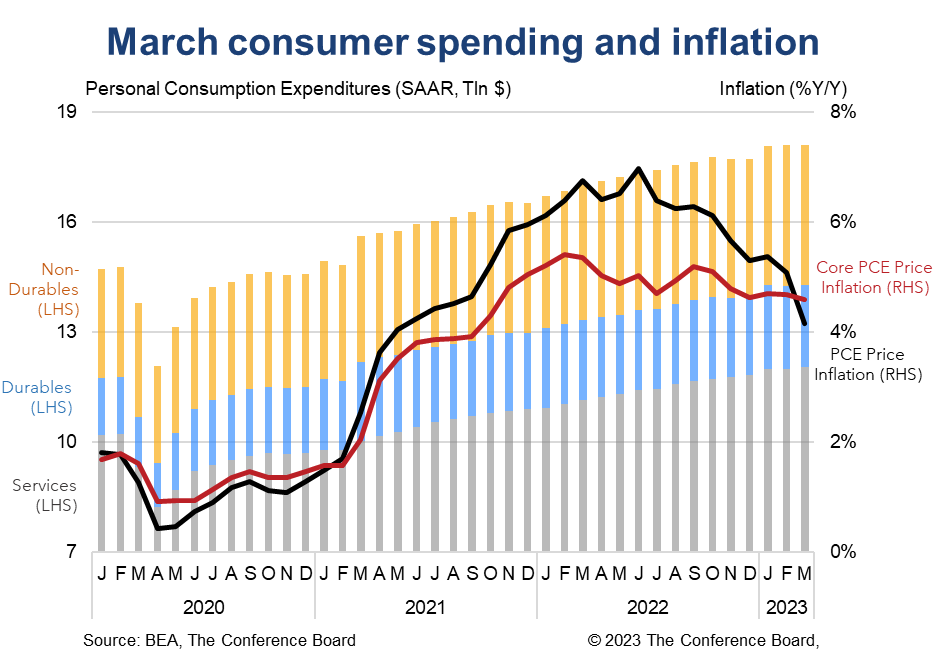

Personal income, spending and inflation all saw small improvements in March. Personal income growth expanded modestly for the month and real spending was flat (it contracted in February). Meanwhile, inflation metrics for March cooled. Headline PCE price inflation fell to 4.2 percent from a year earlier and dropped to 0.1 percent in month-over-month terms. Core PCE price inflation also saw softer numbers for the month. Collectively, this report showed that the US consumer is holding up and that inflation is moderating. Given yesterday’s GDP print we had expected a more troubling report this morning, but revisions to January and February data resulted in more favorable readings for March than anticipated. The Federal Reserve will likely welcome these data, but may be disappointed that more progress on inflation is not being made more quickly. We continue to forecast that the Fed will raise interest rates by 25 basis points twice more – once next week and once in June. Thereafter, we expect interest rates to stay flat for the remainder of 2023. Headline PCE price inflation fell from 5.1 to 4.2 percent year-over-year (y/y) in March and core PCE price inflation (which excludes food and energy) fell from 4.7 to 4.6 percent y/y. The large decline in the headline reading is due to base effects related to the start of the war in Ukraine a year ago. On a month-over-month basis (m/m), headline PCE inflation fell from 0.3 percent to 0.1 percent while core PCE inflation remained flat at 0.3 percent. Prices for services rose in the month, contributing to inflation, but prices for goods fell. Overall personal income rose 0.3 percent m/m (in nominal terms) in March, vs. 0.3 percent m/m in February. However, when factoring in inflation the real month-over-month growth rate was 0.2 percent. Meanwhile the savings rates rose to 5.1 percent of disposable personal income. Personal consumption expenditure rose by 0.1 percent m/m (in nominal terms) in March, vs. 0.1 percent m/m percent in February. Spending on services rose by 0.4 percent m/m while spending on goods fell to -0.6 percent m/m. However, after accounting for inflation, real consumer spending was 0.0 percent m/m in March with spending on goods falling to -0.4 percent m/m and spending of services rising to 0.2 percent m/m.Inflation

Incomes

Spending

Shutdown Aside, Growth Moderates Under Inflationary Pressures

February 20, 2026

January CPI Raises More Questions than Provides Answers

February 13, 2026

Lukewarm Holiday Shopping in 2025 Augurs Slower Spending in Q4

February 10, 2026

FOMC Reaction: US Economy In a Good Place, But Staying Vigilant

January 28, 2026

Fed January Decision: Pause or Full Stop?

January 27, 2026

November PCE: Are Consumers Spending Beyond Their Means?

January 22, 2026