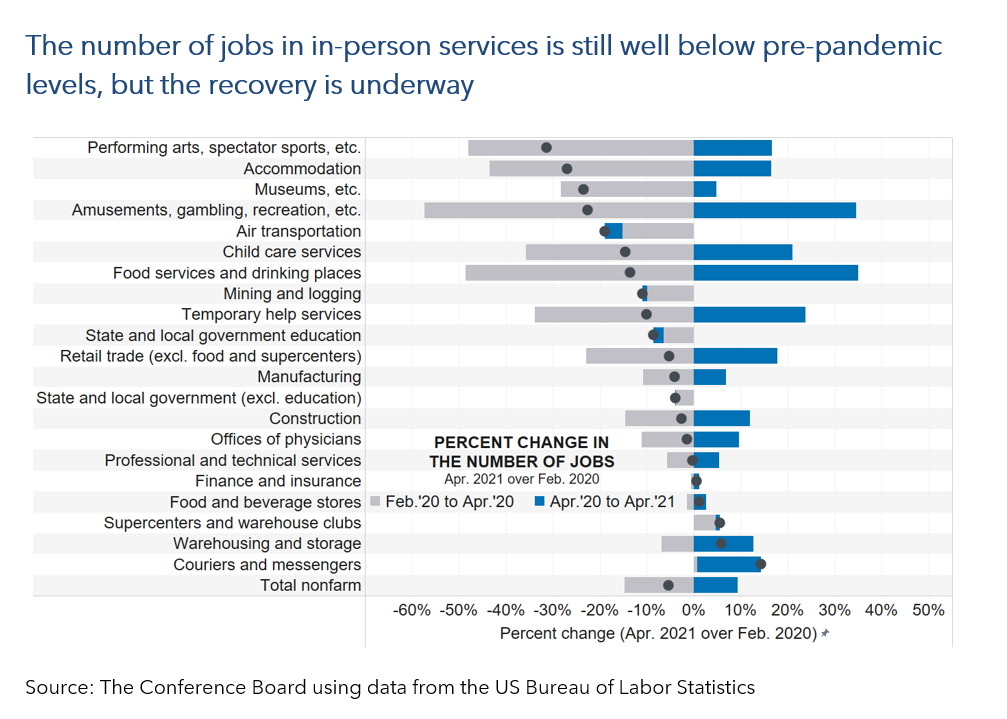

Comment – Gad Levanon, Vice President, Labor Markets April marked a very disappointing moment in what had been a rapidly improving jobs market. Nonfarm employment grew by a relatively subdued 266,000 in April, after a downwardly revised increase of 770,000 in March. The published unemployment rate inched up from 6.0 to 6.1 percent. The true jobless rate, after adjusting for the misclassification error, remained unchanged at 6.4 percent. The labor force participation rate increased slightly from 61.5 to 61.7 percent. Overall, the US economy is still down 8.2 million compared to February 2020 levels. While one month of data does not make a trend, today’s jobs report makes us a little less optimistic about the number of jobs that will be added in the rest of 2021. The recovery in the leisure and hospitality sector remains strong, but, very surprisingly, employment in the rest of the economy, in aggregate, declined in April. Some of this decline reflected a reversal of pandemic trends. As more people frequent restaurants, fewer workers are needed in food stores. As more people shop in person, fewer workers are needed for home deliveries. Moreover, as employers are more confident about the economic outlook, they hire more regular employees and fewer workers from the temporary help industry. With pandemic-related restrictions being gradually curtailed, and the proportion of vaccinated people growing, employment in in-person services continued expanding rapidly in April. Many jobs were added in restaurants, hotels, and in-person entertainment. Nonetheless, employment in these industries is still well below pre-pandemic levels (See chart). In sum, in-person services still have a lot more room to grow, and they will. But overall employment may recover a little more slowly than we thought prior to the release of April’s job numbers.

Shutdown Aside, Growth Moderates Under Inflationary Pressures

February 20, 2026

January CPI Raises More Questions than Provides Answers

February 13, 2026

Lukewarm Holiday Shopping in 2025 Augurs Slower Spending in Q4

February 10, 2026

FOMC Reaction: US Economy In a Good Place, But Staying Vigilant

January 28, 2026

Fed January Decision: Pause or Full Stop?

January 27, 2026

November PCE: Are Consumers Spending Beyond Their Means?

January 22, 2026