A Wealth of Opportunity

- Authors:

-

Publication Date:

November 03, 2016

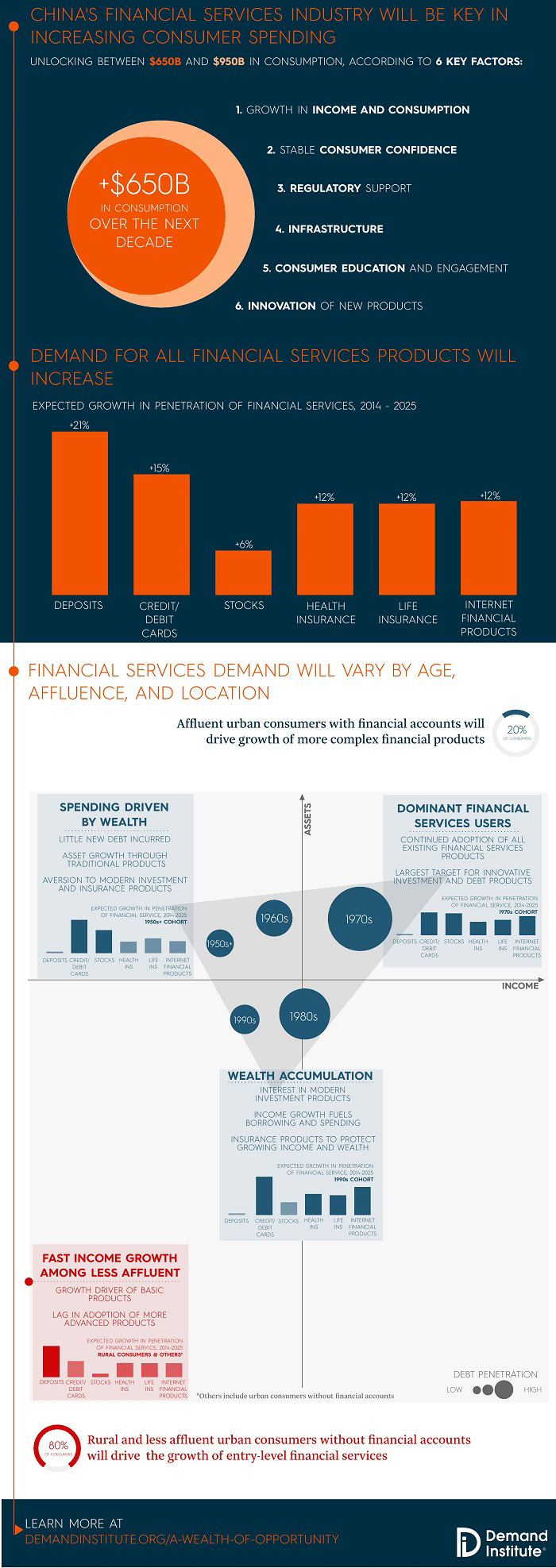

Over the past several decades, China has brought hundreds of millions of citizens out of poverty and created a thriving consumer class that has made it the second-largest consumer market in the world in aggregate terms. But, on a per-capita basis, consumption is a fraction of the level in mature economies. A Wealth of Opportunity: Chinese Consumers and Their Shifting Demand for Financial Services finds vast untapped demand among Chinese consumers for household financial services products such as deposit accounts, credit cards, and debit cards. It identifies two scenarios for how growth in Chinese financial services could accelerate consumption. Under the most likely scenario, expanded access will add $650 billion to Chinese consumption over the next decade, but it could be as much as $950 billion. In this report, we describe the forces that drive demand for financial services in China and how those forces will change in the next ten years, producing the added consumption we estimate is possible. Among the report’s key findings:

- CREATE AN ACCOUNT SIGN IN

-

Complimentary. Sign in or create an account to access.