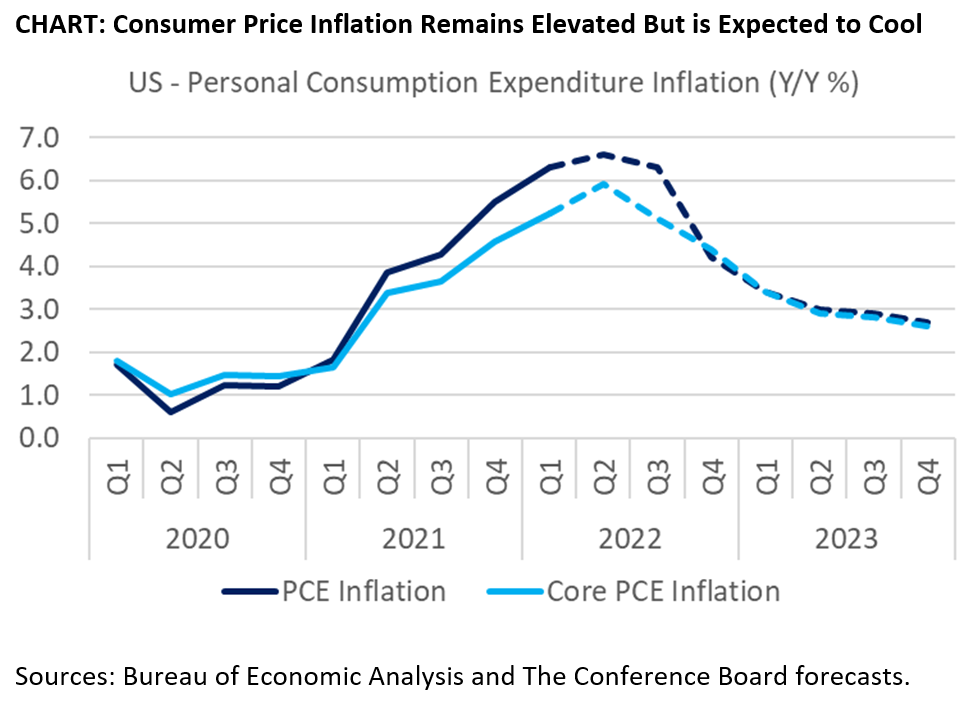

The April Personal Income & Outlays data had many positive notes even as recession fears are rising amid high inflation and Fed rate hikes. According to the Bureau of Economic Analysis (BEA), US income and spending rose in real terms, starting the second quarter off on positive footing. This information supports our expectation of a rebound in real GDP growth (+2.1 percent Q/Q SAAR) in 2Q after a 1.5 percent drop in the first quarter. Inflation remained extremely elevated as primary drivers are shifting towards food and energy amid the shock to commodity prices amid the war in Ukraine, and housing as rents levitate with home values. Nonetheless, both overall and core inflation gauges slowed in April, suggesting year-on-year rates of increase may have peaked. High inflation rates continue to undermine real incomes this year compared to last year, but consumers appear to continue to spend, reflecting a combination of a strong labor market, rising wages, and savings. That said, downside risks to consumption remain, largely reflecting the potential for renewed inflation spikes linked to the war in Ukraine and China’s COVID-19 lockdowns, and the Fed’s interest rate hikes. Headline PCE price inflation came in at 6.3 percent year-over-year (y/y) in April, vs. 6.6 percent y/y in March. The BEA also reported that Core PCE Inflation, which excludes food and energy prices, came in at 5.3 percent y/y, vs. 5.5 percent y/y in March. On a month-over-month (m/m) basis, headline PCE price inflation slowed to 0.2 percent m/m, vs. 0.9 percent m/m in March. Meanwhile, core PCE price inflation increased by 0.4 percent m/m, matching the prior month’s gain. Despite rising food and energy prices linked to the war in Ukraine, prices for goods appears to be starting to cool, with falling used car prices. Meanwhile services prices are picking up with the pandemic in the rearview mirror for many consumers, but also due to rising home prices. Prices for services including restaurants and travel are increasing as Americans venture out. Surges in prices for new and existing homes are fueling increases in rents, which are a notable share of costs for consumers. Overall personal income growth rose 0.4 percent m/m (in nominal terms), vs. up 0.5 percent m/m in March. Employee compensation grew by 0.6 percent m/m, proprietors’ income actually fell by 0.5 percent m/m, and rental income jumped by 1.5 percent m/m. However, recent increases in personal income have been more than offset by increases in prices. In inflation adjusted terms, personal income rose by a modest 0.2 percent m/m but was down 3.5 percent year-on-year in April. Thus, while Americans have seen their incomes rise in nominal terms, they are seeing their purchasing power eroded. Personal consumption expenditures rose by 0.9 percent m/m (in nominal terms) in April following an upwardly revised 1.4 percent m/m increase in March. Spending on services rose by 0.9 percent m/m while spending on goods rose by 0.8 percent m/m. Spending on durable goods surged by 2.4 percent m/m on broad based gains across categories, while spending on non-durables dipped by 0.1 percent m/m as a decline in spending on gasoline just offset increased spending on other items. After accounting for inflation, consumer spending rose by 0.7 percent m/m in April with increased spending on durable goods, nondurable goods, and services. While wanning pandemic effects are helping boost services spending, goods spending continued to hold up at the start of the second quarter. Today’s relatively positive report notwithstanding, personal income, consumer spending, and inflation likely will face continued challenges in the months ahead. As the impact of COVID-19 on the US economy gradually wanes the conflict in Eastern Europe is taking its place as the economic disruptor. Russia and Ukraine are large energy and grain producers and are key global suppliers. With conflict and sanctions curbing this supply, energy and food prices around the world will continue their recent climb, adding to inflationary pressures and creating further drag on households’ wallets. Additionally, recent COVID-19 related lockdowns in China have reversed some of the progress made in untangling global supply chains. We are concerned production and shipping disruptions in China will propagate overseas and result in increased inflationary pressures. Importantly, the Fed’s monetary tightening program to tame inflation will add to headwinds to the economy, as higher rates will reduce domestic demand, and thereby the overall economy. The risk that the Fed may raise the fed funds rate above what is considered neutral territory (2-3 percent) does raise the specter of recession either late this year or next.

January CPI Raises More Questions than Provides Answers

February 13, 2026

Lukewarm Holiday Shopping in 2025 Augurs Slower Spending in Q4

February 10, 2026

FOMC Reaction: US Economy In a Good Place, But Staying Vigilant

January 28, 2026

Fed January Decision: Pause or Full Stop?

January 27, 2026

November PCE: Are Consumers Spending Beyond Their Means?

January 22, 2026

Retail Sales Highlight Affordability Issues

January 14, 2026