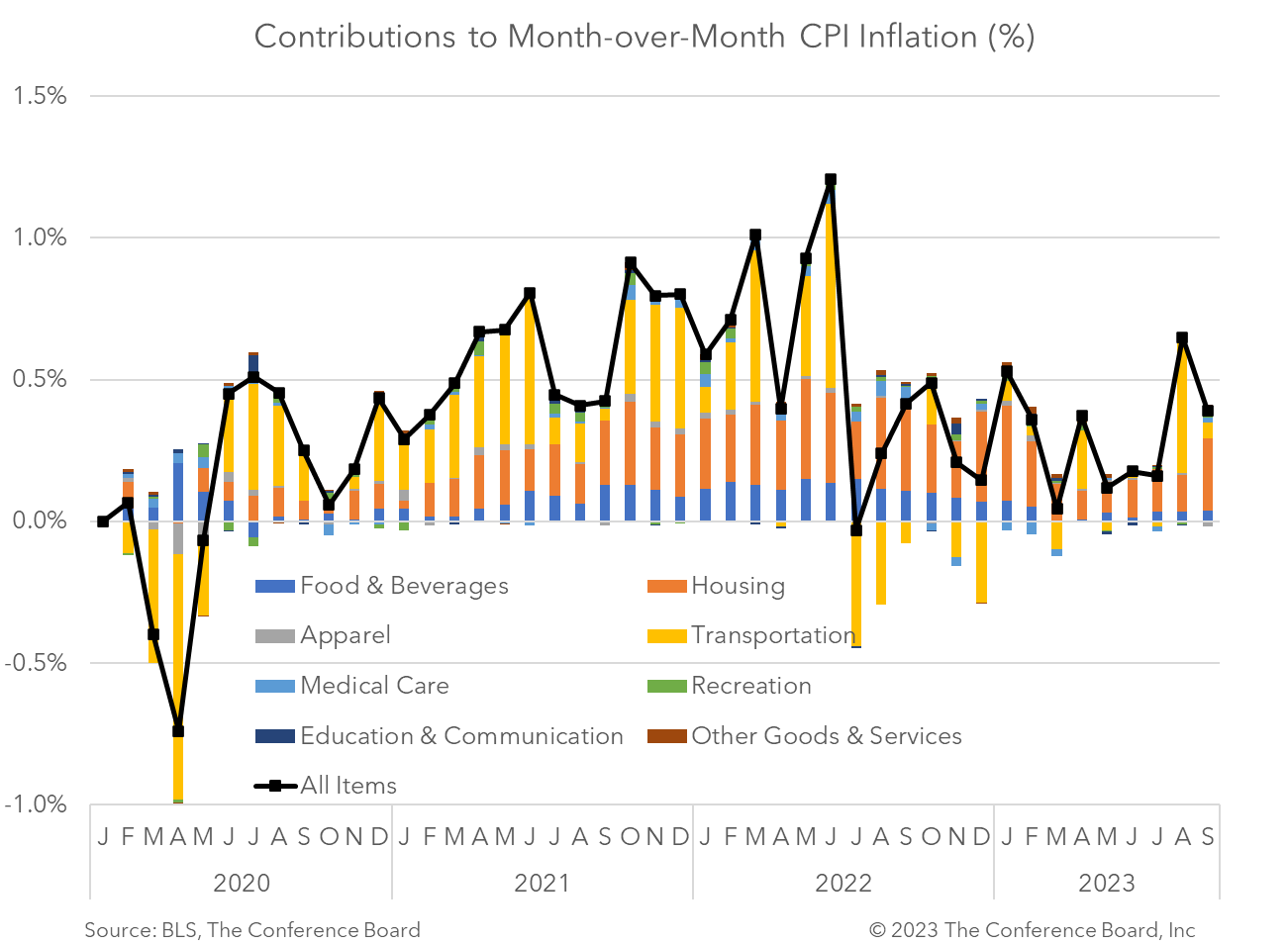

The September Consumer Price Index (CPI) showed that inflation rose 3.7 percent from a year earlier, vs. 3.7 percent in August and the peak of 9.1 percent in mid-2022. Meanwhile, core CPI, which excludes volatile food and energy prices, rose 4.1 percent in September from a year earlier slowing from 4.3 percent year-over-year in August. The Fed will likely be dissatisfied with these data and we continue to expect interest rates to rise an additional 25 basis points at either the November or December FOMC meeting. Thereafter, we expect the Fed to keep rates steady until mid-2024 whereupon monetary loosening will be appropriate due to an improved inflationary environment and weaker economic activity. However, the recent flare up in energy prices seen in the August and September CPI data run the risk of complicating things. Persistent pressure on the energy side could bleed into other parts of the economy and trigger additional rate increases from the Fed. The outbreak of war in the Middle East elevates this risk significantly and should be watched very closely (read our assessment here). Headline CPI rose by 0.4 percent month-on-month and 3.7 percent year-on-year, vs. August’s 0.6 percent m/m and 3.7 percent y/y. The primary drivers of inflation were energy commodities and shelter prices. Gasoline rose 2.1 percent m/m, vs. 10.6 percent m/m in August. Meanwhile food prices rose 0.2 percent m/m matching the prior month’s increase. Core CPI rose 0.3% percent month-on-month and 4.1 percent year-on-year, vs. August’s 0.3 percent m/m and 4.3 percent y/y. While there was some progress seen in shelter prices, which are a major driver of inflation, they have not come off as much as expected. There should be more progress here soon according to past declines in home price valuations and smaller new rent increases.

Data Details

myTCB® Members get exclusive access to webcasts, publications, data and analysis, plus discounts to events.

Shutdown Aside, Growth Moderates Under Inflationary Pressures

February 20, 2026

January CPI Raises More Questions than Provides Answers

February 13, 2026

Lukewarm Holiday Shopping in 2025 Augurs Slower Spending in Q4

February 10, 2026

FOMC Reaction: US Economy In a Good Place, But Staying Vigilant

January 28, 2026

Fed January Decision: Pause or Full Stop?

January 27, 2026

November PCE: Are Consumers Spending Beyond Their Means?

January 22, 2026