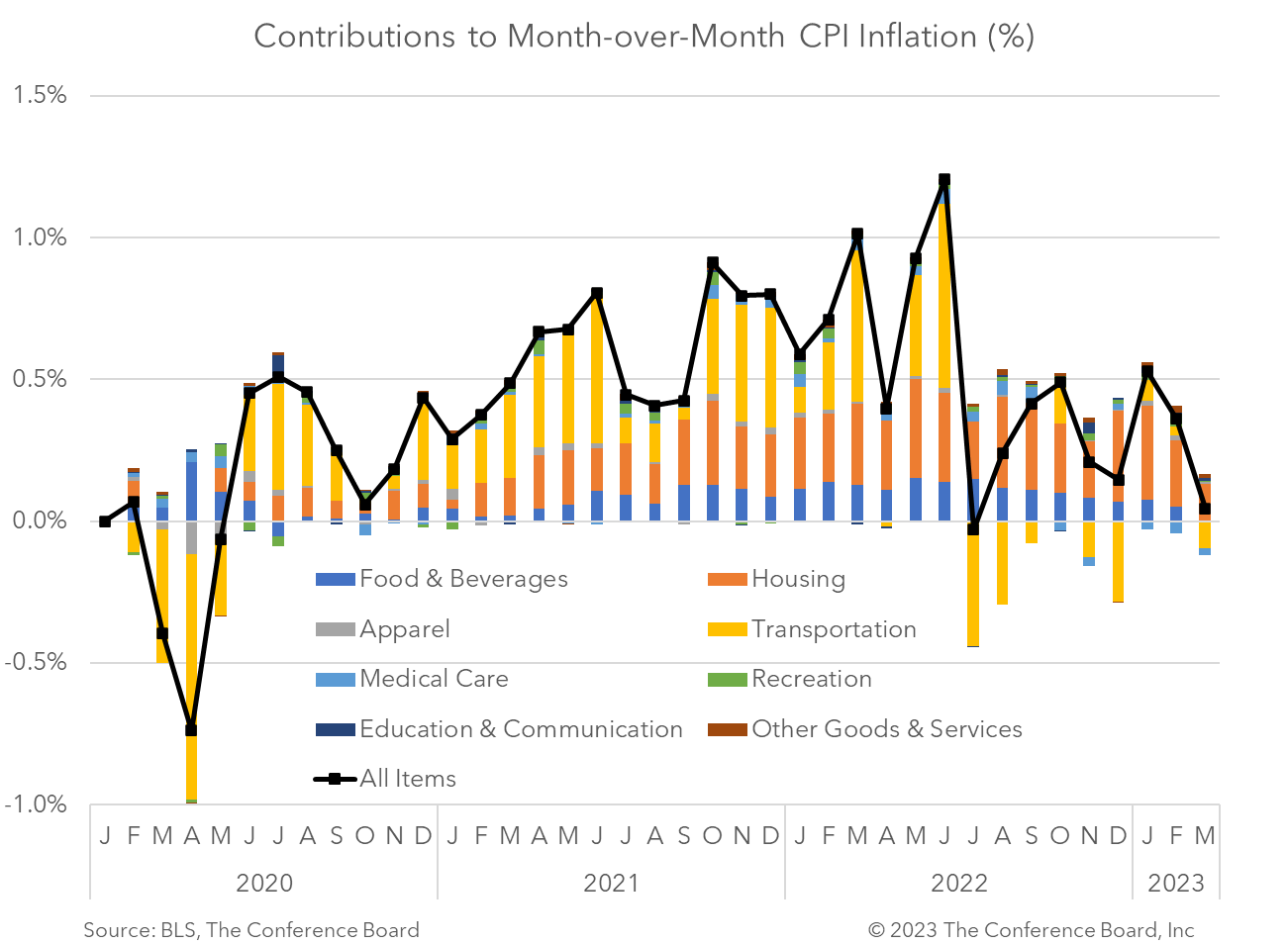

The March Consumer Price Index (CPI) showed that headline inflation slowed to 0.1 percent month-over-month (vs. 0.4% in Feb) and core inflation, which excludes food and energy, slowed to 0.4 percent month-over-month (vs. 0.5% in Feb). Year-over-year inflation rates for both the headline and core indices fell, but much more so for the headline index due to strong base effects. Many CPI components improved in the month, but rising shelter prices remained a major factor in the month-over-month increases in this month’s CPI readings. We do not believe these data are enough to keep the Fed from hiking rates further. March CPI readings showed relief across a variety of goods and services. For instance, food prices were flat for the month and energy prices fell. However, continued increases in shelter prices were responsible for approximately 60% of the inflation reported in the Core CPI. While relief in this key component of inflation is on the way, according to Chair Powell and private sector data on new rents, it will take time for the CPI numbers to fully incorporate this trend. While the 1.0 percent decline in topline year-over-year CPI looks like a big, positive development (and it is nice to see), it does not portend an end to the inflation debacle. This dramatic fall was due to base effects associated with the initial invasion of Ukraine one year ago, not a sudden turnaround in prices. Indeed, year-over-year Core CPI rose a touch for the month. We do not believe this CPI print puts the Federal Reserve in a position where additional rate hikes are no longer needed. We continue to expect two more 25 basis point hikes over the coming months and do not forecast any rate cuts until early 2024. Headline CPI slowed to 5.0 percent year-over-year in March, vs. 6.0 percent in February. In month-over-month terms this topline inflation metric fell to 0.1 percent, vs. 0.4 percent the month prior. According to the BLS, the index for shelter was the largest contributor to topline CPI this month. The energy index fell for the month and the food index was flat. Core CPI, which is total CPI less volatile food and energy prices, rose to 5.6 percent year-over-year in March, vs. 5.5 percent in February. The core index fell to 0.4 percent month-over-month in March, vs. 0.5 in February. As was the case with topline CPI, the increases in the core CPI was driven by shelter prices. Insights for What’s Ahead

March Inflation Highlights

Shutdown Aside, Growth Moderates Under Inflationary Pressures

February 20, 2026

January CPI Raises More Questions than Provides Answers

February 13, 2026

Lukewarm Holiday Shopping in 2025 Augurs Slower Spending in Q4

February 10, 2026

FOMC Reaction: US Economy In a Good Place, But Staying Vigilant

January 28, 2026

Fed January Decision: Pause or Full Stop?

January 27, 2026

November PCE: Are Consumers Spending Beyond Their Means?

January 22, 2026