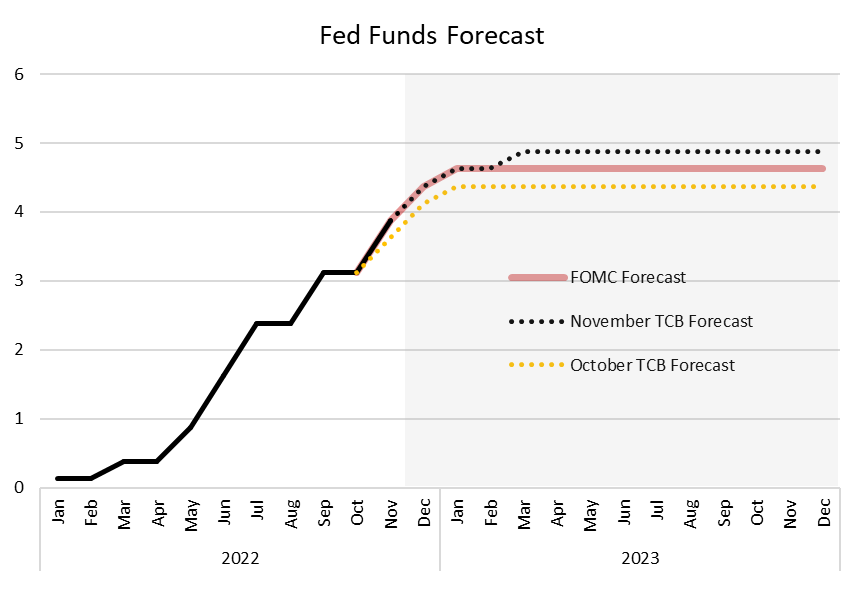

The Fed hiked by another 75 basis points in November and pushed the Fed Funds window to 3.75 – 4.00 percent. This increase raises the rate further into ‘restrictive’ territory (anything above 3 percent). The Fed also said that there will be no change to its ongoing plan to reduce the size of its balance sheet (currently $95 bln per month), which was first unveiled in May 2022. Today’s actions were unanimously approved by the members of the Federal Open Market Committee. The Federal Reserve’s actions today were widely anticipated, but its tone about the future shifted somewhat. In the policy statement, the FOMC said it will “take into account the cumulative tightening in monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.” This new language suggests that this may be the last 75 basis point rate increase seen this tightening cycle. Indeed, Chair Powell said that a downward shift to a 50 basis point hike will be discussed at the December FOMC meeting. However, Powell also said that the terminal rate this tightening cycle is likely to be higher than the one the Fed forecast in September (4.50 – 4.75, with a midpoint of 4.625 percent). As a function of this, The Conference Board now expects rates to rise to 4.75 – 5.00, with a midpoint of 4.875, in March 2023. We do not expect to see the Fed lower rates next year. Since tightening started in March 2022, the Fed Funds rate has risen by a total of 375 basis point. As a function of this, interest rates throughout the economy have risen rapidly. Tighter policy has begun to cool the overall economy – though with a lag. While the labor market remains exceptionally tight, other parts of the economy have begun to slow (like consumption and business fixed investment) while other parts have begun to contract (like residential investment). As the full impact of this year’s Fed Funds hikes continue to weigh on businesses and consumers, economic activity will slow further – tipping the economy into a broad, but shallow, contraction. This recession should begin around the end of 2022 and is expected to last for three quarters.Insights for What’s Ahead

What were the Fed’s actions?

What does this mean for the US economy?

January CPI Raises More Questions than Provides Answers

February 13, 2026

Lukewarm Holiday Shopping in 2025 Augurs Slower Spending in Q4

February 10, 2026

FOMC Reaction: US Economy In a Good Place, But Staying Vigilant

January 28, 2026

Fed January Decision: Pause or Full Stop?

January 27, 2026

November PCE: Are Consumers Spending Beyond Their Means?

January 22, 2026

Retail Sales Highlight Affordability Issues

January 14, 2026