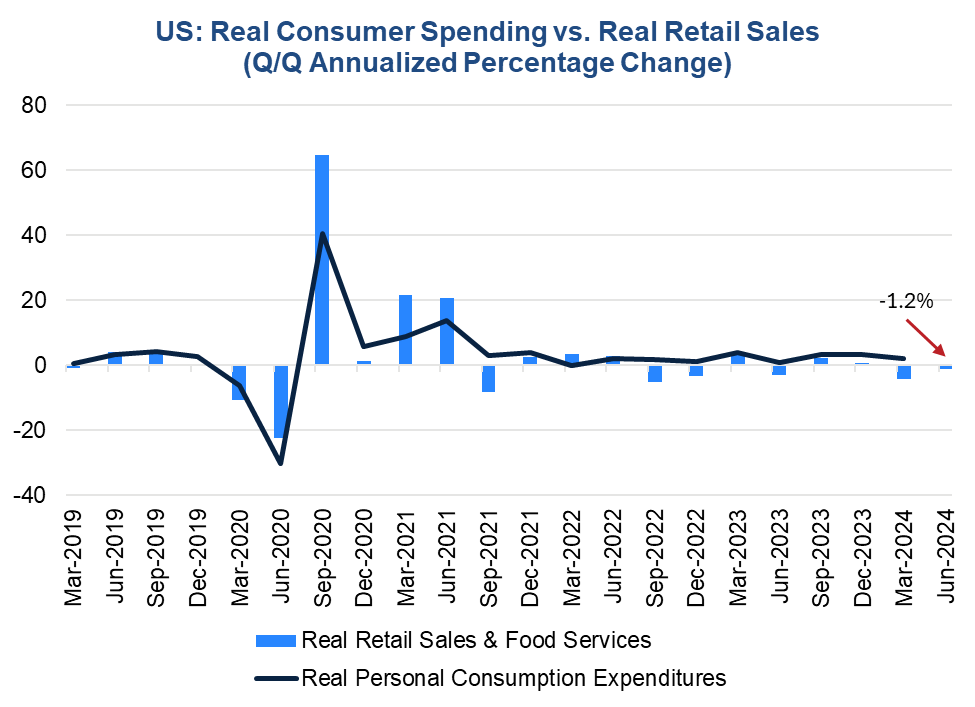

Nominal retail sales edged up by 0.1 percent in May following a 0.2 percent decline in April. Real retail sales (i.e., sales adjusted for inflation) also rose by 0.1 percent in May after a dramatic 0.5 percent decline in April. Nonetheless, real retail sales over the April-May span were down 1.2 percent annualized from Q1, suggesting consumer spending, especially on goods, continued to be weak in Q2. Figure 1. Real Retail Sales Point to Weak Q2 2024 Real Consumer Spending Sources: Census Bureau, Bureau of Labor Statistics, Bureau of Economic Analysis, and The Conference Board. Total nominal retail sales rose slightly in May largely due to a 0.8 percentage point pop in motor vehicle and parts dealer sales. Autos were up 0.8 percent and parts rose by 1.2 percent. Excluding motor vehicles and parts, sales dipped by 0.1 percent in the month. The dip reflected a 0.4 percent decline in food services and drinking places. This category has fallen in nominal terms for three out of the last five months. Sales for building materials fell by 0.8 and gasoline station sales declined by 2.2 percent. Retail control, which excludes volatile gasoline, motor vehicle, and building material store sales, as well as food and drinking places, rose by 0.4 percent in May after declining by 0.5 percent in the prior month. Sales increased at electronics, clothing, health care and personal care, sporting goods, general merchandise, nonstore retailer, and miscellaneous stores. Sales were down at furniture and grocery stores. Why Are Retail Sales Slowing? Still, real sales were only up modestly in May and were down 1.2 percent annualized from Q1, revealing continued reduction in consumer demand. Retail sales are fading as consumers continue to shift away from spending on goods. Slower real wage growth, depleted excess savings, and rising credit card debt are dampening consumption in general. Elevated interest rates (i.e., for financing), high prices, and rising insurance premiums (e.g., for autos) are weighing on goods purchases, in particular. Consumers have indicated reduced demand for big ticket items in The Conference Board Consumer Confidence Survey over much of the last 12 months, and the caution is now evident in weaker goods spending. Additionally, consumers are still concerned about the price levels of nondurable goods like food and energy, which are significantly higher than they were pre-pandemic, even though the rate of increase has slowed. In Q1 2024, consumers largely purchased services and goods spending fell. Consumers Planning to Alter Services Consumption Today’s retail sales report also showed a 0.4 percent decline in nominal restaurant and bar sales. After adjusting for inflation, real spending at these establishments were likely even lower. This bodes poorly for services consumption in Q2. The Conference Board Consumer Confidence Survey also reveals that even among services, consumers are intending to cut back on discretionary services (e.g., out of home entertainment) in favor of necessary services (e.g., health care, car insurance). Consumers are also trading down in the types of services they purchase. For example, consumers are more willing to pay for cheaper streaming services than go to the movies. Implications for the Fed Weaker consumer spending is all according to the Fed’s plan: cool economic activity and thereby inflation, hopefully without inducing a recession. We believe Q2 and Q3 real GDP growth will be anemic (between 0% and 1% q/q annualized). Still a recession is unlikely because businesses are still generally willing to hold on to their best talent. Against this backdrop, we anticipate that slower real GDP growth and inflation, plus a relatively healthy labor market will enable the Fed to cut interest rates twice this year – potentially at the November and December meetings. Indeed, only a slight majority of FOMC participants desired one cut at the June meeting, with others mostly anticipating two cuts.Trusted Insights for What’s Ahead®

Consumers Souring on Spending

Retail Control Increase Barely Offsets Declines in Services and Volatile Goods

myTCB® Members get exclusive access to webcasts, publications, data and analysis, plus discounts to events.

January CPI Raises More Questions than Provides Answers

February 13, 2026

Lukewarm Holiday Shopping in 2025 Augurs Slower Spending in Q4

February 10, 2026

FOMC Reaction: US Economy In a Good Place, But Staying Vigilant

January 28, 2026

Fed January Decision: Pause or Full Stop?

January 27, 2026

November PCE: Are Consumers Spending Beyond Their Means?

January 22, 2026

Retail Sales Highlight Affordability Issues

January 14, 2026