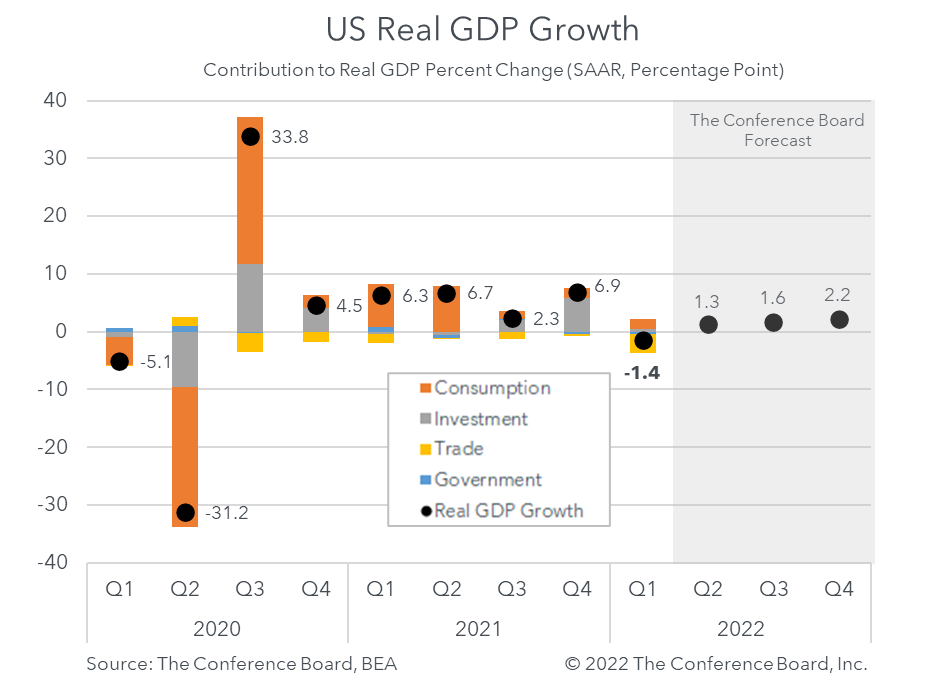

US Real Gross Domestic Product contracted by 1.4 percent (annualized) during the first quarter of 2022, missing the consensus forecast of 1.0 percent* growth and The Conference Board’s forecast. This quarterly annualized growth rate was down from the 6.9 percent rate seen in Q4 2021, when the US economy rebounded from the impact of the COVID-19 Delta variant. While a slowdown in Q1 2022 was widely expected, a contraction was not. Regardless of the weak headline number, many of the economy’s underlying drivers remained sound. While the individual components of GDP were quite mixed, those segments representing domestic demand held up well. Personal Consumption Expenditures contributed 1.8 percent to growth for the quarter – driven overwhelmingly by spending on services. On the investment side, non-residential investment contributed 1.2 percent to growth and residential investment contributed 0.1 percent. Thus, consumers and businesses continued to spend and invest over the quarter. Meanwhile, volatility in other components pushed overall growth into negative territory. Paradoxically, changes in private inventories limited growth despite expanding by US$ 159 billion**. This was because inventories grew at an even faster rate the previous quarter (US$ 193 billion**). However, the largest headwind to GDP growth in Q2 2022 came from trade. Exports contributed -0.7 percent for the quarter while imports contributed -2.6 percent. These data suggest that domestic demand remains strong, but external demand remains weak. Finally, government spending hurt growth for the quarter, contributing -0.5 percent, reflecting drops in both defense and nondefense outlays. These data do not mean that the US economy was in recession in Q1 2022, as Omicron and supply-chain disruptions distorted trade and private inventories. Key economic actors – consumers and businesses – continued to drive growth in the quarter. Importantly, consumers are still spending despite headwinds from higher interest rates and inflation because the job market remains solid. Additionally, these data show that businesses are still investing despite rising wage and input costs. However, these data will result in a lower growth rate for the full year and we will likely downgrade our 3.0 percent annual forecast accordingly. * Survey conducted by the Wall Street Journal ** chained 2012 US$

Shutdown Aside, Growth Moderates Under Inflationary Pressures

February 20, 2026

January CPI Raises More Questions than Provides Answers

February 13, 2026

Lukewarm Holiday Shopping in 2025 Augurs Slower Spending in Q4

February 10, 2026

FOMC Reaction: US Economy In a Good Place, But Staying Vigilant

January 28, 2026

Fed January Decision: Pause or Full Stop?

January 27, 2026

November PCE: Are Consumers Spending Beyond Their Means?

January 22, 2026