitals, and evolving regulatory requirements reshape the market. Industry coalitions, employer alliances, and data-driven purchasing initiatives that emphasize quality and outcomes already help foster some coordination. However, strengthening collaboration around systems that deliver strong health outcomes could better align public and private payers’ objectives. After all, employers, insurers, and providers alike share a mutual interest in predictable, high-value care. Ongoing communication with policymakers can help ensure that regulatory changes support innovation and competitiveness across the system. Federal and state policymakers should recognize the scale of employer participation in health care financing and the important role that private purchasers play in promoting access and efficiency. Recently enacted reforms and the Administration’s health care priorities have reoriented US health policy toward fiscal discipline, program integrity, and value-based care across both public and private systems. But fiscal objectives should not stand alone; instead, they should serve as a foundation for a system that delivers greater value, innovation, and efficiency across all payers and providers. Achieving this transformation will depend on how effectively the private and public sectors translate fiscal restraint into operational improvement. Employers, insurers, and providers are not just implementing policy; they are actively shaping how well the system performs. Innovation, effective data utilization, and competition on quality will determine whether the current policy shift yields lasting improvements in efficiency and access. As legislators, regulators, and business leaders align around the shared goal of a modern, value-driven health system, fiscal discipline can become a catalyst for transformation. A health system for the 21st-century economy should manage costs responsibly while investing in prevention, leveraging competition, and promoting health care access to build sustained economic growth.

Trusted Insights for What’s Ahead®

Policy Recommendations

Understanding Health Care in 2025

Challenges and Reforms to Major Public Health Care Programs

Medicaid

Medicare

The Affordable Care Act (ACA)

by Health Insurance Coverage Status and Type by Selected Characteristics: 2022 and 2023, September 2024, pp. 18–

19; The Conference Board, December 2025Connecting Fiscal Reform to Modernization and Growth

Private Sector Partnership

Promoting Competition Among States

Implementing Medicaid Reforms

National Data and Interoperability Framework

The Rural Health Transformation (RHT) Program

Making Progress Toward a Stable and Value-Driven Medicare Payment System

Embedding Prevention in the US Health System

Business Leadership in a Competitive, Value-Driven Health System

Advancing Systemic Reform

In US health care, demand is rising, costs continue to climb, and some workforce shortages are worsening.

learn moreA Bipartisan Fiscal Commission to Tackle the National Debt

February 17, 2026

250 Years Forward

January 20, 2026

250 Years Forward: Strengthening an American Future

January 20, 2026

US Lead in Public R&D Is Eroding

October 20, 2025